jetcityimage

The packaging industry may not seem like all that exciting a space. But the fact of the matter is that you can find some rather attractive prospects to be had. One firm in the packaging market that does deserve some attention is Amcor (NYSE:AMCR). Based in Switzerland, the company owns well over 230 locations spread across no fewer than 43 different countries. It provides packaging services for food products, beverages, and even to the healthcare space. All things considered, the company has been performing very well from a fundamental perspective as of late. But this doesn’t necessarily make it a great prospect for investors to buy into. Yes, shares of the company are trading at attractive levels. But compared to similar firms, the stock is a bit lofty. Considering its most recent performance, I would now rate it a soft ‘buy’, with the caveat being that investors can probably get more bang for their buck from other prospects in the space.

Great stability during these times

Back in January of 2021, I wrote my first article detailing the investment worthiness of Amcor. I found myself particularly impressed by how high quality the company had demonstrated itself to be and by the mergers and acquisitions activities that it had engaged in during the prior few years. With the prospect of synergies resulting from its acquisitions, and just organic growth on its own, I found myself optimistic about the company’s future. But at the end of the day, the pricing of the firm and the uncertainty regarding the planned synergies led me to rate the business a ‘hold’, reflecting my belief at that time that it would likely perform along the lines of what the broader market would for the foreseeable future. So far, the company has held up well in the current market, with a loss for shareholders of 1.7%. That compares to the 4.8% decline experienced by the S&P 500 over the same window of time.

Author – SEC EDGAR Data

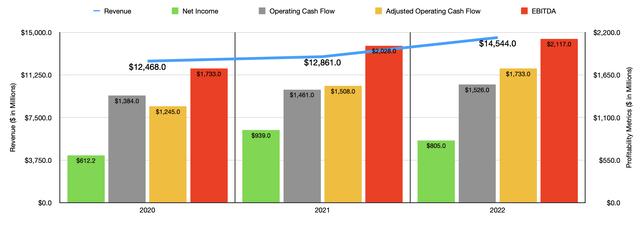

A lot has transpired since I last wrote about Amcor. We have seen nine quarters’ worth of data reported, taking the company not only through the 2021 fiscal year in its entirety but also through its 2022 fiscal year. The results so far are definitely promising. For instance, during the 2021 fiscal year, sales came in at $12.86 billion. That represents a 3.1% increase over the $12.47 billion generated in the 2020 fiscal year. But the real growth for the firm came in 2022, with revenue of $14.54 billion translating to a year-over-year increase of 13.1%. The company benefited that year from a 0.4% rise in volumes, and by a 3.4% increase caused from pricing and product mix. What is really fascinating is that the revenue increase came even as the company was negatively impacted by other factors. For instance, asset dispositions and ceased operations hit the firm to the tune of $87 million, while foreign currency negatively affected sales by $249 million. Much of the company’s increase in sales, however, came from $1.53 billion in additional passing through of raw material costs to its customers.

Profitability for the company, meanwhile, has been a bit more complicated. For instance, from 2020 to 2021, net income rose nicely from $612.2 million to $939 million. But in the 2022 fiscal year, profits dropped to $805 million. Foreign currency translation, higher costs associated with the plants that it operates, a rise in selling, general, and administrative costs and other expenses, as well as lower gross profit margins, all hurt the company from a profitability standpoint. Even though this was the case, other profitability metrics for the firm came in strong. Operating cash flow rose from $1.38 billion in 2020 to $1.46 billion in 2021. During the 2022 fiscal year, the metric rose further, hitting $1.53 billion. The performance disparity looks even greater if we adjust for changes in working capital. In this case, the metric would have risen from $1.25 billion in 2020 to $1.51 billion in 2021. During the 2022 fiscal year, it rose yet again, hitting $1.73 billion in all. A similar trend can be seen when looking at EBITDA, with the metric climbing from $1.73 billion in 2020 to $2.03 billion in 2021. During the 2022 fiscal year, the metric continued to increase, hitting $2.12 billion.

Author – SEC EDGAR Data

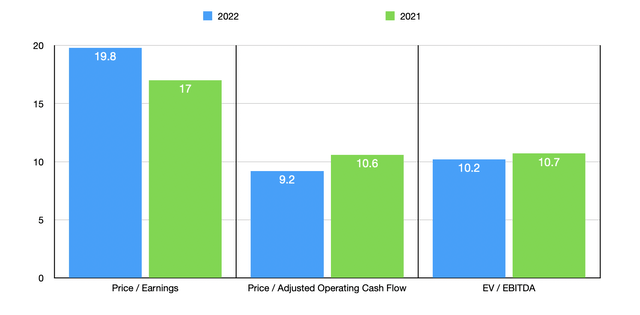

For the 2023 fiscal year, management expects growth to continue, with earnings per share forecasted to expand by between 3% and 8%. The company also intends to buy back roughly $400 million worth of stock (on top of $600 million worth of purchases made during the 2022 fiscal year) during the year. Assuming that the company buys back the stock at the average price that shares are currently trading at, $10.73 apiece, this should translate to net income of $825.3 million. That’s marginally higher than the $805 million the company generated during the 2022 fiscal year. Since we don’t have any indication on the other profitability metrics, I have decided to price the company based on the 2022 data instead. Doing this, we end up with a price-to-earnings multiple of 19.8, a price to adjusted operating cash flow multiple of 9.2, and an EV to EBITDA multiple of 10.2.

These numbers stack up against the 17, 10.6, and 10.7, respectively, that we get using data from the 2021 fiscal year. As part of my analysis, I also decided to compare Amcor’s 2022 pricing to the trailing 12-month multiples of five similar firms. On a price-to-earnings basis, these companies range from a low of 8.8 to a high of 21.2. And using the EV to EBITDA approach, the range was between 5.1 and 10.7. In both cases, four of the five companies are cheaper than our prospect. Using the price to operating cash flow approach, the range was between 3.8 and 14.7, with two of the five companies being cheaper than our prospect and the other one being tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Amcor | 19.8 | 9.2 | 10.2 |

| Packaging Corporation of America (PKG) | 10.4 | 8.0 | 6.3 |

| WestRock Co. (WRK) | 8.8 | 3.8 | 5.1 |

| Sonoco Products (SON) | 13.3 | 14.7 | 9.9 |

| Sealed Air Corp. (SEE) | 12.1 | 9.2 | 8.8 |

| Graphic Packaging Holding Co. (GPK) | 21.2 | 10.3 | 10.7 |

Takeaway

What data we have today suggests to me that Amcor continues to perform nicely. Although net income might be a bit volatile, other profitability metrics are promising. On an absolute basis, shares of the company are attractive at this time. But it’s also true that there are cheaper players that are likely offering greater upside in this space than what Amcor can offer. Due to these factors, I do think that the company still provides investors with enough upside to warrant a soft ‘buy’ rating at this time.

Be the first to comment