brebca/iStock via Getty Images

Sales Strong While Margins Continue To Improve

The Toro Company (NYSE:TTC) reported fiscal 2Q 2022 results and raised guidance for the year. The company now expects sales to grow 14%-16% this year, up from the previous estimate of 12%-14%. The Professional segment, which makes up around 3/4 of company sales, continues to be the growth driver with the acquisition of the Intimidator Group, as I mentioned last quarter. The Residential segment had a more challenging quarter with a cold start to the spring season this year. Still, the company noted on the earnings call that channel partners remain positive on retail demand and strong preseason snow bookings should provide momentum in the second half of the year. Longer-term, the company continues to innovate, with a robotic mower launch planned for next year.

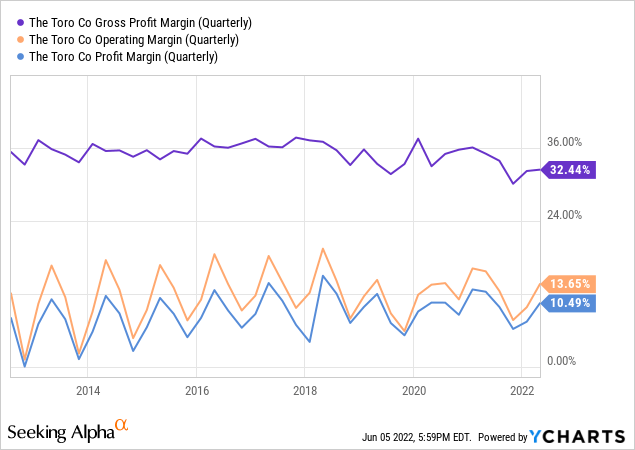

It is encouraging that the sales growth is supported by demand and not just price inflation. Additionally, margins continue to improve after bottoming last year. Gross margin took a big hit in the second half of FY 2021 due to inflation but has been increasing sequentially the last two quarters. Thanks to good operating cost control, the operating and net income margins have held up better than the gross margin and are back at long-term average levels.

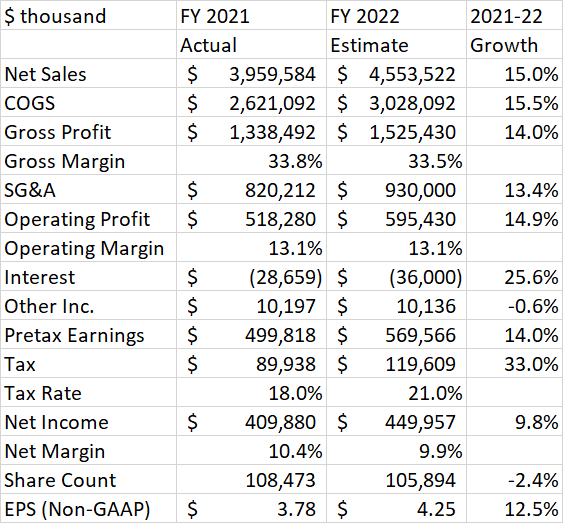

With this satisfactory performance in the first half, Toro raised FY 2022 EPS guidance to $4.00 – $4.15, up from the $3.90 – $4.10 range they had guided to previously. Analyst consensus agrees with management at the time of writing. However, I believe the EPS numbers are still conservative based on management commentary around individual lines in the income statement. On that basis, FY 2022 EPS looks more like $4.25. That would put Toro’s forward P/E at 20.3, a value it has rarely seen since 2016.

Guidance Is Still Conservative

As noted above, the midpoint sales growth guidance is now 15%, 2 percentage points better than previous. This is supported by both pricing and volume as the order backlog indicates continued strength in demand. Gross margin is now expected to be higher in the second half of FY 2022 than the first half, resulting in an average gross margin for the year “slightly below 2021” as discussed on the call. I am using 33.5% gross margin in my model, compared to 33.8% in FY 2021. This is a considerable improvement from the 32.2% I assumed for 2022 last quarter.

The CFO went on to say that the company continues to expect “similar adjusted operating earnings as a percent of net sales compared to fiscal 2021”. For modeling purposes, I interpret that to imply an operating margin of 13.1% in both years. This seems especially conservative to me as it suggests no operating leverage benefits from the better gross margin outlook. However, the company does expect to increase travel & entertainment spending as well as R&D.

This also considers more normalized spending in the second half as we expect to engage more directly with our customers, along with the continued prioritization of strategic research and development investments.

Source: Renee Peterson, CFO, Toro 2Q 2022 Earnings Call

These activities can lead to future growth if done intelligently, but the SG&A line should be watched carefully going forward to ensure these costs are not getting out of line.

Toro now expects $36 million of interest expense this year. This is higher than last year due to the debt added to acquire Intimidator, but less than my estimate from last quarter. The expected tax rate of 21% is unchanged from previously.

Rolling all these estimates together and using an updated share count, I get an EPS estimate of $4.25, above the high end of the company range.

Author Spreadsheet (Company Estimates)

Capital Management

Toro’s free cash flow in 1H 2022 was only slightly above breakeven at $7 million. This is due to working capital build in the inflationary environment. In 1H 2022, working capital consumed $212.5 million of cash, compared to a release of $11.2 million in 1H 2021. Additionally, the company spent $403 million on Intimidator Group, paid dividends of $63 million and bought back $75 million of stock. The company issued a net $400 million in debt and drew down its cash balance to cover the dividends and buybacks.

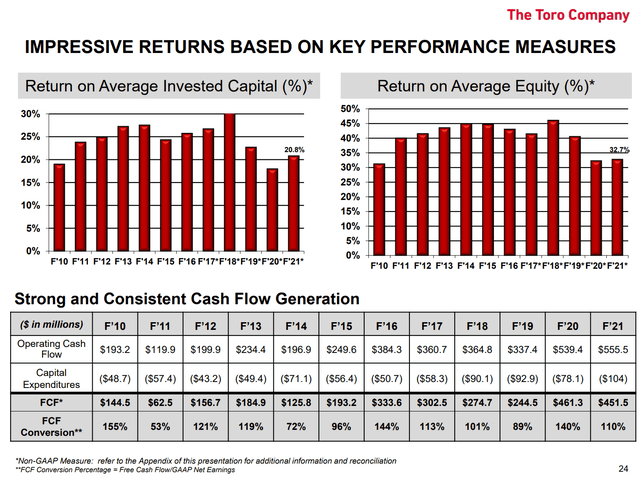

For FY 2022, the company is still projecting free cash flow conversion of 80% – 90% of net income. The company currently has high work in process inventory to help manage supply chain issues but expects to work this off by the end of the year. They also have some finished goods inventory to move due to the slow start to spring. Based on the 80% conversion level, Toro would have about $360 million FCF in FY 2022. This covers the dividend of $129 million, the completed buybacks of $75 million, and $100 million of debt from the Intimidator deal which is due within 1 year. I expect the company to hold on to the remaining $56 million of cash for a few quarters as the supply chain normalizes, but the CFO did mention the possibility of additional buybacks at the end of the fiscal year. Debt of $1.1 billion is now around 1.5 times my latest EBITDA estimate of $715 million. Leverage has increased from 1.0 times last quarter due to the Intimidator acquisition but remains within the company’s target range of 1-2 times.

Valuation

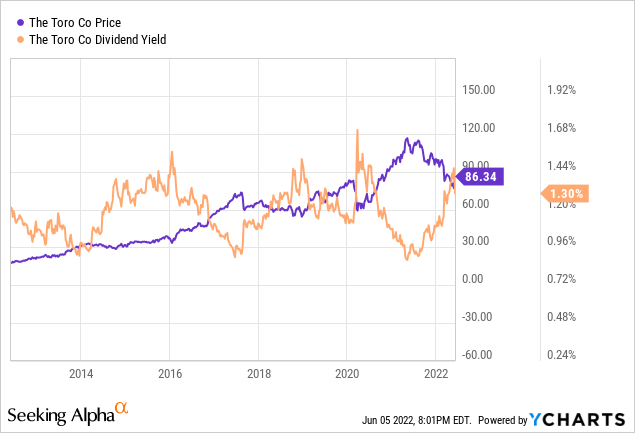

At $4.25, Toro has a forward P/E of 20.3. Historically, the P/E has been above this level since 2016.

Toro is a more diversified company since then, having added to the Professional segment by purchasing Boss snow plowing equipment and Charles Machine Works trenching and digging equipment. This makes the company less susceptible to housing market downturns like the one that took over 63% off the share price between 2007 and 2009.

On the other hand, the recent acquisitions and the working capital build are temporary drags on return on capital. Returns have started to trend upward again but remain under pre-2020 levels.

Fiscal 2Q 2022 Earnings Slides (Toro)

Toro is not a high dividend payer, but it has steadily grown the amount paid around 10% per year on average, keeping up with the growth in the share price. The dividend yield has traded in a tight range, but the recent pullback in the stock has taken it from the low end of the yield range back to the high end.

Conclusion

Toro was hit by margin compression in 2021 but margins appear to have bottomed, and sales projections have been revised higher. Management still appears conservative with their FY 2022 EPS guidance which I believe is about 4% understated at the midpoint. Shares are trading around 20.3 times forward earnings which is now the lowest seen since 2016. Although the stock has traded lower since my buy rating last quarter, the strong order backlog, pricing power, and further multiple contraction make it even more of a buy since then.

Be the first to comment