metamorworks/iStock via Getty Images

Investment Thesis

Tremor International (NASDAQ:TRMR) will be able to rise to greater heights in 2022 thanks to a favorable macro environment, a revenue focus on video and CTV, and being one of the distinct end-to-end, platform tech stack for programmatic advertising.

An Edge with an End-to-End Platform with Proprietary Technology

As per TI latest 20F, it sits within a market opportunity of approximately $492 billion of global digital advertising space that is expected to grow at CAGR of 12% through 2025.

In order to capture more of the market share, it has to provide a unique proposition to its customer and stand out from the crowd.

This comes in the form of their video first, end to end fully integrated platform for its customers and partners that supports their demand or supply side requests.

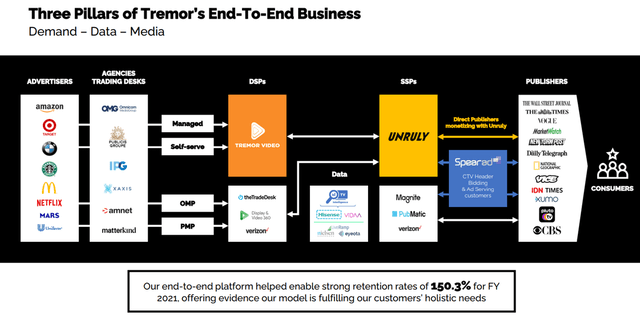

TI’s End to End Business Model (Q4 2021 Earnings Presentation)

This is actually similar to Digital Turbine (APPS). By offering a completely integrated solution to its customers, the client will only need to speak with one firm to obtain the whole suite of services, rather than several platforms or an advertising agency to get their advertising campaign on TV or the internet.

This is a win-win situation for both TI and its customer, as it makes both of them more operationally and cost-efficient.

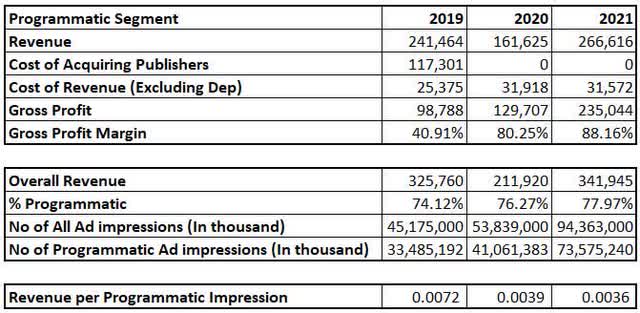

Win-Win for TI and its Customer (Selected Data from FY21 20F)

To illustrated the point, selected information are extracted from the latest 20F.

While comparing the information from 2019 to 2021, it is important to note the following stated in the 20F:

In 2021 and 2020 programmatic revenue are reported on a net basis and in 2019 on a gross basis, and performance revenue reported on a gross basis for all years presented. Media cost amounted to USD 117,301 thousand in the year ended December 31, 2019.

The win for TI was an increase in Gross Margin for its programmatic segment. According to the programmatic segment, the purchase of Unruly in 2020 eliminated the expense of acquiring publishers from that point forward. As a result, TI’s programmatic segment’s Gross Margin increased from 40.91% in 2019 (prior to Unruly being acquired) to 88.12% in 2021.

Customers benefited from the cost savings per programmatic impression. In the table above, this is defined as the revenue per programmatic impression, as the revenue for TI is seen as the cost for its customer.

This was calculated by dividing the percentage of Programmatic Revenue by the total Revenue and utilizing that percentage as an indicator of the percentage of Programmatic Ad Impressions divided by the total Ad Impressions for that year. Then, using the number of Programmatic Ad Impression and the Programmatic Revenue for that year, we can calculate the Revenue per Programmatic Impression – also known as the Cost per Programmatic Impression.

According to the table above, the cost per programmatic ad impression has been cut in half over the last three years, which is clearly much better for customers who continue to work with TI.

As a result, TI now has an advantage in the AdTech sector by offering a fully End-to-End platform to its customers.

Marco Environment in 2022

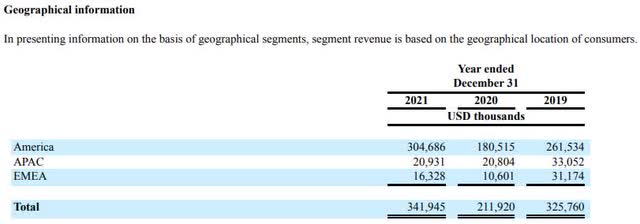

Geographical Segmentation of TI’s Revenue (FY21 20F)

America will account for around 88% of TI Revenue in 2021, according to their most recent 20F. This is an increase from the over 80% figure in 2019.

It also states in the 20F:

Tremor International Ltd. is headquartered in Israel and maintains offices throughout the US, Canada, EMEA and Asia-Pacific.

So while the Geographical segmentation just reads “America,” I assume this refers to the entire continent, with a focus on the United States and Canada.

This revenue concentration may appear to be a concern, yet it will be beneficial to TI in 2022.

In 2022, two key events will occur that will lead the advertising rate in America to skyrocket as demand for advertising space rises.

(1) The US Mid Term Elections

As per Wikipedia, midterm elections in the United States are general elections held near the midpoint of a president’s four-year term. All seats in the House of Representative and 35 seats in the Senate will be contested. The election day is 8 Nov 22.

Political ad spending is likely to be close to what was spent during the 2020 US presidential elections, with broadcast TV and digital video accounting for the majority of ad spending.

(2) The 2022 World Cup

The second event is the 2022 World Cup, which will be held from 18 Nov 22 to 18 Dec 22.

2022 World Cup Grouping (As.com) 1st Time US & Canada Qualified for World Cup (Wikipedia)

This is the first time Canada and the United States have qualified for the World Cup jointly. This suggested that there could be an increase in viewership in both countries this year during the event.

Furthermore, this is the first time a World Cup is held in a Middle East. Brands will want to take advantage of this opportunity to introduce their products to consumers who are unfamiliar with them.

Therefore, with the 2 major events taking places in 2022, demand for advertising space will significantly increase and this will also push up the advertising rate for the whole industry – which TI will also benefit from.

As quoted from a Dentsu Article:

2022’s first Quarter is anticipated to grow by 8.9% on a like-for-like basis, boosted by the Winter Olympics & Paralympics Beijing, while Q2 and Q3 are forecast to grow by 10.3% and 10.7% respectively, enhanced by mid-term election spend in the US expected to pick up from Q3 continuing into Q4. Towards the end of the year Q4 is forecast to grow by 9.2% on a like-for-like basis driven mainly by the FIFA World Cup Qatar and the holiday season.

Digital and television continue to be the two powerhouses driving global ad spend, yet with opposite dynamics. Following a 29.1% increase in 2021, Dentsu forecast digital investment to grow by 14.8% in 2022, fuelled by video, connected TV, programmatic and e-commerce. This will result in the digital share of spend to 55.5% (US$408 billion) of the total ad spend, becoming twice as big as the television share of spend (26.9%) for the first time.

Exclusive Partnership with VIDAA

In Nov 21, TI signed a global exclusive strategic partnership with VIDAA, to gain exclusive access to VIDAA’s automatic content recognition data.

The following is stated in the article:

Tremor International will bring VIDAA’s ACR data into its TV Intelligence solution starting May 1, 2022, which will make Tremor International the only end-to-end technology platform with direct access to OEM ACR data for targeting purposes, outside the walled gardens.

Following the integration into its TV Intelligence solution, Tremor International will have exclusive rights to the VIDAA ACR data in all global markets, and Tremor will activate in the US, Canada, UK, Germany, France, Italy, Spain, Portugal, Netherlands, Australia and Japan.

However, as per VIDAA website, it states that:

VIDAA is available in more than 155 countries and installed 30+ million TV’s. We have significant presence all over the world and are the dominant player in Australia, Mexico, Argentina and Sub Saharan Africa where we outsell any other Smart TV platform in the market. Other key territories include United Kingdom, Spain, Germany, Italy, France, Russia, Ukraine as well as countries of Central and Eastern Europe, Middle East and North Africa, and several countries in the Asia-Pacific region.

In my perspective, this appears to be a data-sharing relationship. VIDAA does not appear to have extensive data in the US. VIDAA will have more data in the US as a result of the partnership, while TI will have more data in EMEA and APAC.

This collaboration will provide TI access to data that it did not previously have and may allow it to expand into the EMEA and APAC regions where it does not now have a significant presence.

Other Catalysts

There are definitely other catalysts that are worth mentioning.

(1) Share Buy-Back

On 24 Feb 22, Company announces a $75 Million Share Repurchase Program in AIM (London Stock Exchange).

As per StockPsycho on Twitter, TI has bought back 2,366,120 shares in last 27 trading days since 1 Mar 22. $17.7m was spent and $57.3m left in buy-back program.

The remaining amount left in the buy back program is still about 5% of the current market cap.

(2) Tr.ly and Market Place

Tr.ly, TI’s creative studio, supports clients from turn-key to end-to-end production for those customers who don’t know what to do. As a result, TI becomes a one-stop shop for these clients.

For clients who know exactly what they want, TI has launched a Programmatic TV Marketplace where advertisers can construct ad campaigns across CTV and video. It will first be available in the United States, with intentions to extend internationally in 2022.

Risks

There are a few risks that could have an negative impact on this thesis.

(1) Competition

The major risk that TI faces is competition. There are far too many AdTech competitors, such as The Trade Desk (TTD), Magnite (MGNI), Digital Turbine and PubMatic (PUBM), to mention a few.

The primary competitor could be The Trade Desk, which recently launched OpenPath, implying that they will be able to provide similar services to their clients.

Mitigation – Currently, having an End-to-End Integrated Platform will give TI a competitive advantage over competitors who focus primarily on the demand or supply side. Furthermore, with 1,578 active publishers as of 31 Dec 21, TI has a temporary edge.

(2) Disruption to the Economic Trade

With the on-going Ukraine/Russia war, supply chain shortage, inflation and possible future recession risks in place, clients might scale back advertising.

Mitigation – While the Ukraine/Russia war remains relevant, the impact to Canada and US might be less impactful. On the other hand, I will argue that if TI clients reduce their advertising spend during these difficult times, they will be merely allowing their competitors to gain more market share, and the impact on their sales may be more drastic.

(3) Privacy Issue

With Google intending to remove 3rd Party Cookies, there will definitely be some impact to TI in terms of its targeted marketing services.

Mitigation – It will be approximately a year before Google removes the 3rd Party Cookies. As a result, TI still has time to develop a solution. Furthermore, according to the most recent 20F, TI is integrating with significant alternative identification solutions such as IdentityLink and Unified ID 2.0 to address this issue.

(4) News Corp Partnership Potentially Ending Jan 23

This was not previously explained, but for the uninitiated, TI purchased Unruly from News Corp (NWSA) in Jan 2020. This agreement kicks off a three-year partnership with News Corp, giving TI the exclusive rights to sell outstream video on more than 50 News Corp titles in the UK, US, and Australia.

This deal has around 9 months left before it expires. Without the exclusive right to sell outstream video on all 50 News Corp titles, the financial impact is unknown.

Mitigation – Based on News Corp (NWSA) latest Transcript, there seem to be a positive emphasis on advertising, especially digital advertising which TI plays a part in. TI partnership with VIDAA will also indirectly help News Corp titles inside Unruly SSP by enabling better targeting for clients who want to feature in News Corp titles. Although this risk exists, it is now modest.

Valuation

To be clear, I am just valuing TI for FY22. Given the risks involved, it will be difficult to value it beyond Q1 FY23.

Nonetheless, valuation, in my opinion, should be the highest target price TI can potentially achieve. As a result, if it does not meet the target price, you will have a margin of safety built into your valuation.

Tremor International Valuation Metric (Seeking Alpha)

Based on the valuation metrics, TI appears to be undervalued in comparison to the sector median.

However, in order to establish a valuation, I will use the company’s forward Q1 projection and the sector median TTM EV/EBITDA to determine a probable target price.

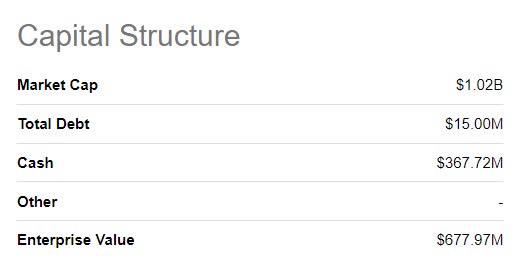

Tremor International Capital Structure as of 18 Apr 22 (Seeking Alpha)

According to the most recent Transcript, the CFO expects Q1 EBITDA to be at least $33 million. This means that EBITDA is predicted to increase 31.5 percent in Q1 FY22 (Q1 FY21 EBITDA is $25.1 million, according to Seeking Alpha).

Thus, if we anticipate EBITDA to expand 31.5 percent in FY22, the expected EBITDA will be $134 million (Seeking Alpha indicates FY21 EBITDA to be $102.1 million).

Using the sector medium TTM EV/EBITDA of 11.42 and the predicted EBITDA of $134m, the EV might be estimated to be $1.5 billion.

This implied that there may be a 120 percent increase in EV over the existing EV of $677 million, which could signify a similar increase in Market Cap!

Conclusion

2022 is a year of uncertainty, but it is also a year of opportunities.

According to an article with several advertising agencies, the advertising sector falls towards the latter category.

In 2022, TI will have the opportunity to realize its full potential as a one-stop AdTech platform for its clients, as well as the various tailwinds in the advertising sector.

However, I anticipate increased rivalry as the AdTech market consolidates and its competitors develop. There will be an intense battle for market share, and it remains to be seen how TI will overcome these challenges.

Despite these obstacles, as one of the leading End-To-End AdTech Platforms in the world with access to VIDAA data, it is currently in pole position to gain additional market share in the US and internationally.

The current share price decline is the ideal opportunity for investors to buy on the cheap.

Be the first to comment