Halfpoint/iStock via Getty Images

Healthcare in all forms is incredibly important. It helps us to live better and longer. It’s because of this that the healthcare industry has grown to become one of the largest segments of the economy. And as such, it should come as no surprise to investors that there exists a vast pool of companies in this space, each one dedicated to some particular subset of the market. A great example of this can be seen by looking at U.S. Physical Therapy (NYSE:USPH). With a market capitalization of only $1.08 billion, U.S. Physical Therapy is a fairly small player in the healthcare market. But it caters to a very particular need, nonetheless. In short, the company operates physical therapy clinics that provide pre- and post-operative care for a variety of orthopedic-related disorders, sports-related injuries, treatment for neurological-related injuries, and rehabilitation of injured workers. In recent years, the company has done well to steadily grow its operations. So far, the 2022 fiscal year is proving to be a bit difficult from a profitability perspective, even as revenue continues to expand. From a valuation perspective, shares don’t look all that bad. But given the uncertainty of the market and factoring in recent performance, I do believe that a ‘hold’ rating is most appropriate at this time.

A niche healthcare play

Already, I have covered the short version of what U.S. Physical Therapy does. The company essentially operates physical therapy clinics in order to provide services to those who need them. In addition to this, though, the firm has a majority interest in businesses that are leading providers of industrial injury prevention services. These particular services include on-site injury prevention and rehabilitation, performance optimization, post-offer employment testing, functional capacity evaluations, and ergonomic assessments. The company caters to a wide variety of customers, including individuals, employers, insurers, and the contractors of insurers.

At first glance, you might think that this is an industry that doesn’t offer much in the way of change. But management has been very active in transforming its operations. Between April 2019 and the end of the 2021 fiscal year, the company completed acquisitions of seven clinic practices and three industrial injury prevention service businesses, with stakes acquired ranging from 65% all the way up to 100%. For the actual physical therapy operations, the company operates through subsidiary clinic partnerships, in which it typically has a 1% general partnership interest and a limited partnership interest that could range from 10% to 99%. However, some of its clinics operate through wholly owned subsidiaries under profit-sharing arrangements with the therapists who work in them. In total, at the end of its 2021 fiscal year, the company boasted the operation of 591 clinics spread across 39 states. In addition to this, it also had 35 physical therapy practices that it managed on behalf of unrelated physician groups and hospitals. By the third quarter of this year, the company’s operations had expanded to 40 states, with 629 clinics and 40 physical therapy practices under management under its belt.

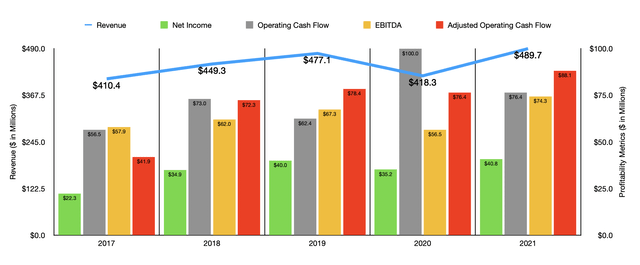

Between its acquisitions and organic growth, the company has steadily grown its business over the years. Between 2017 and 2021, revenue increased from $410.4 million to $489.7 million. With this rise in revenue came improved profits. For instance, net income for the company rose from $22.3 million in 2017 to $40.8 million in 2021. Other profitability metrics have been a bit more volatile. An example of this can be seen by looking at operating cash flow. But on the whole, the trend forward is positive, with the metric rising from $56.5 million to $76.4 million over the past five years. If we adjust for changes in working capital, the trend is even clearer, with the metric rising in all but one of the years during this time. Over this five-year window, the adjusted figure grew from $41.9 million to $88.1 million. And a similar trend can be seen when looking at EBITDA, with that metric jumping from $57.9 million to $74.3 million.

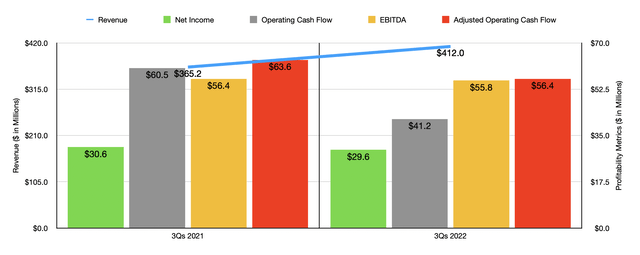

On November 2nd, the management team at U.S. Physical Therapy announced financial results covering the third quarter of the company’s 2022 fiscal year. Thanks to this, we now have insight into the first nine months of the year. During this window, revenue rose from $365.2 million to $412 million. Clinic acquisitions made between 2021 and 2022 were responsible for $25.8 million of the sales increase that the company experienced. But there were other factors behind its growth as well. The biggest involved increased revenue from the industrial injury prevention services that the company offers. This number rose from $30.5 million in the first nine months of 2021 to $58.7 million the same time this year. This 92.1% surge was driven, according to management, by strong organic growth and by $20.5 million and additional revenue associated with an acquisition the company made.

Although the company experienced some nice upside from a revenue perspective, it did experience some weakness on the bottom line. Net income, for instance, fell from $30.6 million in the first nine months of 2021 to $29.6 million the same time this year. A lot of this pain came from $17 million in additional expenses associated with the acquisition of industrial injury prevention services operations. But the company also saw the costs of mature clinics rise by $15.9 million due to increased salaries and other expenses. In particular, management said that pressure on labor rates and other costs caused by the inflationary economic environment have been problematic. It should come as no surprise then that other profitability metrics followed suit. Operating cash flow dropped from $60.5 million last year to $41.2 million this year. If we adjust for changes in working capital, it would have fallen from $63.6 million to $56.4 million. And over that same window of time, even EBITDA worsened, dipping from $56.4 million to $55.8 million.

When it comes to the 2022 fiscal year in its entirety, management has provided some guidance. They currently anticipate earnings per share of between $2.65 and $2.75. At the midpoint, that would translate to net income of $35 million. Meanwhile, EBITDA is forecasted to come in at between $73.5 million and $75.4 million. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that net income should, then we should anticipate a reading of $78.1 million.

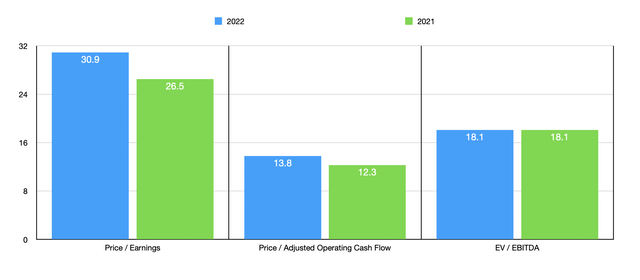

Based on these figures, I calculated that the company is trading at a forward price-to-earnings multiple of 30.9. The price to adjusted operating cash flow multiple is substantially lower at 13.8, while the EV to EBITDA multiple should be 18.1. Using the data from 2021 instead, these multiples should be 26.5, 12.3, and 18.1, respectively. To put this in perspective, I did look at five other companies. On a price-to-earnings basis, these companies range from a low of 1.8 to a high of 162.1. And when it comes to the EV to EBITDA approach, the range was between 7.7 and 125.6. In each of these scenarios, three of the five companies were cheaper than our prospect. Meanwhile, using the price to operating cash flow approach, only three of the five firms had positive results, with multiples of between 3.6 and 13.7. In this scenario, though, U.S. Physical Therapy was the most expensive of the group.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| U.S. Physical Therapy | 30.9 | 13.8 | 18.1 |

| Select Medical Holdings (SEM) | 13.3 | 13.7 | 9.9 |

| Encompass Health (EHC) | 20.1 | 8.3 | 8.0 |

| Pennant Group (PNTG) | 162.1 | N/A | 125.6 |

| Community Health Systems (CYH) | 1.8 | 3.6 | 7.7 |

| The Oncology Institute (TOI) | 53.1 | N/A | 23.3 |

Takeaway

Historically speaking, U.S. Physical Therapy has been a pretty solid operator in its market. Revenue, profits, and cash flows have generally grown over time. This year, the company is experiencing some bottom line pressure. But in the long run, it will likely work things out. On an absolute basis, I would say that shares look more or less fairly valued. And relative to similar players, I would make the same case. Due to these factors, I feel as though a ‘hold’ rating is perfectly appropriate at this time.

Be the first to comment