PhonlamaiPhoto/iStock via Getty Images

1Q22 Results & Outlook

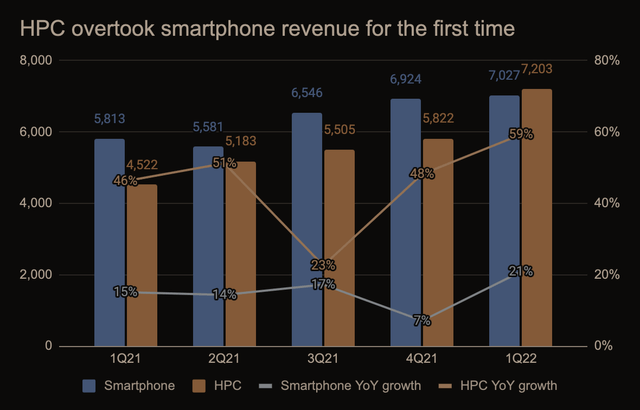

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) (“TSMC”) reported solid 1Q22 results, with record revenue and margins. On the top line, revenue of $17.6 billion (+36% YOY / vs. $16.3 billion consensus) was driven by strong demand for HPC (high-performance computing) and automotive, while gross margin saw a record +56% thanks to a 5%-20% price hike in 4Q21. On the bottom line, operating margin of 46% and net margin of 41% both compare favorably to 43% and 39% in 1Q21. Finally, EPS of $1.40 beat street consensus by $0.09.

For 2Q22, TSMC expects revenue of $17.9 billion at midpoint (+35% YOY) vs. $16.3 billion consensus; gross margin between 56% and 58% (vs. 50% in 2Q21); and operating margin between 45% and 47% (vs. 39% in 2Q21). Further, management noted that gross margin of 57% at midpoint includes a 100 bp tailwind from a better USD/NTD exchange rate assumption of TWD 28.8/USD vs. TWD 28/USD last year.

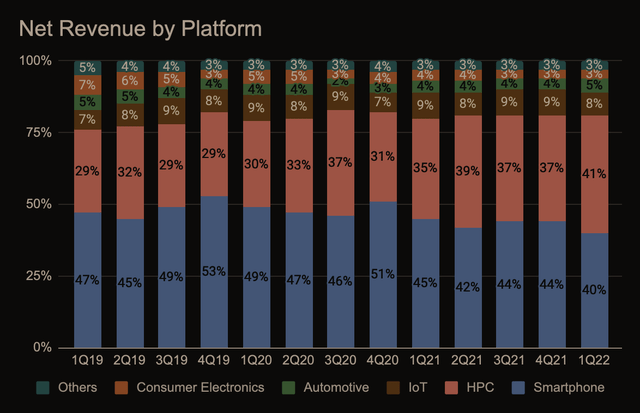

For full year 2022, TSMC sees revenue growing at 25% to 29% or higher (vs. 21-26 CAGR of 15%-20%), as capacity is to remain tight throughout the year while volume and pricing will both contribute. Despite a softer outlook for PCs, smartphones, and tablets, HPC will be a key top-line driver for 2022 and beyond due to structural demand for greater computing power. Note that in 1Q22, revenue from the HPC platform exceeded smartphones for the first time by growing at 59% YOY and 48% in 4Q21.

How’s N3 (and N2) Going?

As previously confirmed by management, the advanced chip N3 will be entering volume production in 2H22, with revenue contribution starting in 2023. Apple (AAPL) will be amongst the first customers alongside Intel (INTC) to use the latest technology for its M3 and A17 chips set to debut for iPhone, iPad and Macs in 2023.

In addition, N3E development is ahead of schedule. Though TSMC may consider early release, the exact timeline is yet to be confirmed. Qualcomm (QCOM) and MediaTek (OTCPK:MDTKF) are expected to first adopt N3E for 5G flagship SoCs.

N2 will be TSMC’s first process node to use GAA transistors instead of FinFET (vs. Samsung already using GAA for N3). Management expects risk production at the end of 2024 and volume production in 2H25, representing a roughly 3-year cadence from N3.

It’s worth noting that TSMC usually takes a cautious approach in developing new technology. This explains why the foundry giant is sticking with the more tried-and-true FinFET transistor structure until N2. By 2025, TSMC will have 6 years of experience with ASML’s EUV tools with projection optics with numerical aperture (NA) of 0.33 (used for 7nm and below). This should help reduce the risk of adopting a new transistor architecture.

Is Neon Supply a Problem?

It’s been widely reported that roughly 50% of the world’s semiconductor-grade neon is made by two Ukrainian companies, Ingas and Cryoin. Both manufacturers have paused operations as Russian troops continue to make advances in Ukraine, causing concerns around further constraints in chip production.

However, TMSC sources special chemicals and gases (including neon) from multiple suppliers across different regions, and the company has a certain level of inventories on hand. Overall, management does not expect the Russia/Ukraine crisis to have a material impact on the supply of neon.

Any Changes to the Capex Roadmap?

TSMC reiterates 2022 Capex of $40-$44 billion, where 70%-80% of the investment will be in advanced technology. On the call, management highlighted that since Capex is usually based on long-term client demand profiles and future capacity already discounts IDM insourcing (e.g., Intel), Capex plan will remain intact even if there’s a short-term slowdown. TSMC currently does not have issues with equipment availability but expects to see some impact on all nodes in 2023, a problem that is already being worked on.

PCs and Smartphones Are Slowing. Is That Bad For TSMC?

It shouldn’t come as a surprise that the pandemic has pulled in peak demand for PCs, smartphones and tablets. In March, TSMC warned of slowing PC and smartphone demand, and famous tech analyst Ming-Chi Kuo said Chinese Android smartphone brands have cut shipment plans by 20% thus far in 2022. In April, Baird downgraded Nvidia (NVDA) on excess GPU inventories, and Truist slashed price targets of both Nvidia and AMD on evidence of order cuts for 2Q22.

While the market is understandably concerned about a down cycle, demand in other end markets such as HPC may prove to be more structural than short-lived for TSMC. For instance, Nvidia’s new GPUs (the Hopper architecture) will be using TSMC’s 4nm process, migrating from Samsung’s 8nm for the prior generation. Marvell (MRVL) is moving its infrastructure products to TSMC’s N5 in 2022 and is developing new IPs for N3. Apple, besides ramping its M1 chips, is testing the new M2 chip on at least 9 Mac models and developing its own RF chips as well. Aiming to advance 5 nodes in 4 years, Intel is relying on TSMC for its next-generation GPUs.

Bottom line, while consumer electronics may be slowing, TSMC is seeing strong acceleration in HPC given its technology leadership. I believe this is the driver behind the company’s 2022 revenue guide of 25%-29% YOY growth vs. 20% in the overall foundry industry.

Why Hasn’t the Stock Gone Anywhere?

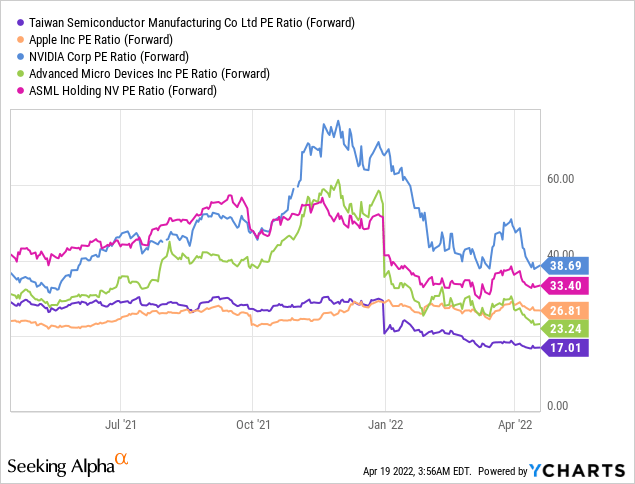

TSMC stock has been challenged by: (1) a relative underperformance of the Philadelphia Semiconductor Index (SOX) triggered by fears of an industry downturn; (2) renewed investor concerns over China’s invasion of Taiwan due to the Russia/Ukraine crisis; and (3) a tightening cycle in the US that typically encourages foreign outflows from Taiwan stocks. Additionally, there’s a tendency amongst some investors to give up on TSMC stock given the dividend yield of 2% is not enough to compensate them for the risk, since the US 10-yr treasury currently yields 2.8% (I disagree with this view, as TSMC is a growth stock vs. a dividend stock).

From a relative valuation standpoint (see below), it’s clear TSMC trades at a discount with geopolitical risks being a major factor. Taiwan is constantly under military threat from China. But it’s important to recognize that the most advanced CPUs and GPUs in Apple’s smartphones and Amazon’s data centers cannot happen without TSMC’s leading-edge technology. In other words, if China invades Taiwan, nationalizes TSMC, and suspends production for all customers in the West, a global semiconductor crisis is guaranteed and it’d be virtually impossible for Western industry leaders to continue their dominance.

As a result, I see a strong case for TSMC stock to revert back to its 1-year average forward P/E of 25x based on 2022 EPS of $5.7, leading to a price target of $143 (44% upside) vs. my previous estimate of $160 at a 30x multiple. While a lower P/E target reflects cycle concerns, a new interest rate paradigm, and lingering geopolitical overhangs, TSMC remains the undisputed leader in the foundry space with an 80% market share in N5 and N7 and possibly a monopoly in N3. Bottom line, I believe long-term investors will be handsomely rewarded.

Be the first to comment