FabrikaCr/iStock via Getty Images

The stock market is the side-show in 2022; the bond market has had the real action. Soaring interest rates worldwide have caused record declines in bond values throughout the year, leading to even more considerable losses for companies with significant unhedged debt assets. Sovereign bond yields are resting at long-term highs and, if they break higher, may trigger more significant bond declines as pensions, hedge funds, and private investors race out of leveraged bond positions. To try to stop this, the UK’s Bank of England recently began a “mini QE” bond-buying program to provide liquidity to its many levered pension funds struggling to meet margin calls.

In my view, the UK’s situation with pension funds is very similar to that of the US with mortgage-backed securities “MBS” and Mortgage REITs. Rising mortgage rates have caused a dramatic decline in the values of many mortgage bonds. Some mortgage REITs have significant derivative positions to hedge against this risk, but others, such as Orchid Island Capital (NYSE:ORC), have insufficient hedges to offset the growing pressure.

Like many of its peers (and UK pension funds), Orchid Island operates by leveraging low-rate debt (specifically, residential MBS assets) by 5-10X to create high cash flows that can be paid to investors. Problematically, however, this means a 5-10% decline in MBS asset values (from rising rates) can trigger a 50-100% decline in Orchid Island’s book value. The flat yield curve is causing Orchid’s short-term borrowing costs to rise compared to its bond yields, potentially limiting its cash flow dramatically.

Much has changed since the end of Q2, and, in my view, Orchid Island’s upcoming quarterly report is likely to show a significant decline in cash flows and book value. Most likely, these losses will be substantial enough that the company’s survival will appear in jeopardy. I have a history with ORC, first giving it a bullish outlook in April of 2020 due to its “Fed put.” As expected, the stock rose dramatically over the following months as the Federal Reserve’s massive QE MBS purchase program caused a dramatic decline in mortgage rates. I became cautious in late 2020 and have been consistently bearish since.

I covered the company last in August in “Orchid Island Capital: Insolvency Risks Grow As Fed Considers MBS Sales,” and it has fallen by an additional ~36% since. Interest rates spiked even higher since then, likely putting its core book value in significant jeopardy. The company has cut its dividend by ~30% (after adjusting for a reverse split) but does yield around 21% at today’s price, making it among the highest-yielding stocks on the market. Further, since central banks often follow each other’s lead, the UK’s liquidity creation effort has increased the probability of the Federal Reserve supporting the MBS market. In my view, ORC will still likely face bankruptcy, but given the recent changes, I believe it is an opportune time to look at its bullish and bearish potential.

Orchid Island’s Estimated Book Value Today

Orchid Island appears to be at a critical moment where it must either bottom or collapse toward an equity value of zero. While many agency-MBS mortgage REITs are in similar positions, Orchid’s is worse due to its higher leverage and, most importantly, its lack of sufficient hedges against Treasury rates. As of the end of Q2, the company posted a ~69% downside book value exposure to a 2% rise in Treasury rates and, importantly, effectively no upside sensitivity to a fall in Treasury rates. As such, a rise in Treasury bond yields harms the company, creating permanent book value losses due to its lack of reverse exposure. This tendency is likely a significant reason why ORC’s book value has nearly consistently declined every year it operates.

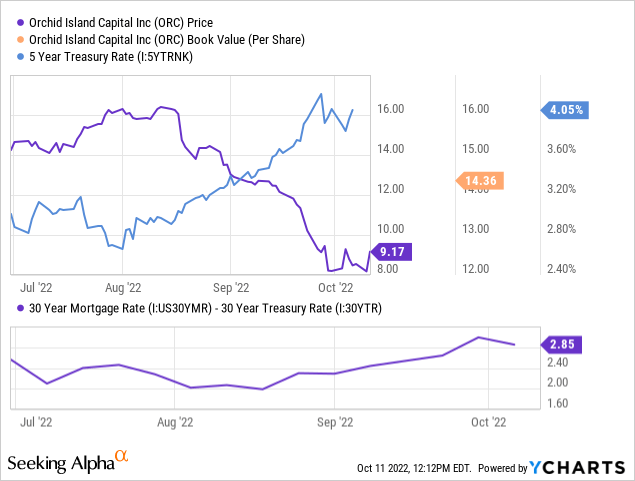

Since the end of the second quarter, the five-year Treasury rate has risen by roughly 115 basis points. From the end of Q2 to the end of Q3, it rose to the same extent. The yield curve has not changed dramatically, so I expect Orchid Island’s book value has shifted accordingly. Further, the mortgage spread, or the difference between mortgage rates and the Treasuries, has likely risen by 20 bps – extrapolating from average US mortgage rates. Mortgage rates were marginally higher from the end of September to today, but ~20 bps appears most likely from the end of Q2 to the end of Q3. See below:

In Q2, Orchid Island stated ~14% downside book value exposure to a 100 bps rise in Treasury rates and a 69% exposure to a 200 bps move. The company has some hedge against a smaller rise in rates, but extreme tail exposure to a more significant move. Of course, this creates difficulty in estimating its book value as its hedge positions have likely shifted since. Extrapolating from the 100 bps sensitivity, we arrive at an estimated 16% book value decline, but this rises to 40% if we extrapolate from the 200 bps sensitivity. As such, I estimate its book value loss from Treasury rates alone is likely around 20%, but possibly higher due to the asymmetry in sensitivity at more significant moves.

Orchid Island does not publish its sensitivity to mortgage spreads, which is a greater risk factor considering the spread can not be hedged effectively. In the past, I’ve approximated it using sensitivity tables from ORC’s peer AGNC (AGNC) since the two mortgage REITs have virtually identical assets and very similar leverage. AGNC’s last sensitivity estimate showed 15.5% in book value losses, given a 25 bps rise in mortgage MBS spreads. Considering the mortgage spread has likely risen by around 20 bps, I believe ORC’s book value may have taken a ~12.5% estimated loss from this factor. Combined with 20% in estimated losses directly from rising Treasury rates, my Q3 book value loss estimate for ORC is 32.5%. Accordingly, I estimate its Q3 book value per share will likely be $9.70.

ORC is currently at $9.18, or 6.5% below my estimate. Of course, because ORC’s book value declines virtually every year, it usually trades at a 5-10% discount to book. Indeed, given that and its heavily asymmetric downside exposure to rising interest rates, I believe it should trade at a book value discount of 15% at the very least. Accounting for that, my fair-value estimate for the stock is $8.25, or ~11% below its current price. Of course, the stock was trading at almost exactly that price just hours ago (at the time of writing), so it may fluctuate around this level with a high degree of volatility.

Rising Borrowing Costs Decrease Margins

Last quarter, ORC’s interest income was $141M annualized, while its interest expense was $32.7M annualized. The weighted-average borrowing rate on its short-term (repurchase) borrowing facilities was 1.36%, with most of its borrowings being <30 days. Since then, the SOFR rate has risen from ~1.5% to ~3%. So, assuming ORC’s borrowing rate has been increased to a weighted average of ~2.85%, its total interest cost has likely doubled (~110% higher) to an estimated $69M annualized, bringing its estimated net interest income to $72M (or $18M quarterly). The actual figure is likely a bit lower, assuming Orchid sold assets as they declined in value to avoid a sharp rise in its leverage. After management fees, incentive compensation, and other expenses, Orchid had $9.6M in operating costs last quarter, or $19.3M annualized.

Not considering changes in asset values, the rise in short-term rates brings its annualized estimated (dividend-payable) income to $53M or $13.2M quarterly. After its last dividend cut, its quarterly dividend payment would be around $16.9M, making it potentially at risk of another dividend cut, considering its cash flow (excluding changes in asset values) is likely below that amount.

Short-term borrowing rates are expected to rise an additional 100-125 bps before the Fed stops hiking, potentially causing borrowing costs to rise to a point where it will be impossible for Orchid Island’s net interest income to be above its operating costs. As such, by next year, Orchid Island may be simply unable to pay any dividends as all potential income goes to interest and operating costs.

Over 95% of the company’s assets are fixed-rate and will not see higher income with interest rates. That said, it does have some interest rate swaps and similar derivative positions that could offset the rise in borrowing costs. As mentioned in its last investor call, these swaps generally slow the rise in borrowing costs associated with increased Fed funds rate. These swaps may buy the company greater time before it must dramatically cut its dividend, but unless there is a large subsequent decline in the Fed funds rate, it has very limited long-term dividend potential.

The Best-Case Scenario For Orchid Island

I believe we’re sitting around the precipice where Orchid, and many of its peers, are likely to face a sizeable wave in margin calls if there is another rise in interest rates. Over recent months, Orchid likely had to sell some of its MBS assets since its leverage would have risen dramatically, given the decline in its equity value. Hypothetically, if rates rise slowly enough that Orchid can offload assets, it may avoid bankruptcy.

This situation is similar to that of the UK with levered pension funds. At this point, I do not believe the Federal Reserve will look to “save” the MBS market from declines. Still, like the BOE, it is likely willing to provide liquidity sufficient to avoid a viral increase in margin calls from highly levered mREITs (and similar). This is a critical point that investors may want to understand that differs from the situation in 2020. In 2020, the market experienced extremely rapid significant declines due to panic and margin unwind related to a black-swan problem. Today, the market is essentially in a state of withdrawal as it comes off its dependence on QE stimulus while suffering the inflationary consequences of that stimulus.

In this situation, it is sensible for the Fed to give the market enough further liquidity that a “flash crash” is avoided, but not so much that its dependence on QE is restored. Indeed, if the Federal Reserve, or any central bank, were to again create trillions in QE to save markets, a hyperinflationary crisis would be likely as the (very strained) foreign exchange currency market may dislocate. This situation is playing out in Turkey after its central bank recently decided to renew stimulative policies, quickly causing its inflation to rise to 90% (from 20% a year ago). Since hyperinflation’s social, political, and economic consequences are almost certainly worse than a decline in asset prices, I highly doubt the Federal Reserve will pursue any truly stimulative policies unless inflation normalizes. That said, efforts to provide short-term liquidity to “slow” the speed of declines in asset prices seem likely.

With this in mind, I believe the best-case scenario for Orchid Island is a substantial decline in interest rate volatility. Its sensitivity tables suggest its book value would not recover if interest rates were to decline, but an eventual fall in short-term borrowing rates would give the firm, strong cash flows. The considerable rise in discount rates during Q3 will cause Orchid’s net interest income to fall dramatically in its Q3 report. Truthfully, I doubt short-term interest rates will ever be below 2.5% this decade since numerous demographic forces push inflation (growing baby-boomer retirements combined with a growing lack of skilled blue-collar labor). With that in mind, the best outcome for Orchid may be an end to interest rate hikes and a prolonged plateau in longer-term Treasury and mortgage rates.

The Bottom Line

After looking closely at Orchid Island, its survival appears questionable and generally unlikely. There are two chief reasons for this. Immediately, it is the deadly effect of rising longer-term interest rates on its book value. While the risk of a flash-crash margin-call decline to bankruptcy is mitigated by potential Fed liquidity provision, I do not believe an actual return to QE is likely given the hyperinflation potential.

The second reason I doubt Orchid will survive is the rise in short-term borrowing costs. I estimate the company’s current cash flows are not high enough to sustain its dividend, even after its latest dividend cut. If the Fed funds rate rises by 100-125 bps, its net interest income would likely be below its operating expenses. A potential cut to its management and incentive fees (~$12M annually) could aid negative cash flows, but probably not by enough to restore its dividend. Its swap positions will likely slow the rise in its borrowing costs, but given how quickly the Fed has hiked since Q2, I doubt it can be by enough that ORC’s dividend can be sustained.

Altogether, I am very bearish on ORC and believe it will likely have no value within twelve months as its income and equity value fall to the point that it struggles to sustain operating costs. Still, I would not short the stock since it is currently close enough to its immediate estimated net asset value and is highly volatile.

Be the first to comment