Nicholas Hunt/Getty Images Entertainment

This article is part of a series that provides an ongoing analysis of the changes made to Dan Loeb’s 13F stock portfolio on a quarterly basis. It is based on Third Point’s regulatory 13F Form filed on 2/14/2022. Please visit our Tracking Dan Loeb’s Third Point Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q3 2021.

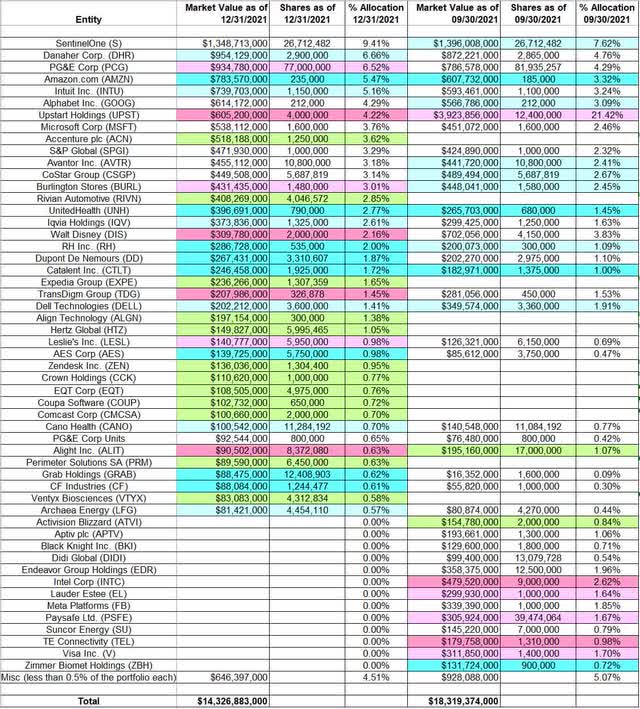

This quarter, Loeb’s 13F portfolio value decreased ~22% from $18.32B to $14.33B. The 13F portfolio is very concentrated with the top three holdings accounting for ~23% of the entire portfolio. The number of holdings decreased from 113 to 92. 40 of the holdings are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five individual stock positions are SentinelOne, Danaher Corporation, PG&E, Amazon.com, and Intuit.

Third Point returned 22.70% in 2021 compared to 28.7% for the S&P 500 Index. Annualized returns since December 1996 inception are at 15.1% compared to 9.6% for the S&P 500 Index. AUM is distributed among several strategies of which the long/short equity portion is the majority: of the roughly 55% net portfolio exposure, 96.9% is the net-long equity portion. In addition to partner stakes, Third Point also invests the float of SiriusPoint (SPNT) and capital from London-listed closed-end fund Third Point (OTCPK:TPNTF). To know more about Dan Loeb’s Third Point, check out his letters to shareholders at their site. His activist investing style is covered in the book “The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds“.

Note 1: They have a significant portfolio of investments thru their venture firm Third Point Ventures. The fourth quarter investor letter unveiled a significant position in Verbit (Israel-based business led by Tom Livne aiming to disrupt the $30B transcription market) by leading their $200M Series E round. Other investments previously disclosed include Yellowbrick Data, Aryaka, Kentik, Kumu Networks, Ushur, CipherTrace, Bitwise, FTX, etc.

Note 2: Large equity investments not in the 13F report include Sony (SONY), EssilorLuxottica (OTCPK:ESLOY), and Nestle (OTCPK:NSRGY). All three are activist stakes. SONY is a $1.5B investment made in June 2019 when the stock was trading at around $50 per share. It is currently at ~$98. The ESLOY investment was made in early 2019 when the stock was trading at ~$62.50 per share. It currently trades at ~$78.55. The NSRGY position is from 2017 and the stock has rallied from ~$75 to ~$127 now.

New Stakes:

Accenture plc (ACN): ACN is a fairly large 3.62% of the portfolio position established this quarter at prices between ~$320 and ~$415 and the stock currently trades just below that range at ~$314.

Rivian Automotive (RIVN): The 2.85% of the portfolio, RIVN stake was first disclosed in their Q3 2021 investor letter. They made the investment in two rounds prior to the IPO: a small stake in late 2020 and a larger one in July last year prior to the IPO. The stock started trading at ~$100 and currently goes for ~$47.

Note: Their Q4 2021 letter had the following regarding Rivian – they reduced the position in late January and then bought it back below the IPO price of $78 per share.

Expedia Group (EXPE): EXPE is a 1.65% of the portfolio position purchased this quarter at prices between ~$145 and ~$188 and the stock currently trades at ~$176.

Align Technology (ALGN), Hertz Global (HTZ), Zendesk, Inc. (ZEN), Crown Holdings (CCK), EQT Corporation (EQT), Coupa Software (COUP), Comcast Corporation (CMCSA), Perimeter Solutions, SA (PRM), and Ventyx Biosciences (VTYX): These are small (less than ~1.5% of the portfolio each) stakes established during the quarter.

Stake Disposals:

Intel Corporation (INTC): INTC was a 2.62% of the portfolio position built in Q2 2021 at prices between ~$53.50 and ~$68. The stock currently trades below that range at $48.07. There was a ~35% selling last quarter at prices between ~$52 and ~$57. The disposal this quarter was at prices between ~$48 and ~$56.

Visa Inc. (V): The 1.70% Visa stake was established in Q2 2018 at prices between $118 and $136. H1 2020 had seen a ~17% reduction at prices between $136 and $213, while next quarter, there was a ~25% stake increase at prices between ~$189 and ~$217. The elimination this quarter was at prices between ~$190 and ~$234. The stock is now at ~$200.

Paysafe Limited (PSFE): PSFE was a 1.67% of the portfolio position established in Q1 2021 at $10 per share as Third Point led the PIPE of this de-SPAC. The position was sold this quarter at prices between ~$3.40 and ~$8.30. The stock currently trades at ~$3.

Estee Lauder (EL): The 1.64% EL stake was built over the three quarters through Q2 2021 at prices between ~$218 and ~$318. The position was eliminated this quarter at prices between ~$300 and ~$370. The stock currently trades at ~$286.

Endeavor Group Holdings (EDR): EDR had an IPO last April. Shares started trading at ~$25 and currently goes for $27.05. Third Point’s position goes back to a private placement done concurrent with the IPO. The stake was sold during the quarter at prices between ~$24 and ~$35.

Meta Platforms (FB) previously Facebook: The 1.85% FB position was purchased in Q2 2020 at prices between $154 and $242 and the stock is now at ~$200. Q3 2020 saw a one-third stake increase at prices between ~$230 and ~$304. The disposal this quarter was at prices between ~$307 and ~$348.

Activision Blizzard (ATVI): The 0.84% of the portfolio ATVI position was established at prices between ~$73 and ~$94. The stake was sold this quarter at prices between ~$57 and ~$81. The stock is now at $83.43.

Note: In January, Microsoft announced a $95 per share all-cash deal to buy Activision Blizzard.

Aptiv PLC (APTV), Black Knight, Inc. (BKI), DiDi Global (DIDI), TE Connectivity (TEL), Suncor Energy (SU), and Zimmer Biomet Holdings (ZBH): These small (less than ~1.15% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

Danaher Corporation (DHR): The top three 6.66% DHR stake was established in Q3 2015 at prices between $60.90 and $71.50 and increased by two-thirds in Q1 2016 at prices between $62 and $74. There was a ~20% stake increase in Q1 2019 at prices between $98 and $132 while H1 2020 saw a ~20% selling at prices between $129 and $177. It currently trades at ~$273. Last several quarters have seen only minor adjustments.

Note: The prices quoted above are adjusted for the Fortive (FTV) spin-off in July 2016.

Amazon.com (AMZN): AMZN is a 5.47% of the portfolio position purchased in Q4 2019 at prices between $1705 and $1870. The stake saw a ~200% increase in Q1 2020 at prices between $1677 and $2170. The stock is now well above those ranges at ~$2913. There was a ~30% selling in Q4 2020 at prices between ~$3005 and ~$3444. Next quarter saw another ~20% reduction at prices between ~$2951 and ~$3380. Last three quarters have seen a stake doubling at prices between ~$3094 and ~$3731.

Intuit Inc. (INTU): INTU is a 5.16% of the portfolio stake built over the four quarters through Q1 2021 at prices between ~$218 and ~$422. The stock currently trades at ~$465. Last few quarters have seen only minor adjustments.

IQVIA Holdings (IQV): The 1.63% IQV position was purchased in Q3 2018 at prices between $99 and $131 and increased by ~25% in Q3 2019 at prices between $143 and $162. There was a one-third selling in Q2 2021 at prices between ~$193 and ~$247. The stock currently trades at ~$227. There was a minor ~6% increase this quarter.

DuPont de Nemours (DD): The 1.87% of the portfolio stake in DD was established in Q1 2021 at prices between ~$69 and ~$86 and it is now at $74.39. There was a ~11% stake increase this quarter.

Dell Technologies (DELL): DELL is a 1.41% of the portfolio position built during H1 2021 at prices between ~$33 and ~$49 and it is now at ~$52. There was a ~7% stake increase this quarter.

Note: The prices quoted are adjusted for the ~$55 per share of value in VMware (VMW) distributed to Dell shareholders last October.

Archaea Energy (LFG), Cano Health (CANO), Catalent, Inc. (CTLT), CF Industries (CF), Grab Holdings (GRAB), RH (RH), and UnitedHealth (UNH): These small (less than ~1.5% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Upstart Holdings (UPST): UPST stake is now at 4.22% of the portfolio. Third Point’s original position goes back to a Series C funding round in 2015 when the business was valued at ~$180M. They also added 1.2M shares in the December IPO. UPST started trading at ~$44 and currently goes for ~$128.

Note: Regulatory filings since the quarter ended show that they have sold the entire stake at prices up to $228 per share. They had a ~15% stake in Upstart Holdings and was sitting on gains of ~20x from ~$206M in total investments (~$66M six years ago and ~$140M at IPO).

PG&E Corporation (PCG): PCG is currently the third-largest 13F stake at 6.52% of the portfolio. Third Point’s Q2 2020 letter had the following regarding the investment in PG&E – the position came about as a result of participating in a PIPE (terms for the exit financing called for up to $10.50 per share purchase price). They believed the stock was undervalued as there were several risk mitigation measures in place – wildfire fund (insurance against wildfires), $3B per year investments in wildfire safety, ESG plans, etc. The stock currently trades at $11.20. There was minor trimming in the last three quarters.

Burlington Stores (BURL): The ~3% portfolio stake in BURL was established in Q2 2019 at prices between $146 and $177. The position saw a ~115% stake increase next quarter at prices between $168 and $205. Q1 2020 saw a ~20% selling at prices between $121 and $248, while next quarter, there was a similar increase at prices between $141 and $217. Q3 2020 also saw a ~20% stake increase at prices between ~$171 and ~$217. The stock currently trades at ~$190. Last four quarters have seen only minor adjustments.

Walt Disney (DIS): DIS is currently at 2.16% of the portfolio. It was purchased in Q1 2020 at prices between $85 and $148. Next quarter saw a ~300% stake increase at prices between $94 and $127. The stock currently trades at ~$141. The position was sold down by ~50% this quarter at prices between ~$142 and ~$178.

TransDigm Group (TDG): The 1.45% TDG stake was purchased in Q3 2020 at prices between ~$411 and ~$519 and it is currently well above that range at ~$633. There was a ~12% stake increase in Q4 2020. This quarter saw a ~27% reduction at prices between ~$553 and ~$685.

Alight, Inc. (ALIT): The ~1% of the portfolio stake in ALIT was purchased last quarter at prices between ~$8.50 and ~$13 and the stock currently trades at $9.41. This quarter saw a ~50% selling at prices between ~$10 and ~$12.

Leslie’s Inc. (LESL): The small ~1% of the portfolio stake in LESL saw a minor ~3% trimming this quarter.

Kept Steady:

SentinelOne (S): SentinelOne is now the top position at 9.41% of the portfolio. The stake goes back to 2015 when they led the Series B funding round at a post-money valuation of $98M. They participated in each subsequent round as well as the IPO and after-market. The stock currently trades at $36.74 at a valuation of ~$10B – their initial 2015 investment has so far returned a stunning ~100x.

Alphabet Inc. (GOOG): GOOG is a 4.29% of the portfolio position purchased in Q4 2020 at prices between ~$1453 and ~$1828 and the stock is now well above that range at ~$2642. There was a ~20% reduction in Q1 2021 at prices between ~$1728 and ~$2138. Last two quarters saw a ~10% increase.

Microsoft Corporation (MSFT): The 3.76% of the portfolio, MSFT stake was purchased in Q3 2020 at prices between ~$200 and ~$232. The two quarters through Q1 2021 had seen a ~60% stake increase at prices between ~$200 and ~$245. The stock currently trades at ~$290.

S&P Global (SPGI): SPGI is a 3.29% stake established in Q2 2016 at prices between $96 and $128. The position has wavered. Recent activity follows: the five quarters thru Q1 2019 saw a combined ~60% selling at prices between $164 and $213. There was a ~30% stake increase over the two quarters through Q1 2021 at prices between ~$306 and ~$379. The stock is now at ~$408.

Avantor, Inc. (AVTR): The 3.18% AVTR stake was established in Q3 2020 at prices between ~$17 and ~$23 and increased by ~235% next quarter at prices between ~$22.50 and ~$28. The stock currently trades at $33.11. Last three quarters have seen only minor adjustments.

CoStar Group (CSGP): CSGP is a 3.14% of the portfolio position purchased in Q1 2021 at prices between ~$76 and ~$94 and the stock currently trades below that range at $57.92. There was a minor increase in the last two quarters.

Note: their investment thesis is that CoStar Group’s Ten-X acquisition should result in a second tailwind – “Bloomberg of CRE” to also be “Nasdaq of CRE” – cross-selling should result in revenue growth acceleration to 20% and EBITDA growth from 20% to 30% over time.

PG&E Corp & Units: The small 0.65% stake in PCG Units was kept steady this quarter.

The spreadsheet below highlights changes to Loeb’s 13F stock holdings in Q4 2021:

Dan Loeb – Third Point’s Q4 2021 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Third Point’s 13F filings for Q3 2021 and Q4 2021.

Be the first to comment