Thank you for your assistant/iStock via Getty Images

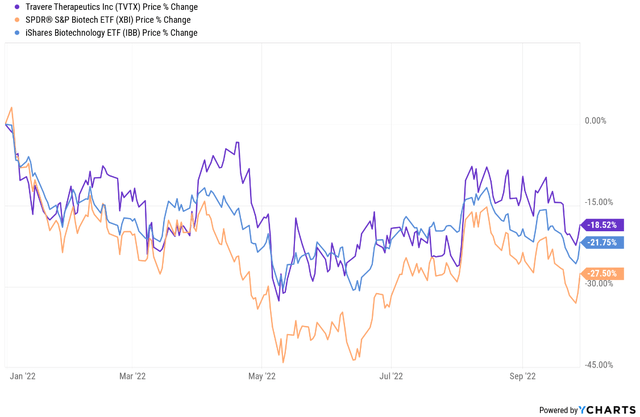

Shares of Travere Therapeutics (NASDAQ:TVTX) are down 18% year-to-date and this is somewhat better than the performance of the two biotech ETFs IBB and XBI. Since my previous update, the company has submitted a new drug application for sparsentan for the treatment of IgA nephropathy (‘IgAN’) and it was accepted and granted Priority Review.

I have decided to shift my view on Travere from bullish to neutral due to the lack of conviction in the upcoming events and catalysts, and due to the underwhelming recent launches in the nephrology market – specifically, the launches of Tarpeyo in IgAN which has direct implications for Travere’s sparsentan, and of Lupkynis in lupus nephritis.

Risk-reward on sparsentan not as favorable

Regulatory events are my least favorite catalysts. There is often not enough reward to justify the risk of holding a stock into an important regulatory event, especially when the consensus is that a specific drug is likely to be approved.

Additionally, the post-approval period is, on average, unrewarding because of the launch risk for a drug, and the majority of drug launches fail to live up to Street expectations.

For Travere, the upcoming PDUFA date for sparsentan in early November for the treatment of IgA nephropathy is a very important event, but there may not be as much reward for holding the stock for a positive outcome. That would especially be the case if the current poor market conditions persist into early November.

I wrote earlier this year that the approval of Tarpeyo is good news for sparsentan and that remains the case. Sparsentan has achieved a greater proteinuria reduction than Tarpeyo and Travere says it has supportive eGFR data to warrant a successful outcome (although the company has not shared the eGFR data). The NDA was accepted and the FDA has granted the application Priority Review which results in a shorter six-month review period.

Overall, the situation looks to be pointing to a positive outcome, although it is not guaranteed. And when there is the expectation of a positive outcome, the reward for holding the stock is usually lower. If the stock stays in the 20s by early November, and if sparsentan is approved, I expect a 10% to 20-25% move higher.

And if Travere receives a complete response letter from the FDA, the move down could be far worse, and the stock could drop 30% to 50%.

However, the primary reason I am shifting to neutral is the post-approval period (if sparsentan is approved, of course) and the recent underwhelming launches in the nephrology space.

The first underwhelming launch is of the direct competitor Tarpeyo in the IgAN market. Calliditas Therapeutics (CALT) reported 134 patient enrollments in the first quarter and 315 in the second quarter, and net sales in the first two quarters on the market were $1.9 million and $6.6 million, respectively, and analysts have already started to temper their expectations.

The second underwhelming launch is of Aurinia Pharmaceuticals’ (AUPH) Lupkynis. The launch has underperformed investor expectations and new patient starts have declined sequentially in the last two quarters and will likely decline in the third quarter. Lupkynis’ launch was similar to Tarpeyo’s in the first two quarters with $0.9 million and $6.6 million in net sales, respectively, and sales in the first year on the market were $45.6 million. Aurinia has guided for $115-135 million in Lupkynis net sales this year along with a $30 million milestone payment from partner Otsuka.

At the time of Lupkynis’ approval, the Street revenue consensus for 2022 was $232 million. It has since dropped to $135 million. Calliditas started 2022 with a $61 million revenue consensus, and it has dropped to $49 million this month. With $8.5 million in net sales in the first half of the year, $40 million in the second half of the year seems a stretch.

As of this writing, Travere’s 2023 revenue consensus is $299.5 million, and given the run rate of existing products of slightly above $200 million, the consensus implies that sparsentan will generate nearly $100 million in its first year on the market.

I think these estimates will be revised lower in the following quarters, and such revisions are usually not accompanied by great share price performance. I would expect sparsentan to generate no more than $50-$55 million in its first full year on the market, similar to what Aurinia accomplished with Lupkynis.

More competition on the horizon

The competitive landscape is evolving and there will be more competition in the following years.

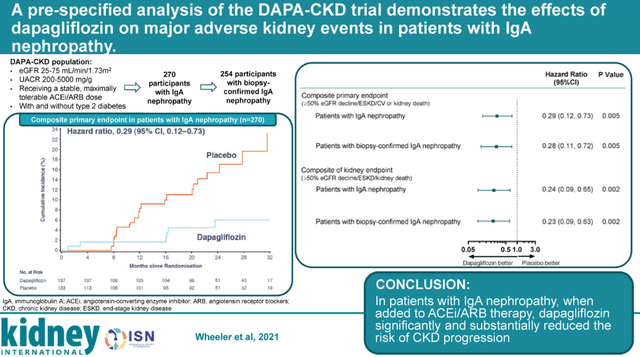

SGLT2 class seems to have a positive effect on IgAN patients. Dapagliflozin (Farxiga) achieved a robust treatment effect in the IgAN sub-group in the DAPA-CKD trial – a greater than 70% reduction in the risk of major kidney adverse events versus placebo, defined as a greater than 50% reduction in eGFR or end-stage kidney disease, or kidney death. The eGFR and proteinuria effects were more modest in the DAPA-CKD trial – eGFR declined by 3.5 mL/min/1.73m2/year in the dapagliflozin arm versus a 4.7 mL/min/1.73m2/year in the placebo arm, and it achieved a 26% reduction in proteinuria relative to placebo.

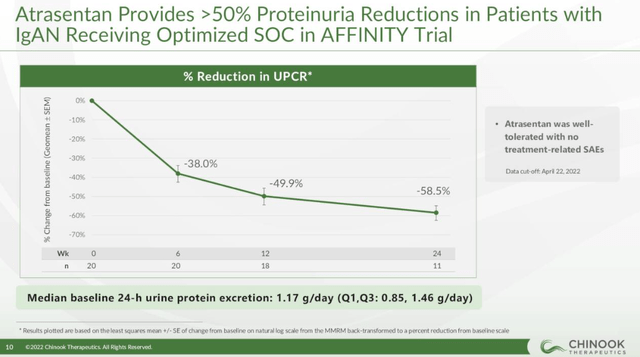

Chinook Therapeutics’ (KDNY) atrasentan is a more direct competitor to sparsentan, and it has achieved high proteinuria reductions in the phase 2 trial. It was a small trial, but atrasentan looks competitive.

Chinook Therapeutics investor presentation

Chinook expects to report topline proteinuria data from the phase 3 trial of atrasentan next year. Chinook also plans to evaluate atrasentan in combination with SGLT2 inhibitors such as dapagliflozin, and this may be a path forward for Travere’s sparsentan and could provide another shot on goal for the combination to achieve even better outcomes for IgAN patients.

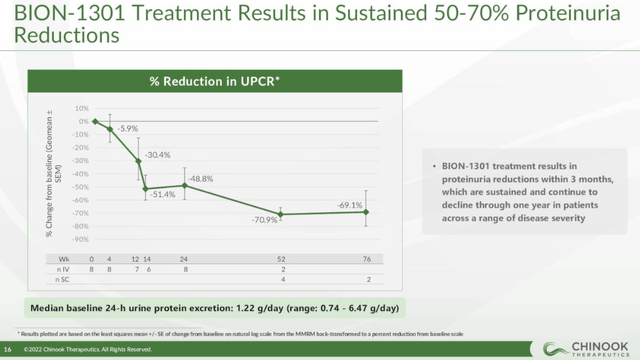

And Chinook’s BION-1301, an anti-APRIL monoclonal antibody, looks pretty good as well, at least based on the early clinical data – it has achieved a 70% reduction in proteinuria in IgAN patients, the caveat being the small number of patients in this trial.

Chinook Therapeutics investor presentation

There are other potential competitors on the horizon as well – Alnylam (ALNY) recently reported positive phase 2 results of cemdisiran, with complement C5 as a target, although the results appear less impressive than those achieved by sparsentan, atrasentan, and BION-1301. Cemdisiran achieved a 37% proteinuria reduction relative to placebo and a 31% absolute reduction in proteinuria.

There are other complement players going after IgAN as well – Ultomiris (also targeting C5), pegcetacoplan (targeting C3), iptacopan (factor B – alternative pathway), and narsoplimab (MASP-2 inhibitor – lectin pathway).

Given the convenience of oral administration of sparsentan and atrasentan, other competitors will have to show much better data to be competitive because they are all administered as subcutaneous injections or intravenous infusions, except for iptacopan which is also an orally administered candidate.

If atrasentan achieves similar or better proteinuria reductions along with similar safety to sparsentan next year, it could further reduce sparsentan’s sales estimates and would represent another headwind in the medium term, although Travere will have a head start of approximately 18 to 24 months.

Conclusion

The potential approval of sparsentan for the treatment of IgAN may not be enough for the shares of Travere to trade significantly higher in the following months and the launch represents another significant hurdle. If sparsentan is approved, I believe we will see downward revenue estimate revisions in 2023, and additional downward revisions if atrasentan impresses in its phase 3 trial next year.

For these reasons, I am shifting from a previously bullish stance to neutral. The risks may not materialize, and things could go the company’s way, but the current risk-reward is insufficient for me to have a bullish view.

Be the first to comment