Anna Everes/iStock via Getty Images

Analysts at Morgan Stanley (MS) unveiled a list of stocks on July 12 that, according to them, could act as “Deflation Enablers“, or those which can produce real cost savings for their clients. This has become crucial in a period where the costs of doing business are rising as a result of high wage inflation, supply chain-induced scarcity, and escalating energy costs.

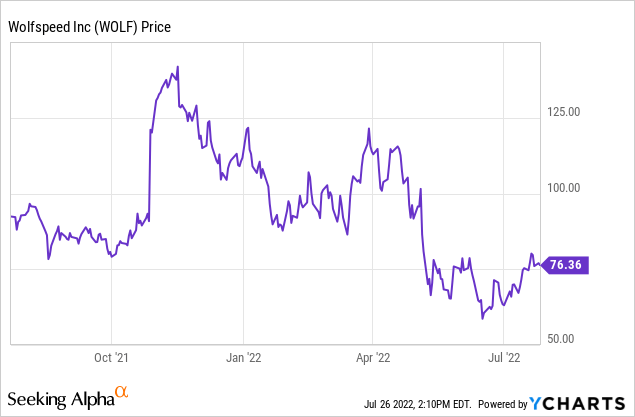

The list includes Wolfspeed (NYSE:WOLF), a $9.4 billion semiconductor company whose shares trade at around $76 after a 35% fall since the beginning of this year, with part of the downside occurring after May 4, just after the company announced its third quarter 2022 financial results.

The aim of this thesis is to assess how the company can deliver products that can prove effective at addressing high inflation concerns, while at the same time profit from more demand.

For this purpose, I focus on capital expenses, profitability, and debt metrics, but, first, it is important to identify how Wolfspeed achieves product differentiation.

Wolfspeed’s SiC Differentiator

Wolfspeed previously known as Cree develops semiconductors based on silicon carbide (“SiC”) and gallium nitride, materials that are used in electronic circuits ranging from power supplies, and wireless systems to transportation. More precisely, it has started to play a key role in the transition of America’s auto industry from ICE (internal combustion engines) to EVs (electrified vehicles) as its chips enable the conception of more energy-efficient car powertrains, which can increase vehicle range by 5%-10%.

In April this year, the company opened the world’s largest and only Silicon Carbide 200 mm Wafer fab in New York.

Mohawk Fab (www.wolfspeed.com)

Now, the transition from 150mm to 200 mm SiC wafers marks an important step to optimizing production capacities in the automotive and industrial sectors as it makes it possible to manufacture more compact, lighter, and efficient components. This means that SiC comes with a lower total cost of ownership than normal silicon for Wolfspeed’s customers many of whom are automakers, but it also supplies STMicroelectronics (STM) with substrates (materials).

In addition to STM, the U.S. company established long-term wafer supply agreements with other manufacturers like Infineon Technologies (OTCQX:IFNNY) and ON Semiconductor (ON) and has emerged as a key player in driving the industrial shift from silicon to SiC with around 60% of global production capacity. For this purpose, its Durham facility and the North Carolina fab allow it to supply materials and devices (chips) respectively.

The competition and Capital Expenses

Now, compared to Silicon, SiC-based chips are more complicated to manufacture as it requires special furnaces and Wolfspeed with its 30 years of experience is well ahead of its competitors in this niche market.

For investors, STM, Infineon (OTCQX:IFNNY), and Onsemi are in a way, Wolfspeed’s competitors, but they still procure substrate (material) from the latter as these are required by their manufacturing operations. They must satisfy demand from automotive and industrial customers as new generation intelligent cars and consumer electronics require more chips. The fact that competitors have to source material from Wolfspeed provides evidence of high demand and tight supply in what has been described as a “multi-decade growth opportunity for SiC-based applications”.

However, this remains a highly dynamic industry and Wolfspeed now faces competition from Qorvo (QRVO) after the latter acquired United Silicon Carbide in November last year. At the same time, STM is looking to build internal capacity through the construction of a substrate factory. This should satisfy up to 40% of its total requirements by 2024.

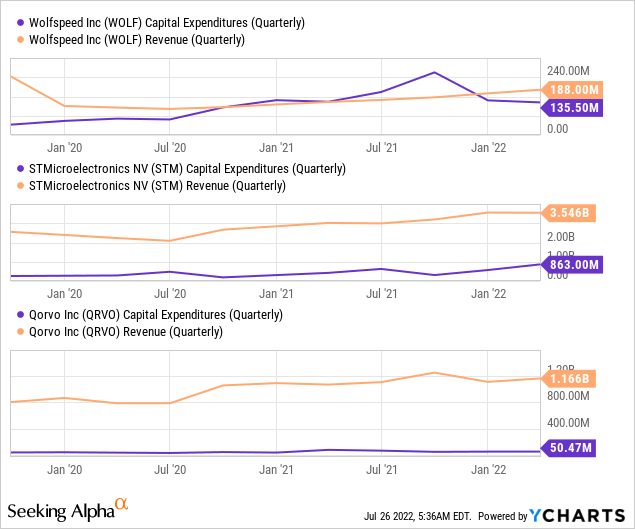

Consequently, Wolfspeed may have a competitive edge currently, but, things can change if it cannot recoup investments, especially in a rapidly changing landscape where different countries including Japan are aiming to lead the world in SiC. In this respect, its capital expenses are about the same as quarterly sales as shown in the chart below. This is in sharp contrast with peers whose revenues are at least four times the amount Capex spent.

Comparison of revenues and Capex (ycharts.com)

Moreover, the initial setup costs for the new Mohawk Valley wafer fab cost were approximately $21 million and should increase to about $75 million level by the end of the fiscal year 2022 which ends in June. Additionally, the net capital expenditures of $550 million for the entire fiscal year, are already up by $75 million over the initial amount forecasted.

On further verification, I found that the New York fab benefited from $500 million worth of state support. Second, customers have to make an upfront deposit proportional to the amount invested by Wolfspeed in the production. On a further positive note, the company should also benefit from funding from the CHIPS Act which is in the process of being enacted into law.

Therefore, the company is benefiting from state-level subsidies and customers are underwriting part of the investment, which are two important positives in the funding strategy.

However, it is also important to identify downside risks.

The Risks

Looking at revenues, the company generated $188 million, which despite constituting a 36.9% Y-o-Y increase, missed analysts’ expectations by $33 million after suffering from the adverse impact of China’s COVID lockdowns. These caused shipping delays and partial shutdowns of Wolfspeed’s semiconductor packaging subcontractors in that country.

Now, due to lockdowns lasting approximately two months from April to May, the company could find it difficult to achieve the $200M to $215M revenues planned for the Q4 which lasts from April to June. The current quarter should therefore bear the brunt of supply chain issues which can either result in a revenue shortfall or reduced gross margins as a result of expedited shipping. Thus, the stock could again be volatile when results are announced in the first week of August.

As for profitability, non-GAAP gross margins of 36.3% for Q3 represented a progression of 0.9% over Q2, in turn, made possible by some modest improvement in the product mix. For Q4, the gross margin should most likely be at the lower end of the expected 35.3% to 37.3% range due to prolonged lockdowns.

Also, expect higher operating expenses as the company ramps up capacity and negative FCF due to capital expenses exceeding cash generated from operations. This was the case in the last reported quarter when free cash flow was -$131 million, and in a stock market where companies that do not generate cash are punished, do not exclude temporary downside risks.

However, the cash position remains adequate and long-term profitability prospects look good.

Long Term Profitability

For this matter, Wolfspeed can rely on $1.3 billion of cash and was able to raise money through a $750 million debt offering at the start of 2022. This has increased debt to $1 billion, but the debt-to-equity ratio stays healthy at 43%.

Looking at the longer term, non-GAAP gross margins of 50% are expected by 2024, but these will depend on three elements, with the first one being optimization of the Durham fab. Second, is the shift from 150-millimeter to 200-millimeter wafers which should bring more operational efficiency. Thirdly, more sales volumes are expected out of the Mohawk Valley fab where customer qualifications (testing) should be completed by June 2023.

As per the management, the company is on track with these three elements, but another area to watch for is the dependency on China for packaging. This is the final stage in the manufacturing process whereby the chip material is put into a casing that prevents damage.

Conclusion

Therefore, it is important to monitor how the company intends to address its dependency on Chinese contractors, as any related revenue shortfall can cause the stock to be volatile. This is the reason I have a hold position on the stock despite the fact that it can fulfill its role as a deflation enabler.

Finally, with a differentiated SiC product offering and more than $3.48 billion of design-wins out of $8.7 billion secured over the last three years, Wolfspeed has threaded a strong bond with potential customers, which not only ensures sustained revenues from 2022 to 2026 onwards but also higher margins as production ramps-up.

Be the first to comment