Diego Thomazini/iStock via Getty Images

By The Valuentum Team

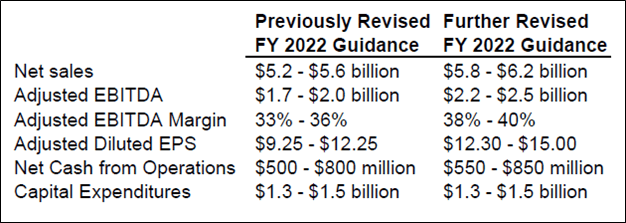

When the specialty chemicals company Albemarle Corp. (NYSE:ALB) published its first quarter 2022 earnings report on May 4, the firm boosted its full-year guidance in a big way. That guidance boost was attributed to outperformance at its lithium operations and to a lesser extent, its bromine operations, which offset major inflationary headwinds facing its refining catalysts operations. In the wake of favorable contract negotiations covering sales of lithium derivatives and related products, Albemarle further boosted its full-year guidance in late May (on May 23).

We liked the company’s two favorable guidance increases in one month, especially in the current environment, and we appreciate the company’s confidence in its near-term performance. Albemarle remains one of our favorite ideas within the specialty chemicals space. The high end of our fair value estimate range stands at $247 per share, and with the company’s equity trading in the mid-$220s, we see potential upside given recent fundamental momentum. Shares yield ~0.7% at the time of this writing.

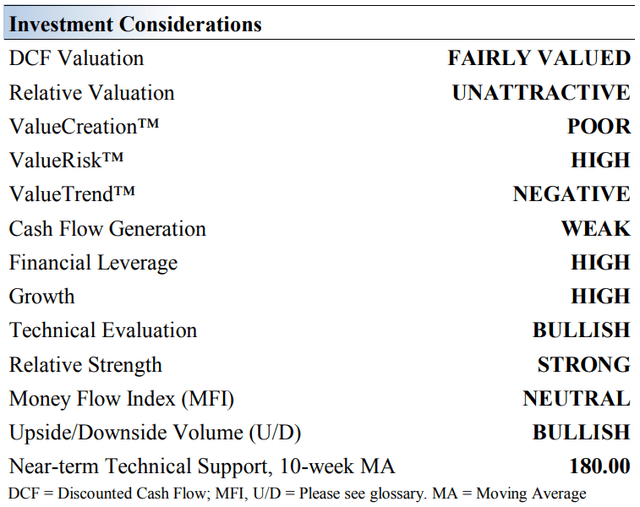

Albemarle’s Key Investment Considerations

Albemarle is a leading supplier of lithium and lithium products, including battery components to electric vehicle manufacturers. Performance catalysts for use by the oil refining industry and bromine derivatives for fire safety solutions represent its other key businesses. The firm was founded in 1994 and is headquartered in Baton Rouge, Louisiana.

Albemarle has a competitively-advantaged (low cost) and diverse lithium derivatives portfolio underpinned by attractive growth opportunities. Its largest segment, ‘Lithium’, carries the highest adjusted EBITDA margin out of its three core segments.

Over the long haul, Albemarle targets a net debt-to-adjusted EBITDA ratio of 2.0x-2.5x. The Dividend Aristocrat has increased its payout over the past 25+ consecutive years. Its key capital allocation priorities include investing in the business, growing its dividend, and potential M&A and JV activities. Share buybacks are expected to be limited going forward.

Albemarle is laser-focused on growing its ‘Lithium’ business as it forecasts lithium demand will grow by 30+% CAGR through 2025 from 2020 levels, underpinned by rising demand for electric vehicles and battery storage offerings. Scale and efficiency gains should support its ‘Lithium’ margins going forward.

Our cash flow valuation model assumes Albemarle posts meaningful revenue growth and margin expansion in the coming years, though should the company stumble for any reason, its intrinsic value estimate would face meaningful headwinds, with expectations for a revision lower.

Albemarle’s Latest Guidance Boost

Here is what Albemarle had to say regarding its near term outlook within its May 23 press release:

Lithium adjusted EBITDA for the full year 2022 is now expected to grow approximately 300% year over year, up from [our] previous outlook. Average realized pricing is now expected to be up approximately 140% year over year resulting from the implementation of index-referenced, variable-price contracts and increased market pricing. Full-year 2022 volume is expected to be up 20-30% year over year primarily due to new capacity coming online (unchanged from [our] previous outlook).

Revised Lithium outlook assumes the company’s updated second-quarter 2022 realized selling price remains constant for the remainder of the year. There is potential upside if market pricing remains at historically strong levels or if current fixed contract renegotiations result in additional index-referenced, variable-price contracts. There is potential downside in the event of a material correction in lithium market pricing or potential volume shortfalls (e.g., delays in acquisitions or expansion projects).

Stronger than expected realized pricing for its lithium product sales was due to favorable contract negotiations, as its revised contracts better enable Albemarle to capitalize on surging lithium derivatives pricing seen over the past 18 months. When combined with expected output growth this year, that dynamic created a powerful source of upside for Albemarle’s financial performance. The potential for downward movements in lithium product pricing and delays in its growth endeavors (both organic and inorganic) represent potential hurdles for Albemarle, though conversely, there is also room for additional upside as well. Management noted in the May 23 press release that Albemarle left its guidance for its bromine and refining catalysts businesses unchanged during its latest forecast revision.

Albemarle is now forecasting it will generate $6.0 billion in net sales this year at the midpoint, up meaningfully from its previous guidance (issued on May 4) which called for $5.4 billion in net sales at the midpoint. Furthermore, that is sharply higher than the midpoint of guidance Albemarle issued on February 16 in conjunction with its fourth quarter 2021 earnings report, which called for $4.35 billion in net sales in 2022.

Pivoting to Albemarle’s expected non-GAAP adjusted diluted EPS performance, the midpoint of its current guidance stands at $13.65, up substantially from $10.75 billion previously and up sharply from the $6.15 guidance midpoint issued in February 2022. The company also increased its forecasted net cash from operations, non-GAAP adjusted EBITDA, and non-GAAP adjusted EBITDA margin for 2022 during its latest guidance revision while leaving its capital expenditure expectations unchanged.

Albemarle – May 2022 Press Release (Albemarle’s latest guidance boost highlights the immense amount of confidence management has in the company’s near term performance. The firm has increased its full-year guidance for 2022 multiple times, and farther out, its booming lithium operations underpin its incredibly promising longer term growth runway.)

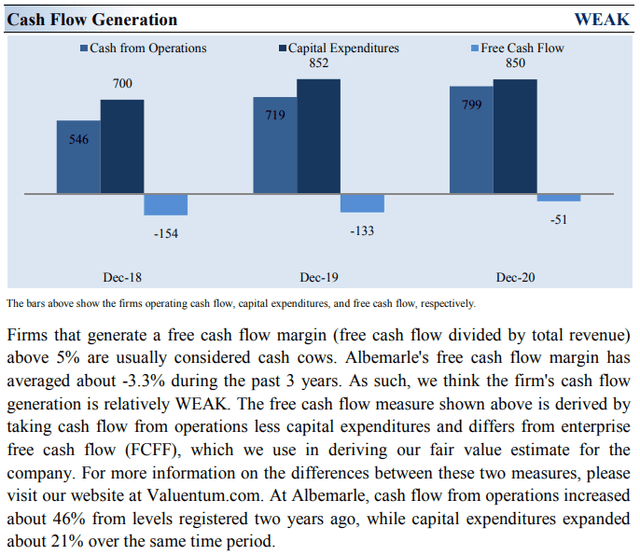

On a year-over-year basis and at the midpoint of its latest guidance, Albemarle is now guiding to generate ~80% net sales growth, ~170% adjusted EBITDA growth, and its adjusted diluted EPS is expected to more than triple. Additionally, Albemarle forecasts its adjusted EBITDA margin will grow by ~1,280 basis points year-over-year in 2022 at the midpoint. The company still expects it will generate sizable negative free cash flows this year as it invests heavily in growing its lithium operations, though in our view, Albemarle should continue to retain access to capital markets at attractive rates to meet its funding needs going forward.

Albemarle’s Economic Profit Analysis

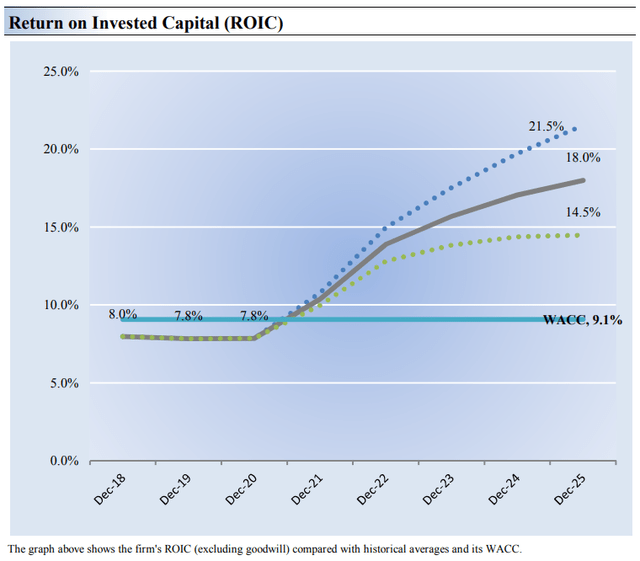

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Albemarle’s 3-year historical return on invested capital (without goodwill) is 7.9%, which is below the estimate of its cost of capital of 9.1%.

In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate of the company. Though Albemarle’s economic returns haven’t been as strong on a historical basis, we expect the firm to become a strong economic-profit generator on a go-forward basis. The recent fundamental momentum behind its guidance raises speaks to continued improvement in ROIC.

Albemarle’s Cash Flow Valuation Analysis

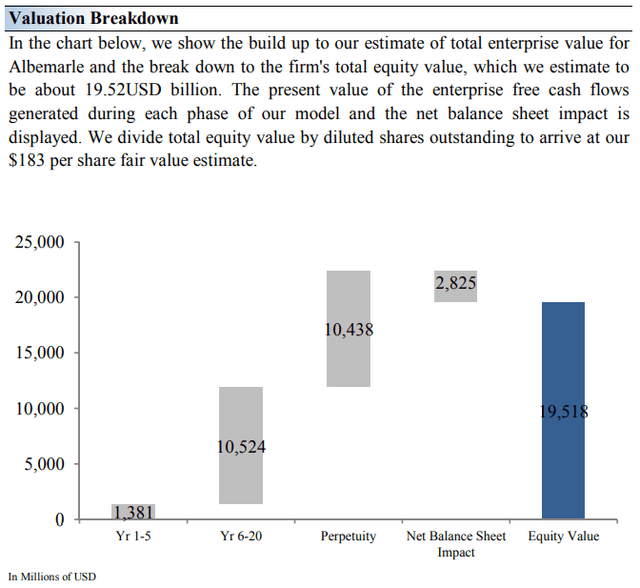

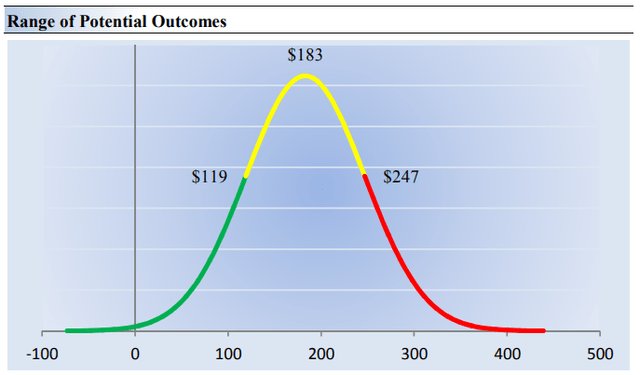

We think Albemarle is worth $183 per share with a fair value range of $119-$247. The margin of safety around our fair value estimate is driven by the company’s HIGH ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 10.5% during the next five years, a pace that is higher than the firm’s 3- year historical compound annual growth rate of 0.6%.

Our valuation model reflects a 5-year projected average operating margin of 24.2%, which is above Albemarle’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 9.6% for the next 15 years and 3% in perpetuity. For Albemarle, we use a 9.1% weighted average cost of capital to discount future free cash flows.

Albemarle’s Margin of Safety Analysis

Our discounted cash flow process values each company on the basis of the present value of all future free cash flows. Although we estimate Albemarle’s fair value at about $183 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

This is an important way to view the markets as an iterative function of future expectations. As future expectations change, so should the company’s value and its stock price. Stock prices are not a function of fixed historical data but rather act in such a way to capture future expectations within the enterprise valuation construct.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph below, we show this probable range of fair values for Albemarle. We think the firm is attractive below $119 per share (the green line), but quite expensive above $247 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Along the same lines, we think Albemarle has upside potential to the high end of our fair value estimate range. Recent guidance increases give us greater confidence of potential upside potential, and the company’s strong competitive position speaks to sustainable improvement as well. Valuation will always be a range of potential fair value outcomes, and we think the high end of the fair value range may be most appropriate for Albemarle at the moment.

Concluding Thoughts

Dividend Aristocrat Albemarle has increased its annual dividend during the past 25+ consecutive years. The company’s dividend represents one of Albemarle’s core capital allocation priorities alongside investing in the business and potential M&A and JV activities. Albemarle has substantial growth opportunities across its portfolio and arguably has access to the world’s best raw material reserves (bromine and lithium). Free cash flow generation can be lumpy due to significant capital investments, though growth, scale and efficiency gains at its growing ‘Lithium’ business should significantly improve Albemarle’s free cash flows over the long haul.

There’s probably not a lot that would put management’s willingness to keep raising Albemarle’s dividend each year at risk. Albemarle’s free cash flow performance has been inconsistent in recent years though its growth outlook is incredibly bright. Management is targeting Albemarle to have a long-term net debt-to-adjusted EBITDA ratio in the 2.0x-2.5x range. Albemarle has significantly improved its balance sheet of late, though it still has a net debt load. The firm raised ~$1.5 billion in February 2021 via a secondary offering and in June 2021, it completed the divestment of its ‘Fine Chemistry Services’ business for ~$0.6 billion in total considerations. All told, we like its business quite a bit and see upside potential under more optimistic forecasts.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment