HJBC

Last week, TotalEnergies released its Q3 results (NYSE:TTE). We recently commented on the company’s strategy update with a publication called Contrarian Idea and since then, Total is up by more than 25%.

TotalEnergies: One Week Ahead Of Its Strategy Update

Source: Mare Evidence Lab’s previous article

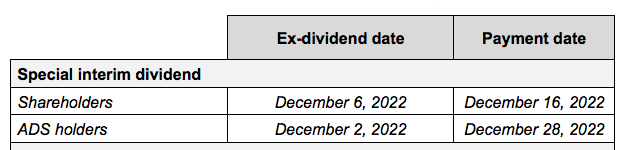

Before analyzing the company’s Q3 accounts and in line with the strategy day announcement, Total confirmed its special dividend payment of €1 per share on the following date.

Total Special Dividend

Source: Total press release

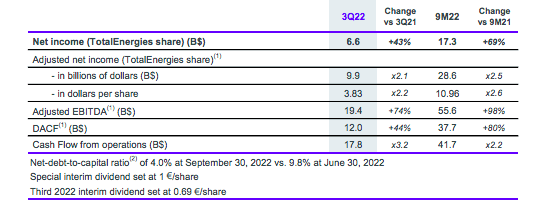

Q3 results

Numbers in hand, the French oil giant announced a net profit of $6.6 billion in Q3, up 43% on a yearly basis. This was mainly due to the record results of the gas and LNG activities. Looking at the nine months, TotalEnergies has already generated $17.3 billion in profits, more than all of last year which was approximately $16 billion. “In a context marked by an average oil price of $100 a barrel and gas prices exacerbated by Russia’s military invasion in Ukraine, TotalEnergies has been able to take advantage of its integrated model” confirmed the Group CEO Patrick Pouyanné. The Q3 results were also impacted by a new provision for a total amount of $3.1 billion related to risks in Russia, after a write-off already booked in the half-year result. Here at the Lab, we already commented on TotalEnergies’ Russian Exposure. Excluding these one-offs, the adj. net income reached $9.9 billion, higher than Wall Street’s consensus estimates that were forecasting $9.6 billion.

As already mentioned, record activities were performed in the Integrated Gas, Renewables & Power division, which notably includes liquefied natural gas. This segment’s EBIT profit reached $3.6 billion and was considerably up from the Q2 results. A great outcome was also achieved by the Exploration-Production division with an adjusted EBIT of $4.2 billion in the quarter versus the $2.7 billion performed a year earlier. In Q3, there was an acceleration of cash flow generation thanks to 1) lower inventory price, 2) margin call reduction, and 3) electricity and gas seasonality. Thus, Total was able to further deleverage (the gearing ratio reached 4%).

Total Financial ratio

Source: Total Q3 press release

Conclusion and Valuation

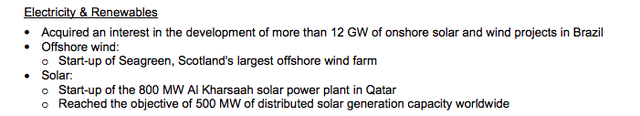

In our last article, we already analyzed Total’s next plan for higher CAPEX and its capital allocation policy. As previously mentioned, the company’s focus is more on renewable energy generation, and in Q3, Total made clear progress with the latest highlights presented here below:

Total new ren. projects

Source: Total Q3 press release

Renewable energy projects have lower IRR than oil and “even if our internal team recognized that this oil environment will last, the company’s long-term strategy is likely the right one – and what the current market dislikes is probably going to be the company’s clear competitive advantage in the future”. In the meantime, we should also report that Petronas, a Malaysian oil company, has signed a production sharing agreement with TotalEnergies Ep Malaysia and Shell Sabah for ultra-deepwater extraction works in a place located off the coast of the Malaysian state of Sabah. Therefore, oil investors might enjoy a new expected reserve. Here at the Lab, we confirm our buy rating target, and with the latest stock price upward movement, we are almost reaching our €60 target price based on an EV/Debt-adjusted cash flow of 6x.

Be the first to comment