SlavkoSereda

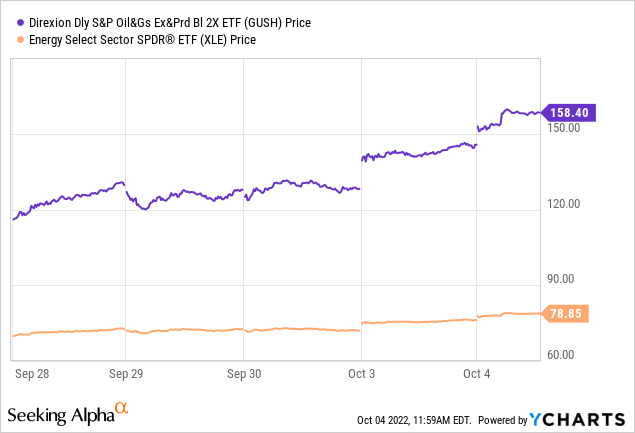

The share prices of the Energy Select Sector SPDR ETF (NYSEARCA:XLE) and the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares ETF (NYSEARCA:GUSH) both surged on Monday and Tuesday, before the October 5 meeting of the Organization of Oil Exporting Countries (OPEC) and its allies, to consider an above one million barrels per day of production cut.

Now, XLE and GUSH surged by over 5% and 15% respectively as shown in the charts below, and for those who missed the opportunity to invest before the upside, the question is whether the price action can turn into a rally.

In order to provide an answer, I consider the reasons why the oil exporters and particularly Saudi Arabia want to cut supply when there are economic slowdown risks in various parts of the world which are already threatening demand.

For this purpose, I start by going through the demand-supply dynamics.

The Demand-Supply Equation

First, one of the reasons for cutting production is to address the problem of weaker prices. This has been caused by a darkening of the economic outlook in turn depressing demand for crude oil and bringing down the prices. Additionally, China’s Covid lockdowns have resulted in a reduction in consumption of diesel, gasoline, and jet fuel by around 380K barrels per day (b/d) in 2022.

On the supply side, according to some estimates, Russia, which is among the top three crude producers had seen a curb of only 310K b/d compared to before the Ukrainian conflict. At the same time, U.S. production of crude had climbed by around 100K b/d in the first week of August, the U.S. Energy Information Administration.

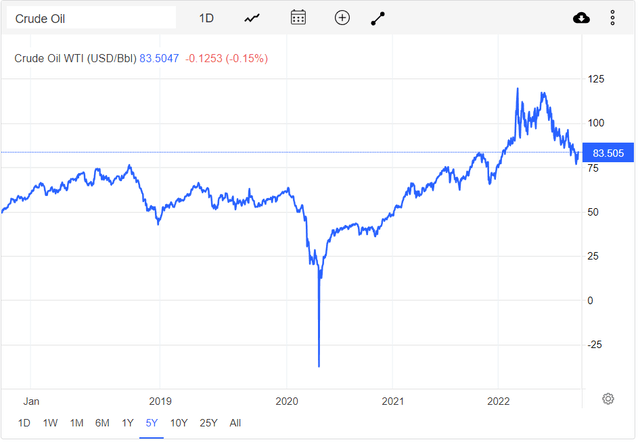

Therefore, the acute shortages that many traders had betted on after the Ukrainian conflict did not materialize, and adding to the equation was a stronger dollar which is not favorable to commodity prices. As a result, there was a retreat in global crude benchmarks with West Texas Intermediate or WTI falling below $85, far from its March high of $119.65.

Crude Oil prices (Trading Economics)

This downtrend in crude oil prices only obtained a temporary reprieve after an announcement made in the first week of September by OPEC+ (or OPEC and its allies which include Russia) for dropping October production by 100K b/p compared to the previous month. Thus, the pledge for a 1M reduction as mentioned in the introduction becomes significant because of its size.

Moreover, for those doubting that a consensus can be reached as to the cuts, there is a strong precedent. Thus, in the spring of 2020, after Covid had been declared a pandemic, the organization’s 23 members held regular virtual meetings and managed to clinch an agreement to restrain production in order not to flood the market with oil, as demand had been severely impacted by stay-at-home orders, sanitary restrictions, and lockdowns. The move worked and prices, which had fallen into negative territory earlier that year as shown by the vertiginous drop in the chart above, rose again until the March peak.

Trading OPEC’s Hawkishness with GUSH

Therefore, OPEC+ has shown the capability to coordinate an increase in production as demand rose and prices went higher. This resulted in windfall gains for its members, which makes us wonder why Saudi Arabia, which was the world’s largest exporter in 2021, wants to see even higher crude oil prices, and this is at risk of triggering economic slowdowns among importers.

The reasons lie in the cost of production. In this respect, that country, which is among the world’s top three producers of crude oil, incurs a breakeven fiscal oil price for 2022 of $79.18. Now, this is the cost of extraction of oil from below the earth’s surface right to its transportation to a port for eventual embankment aboard a tanker. Therefore, its oil operations are already profitable, but, only slightly with crude hovering around $80. Thus, the oil kingdom wants more.

According to some sources, the country has a preference for a $100 Brent crude price. Now, given that the differential between Brent and WTI is currently about $5 in favor of Brent, this would translate to a WTI price of around $95 (100-5). This, in turn, implies a 13.8% upside from the current price of $83.5.

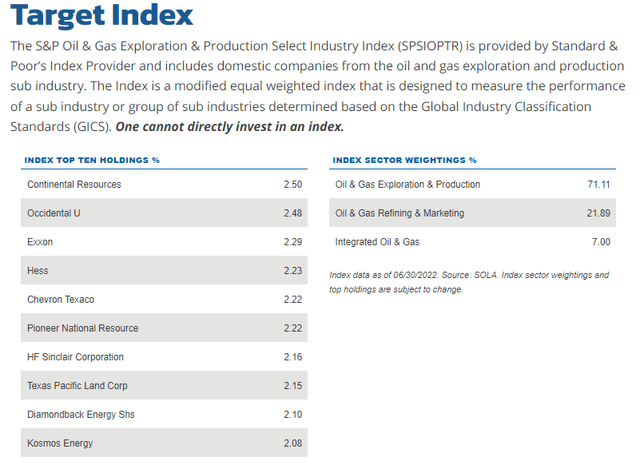

This could result in an above 27% (13.8 x 2) upside in GUSH which seeks to provide (before fees and expenses) returns equivalent to 200% of the performance of the S&P Oil & Gas Exploration & Production Select Industry Index. This index includes big names like Exxon (XOM), Chevron (CVX), etc. whose profitability would automatically receive a boost in case commodity prices move higher.

Target Index for GUSH (Direxion)

However, 27% is rather a long-term target and there are uncertainties, which I will elaborate upon below. Also, GUSH aims to take advantage of short-term trends, and for this purpose, I look at momentum indicators. Its share price of $151.43 has moved above the 10-Day SMA of $131.83 which indicates a buy. However, the share price remains below the 50-Day SMA of $156.03, which reduces the probability of a sustained upside. This is further confirmed by its RSI of 51.87, which is above 50.

Thus, this is more of a trading opportunity and after a two-day surge, do expect a slight retrenchment, before further upside, possibly to the $160 level as the OPEC+ meeting looms.

XLE is a Buy-and-Hold

To be realistic, there is a lot of speculation and things will depend on the way OPEC’s members physically interact with each other in Vienna. Also, it may not be easy to find a consensus concerning the reduction as a Russian News Agency points to a lower production cut of between 500K and 1M b/p for November’s output target. The midpoint of 750K is lower than the $1M target mentioned by the Wall Street Journal.

Pursuing further, an increase in oil prices is against the interest of the majority of the world’s countries that have to import oil as well as the U.S., which despite being the world’s top producer of crude, also remains the top consumer. Also, high oil prices contribute to spiraling inflationary as the commodity is used in huge amounts in raw materials for everything from transportation, and manufacturing to the production of fertilizers. Furthermore, many countries in the world, including developed ones like the U.K., are having to subsidize rising power bills.

Thus, with higher oil prices building up inflationary pressures everywhere in the world, there should be widespread opposition to a drastic cut. Along the same lines, economic data from the St. Louis Fed also indicates that Saudi Arabia’s breakeven price for 2023 will be $69, or lower than this year. Without going into details of how this is feasible, this ultimately means that the country may see less of a need for higher crude prices for its oil operations to be profitable in the future.

Combine this with the possibility of a winter recession in Europe, uncertainties in the U.S. following job openings in August dropping by 10% compared to July, and China prioritizing a strict Covid policy which severely hampers mobility in the world’s largest automobile market and it becomes less likely for WTI to stage a rally.

Still, with OPEC+ controlling more than half of the world’s energy supply and more cohesion among members since Covid, a price of around $100 seems achievable. This is a target that analysts at BofA expect in 2022, but they foresee a fall to $95/bbl in 2023.

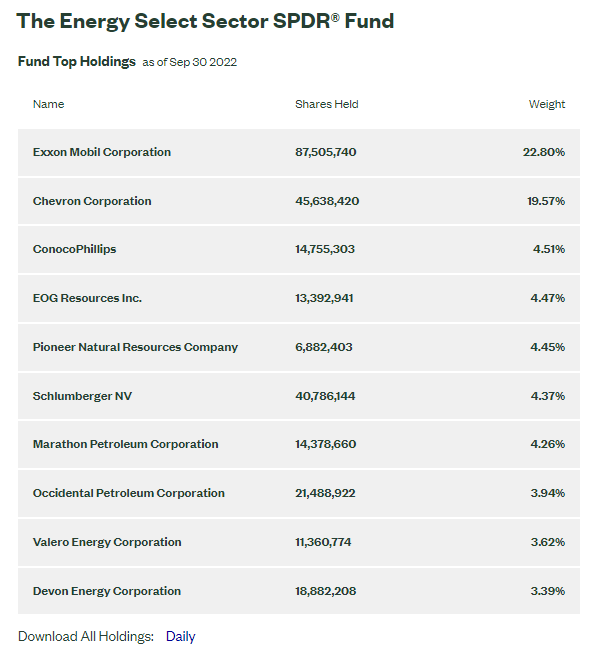

This means that with a 13.8% gain as I calculated earlier, XLE could reach $89.8 (78.95 x 1.138). The ETF has a distribution yield of 4.25% thanks to the strength of its holdings as shown in the table below.

XLE’s Holdings (SSGA)

Conclusion

Commodity prices, especially oil, are quite difficult to predict when you have so many factors which can impact demand and supply. Additionally, commodity traders play a key role in determining prices.

Hence, it is important to be vigilant, especially when trading GUSH, which is a highly leveraged ETF. To this end, use a stop loss strategy to exit in case some adverse news impacts the market. Two of them are, firstly, a possible price cap on purchases of Russian oil being worked out by Finance ministers from the Group of 7 nations and, secondly, progress in negotiations with Iran on the Nuclear deal. In case, there is any agreement, there should be an additional 1.3M b/d of crude pumped into global markets, implying a supply glut in current circumstances.

As for XLE, this ETF remains a good option for income investors and, while there are uncertainties around demand mostly related to recession fears, the lingering conflict in Ukraine has inexorably impacted supply thereby contributing to putting a floor on commodity prices, with the pickup in air travel after many destinations have removed Covid restrictions also helping jet fuel demand to recover rapidly.

Finally, do not expect a rally in crude oil to $120, but more of a modest upside to $100, which will follow a volatile path this week as unemployment numbers are released on Friday, October 7.

Be the first to comment