Joe Raedle/Getty Images News

Comcast (NASDAQ:CMCSA) is set to release its 2Q22 earnings on July 28. Consensus Analysts expect revenues of $29.75 billion and an EPS of $0.92. However, based on the company’s average earning surprises for revenue and EPS, it may actually report a revenue of $30.12 billion and an EPS of $1.03. Comcast could exceed analyst expectations due to new developments that came about in the second quarter including the expansion of the Xfinity Stream App across new platforms and recent advancements of the joint venture between Comcast and Charter (CHTR). The company’s share price is down almost 27% over the past year, however this is not all bad. The tech sell off has brought the entire industry down, and Comcast has actually performed better than all of its top competitors over the last year despite a near 30% drop in share price. The company also pays an attractive $1.08 dividend which equates to a 2.54% yield. It is fairly safe and sustainable, as Comcast has paid a dividend for 14 straight years. Additionally, Comcast stock is adequately undervalued as it could return an upside of 37.86%. With all of this put into mind, I will apply a Buy rating to CMCSA stock.

Comcast May Outperform Expectations in Earnings Report

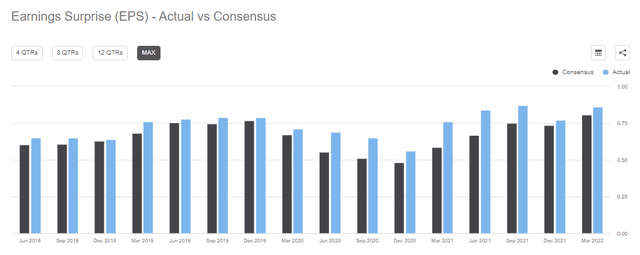

Comcast is expected to report earnings for the second quarter on July 28. Consensus analysts expect revenue of $29.75 billion and an EPS of $0.92 for the quarter. These estimates reflect a decrease in revenue and an increase in EPS from the previous quarter, in which the company posted revenue of $31.01 billion and an EPS of $0.86. It is important to note that Comcast has been consistently performing above analyst expectations for EPS, as actual EPS has outperformed expected EPS in each of the last 16 quarters. This means that it is very likely that Comcast will report an EPS above $0.92 in its upcoming report. The company’s average earnings surprise over the past 16 quarters is 12.39%. If this is applied to the current analyst expectations, Comcast may actually report an EPS of $1.03.

Comcast EPS Surprise (Seeking Alpha)

Comcast EPS Quarterly Earnings (Seeking Alpha)

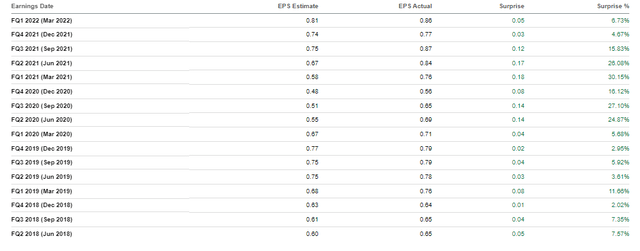

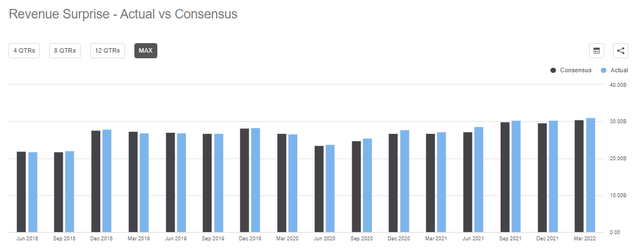

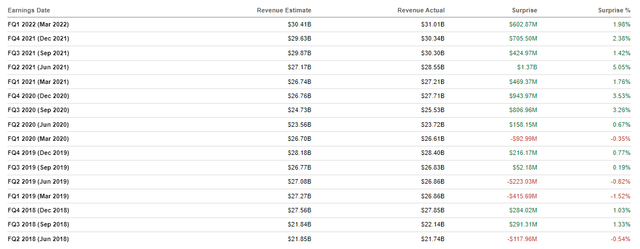

Comcast has also been pretty consistent in terms of revenue expectations. The company has beat analyst expectations for revenue in 12 of its last 16 quarters. The company has also posted 8 straight quarters of actual revenue beating expectations. Its average revenue surprise over the past 16 quarters is 1.26%. If this is applied to the current analyst expectations, Comcast may actually report a revenue of $30.12 billion.

Comcast Revenue Surprise (Seeking Alpha)

Comcast Revenue Quarterly Earnings (Seeking Alpha)

Comcast could perform above analyst expectations in the upcoming earnings report, mainly due to the new developments that were announced throughout the second quarter. During the quarter, the company announced the launch of the Xfinity Stream app on Apple TV 4K and Apple TV HD. Also, on April 17 it was announced that Marcien Jenckes has been selected to lead Comcast and Charter’s new streaming platform joint venture. Jenckes is the President of Advertising for Comcast and has plenty of experience with the company and within the industry, making him a great pick for the job. For the joint venture, Comcast will license the steaming platform and hardware known as Flex, provide to the retail side of XClass Televisions, and will contribute Xumo, an internet television service owned by the company. Charter will provide its part to the deal by contributing $900 million, over multiple years. These developments were big news for Comcast and can have a big part in the company potentially outperforming expectations in 2Q22.

Why Is The Share Price Down So Much?

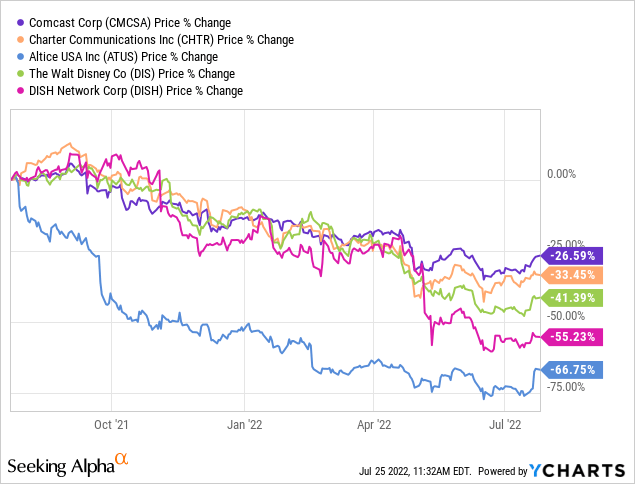

Comcast’s share price is down by almost 27% over the past year. This would often signify that the company is on the decline and may have trouble generating revenue. However, it has grown its revenue by almost $36 billion from FY16-FY21. Throughout the broadcasting industry, companies’ stocks have been falling. Comcast’s top competitors Charter, Altice USA (ATUS), Disney (DIS), and Dish Network (DISH) have all seen their share prices drop at larger rates than Comcast has over the last year. These drops throughout the industry can be attributed to the tech sell off. As of June 24, tech shares are down 16.3% over the past year and are down 18.5% in the past 6-months. The tech sell off are highly due to the threat of a possible economic downturn and rising interest rates. Comcast stock has been on the decline over the past year, but the company is still outperforming nearly all of its top competitors, which is a great sign.

A Trustworthy Dividend Option

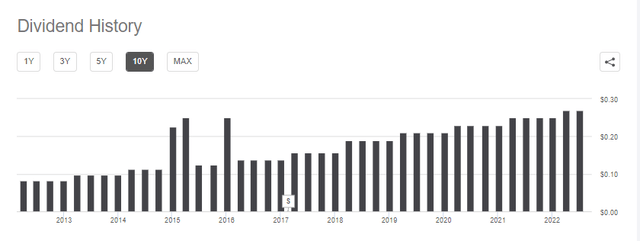

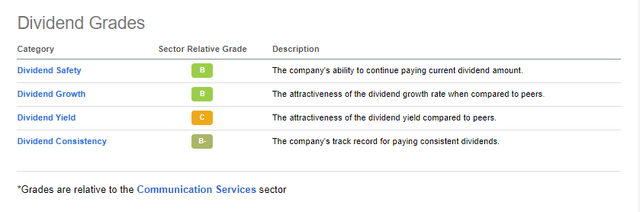

Comcast is a highly popular and attractive option for dividend investors. The company proves to focus on its shareholders as it has consistently paid a dividend for 14 consecutive years, 3 years higher than the average throughout the sector. Comcast pays an $1.08 dividend which equates to a 2.54% yield. This dividend is very sustainable, as the payout has been trending up over time and the company proves its investors are valued. The dividend is rated as a fairly safe option with high potential to continuing to grow.

Comcast Dividend History (Seeking Alpha)

Comcast Dividend Grades (Seeking Alpha)

Valuation

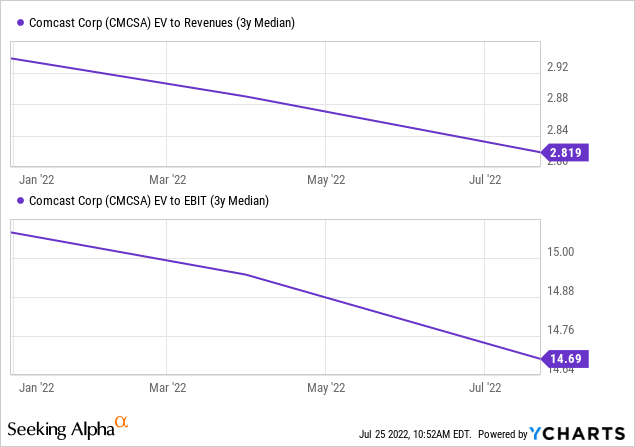

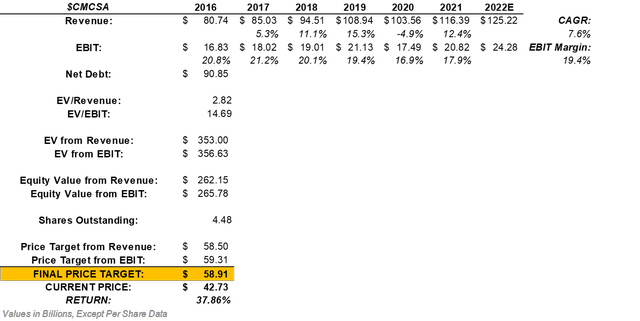

Over the last 6 years, CMCSA increased its revenue from $80.74 billion to $116.39 billion. This indicates a CAGR of 7.6% which can be applied into the company’s next fiscal year. This projects the company to generate $125.22 billion in revenue in 2022. On top of that, CMCSA has seen an average EBIT margin of 19.4%. Multiplying this margin by the estimated revenue of $125.22 billion projects the company to produce $24.28 billion in EBIT in the upcoming fiscal year. After multiplying these projections by its 3-year median EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s estimated enterprise values for net debt, we can find CMCSA’s projected equity value from revenue and EBIT. Dividing the equity values by the current number of shares outstanding and averaging the price targets bring us to a final price target of $58.91. This means that CMCSA stock could return an upside of 37.86%.

CMCSA Valuation (Created by Author)

The Takeaway For Investors

Comcast is expected to release its second quarter earnings on July 28 and analysts expect revenue of $29.75 billion and an EPS of $0.92. Based upon the company’s average earning surprises for revenue and EPS, it can realistically outperform these expectations. Comcast may report earnings that are closer to $30.12 billion for revenue and $1.03 for EPS. The company could have a strong second quarter due to its platform expansion of the Xfinity Stream App and developments regarding its joint venture with Charter. Comcast’s share price has fallen 27% in the past year, which is actually less than the drops of the company’s major competitors. The tech sell off has brought the entire industry down, and Comcast has seemingly been impacted the least by it. The company also pays an relatively attractive $1.08 dividend which equates to a 2.54% yield. This is very sustainable and the dividend has plenty of room to grow further. On top of this, Comcast stock is greatly undervalued by potentially 37.86%. With all of this put into mind, I will apply a Buy rating to CMCSA stock.

Be the first to comment