izzetugutmen/iStock via Getty Images

This article focuses on S&P Global Ratings’ opinion from July 7 which lowered the issuer credit rating of Transocean Ltd. (NYSE:RIG) to CCC-. The linked press release isn’t behind a paywall, but requires registration. S&P is ringing the alarm that RIG is likely to undertake a distressed debt exchange or debt restructuring over the next six months. I feel this downgrade hasn’t received sufficient attention on Seeking Alpha, but it is important to address its merits, as it likely has significant influence on the stock price.

As I explain below, I find S&P’s analysis to be backward-looking and based on incorrect assumptions about the deepwater drilling market. To be fair, most RIG investors would probably indeed agree that any bullish thesis needs to be cognizant of the 2023 debt maturities. However, I also think the recent events reduced the probability of a credit event, and it now stands lower compared to 2021. That is why the timing of S&P’s downgrade is a bit odd, to say the least.

Background

Transocean is well-known on this forum and hardly needs introduction. My bullish thesis hasn’t changed much since January:

Transocean: Get Ready For The Dayrate Inflection Point

The gist of it is that after several painful years of fleet attrition, renewed offshore activity is pushing up utilizations again. As utilizations rise, dayrates initially don’t move by much. But once utilizations get in the 80% to 85% range, the dayrates start moving up a lot and can get quite high.

We finally seem to be around this “inflection point” and dayrates are starting to move up meaningfully. A few highlights from RIG’s fleet status report update:

- Deepwater Invictus was awarded a two-well contract extension in the U.S. Gulf of Mexico at $375,000 per day.

- Transocean Spitsbergen was awarded a nine-well firm contract in Norway at $335,000 per day, plus two one-well options at $375,000 per day.

- Deepwater Mykonos was awarded a 435-day contract, plus options up to an incremental 279 days in Brazil at approximately $364,000 per day.

One of the two new 8th generation drillships will work at $455,000 per day starting in Q1 of 2023. The Gulf of Mexico is leading, but it appears other regions are starting to follow too. Higher dayrates and longer contract terms not only improve the cash flows, but also increase the rig valuations. The latter may come in handy during refinancing discussions.

The recent articles from other Seeking Alpha contributors are also bullish on RIG. These two articles just came out in July:

Transocean: Industry Recovery Is Gaining Further Traction – Buy

Transocean Is Better Valued Than Valaris – 2 Companies In An Undervalued Industry

The Q2 earnings also appear to be a “beat” indicating the company’s fortunes are improving:

- Total contract drilling revenues were $692 million, compared to $586 million in Q1 of 2022;

- Adjusted EBITDA was $245 million, compared to $163 million in Q1;

- Net loss at $0.10 per share compared to consensus expectations of $0.14 loss; and

- Last but not least, Transocean is now reporting that on July 27 it amended its $1.3 billion undrawn credit facility to extend the maturity date from June 22, 2023 to June 22, 2025; the extension should be good news although the borrowing capacity appears to be reduced to $774 million through June 2023 and to $600 million thereafter.

The FSR announcements will obviously take a few quarters to filter into the earnings, but at preliminary glance Q2 appears supportive of the improvement thesis.

Credit downgrade

Given the improving fundamentals, I was surprised to see that S&P cut RIG’s credit rating. Quoting from the S&P press release:

Switzerland-based offshore drilling company Transocean Ltd faces significant upcoming debt maturities and large capital outlays over the next year while the offshore drilling market has stabilized and shown only modest improvement thus far.

Within the next six months, we believe it is likely the company will undertake a debt exchange, debt restructuring or other transaction, which, depending on the specific terms we could view as distressed.

As a result, we lowered our issuer credit rating on Transocean to ‘CCC-‘ from ‘CCC.’ At the same time, we lowered our issue-level rating on the company’s secured debt to ‘CCC+’ from ‘B (recovery rating: ‘1’), our issue-level ratings on its priority unsecured guaranteed and unsecured guaranteed debt to ‘CCC’ from ‘CCC+’ (recovery rating: ‘2’), and our issue-level rating on its unsecured debt to ‘CCC-‘ from ‘CCC’ (recovery rating: ‘3’).

The negative outlook reflects Transocean’s unsustainable leverage, heavy debt maturity schedule, significant capital expenditures (capex) and the potential that it will execute a debt exchange or debt restructuring that we could view as distressed over the next six months.

For reference, a recovery rating ‘3’ implies the unsecured debt-holders will recover between 50% and 70% of what they are owed. This sounds very bearish as S&P is essentially implying the equity could be worthless in 6 months.

Does S&P know something RIG bulls don’t?

Equity is a residual claim on the assets after debt is paid off, so if S&P feels strongly that debt won’t be repaid in full, this is a huge problem for RIG shareholders.

Let’s examine S&P’s rationale:

Transocean has taken steps to improve its liquidity, but it still has significant debt maturities and capex requirements over the next two years.

Specifically, S&P refers to the $646 million due in the next 12 months plus $895 million later in 2023, as well as payments of $430 million by the end of 2022 for the two 8th generation drillships. S&P acknowledges that RIG has $911 million in cash plus an undrawn $1.3 billion credit facility through June 2023 (now extended to 2025, but with reduced borrowing capacity), but nonetheless still concludes the situation will lead to a credit event.

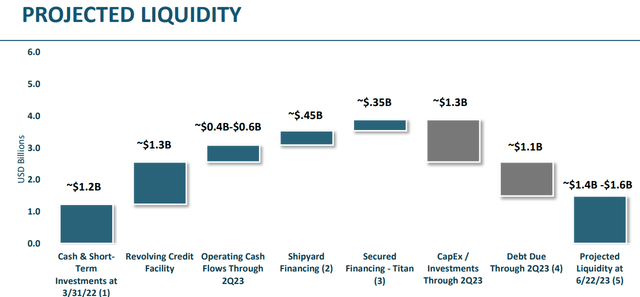

Here is management’s view, as summarized in a June corporate presentation:

Transocean Corporate Presentation

Maintaining the revolver past June 2023 and hitting the operating cash flow targets was obviously important. But even after the scheduled debt repayments, RIG seemed to have at least $1.4 billion of safety margin. Now, it appears the borrowing capacity under the revolver is cut in half, which should still provide adequate liquidity, and Transocean won’t need to repay the facility until 2025.

To me, this looks like RIG should make it through 2023. While after the Q2 earnings we have some benefit of hindsight, I am a bit puzzled what S&P assumed and why they found RIG’s liquidity ladder worse now than in 2021 when WTI crude oil (CL1:COM) averaged in the $60s.

Despite the recent strength in oil prices, the offshore drilling industry has been slower to recover than anticipated, and we expect dayrates and contract terms to be below levels experienced during the last upcycle over at least the next few years.

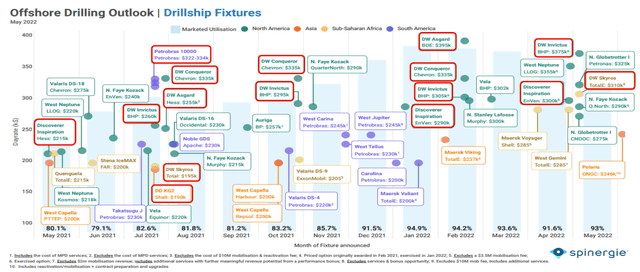

Ouch. This feels like it was written in the fall of 2020, though. Here is a nice visual from RIG’s presentation that shows the dayrate gains over the recent months:

Transocean Corporate Presentation

I think we are certainly well into the $300,000s and already seeing fixtures in the $400,000s. I’m not so sure the $175,000 – $200,000 dayrates from a couple years ago will be coming back any time soon.

We expected offshore activity will be slower to return than onshore plays given the higher up-front costs, longer lead times, and elevated operating risk.

This is probably a valid point, but S&P again references the conventional (no pun intended) wisdom from a couple years ago. However, there are already some signs that U.S. shale is maxing out, except the Permian. It is unlikely the global energy crisis will be resolved without a further call on offshore resources.

Transocean has the strongest backlog in the sector, but it is likely to continue to decline over at least next year. We do not expect Transocean’s backlog to increase meaningfully before late 2023.

Well, that didn’t age well. The July 25 FSR that came out shortly after the downgrade reported incremental backlog of approximately $650 million. This isn’t a small add relative to a now $6.2 billion total.

We believe rates on new contracts will likely be below the average levels in 2018-2019.

I don’t see how $300,000 – $400,000 is below $200,000. Assuming S&P means new fixtures entered into during the respective years, and not rates from legacy pre-2014 contracts that may still have been high through 2018.

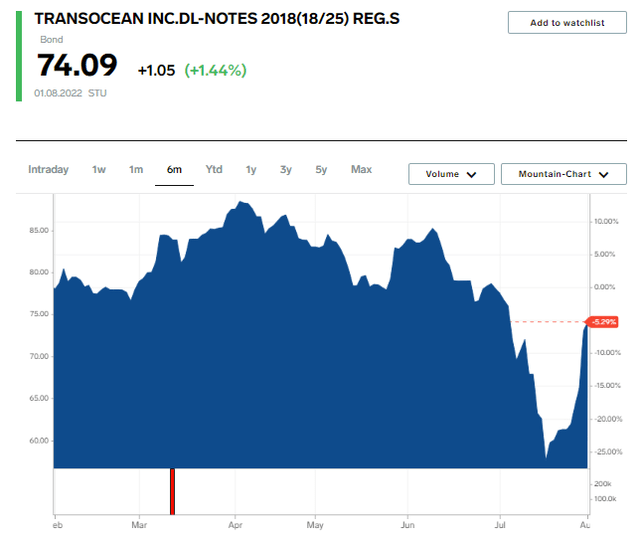

RIG’s bonds indeed fell along with the 30% correction that hit the entire energy sector, but now appear to heading up again:

So, to sum up, S&P’s stated rationale for the downgrade doesn’t appear to hold water. Credit rating agencies of course have access to management and other resources which I don’t have, so they may be seeing something else which isn’t laid out in their public release. But somehow their entire analysis appears backward-looking. It would also be inconsistent with the higher ratings they were assigning in late 2020 and 2021 during a weaker environment for the industry.

The takeaway

Transocean is a very risky investment and the 2023 debt maturities should be a consideration for anyone invested in the stock. Overall, I am bullish on RIG because I think the strong improvements in the industry will push it through 2023. But the risks are there, so I wouldn’t bet the farm on the company. Of course, if RIG avoids bankruptcy, the leverage will add to the upside just as it happened with many smaller E&P companies during 2020. Other drillers, which already underwent bankruptcy and have a cleaner balance sheet, won’t see as much “torque.”

In this context, the S&P credit rating downgrade and insinuation that we are within 6 months away from a distressed restructuring is very worrisome indeed. However, upon scrutinizing S&P’s stated reasons for the downgrade, I feel they aren’t accounting for the latest developments in the deepwater sector. I think we have seen plenty of evidence so far in 2022 that the fundamentals for drillers are much better than what S&P portrays.

Be the first to comment