Anatoly Morozov/iStock via Getty Images

Investment thesis

The shares in Toyo Gosei (OTCPK:TYGIF) have corrected 53% YTD, and we believe key negatives over cost inflation and FX risks have been priced in. Despite the company’s position as a supplier of key chemicals to the semiconductor industry, we believe it is not worth investing in given the limited upside from a cash burn profile and falling profitability which could lead to negative growth YoY. We are neutral on the shares.

Quick primer

Established in 1954, Toyo Gosei is a Japanese specialty chemical manufacturer operating two key business segments. The first is photosensitive materials used in semiconductor manufacturing (for both logic and memory chips) which made up over 60% of FY3/2022 sales. The second is chemicals for use in pharmaceuticals, fragrances, paints, and solvents and their storage management and warehousing. The current CEO Yujin Kimura is a family member of the founder and former Chairman Masateru Kimura.

The company’s largest customer is Shin-Etsu Chemical (OTCPK:SHECY), Japan’s largest chemical company and the global leading manufacturer of PVC by volume. Shin-Etsu Chemical made up 13.6% (page 12) of total sales in FY3/2022.

The company will announce Q2 FY3/2023 results on November 9th, 2022.

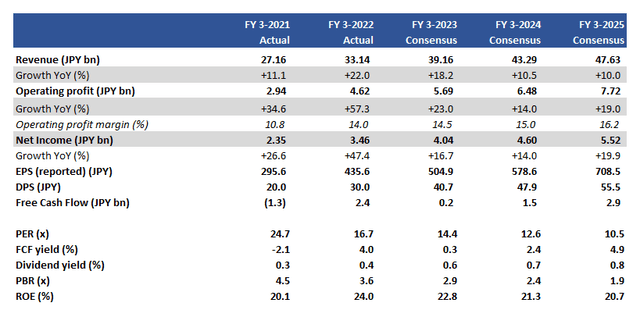

Key financials including consensus forecasts

Key financials including consensus forecasts (Company, Refinitiv)

Our objectives

Toyo Gosei hit the headlines with Kamala Harris’s visit to Japan in September 2022, who hosted a roundtable meeting with semiconductor supply chain companies. Although by no means a major heavyweight in the sector, Toyo Gosei has a role in providing photosensitive material for use in semiconductor lithography.

In this piece, we want to assess the outlook for earnings given the major changes in FX rates, and inflationary pressures affecting raw material and freight costs.

An uphill climb

Whilst the company had expected the depreciation of the Japanese yen versus the US dollar in FY3/2023, nobody could have anticipated its actual rapid rate of decline. Toyo Gosei had expected an FY average FX rate of JPY125 to the US dollar for the current financial year, but it had already reached JPY136 in Q1 FY3/2023 and is currently trading at around JPY147 – a depreciation of 31% YoY.

Whilst this will result in pushing yen-denominated sales strongly YoY, it was already noticeable in Q1 FY3/2023 (page 4) that costs were increasing. Raw materials, fuel, and freight costs rose YoY dampening margins, together with increasing operating costs as the company spent on Capex and R&D. Whilst trading appeared in line with interim company guidance, we see the following challenges ahead.

Firstly, the strength of the dollar will mean higher-than-expected costs. There is room for Toyo Gosei to raise prices, but we believe there will be limited selling power as end-user demand begins to dry up for flat panel display materials, as well as more notably in the memory market with inventory adjustments currently underway recently highlighted by Micron (MU), Western Digital (WDC) and Samsung Electronics (OTCPK:SSNLF). The logic market looks relatively healthier, but the overall outlook for the company’s photosensitive chemical business is negative.

Costs will also play a part in pushing down profitability in the chemical segment, which is reliant on demand from autos, cosmetics, and high-purity solvents for electronics, which are all experiencing a downturn in consumer sentiment.

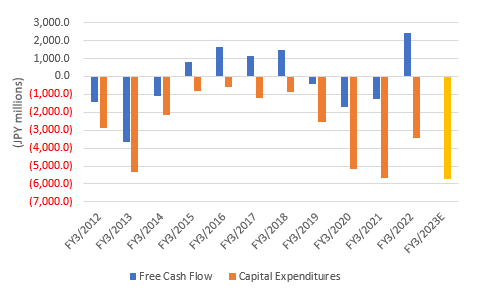

Secondly, the company announced a medium-term plan in FY3/2022, which highlighted a commitment to investment to enhance its infrastructure and raise production capacity. Although these should have longer-term benefits, in the short to medium term it appears to be a perfect storm whereby profitability is pushed down with increasing depreciation, whilst free cash flow is punished as Capex levels are expected to remain historically elevated in order to boost capacity. The company’s track record of generating free cash flow is not exactly stable, and consequently, we expect the company to be burning cash in FY3/2023 and FY3/2024 unless plans are revised – a tall order given the long-term contract nature of these build-outs.

Free cash flow trend (in blue), with planned Capex for FY3/2023 (in yellow)

Free cash flow trend, with planned Capex for FY3/2023 (Company)

Consensus forecasts look too bullish

Despite these major challenges that lay ahead, consensus forecasts appear very positive with continued margin expansion combined with strengthening free cash flow generation (please see table above in Key Financials). We cannot foresee such events occurring, given the cost pressures and waning underlying demand. What appears relatively believable is the dividend forecast for FY3/2023 where the company has already planned JPY40 per share. However, given the current business environment, we believe this will be at best a cap on dividends for the medium term, at worst pointing to a dividend cut YoY. The company is not cash-rich with a net debt balance of JPY14.1 billion/USD97 million, equating to a net debt to equity of 0.9x, which is not a major concern but highlights limits over the company’s ability to cater to increasing shareholder returns.

Despite the company recording historically high operating margins of 14.3% in FY3/2022, it would appear that this was a one-off and not a sustainable trend. To conclude, consensus forecasts are misleading in our view.

Valuations

On consensus forecasts, the shares are trading on PER FY3/2024 12.6x. There is a risk that the company’s EPS could reach this level, but purely through paper gains (under non-operating income) as US dollar deposits are translated back to the Japanese yen. The market generally does not reward temporary FX translation gains. However, the forecast free cash flow yield of 2.4% looks too high given the potential for cash burn, and consequently, we do not believe the shares look undervalued.

Risks

The company may be viewed as a key player in the semiconductor supply chain, and consequently may be valued at a higher valuation multiple than historically assessed. After a major correction in the share price, investors may view that all the negatives have been priced in, and the longer-term picture is attractive given Toyo Gosei’s exposure to structural growth in semiconductor manufacturing.

Negative risks include weaker than expected Q2 FY3/2023 results, with FY company guidance being revised down as cost pressures are quantified and the earnings outlook downgraded. Management may also limit proposals over future dividend hikes, given the risks of rising financing costs.

Conclusion

We believe recent trading is weak at Toyo Gosei and this will be highlighted in Q2 FY3/2023 results. The shares have corrected 53% YTD, and hence we do not see major downside risk. However, given the company’s relatively sketchy track record of free cash flow generation, and its limited ability in boosting prices to mitigate cost inflation, we do not see the shares as being attractive. We have a neutral rating on the shares.

Be the first to comment