monsitj/iStock via Getty Images

Investment Thesis

Earlier this month, Tractor Supply Company (NASDAQ:TSCO) provided upbeat commentary on Q2 sales and earnings. Management now expects net sales growth of ~8%, comparable-store sales growth of ~5% Y/Y, and adjusted EPS growth of 9% Y/Y. In the last quarter also, despite lapping a strong demand and stimulus check in Q1 2021, Tractor Supply Company posted strong results with net sales and comps sale growth of 8.3% and 5.2% respectively. The company is facing a number of headwinds related to elevated freight costs, higher product costs, and interest rate hikes. However, the strength in CUE categories, which constitutes need-based products and is less vulnerable to inflation and interest rate hike, is helping it drive the top line. Moreover, the company-specific initiatives such as side-lot stores and project fusion are helping comp sales by improving store productivity and providing a diverse range of new category offerings. I expect these tailwinds to continue offsetting macro headwinds and keep driving the company’s sales in Q2 2022 and beyond. Higher revenues should help the company leverage the SG&A fixed costs to offset some of the gross margin pressure. Although operating margins may erode, the operating income should increase in Q2 2022 in comparison to Q2 2021.

From a long-term standpoint, the company intends to open new stores to capture market share in the newer as well as existing categories. The company-specific initiatives to improve store productivity should also be beneficial to the company in the longer term. Additionally, several structural trends including post-covid recovery, increased pet ownership, and a rise in self-reliant lifestyle should also aid the top-line growth in the future. The stock price is trading at a P/E of ~19.76x FY22 consensus EPS estimates and ~18.17x FY23 consensus estimates. This is a discount versus its 5-year average (FWD) P/E multiple of ~21.23x. Given the reasonable valuation and good future outlook of the company, investors can consider buying the stock.

Tractor Supply Q1 Earnings

Tractor Supply Company posted the Q1 results with revenue of ~$3.02 billion, beating the consensus estimate of ~$2.92 billion and growing ~8.3% Y/Y. Same-store sales increased ~5.2%Y/Y while adjusted EPS increased ~6.45% to $1.65 versus the consensus estimate of $1.41. The gross profit margin decreased 29 basis points to ~34.94% primarily due to product cost inflation pressures and higher transportation costs. Operating income increased ~5.96% to ~$244.2 million compared to ~$230.53 million in Q1 2021. Net income for the fourth quarter decreased ~3.25% to ~$187.22 million from ~$181.35 million in the same quarter last year.

Delayed Spring Season And Continued Strength In CUE Category To Support Q2 Results

The company posted strong results in Q1 with net sales growth of 8.3% and comps store sales up by 5.2%. Despite a downward pressure on gross margin owing to inflation and higher freight cost, operating income increased to ~$244.2 million compared to ~$230.53 million in Q1 2021. The company experienced impressive demand in the CUE (consumable, usable, and edible categories). The CUE category trend remained strong, with CUE growth of 3x in comparison to overall sales growth. The company continues to see strong CUE performance with strength in categories such as dry dog food, poultry, and heating fuel. For example, dry dog food achieved over 20% comp.

CUE categories have lower gross profit rates, which put some pressure on gross margin. Being a need-based product, we expect the demand to remain strong among the CUE category despite being in an inflationary environment. Moreover, the lower gross margin related to the CUE category should get offset as its demand gains more traction and helps the company leverage SG&A expenses in the future.

The company offers a wide range of spring categories. Spring seasonal categories performed below average in the month of March. Due to cold weather, people postponed their spring season shopping. However, we expect, this deferment should benefit the Q2 results as the spring category purchases which were to happen in Q1 2022 will now take place in the subsequent months.

Additionally, several structural trends including the reopening of the economy, increased pet ownership, home setting, and a rise in self-reliant lifestyle, should aid the top-line growth in coming quarters.

Increasing Offerings And Driving Store Productivity

The company is looking forward to driving store productivity and increasing assortments through a couple of initiatives, including side-lot strategy and project fusion.

TSCO is transforming its vacant side lots of stores into garden centers, enabling it to expand its offering in the lawn and garden category. Moving forward with the initiative, the company also began offering Greenworks Pro 60-volt products online this year and rolled them out in stores in recent weeks. TSCO is the exclusive retailer of the Greenworks Pro 60 volt platform, allowing it to expand its offering of battery-powered outdoor power equipment. These include 75 battery-operated professional-grade residential tools besides zero-turn riding and push mowers, chainsaws, trimmers, leaf blowers, snow throwers, and more. These products should help to capture an incremental share of wallet in the lawn and garden category. As of Q1, 2022, the company has 175 garden centers and expects 15% of the stores to be transformed as per the side-lot initiative by the end of the year.

In terms of project fusion, the company is remodeling the stores by changing the layout, upgrading adjacencies, reallocating square footage, and improving visuals in order to improve store productivity and increase assortments. Recently, TSCO announced the addition of Dremel and Bosch to the power tool line in order to expand its offering in the truck, tool, and hardware which is a key component of Project fusion. This should encourage more people to shop at Tractor Supply stores.

Given the benefits of fusion stores, the company intends to implement Project fusion across 30% of the stores (~600 stores) by the year-end.

The company expects that side-lot stores and fusion stores are capable of generating mid-single-digit to high-single-digit comps growth, which should help to drive the company’s total comps in the longer run.

Store Growth

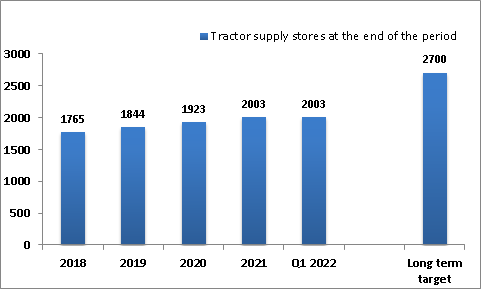

The company expanded its TAM by over ~$40 billion, helped by the investments and initiatives like project fusion and side-lot, which have expanded the category offering like pet and lawn and garden. Given the expansion in TAM, the company intends to capture the market share in the newer categories by opening new stores. As of Q1 2022, the company operates 2003 tractor supply stores and expects to open an additional 70 to 80 stores in 2022. The company has also revised its store target from 2500 to 2700 tractor supply stores. The expansion in TAM along with opening new stores to gain market share in the newer and existing categories augurs well for the company.

Tractor Supply’s store count (Company Data, GS Analytics Research)

Valuation And Conclusion

The stock is trading at ~19.76 times fiscal 2022 consensus EPS estimates, versus its five-year average adjusted P/E (FWD) of ~21.23x. There are a few looming headwinds near-term headwinds such as higher freight costs and rising inflation. Despite that, we expect higher sales in Q2 2022 compared to Q2 2021, thanks to price management action, strength in CUE categories, deferment of spring season’s sales in Q1, and certain company-specific initiatives to drive store productivity and attract additional customers by increasing the range of offerings. Higher sales should help the company leverage the SG&A expense to slightly offset the impact of lower-margin products in CUE categories and higher product and freight costs on gross margin. Although the operating margins may erode, the operating income should increase in Q2 2022 in comparison to Q1 2022.

From a long-term perspective, given the expansion in TAM resulting from increasing assortments, the company also intends to gain market share in these newer as well as existing categories. Moreover, the company-specific initiative as mentioned previously should also prove beneficial for the company in the longer run. At the current price level, the valuation looks attractive. Hence, investors can consider buying the stock for long-term upside.

Be the first to comment