Feverpitched

Thesis

Investors who added the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) at its September lows have benefited markedly from its mean-reversion rally over the past two months.

Accordingly, SCHD buyers who picked those lows have gained 15.4% since we updated previously, outperforming the S&P 500’s (SPX) (SP500) 12.1% gain.

We assess that the extent and pace of the recovery have helped normalize the SCHD’s valuation closer to its average. Also, SCHD’s price action suggests investors should anticipate a pullback that seems increasingly likely.

As such, we encourage investors to be patient at the current levels and not rush to join the recent buyers in its recovery surge. It’s critical to note that SCHD has already lost its medium-term bullish bias, with sellers still in decisive control until buyers could retake its uptrend subsequently.

Revising from Buy to Hold.

SCHD: Valuations Of Top Holdings Normalized

| Name | % Weight | NTM normalized P/E | 10Y average |

| Amgen (AMGN) | 4.41% | 15.9x | 14.3x |

| Merck (MRK) | 4.38% | 14.2x | 14.8x |

| International Business Machines (IBM) | 4.31% | 15.2x | 11x |

| The Home Depot (HD) | 4.03% | 18.5x | 20.5x |

| Texas Instruments (TXN) | 3.98% | 22.2x | 20.8x |

| Pfizer (PFE) | 3.97% | 10.2x | 12.9x |

| PepsiCo (PEP) | 3.92% | 25.2x | 21.4x |

| Broadcom (AVGO) | 3.86% | 12.7x | 14.1x |

| Lockheed Martin (LMT) | 3.77% | 17.7x | 16.7x |

| Cisco (CSCO) | 3.76% | 12.9x | 13.5x |

| Total | 40.39% |

SCHD’s Top ten holdings’ NTM normalized P/E comps. Data source: S&P Cap IQ

SCHD’s forward P/E had normalized to 12.8x, up markedly from 11.2x when we covered it previously. It has also moved closer to its weighted average P/E of 14.8x.

Moreover, we also gleaned that the leading stocks in SCHD have also seen their valuation creep back toward their 10Y averages, as seen above. Accordingly, five of its top ten holdings have a P/E that is now above its 10Y averages.

While SCHD’s valuation remains below its weighted average, we believe it’s appropriate for investors to model a recessionary base case to reflect the increasing risks of earnings compression. As such, it behooves investors to apply a reasonable discount from its historical valuation averages to reflect the risks of earnings estimates being lowered from here.

Price Action Is No Longer Constructive

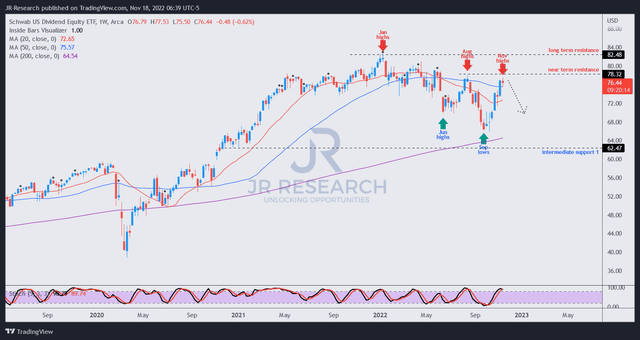

SCHD price chart (weekly) (TradingView)

As seen above, SCHD has recovered remarkably from its September lows, as we postulated. Therefore, the market’s positioning suggests that the base case of a mild-to-moderate recession remains the primary thesis.

Therefore, we are confident that SCHD’s 200-week moving average (purple line) should proffer investors robust buying support if they choose to enter at those levels.

However, the sharp momentum spike to its November highs seems to have faced significant resistance from the sellers waiting at its near-term resistance.

Hence, we deduce that SCHD’s August highs will not likely be retaken decisively in the near term as the market needs to price SCHD appropriately for a recessionary P/E.

Moreover, the 50-week moving average (blue line) continues to resist buying upside robustly, with SCHD already having lost its uptrend momentum. Therefore, it’s prudent for investors to avoid buying into sharp surges in a medium-term downtrend, as seen above.

Our analysis suggests that SCHD investors waiting for another entry opportunity should wait for a pullback that could consolidate at a level above its September lows. Suppose the potential SCHD pullback attempted to break below those lows. Investors need to be cautious in that case, as it could indicate a steeper fall towards its “intermediate support 1” before finding an eventual bottom.

We are confident that that zone should proffer investors a considerable margin of safety based on an implied forward P/E of 10.5x, well below its weighted average P/E of 14.8x.

Revising from Buy to Hold.

Be the first to comment