FG Trade

Investment Thesis

Merck & Co., Inc. (NYSE:MRK) is a global health care company that develops, manufactures, and sells medicines, vaccines, biologic therapies, and animal health products. They have been a premier health care company for long time, and shown well-managed growth backed by a strong pipeline. Their superb technology and patent protection provides a solid economic moat, and they are maintaining their edge through healthy investment in R&D and key acquisitions. I believe Merck is a great investment option because:

- Their oncology portfolio is one of the strongest in the industry, and it will drive growth in the future;

- Merck has a strong balance sheet with a large amount of cash and strong liquidity. This strong fundamentals will enable them to achieve growth targets; and

- Looking at the company’s intrinsic value, the stock price is clearly undervalued, presenting a great opportunity for investors.

Formidable Oncology Portfolio

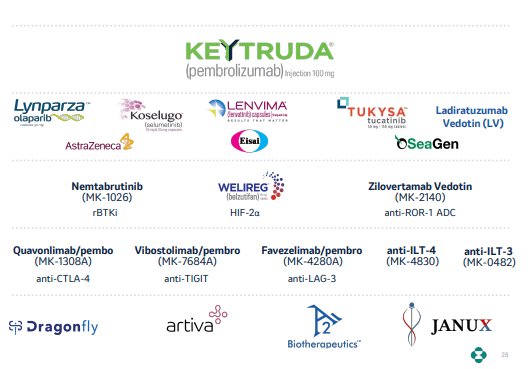

Merck has several blockbuster oncology treatments in the market that are already generating billions of dollar. The sales of KEYTRUDA, their flagship drug, grew 30% YoY to $5.3B in 2Q 2022, and Lynparza (17% growth) and Lenvima (33% growth) also showed strong performance. Even so, Merck is aggressively working to expand their oncology portfolio.

Merck is currently in talks to buy cancer-focused biotechnology company Seagen (SGEN) for $40 billion, which would be Merck’s second major acquisition since 2009. If this deal goes through, this would further boost Merck’s oncology portfolio by adding four approved drugs and several late stage clinical candidates. Merck also just inked a much smaller $290 million collaboration with Orion Corporation for a Phase 2 steroid inhibitor for prostate cancer. Merck has the option to convert this deal into a global exclusive license if development goes well.

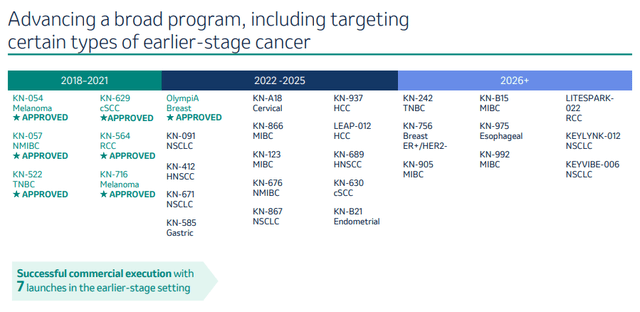

Internal R&D efforts are focused on straight up developing new drugs, as well as targeted towards identifying a combination of therapies that give better outcomes for cancer treatment. At an ASCO investor event, Merck shared an update of current progress and the plans for the future, and the pipeline was pretty impressive.

Merck’s Oncology Portfolio and Pipeline (Merck Investor Relations)

Several noticeable results included the following:

- KEYTRUDA reduced the risk of distant metastasis or death by 36% as an adjuvant treatment option for stage II melanoma. The size of the melanoma therapeutics market is estimated at $3.45 B in 2022, and is expected to grow at 15.8% per year.

- WELIREG for certain Von Hippel-Lindau (VHL) disease-associated tumors was launched successfully. Four phase 3 trials are on-going, with primary completion dates beginning in 2025.

- More than 80 potential approvals are expected through 2028, which will establish Merck as a leader in the oncology space.

Merck’s patent exclusivity on KEYTRUDA expires in 2028, but with this formidable portfolio and pipeline, I expect that Merck will sustain its growth well beyond that.

Strong Fundamentals

Merck has a very strong balance sheet and cash-generating ability. They generated operating cash flow of $17.2 B (free cash flow of $10.2 B), and hold $8.9 B on their balance sheet. Their current ratio (1.4x) and quick ratio (0.9x) are at the upper end among their pharmaceutical competitors – Pfizer (PFE), Bristol Myers Squibb (BMY), etc.

Not only that, their profitability metrics are outstanding. EBIT margin (35.4%), EBITDA margin (42.0%), and net income margin (29.0%) are well above the industry average. Such strong profitability represents the economic moat arising from superb technology and patent protection. I expect them to maintain this strength well into the future. Also, the strong balance sheet and profitability will ensure that Merck has plenty of resources to support their R&D and key acquisitions in the future.

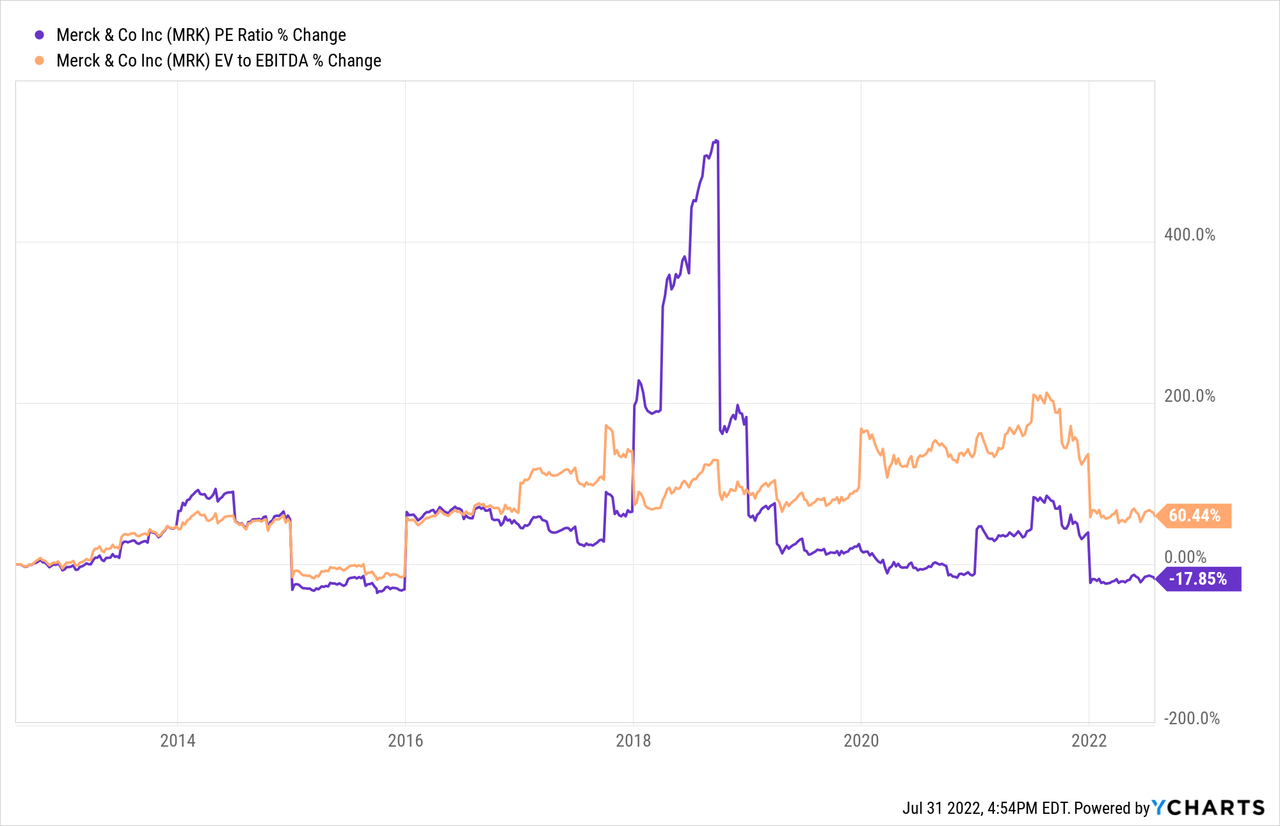

Favorable Valuation

Looking at the valuation metrics, Merck’s stock price is undervalued, and it is presenting a great opportunity for investors to grab the stock. The P/E ratio of 13.6x is significantly lower than both their own historical value (39.2x) and sector median (27.9x). EV/EBITDA value (10.4x) is also lower than historical average (12.8x) and sector median (16.4x). Given their leadership position in the pharmaceutical industry and their impressive pipeline, I expect the market will realize the mispricing soon and the stock price will rise accordingly.

Intrinsic Value Estimation

I used the discounted cash flow (“DCF”) model to estimate the intrinsic value of Merck. For the estimation, I utilized current operating cash flow ($17.2 B) and the current WACC of 8.0% as the discount rate. For the base case, I assumed cash flow growth of 8% (5 year average revenue growth) for the next 5 years, and zero growth afterward (zero terminal growth). For the bullish and very bullish case, I assumed cash flow growth of 10% and 13%, respectively, for the next 5 years and zero growth afterward.

The estimation revealed that the current stock price represents 15-30% upside. Given their strong portfolio and pipeline of drugs, I expect Merck to achieve this upside with ease. Their strong fundamentals and profitability will ensure they have the resources to meet their growth plan.

|

Price Target |

Upside |

|

|

Base Case |

$100.79 | 13% |

|

Bullish Case |

$108.89 | 22% |

|

Very Bullish Case |

$122.11 | 37% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Cash Flow Growth Rate: 8% (Base Case), 10% (Bullish Case), 13% (Very Bullish Case)

- Current Cash Flow: $17.2 B

- Current Stock Price: $89.34 (07/29/22)

- Tax rate: 20%.

Cappuccino Stock Rating

| Weighting | MRK | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 4 |

| Growth Rate vs. Sector | 15% | 4 |

| Margin of Safety | 15% | 4 |

| Sector Outlook | 10% | 4 |

| Overall | 4.3 |

Economic Moat Strength

Merck has a very strong economic moat with superb technology, strong R&D, and patent protection. Their pipeline is very well managed, and they have financial, human, and capital resources to maintain the pipeline, which is critical for a big pharmaceutical company.

Financial Strength

Merck is a financially strong company. They have ample amount of cash on the balance sheet and generate plenty of operating cash flow ($17.2 B) to support their growth. Their total debt to equity ratio (77.6%) is on the higher side compared to peers, but the covered ratio (22.8x) suggests that the debt is well managed.

Growth Rate

They posted pretty strong revenue growth in the most recent quarter (30.21%), but I expect these numbers to decline. Still, organic growth from in-line products and upcoming pipeline drugs should ensure respectable growth. Growth in free cash flow (expected to be 48.45% going forward) will be strong as well.

Margin of Safety

Merck is steadily growing. Based on the DCF calculation, they are about 15-30% undervalued at this point. Also, their dividend yield of 3% is a nice bonus.

Sector Outlook

The healthcare sector is reliable and will grow steadily with the population. Also, advancing technology should bring growth to the industry as well. Maybe not at the super-growth levels of the technology sector, but there will be steady growth for a long time.

Risk

Merck’s success largely depends on maintaining their pipeline and successfully commercializing new drugs. Even though Merck has large resources to carry out R&D and commercialization, it’s far from guaranteed (phase 3 trial success rate is about 50%). There is always a chance that resources spent on developing a new drug goes waste. Therefore, the investor should pay close attention to Merck’s pipeline drug development and clinical trial news.

Oncology Pipeline (Merck Investor Relations)

Even though Merck has a portfolio of successful drug, a large portion (35%) of revenue comes from KEYTRUDA ($17 B out of $48 B total sale in 2021). Also, KEYTRUDA’s revenue growth rate is the highest. While it’s great to have a blockbuster drug, relying too much on a single drug presents risk. One should keep close track of their pipeline development.

While the Seagen deal is generally regarded as positive due to its potential to bolster Merck’s oncology portfolio and potentially extend KEYTRUDA’s patent protection, it will add significantly to the company’s debt position. In addition, the deal will have to pass increased antitrust scrutiny from the Federal Trade Commission. News surrounding this deal and the ultimate outcome could carry significant short and long-term ramifications for stock price.

Conclusion

Merck is a premier healthcare company boasting a strong economic moat. Their profitability and growth is top notch, and I expect that will be the case for the foreseeable future. I am really excited about their focus on oncology, and I believe it will serve them well in the future. The heavy reliance on a single drug does present risks, so the investor should keep an eye on their pipeline. Overall, I expect 15-30% upside going forward.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment