Robert Daly/iStock via Getty Images

The Trade Desk (NASDAQ:TTD) is the rare tech stock that is still up more than 100% from pre-pandemic levels. This is a company competing with the likes of Alphabet (GOOG) (GOOGL) and apparently winning. Part of the stock’s meteoric rise can arguably be attributed to the successful David vs Goliath story, though multiple expansion can only go so far. I also analyze the implications of the performance compensation plan granted to CEO Jeff Green. While the stock remains richly valued even after the pullback, the stock is quite buyable here.

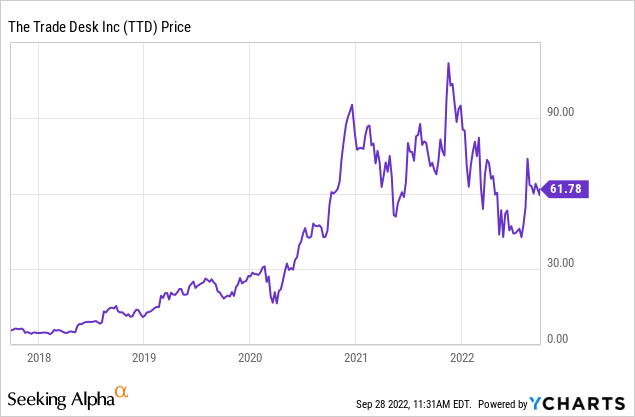

TTD Stock Price

TTD peaked at around $114 per share but has since fallen 45% to current prices.

The stock is still 100% higher than pre-pandemic levels even after the crash – perhaps that indicates that the stock should not have traded as high as it did in the first place.

TTD Stock Key Metrics

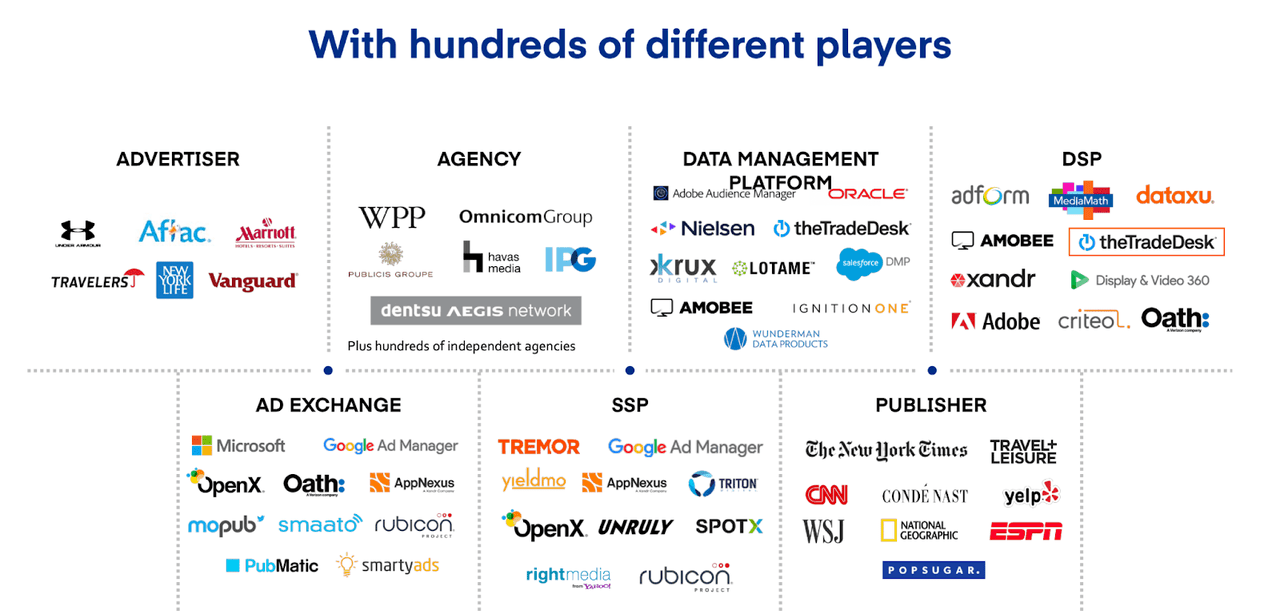

TTD is a demand-side platform which means that it earns its revenues from advertisers (to be clear, the companies which are trying to advertise something). We can see below that the advertising ecosystem contains many core characters.

2022 Q2 Presentation

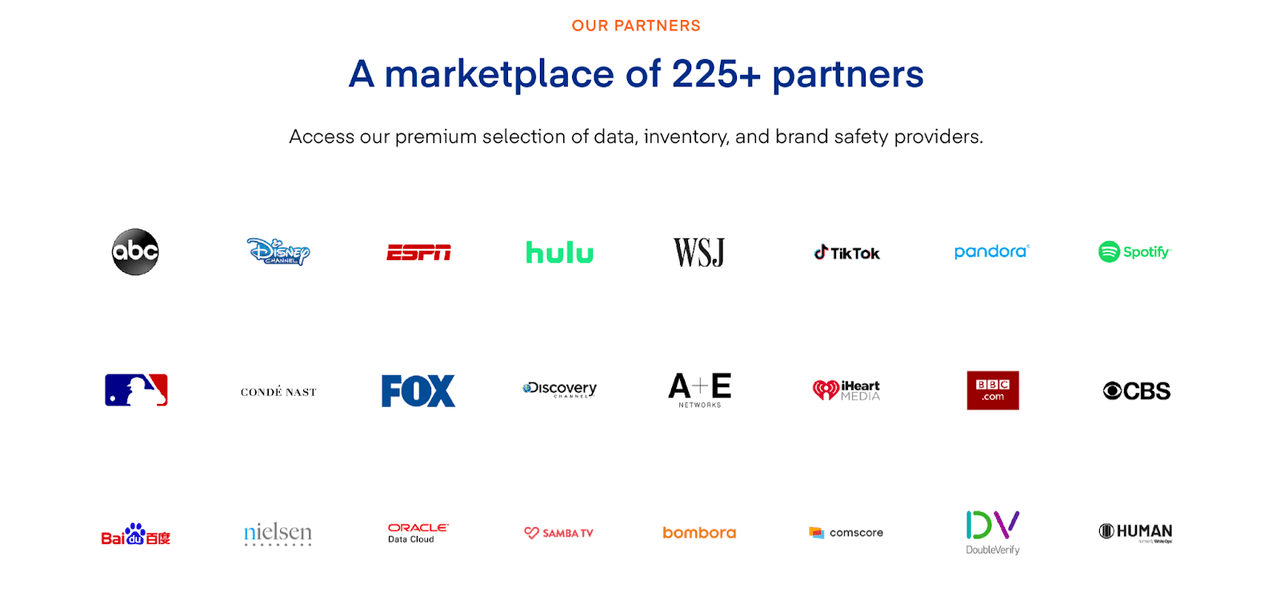

TTD’s YouTube channel has a good video explaining how it all works. In short, DSPs like TTD work on behalf of advertisers to bid through an ad exchange which in turn determines which advertisements show up on the publisher end. This is a real-time bidding system that helps ensure that all publisher ad supply is filled at all times.

YouTube

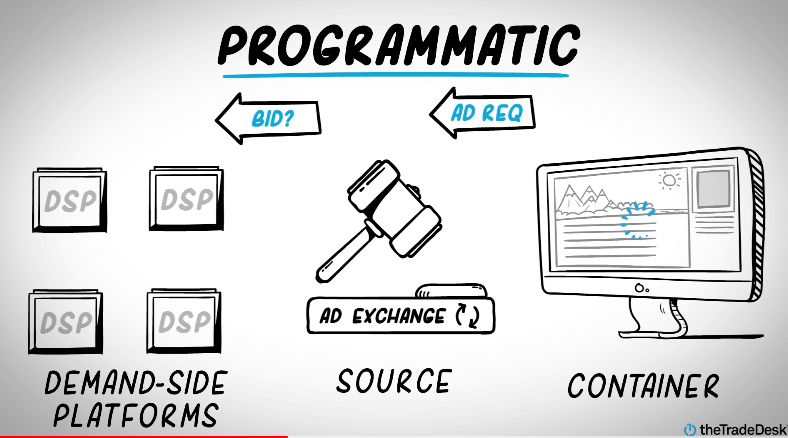

TTD is a major player in the advertising space with a wide breadth of partners. That makes it an appealing DSP of choice for both advertisers and publishers.

2022 Q2 Presentation

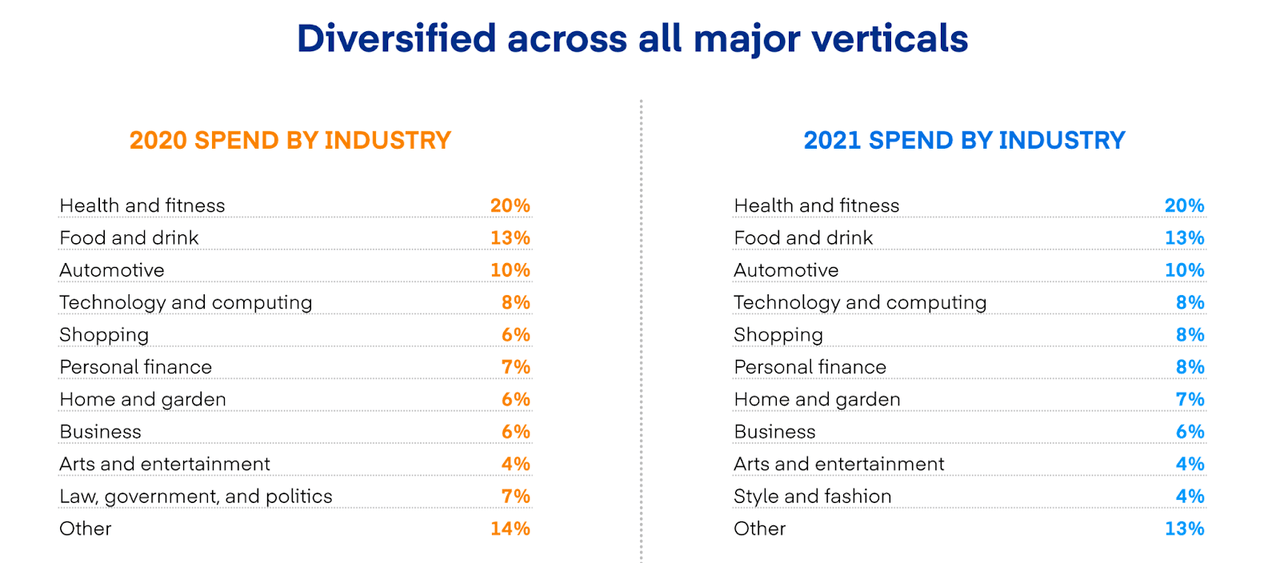

TTD’s advertising business is well diversified across many industries, with health and fitness unsurprisingly being the top category.

2022 Q2 Presentation

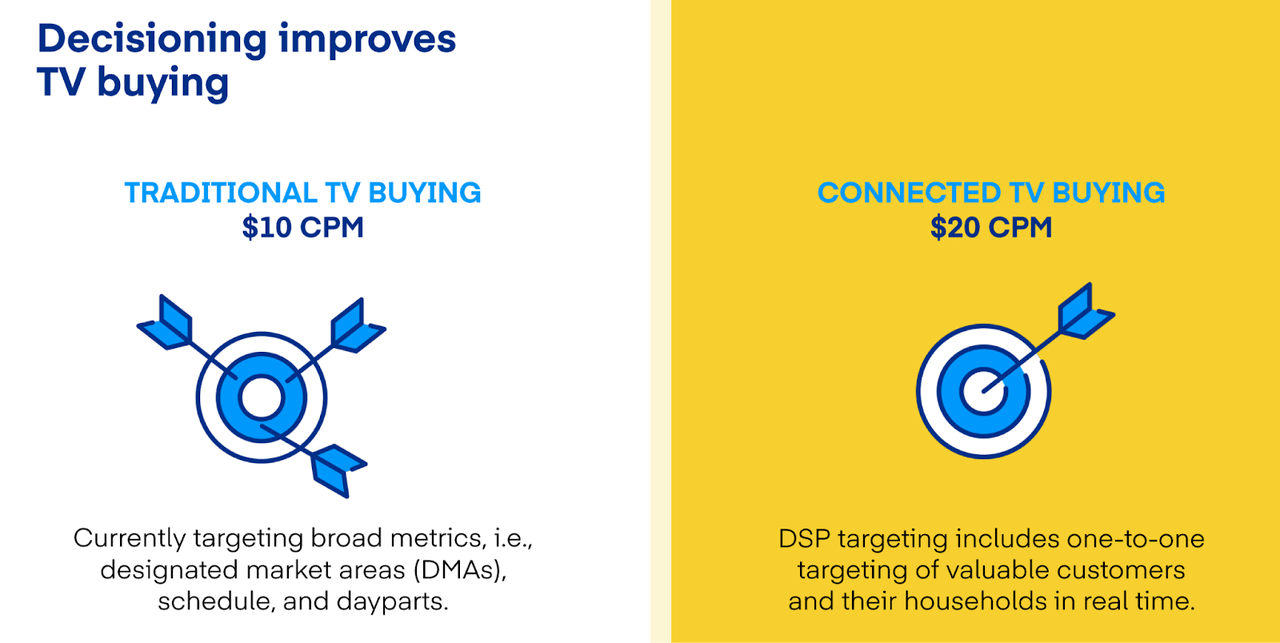

The key growth driver has and will be that of connected TV – referring to “smart TV” capabilities like streaming. Due to the greater personalization ability of connected TV, TTD is able to charge superior rates for such advertisements. It is a win-win situation for all parties involved.

2022 Q2 Presentation

On the conference call, management noted that CTV represented just over 40% of their business and continues to grow as a percentage of the business. Mobile represented a high 30% share of the business, with display and audio representing 15% and 5%, respectively.

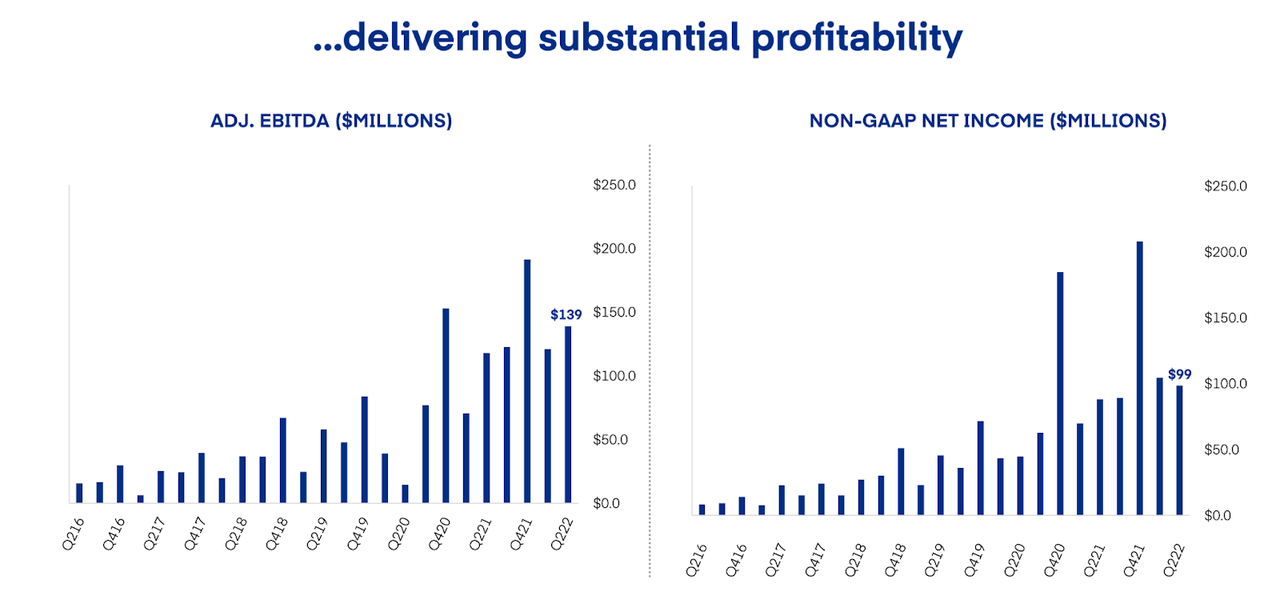

TTD has been popular investors in large part due to the strong underlying fundamentals. The company has delivered impressive revenue growth alongside robust profit margins over the past many years.

2022 Q2 Presentation

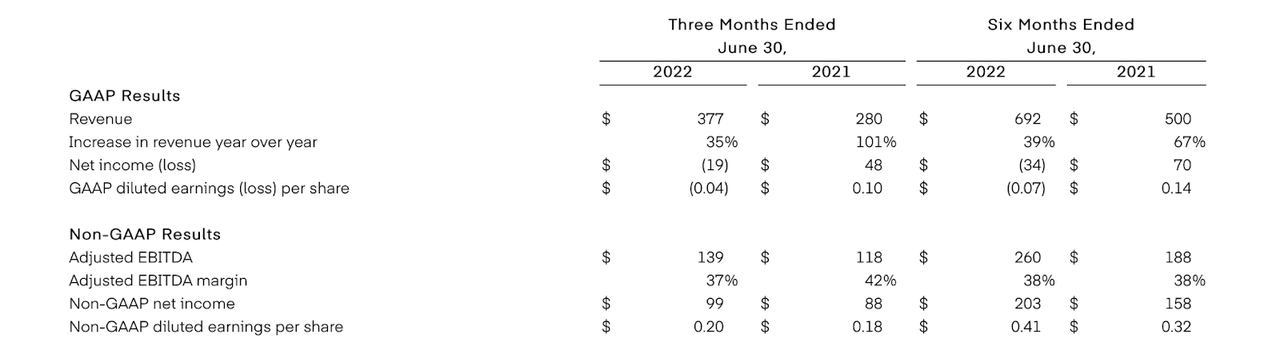

The latest quarter saw TTD grow revenue by 35% at a 37% adjusted EBITDA margin.

2022 Q2 Press Release

TTD ended the quarter with $1.1 billion of net cash, representing a strong balance sheet though it should be noted that this made up only 3.9% of the market cap. I mention that last point because many tech stocks now have net cash making up 15% to 30% of their market cap as a result of the tech crash.

Looking forward, TTD guided for the next quarter to see revenue of at least $385 million, representing 28% YOY growth, with adjusted EBITDA coming in at $140 million. The company expects U.S. political midterm election spend to represent a low single-digit percentage of the business.

Is TTD Stock A Buy, Sell, Or Hold?

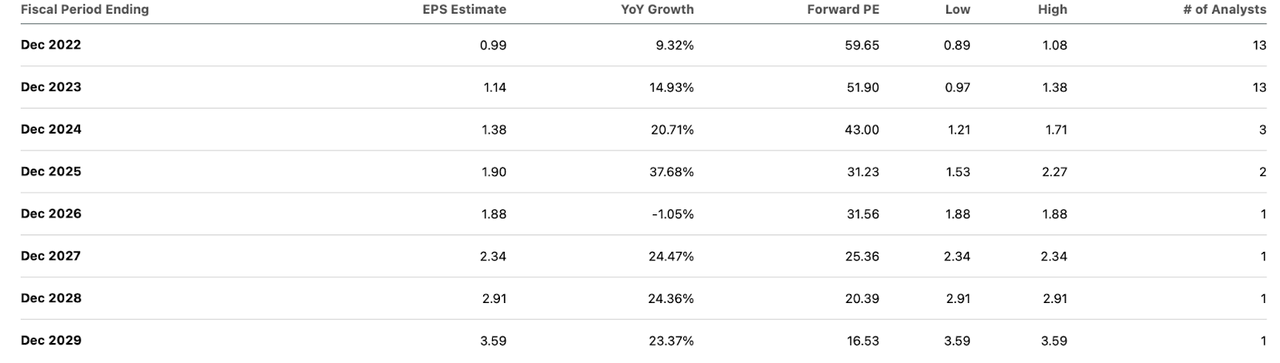

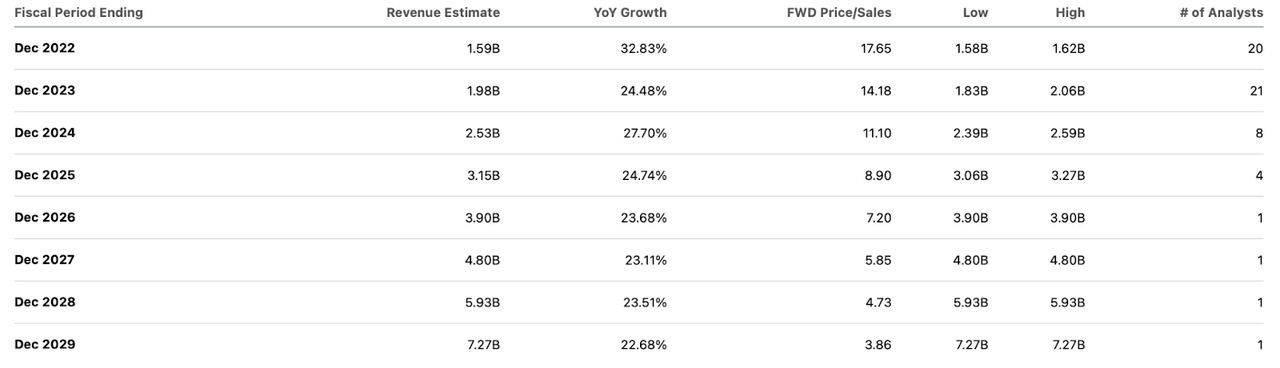

The stock might not look cheap at first glance. The stock is trading at 60x forward earnings, and even if you look out to 2029, the stock trades at 17x earnings.

Seeking Alpha

That may imply positive returns moving forward, but perhaps not enough returns to justify making an investment in the tech sector at this time. Some readers might point out that consensus earnings estimates are too conservative. Indeed, a clear argument could be made in favor of that opinion, as at the very least, consensus estimates are implying margins to contract significantly from 29.4% this year to 23.4% in 2029. One might instead have expected margins to expand due to operating leverage.

Seeking Alpha

On the flipside, one could also make the argument that consensus estimates are not factoring in any deceleration in growth rates, which may be too optimistic.

I assume TTD can achieve at least 35% GAAP net margins over the long term, basing that assumption on the roughly 40% adjusted EBITDA margin of present day. Assuming a 1.5x price-to-earnings growth ratio (‘PEG ratio’), that places fair value at around 12.6x sales, or a stock price of $55 per share, representing 12% potential downside over the next 12 months. On the other hand, looking out several years, TTD might trade at around $133 per share by 2027, implying 16% compounded annual returns over the next 5 years (or around 18% inclusive of earnings yield). Clearly, many years of growth are priced into the stock price today and shareholder returns depend highly on the company’s ability to execute on those growth expectations.

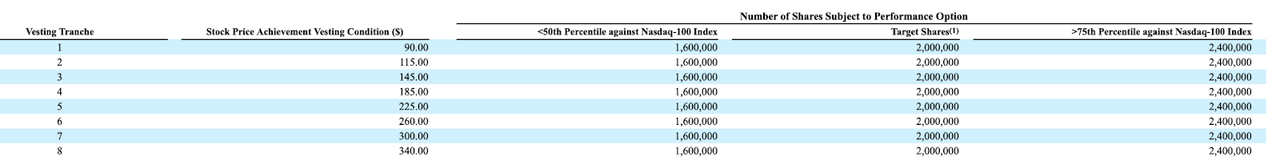

It is worth noting that the company has given CEO Jeff Green an ambitious performance compensation plan in which he can purchase the stock at $68.29 per share, assuming the stock trades above various hurdle prices as seen below:

2022 DEF14A

The $340 per share upper limit of that performance plan implies 448% returns over the next 9 years. While there is no guarantee that this compensation award will be granted, it does somewhat indicate the confidence that management has in the business’s long-term prospects.

The key risks, besides that of over-optimistic consensus estimates as discussed above, revolve around both the prospects of pressured ad spending amidst a recessionary environment, as well as inability to compete against GOOGL. TTD has executed strongly in the past and appears to be rapidly earning market share in CTV, but there is no guarantee that competition will not make inroads in the future. Perhaps the company will need to invest heavily in innovation to stave off competition, explaining why consensus estimates call for deteriorating profit margins. Previous risks revolved around the possibility that GOOGL will eliminate third party cookies, hurting TTD’s ability to sell ads, but I am of the view that such a risk is overblown considering the potential regulatory pushback that GOOGL may face. Lastly, the rich valuation means that investors should be prepared for significant volatility, as the stock will likely sell off very hard if the company hits a roadblock.

I rate TTD a buy on account of the company’s history of strong execution and long growth runway. As discussed with subscribers of Best of Breed Growth Stocks, I am favoring a diversified basket of beaten-down tech stocks in the current environment. TTD fulfills a high quality allocation in such a basket, albeit at a rich multiple.

Be the first to comment