wdstock

There are now more uncertainties about economic growth prompting some S&P 500’s bulls to become more cautious. Also, the strong dollar creates headwinds for big tech Microsoft (NASDAQ:MSFT) which sells products to the rest of the world. In these circumstances, just imagine that one of the most important sources of uncertainty for the S&P 500’s second-most-valued company, namely with regard to competition, is gradually removed.

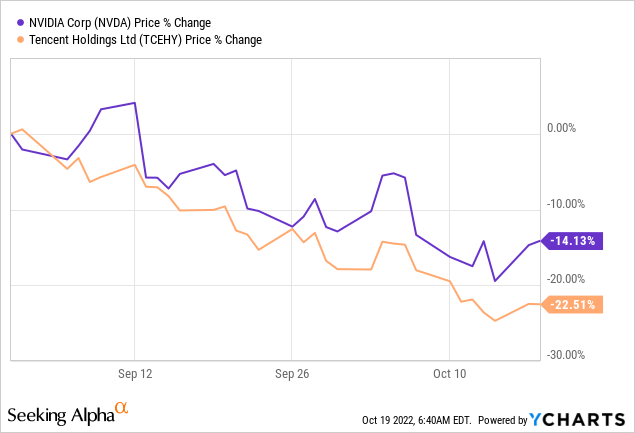

This competitor is Chinese tech giant Tencent (OTCPK:TCEHY) whose share price got a jolt due to the U.S. Department of Commerce tightening the screws on exports of NVIDIA’s (NASDAQ: NVDA) chips to China. The U.S. chip maker’s stock suffered too as shown in the chart below.

While most investors seem to be focused on the woes of semiconductor companies, the aim of this thesis is to elaborate on how denying AI GPU (artificial intelligence graphics processor) chips to the Chinese company could help Microsoft to gain market share in the metaverse, namely with its cloud AI and gaming ecosystem.

As I elaborate below, both Microsoft and Tencent own a number of the most famous gaming properties and aim to play key roles in the metaverse.

Gaming and the Metaverse

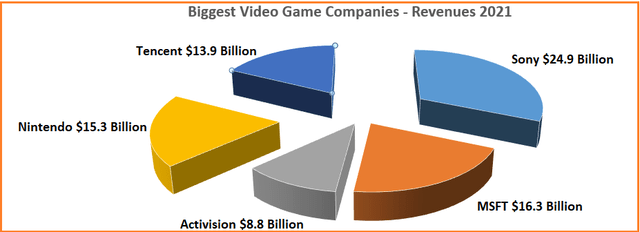

While Microsoft has been making the headlines with its high-profile acquisition of Activision Blizzard (NASDAQ:ATVI), Tencent has been proceeding in a more under-the-radar fashion by scooping several gaming studios in its home country and buying stakes in several ones throughout the world. As shown below, it is now among the top three game providers in Asia, with stakes in Epic Games with hit titles including PUBG Underground and League of Legends. As for Microsoft, after its $68.7 billion acquisition, it rivals Sony (SONY) for the top spot.

Chart built using data from (All Top Everything)

Still, in an evolving industry where subscription and always-connected services have transformed video games to become as natural as downloading a movie on YouTube, one of the rare companies which pose a threat to Microsoft is Tencent.

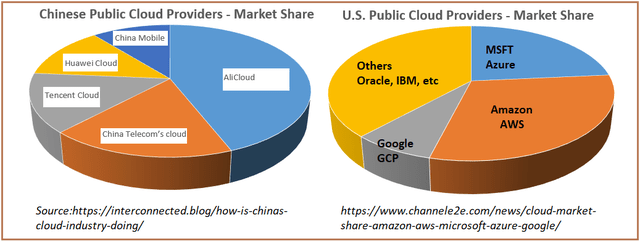

The reason is that to host online games for millions of gamers worldwide, while ensuring reliable performance, you need a solid infrastructure like Microsoft’s Xbox Live services running on Azure infrastructure, or Tencent’s highly popular PUBG Mobile game hosted on Tencent cloud. To this end, the two cloud providers leverage their availability zones distributed across major countries and regions in North America, Asia, Europe, South America, and Oceania to make their games available.

Furthermore, the Chinese cloud providers compete with each other aggressively in their home markets through AI, namely “recommendation algorithms” which recommend a game that a user is most likely to play based on social media or chatting profiles.

Charts built using data from (Seeking Alpha)

They have perfected the technique of extracting valuable insights from the vast data sets that they collect on a daily basis so well that they have rapidly grown their businesses at 27% five-year CAGR, to the point of becoming tech giants

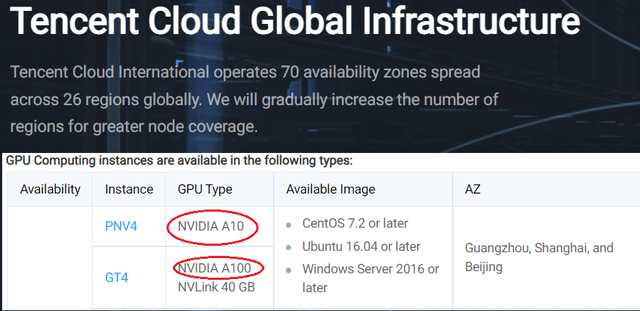

Tencent Cloud’s Dependence on Nvidia

In this respect, Tencent Cloud now has a global infrastructure currently available in 70 areas (zones) in 26 countries and regions around the world, including Silicon Valley, and Frankfurt. The company has millions of servers in its data centers powered by Intel (NASDAQ:INTC) processors, but the most advanced ones proposing AI applications use Nvidia’s A100 GPUs as pictured below.

NVDIA A100 (Tencent Cloud)

Now, Nvidia’s A100 GPU chip includes a graphics processor that enables faster performances than conventional ones and has been adopted by Tencent, both to train its own recommendation algorithms and for leasing as IaaS to cloud customers. Depriving the company of these building blocks as of March 2023 due to restrictions could severely impact the viability of its business model, not only for its AI cloud but the metaverse.

For this purpose, Nvidia’s newly developed H100 is six times more advanced than the current A100 which is used for training AI systems for translating human speech in the area of sentiment analysis, recognizing what’s in photos, or plotting a self-driving car course into traffic. This makes it convenient for the metaverse where virtual reality must reflect the physical world as closely as possible to provide a “realistic” experience for the online gamer or shopper.

In this case, only GPUs have the capacity to process massive volumes of data pertaining to 3D images, animation, or speech on a real-time basis in a profitable fashion, when compared to conventional CPU processes.

Nvidia’s advanced A100 and H100 GPUs

Thus, when the H100 was unveiled last year, both Microsoft and Tencent among a plethora of others were planning to offer it as part of their AI clouds as these are all crucial building blocks for the metaverse.

NVDIA H100 (NVIDIA)

Now, when people talk about the metaverse, they mostly refer to Meta Lab (FB) with its Horizon Workrooms packed with Oculus virtual reality toolsets aimed at expanding the social universe of remote workers into virtual spaces. The same concept can be applied to shopping, buying real estate, or gaming, with FB spending billions of dollars for this purpose.

Microsoft, which has also been spending money to develop its office collaboration through 365 Workspaces, sees the metaverse as bringing together the consumer space and the enterprise through advanced computing and AI. In the words of Nidhi Chappell, the General Manager for Azure AI Infrastructure: “We look forward to enabling the next generation of AI models on the latest H100 GPUs in Microsoft Azure,”.

The aim is to rapidly advance the development of AI worldwide, an area where Chinese competitors will be gradually left with obsolete equipment from 2023 to 2025, due to the life span of the A100 being around 5 years. Moreover, the period running to 2025 should also be marked by the latest AI processors enabling both gamers and employees to share experiences and interact in real-time during “metaverse simulated” scenarios.

Consequently, with its competitor being sidelined, somewhat like China’s Huawei about three years back, Microsoft could gain market share similarly to Ericsson (NASDAQ:ERIC). This gain should be more evident in Europe and Asia, where it is suffering most from currency headwinds, and it becomes important to value Microsoft accordingly.

Valuing Microsoft with a 2026 Timeline

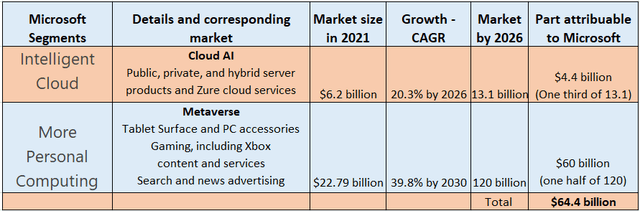

Cloud AI, or consuming advanced computing services through the global infrastructures of Azure, Amazon’s (NASDAQ:AMZN) AWS, and Google’s (NASDAQ:GOOG) GCP was valued at $6.2 billion in 2021 as shown in the table below, after growing by 20% from $5.2 billion in 2020. For investors, these are the three leading cloud-AI service developers in the top 13 forming part of Gartner’s 2022 Magic Quadrant which includes the Chinese cloud giants as well as International Business Machines (IBM) and Oracle (ORCL).

I add the metaverse market size valued at $22.79 billion in 2021 and expected to grow at a CAGR of 39.8% during 2022-2030.

Table built using data from (Seeking Alpha)

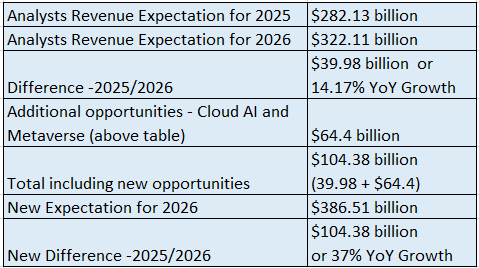

Now, considering the 2026 time horizon and adding cloud AI and metaverse opportunities, I come up with $64.4 billion of sales opportunities, which is in addition to what analysts expect.

Thus, adding the $39.98 billion already expected by analysts from 2025 to 2026 as per the table below, I obtain $104.38 billion, representing a growth of 37% compared for the 2025-2026 period compared to the 14.17% expected by analysts.

Table built using data from (Seeking Alpha)

This additional growth of 22.3% (37-14.17) converts into a forward price-to-sales multiple of 4.68x (322/386 x 5.61) instead of the 5.61x for 2026, in turn yielding a target of $290 (5.61/4.68 x 242) based on the current share price of $242.

Putting Things into Context

This is a long-term target as there are some immediate challenges. First, the $69 billion deal to acquire Activision is drawing the attention of regulators both in Europe and the U.K on antitrust concerns. Second, there has been no sustained growth in sales of video games in 2022 compared to 2021. Third, slowing economic growth fears have prompted the software giant to lay off employees. Therefore, market volatility is likely to persist.

Looking forward into mid-2023, as the Federal Reserve moderates its pace of hiking interest rates and corporations have more disposable income, the economic outlook should improve. Thus, with its cloud, workspace, and gaming ecosystems, and recognition for the top quality of its Machine Learning algorithms in the field of languages, Microsoft, is well placed to synergize its cloud AI with the metaverse. At the same time, chip export restrictions should help it to compete better as its pricing has been flagged when specifically compared with Tencent.

Pursuing further, with AI being used in everything from eCommerce, and improving productivity to creating omnichannel experiences for customer service reps, Microsoft should see more traction for its Azure AI infrastructure. Additionally, it is important to look at the metaverse dimension where apart from Microsoft, the only company which has a global cloud and games business together with chatting apps in the form of WeChat is Tencent.

Now there have been reports that Tencent has designed processors which can be substituted for those made by Intel and Nvidia, but, it is unclear who will manufacture them as these require advanced chip-making gear supplied by the likes of ASML (ASML) and Lam Research (LRCX) who also face export restrictions. Also, there has been a recent news update that Taiwan Semiconductor Manufacturing Company (TSM) will no longer manufacture advanced GPU processors for certain Chinese chip designers.

Conclusion

Consequently, while the economic future remains uncertain, denying Chinese tech giants of critical ingredients for their AI cloud certainly favors their U.S. counterparts. For Tencent, things should become worse as the export restrictions throw a wrench in its plans for building a “staircase to the metaverse“, while, for Microsoft, these appear timely after its Activision acquisition. Its CEO talking during the deal in February this year said that it would “provide building blocks for the metaverse”.

Be the first to comment