Diamond Dogs/iStock via Getty Images

I need to apologize to a small but distinct subset of my readers.

I wasn’t trying to ignore anyone with my recent series about the best real estate investment trusts (“REITs”) for each generation. I’ll admit I first focused on the headline groups – those age brackets that tend to make the news or get mentioned regularly in casual conversation:

Gen X (to be published) almost never comes up, it seems, but that’s the title I fall under nonetheless. So, of course it was on my mind.

What wasn’t, I’ll admit, was the freshest faces among us: Generation Alpha. It’s not like I hadn’t written about one member of that category before. I proudly proclaimed the news of my grandson’s existence to anyone who would listen.

As such, it didn’t take much for me to write about what I was buying him for his starter portfolio. But perhaps I was a little too caught up in tunnel vision to realize that there were other babies, toddlers, and young children out there who could benefit from the same recommendations.

As such, it took a prompt from a member of my staff – someone who has a daughter just a month older than Asher – to remind me to write about REITs for Generation Alpha.

I mention that in my mea culpa to the so-called Silent Generation to show that you guys and gals weren’t the only ones who (foolishly) slipped my mind.

So thank you for your patience, SG-ers. This one’s for you!

The Meaning Behind the Silent Generation Is Unclear

Why is the Silent Generation called the Silent Generation? As a member of another overlooked bracket, I had to look that up.

As it turns out, there’s not necessarily a definitive conclusion. For instance, About Generations writes that they’re:

“… the people born between 1928 and 1945. They are now retirees ranging in age from 75 to 92 years old. Those people were born during the Great Depression and the strife of World War II.”

As such:

“One theory is that children of this generation were expected to be seen and not heard. Another theory is that it was not a time when it was safe for people to say [what was] on their mind.

“TIME magazine in a 1951 article noted: ‘The most startling fact about the younger generation is its silence.’ One of the reasons for their reticence was uncertainty surrounding the Korean War, whether they could proceed with private plans or had to wait and see if they would be drafted.”

Yet for all that quiet – regardless of the reasons behind it – this group has guts:

“The Silent Generation grew up… when it was unbelievably hard for families to survive. WWII was part of their reality not by participation but vicariously through the adults in their lives. The war was [still] real to them…

“After WWII, they found themselves facing social disorder and the spectre of a new threat: communism. These were overwhelming realities for a generation trying to find their own way in the world, and it formed what they would become.”

As with every other generation, what they became was both good and less so. But I truly believe there’s much more of the better to say.

This Generation Is Perfect for REIT Investors

Q Capital Strategies categorizes the Silent Generation as being largely “conservative with [its] money.” And FamilySearch adds this:

“The Silent Generation began life in some of the most difficult conditions, including the Great Depression, the Dust Bowl, and economic and political uncertainty. The circumstances surrounding their upbringing led many of this generation to adopt cautious, conscientious behavior.”

It adds that they’re therefore:

- Thrifty

- Respectful

- Loyal

- Determined.

Naturally, then, I took all that into consideration when picking through the various REIT choices that would best suit the Silent Generation.

You don’t want anything flashy or newfangled, I’m going to guess. So let’s avoid cannabis landlords due to the controversy.

We’ll also sidestep data centers since they tend to be more about price appreciation than dividend yield.

Yet that still leaves us with so many great possibilities. Sure, some of them might not make a lot of noise…

But they’re worth a whole lot nonetheless.

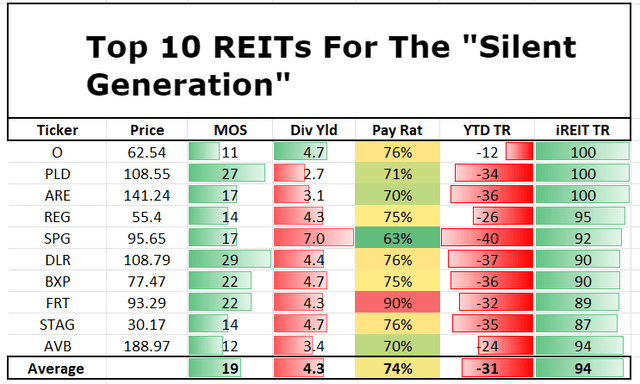

10 REITs for the Silent Generation

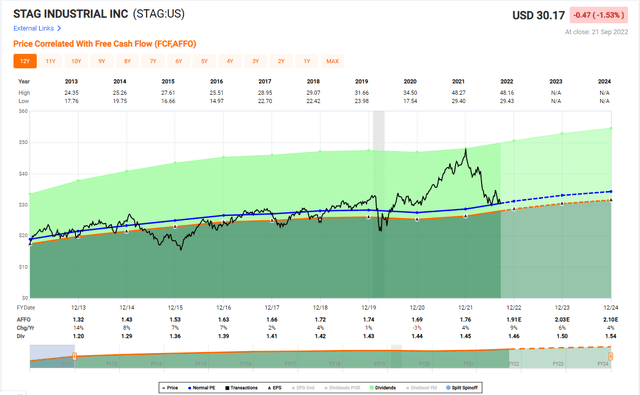

STAG Industrial, Inc. (STAG) is an industrial REIT that owns 551 properties within 40 states all here in the U.S. Those 551 properties are made up of 110.1 million square feet of industrial space.

Since the IPO the portfolio had 21% of its annual base rent attributable to Flex/Office type properties, whereas today that is down to 0.1%, making STAG a pure-play industrial REIT.

STAG’s top 10 tenants make up 10.8% of total ABR with the top 20 tenants making up 17.5% of total ABR. You can see that the company is very well diversified amongst its tenant base, as the largest tenant, Amazon (AMZN), only makes up 3.2% of total ABR.

STAG has plenty of room for growth between the growing demand and lack of supply for industrial real estate combined with the opportunity to remarket some of these leases that are coming to an end.

Like to the REITs referenced above, STAG also has a strong balance sheet with investment grade ratings from Moody’s (Baa3) and Fitch (BBB). The company has around $412 million of liquidity and a Net Debt to Run Rate Adjusted EBITDAre of 5.1x.

STAG shares are trading $30.17 with a P/AFFO multiple of 13.1x (compared with the 5-year average of 16.4x). The dividend yield is 4.7% and 2022 growth estimates are 9% and 6% in 2023. iREIT’s quality score for STAG is “87.”

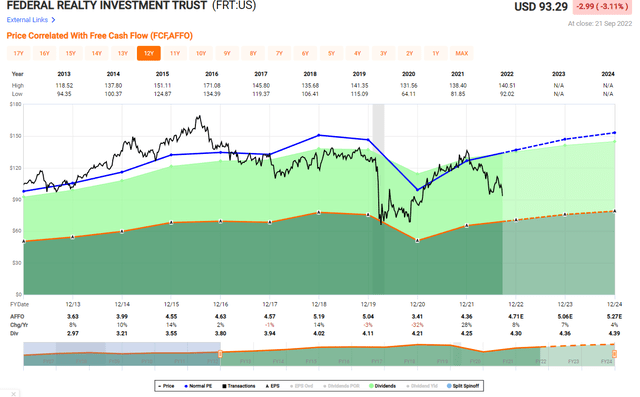

Federal Realty (FRT) is a shopping center REIT that owns 105 properties (3,100 tenants) and 25 million square feet with approximately 3,400 residential units.

During Q2, FRT generated FFO per share of $1.65, which was a 17% increase over the prior year. Comparable property operating income (POI) was up 8% as well, with the portfolio maintaining a 92.0% occupancy rate, which was up 240 basis points from prior year.

FRT has a BBB+/Baa1 credit rating. 93% of the company’s debt has a fixed interest rate, and free cash flow is expected to return to pre-pandemic levels in 2023, which will further help pay down its outstanding debt.

Analysts forecast AFFO to grow by 8% in 2022 and 7% in 2023, which means the dividend should continue to grow beyond its record of 55 years in a row.

Shares of FRT currently trading at $93.29 with a P/AFFO of 22x (compared with the normal P/AFFO of 28x). The dividend yield is 4.3% with a payout ratio of 90% (based on AFFO per share). iREIT’s quality score is “89.”

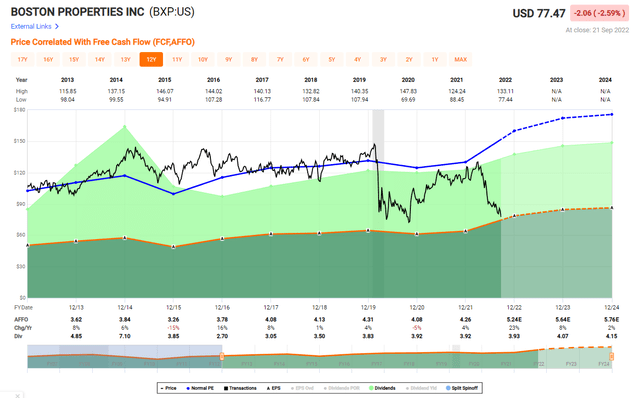

Boston Properties, Inc. (BXP) is an office REIT that has been pivoting away from the cyclical and out-of-favor sector by focusing on life sciences, residential, and even Boston’s premier observation deck will add diversification.

BXP has low near-term lease expirations of only 8.5% in 2022-23 (based on rental revenue) representing 3.99 msf. Of this amount, BXP has signed 1.8 msf of leases that have not commenced, leaving just 2.1 msf to address in the next six quarters (350k sf per quarter).

Given BXP’s 1.3 msf BXP’s quarterly leasing run-rate, BXP should easily be able to grow occupancy in 2023 – even assuming a slowdown. We were disappointed BXP did not provide occupancy guidance.

iREIT continues to monitor costs of capital – something to monitor for REITs with significant ’22 maturities. BXP estimates its cost of debt will increase +26 bps to 3.63% by 4Q23, assuming refinancing of ’23 maturities at current rates.

Share of BXP are trading at $77.47 with a P/AFFO of 15.6x (normal is 30.5x) with a dividend yield of 4.7%. iREIT’s quality score is “90.”

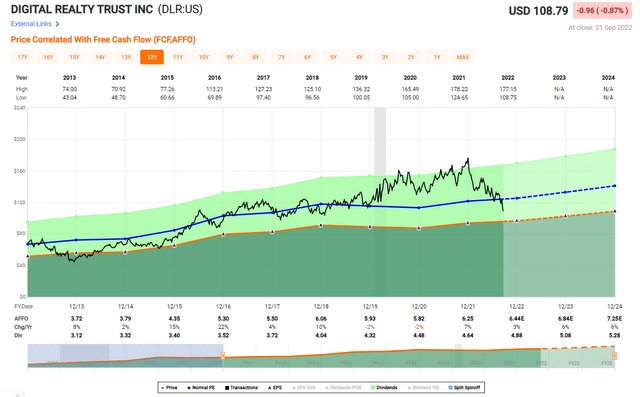

Digital Realty Trust, Inc. (DLR) is a data center REIT with a global portfolio that spans over 4,000 customers in 50 different metro areas, and the company is the 8th largest publicly traded U.S. REIT.

Their extensive development experience, economies of scale, and process-based approaches to design and construction have provided significant cost savings and added value to their customers.

DLR has maintained an excellent balance sheet, rated BBB with a weighted average debt maturity of nearly six years and weighted average coupon of 2.2%.

Nearly 90% of debt is fixed rate and 99% and the debt is unsecured, providing the greatest flexibility for capital recycling. Jordan Sadler, Sr VP at DLR, recently pointed out:

“…what’s happened now is these smaller players like CyrusOne and CoreSite, QTS, they have been recapitalized with significantly more leverage than the previous structures, cost of capital has gone up, availability of debt has gone down, and at the same time, the cost of development has risen. And so, unless these investors are willing to take lower returns, price needs to go up or demand needs to go down and we are not seeing the demand go down.”

Analysts are forecasting the company to grow AFFO per share by 6% in 2023 and in 2024, which provides added comfort and prospects for enhanced total returns.

Shares are attractively priced at $108.79 with a P/AFFO of 17.0x, compared with the normal multiple of 20.3x. The dividend yield is 4.4% and well-covered at 76% (based on AFFO). iREIT’s quality score is “90.”

Simon Property Group, Inc. (SPG) is a mall REIT that owns an interest/ownership in 199 income-producing properties in the U.S., consisting of 95 malls, 69 premium outlets, 14 mills, 6 lifestyle centers, and 15 other retail properties in 37 states plus Puerto Rico.

SPG also owns a majority noncontrolling 80% interest in TRG (Taubman Realty), which in turn has interest in 24 regional, super-regional, and outlet malls across America and Asia.

Additionally, SPG has international exposure. The REIT owns interest in 33 properties in Asia, Europe, and Canada, and also owns a 22.4% equity stake in Klépierre SA (OTCPK:KLPEF), one of the premier real estate businesses in France and Europe.

SPG also has a fortress balance sheet which has credit ratings of A3 from Moody’s and A- from S&P, and this is a major advantage for the company and one reason why they dominate the sector with the highest rated portfolio.

SPG shares are also cheap, trading at $95.65 with a P/AFFO multiple of 11.3x, compared with a longer-term average of 17.x. The dividend yield is 7.0% and well-covered (63% based on AFFO). Analysts are forecasting growth of 5% in 2023. iREIT’s quality score is “92.”

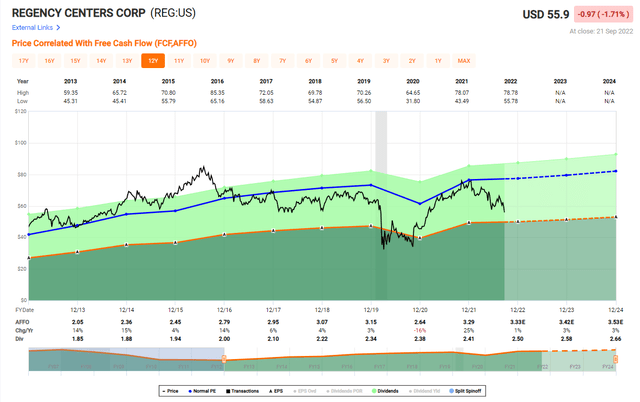

Regency Centers Corporation (REG) develops, owns, and operates income-producing retail real estate located in top markets within the U.S. It leases its assets to necessity, service, convenience, and value retailers. The company has full or partial ownership of 400 properties, primarily anchored by major grocery stores with floor space of at least 54 million square feet.

With a great business model, strong development/redevelopment pipeline, and solid balance sheet… Regency has been growing at a steady pace over the past several years. Which we expect will continue in the foreseeable future.

In the first half of 2022 alone, it acquired eight shopping centers worth a collective $269 million. This will boost its revenue and FFO growth in the future. And this all while maintaining low leverage.

Regency’s net debt-to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio is at 5x. Fixed-charge coverage is at 4.6x. And interest coverage is at 5x.

Not surprisingly, these strong numbers earned Regency a BBB+ credit rating from S&P Global and a Baa1 from Moody’s. Both ratings come with a stable outlook.

The company’s debt maturity schedule is very well spread out over the next several years. Only 15% of total debt will mature in any given year. At most. Its weighted average interest rate of 3.8% is also very manageable. And its weighted average time to maturity is 8+ years.

As a result, Regency won’t have any problem executing its growth plan or weathering any challenging economic conditions that could be around the corner.

Shares are trading at $55.40 with a P/AFFO of 16.8x (normal multiple is 23.2x). The dividend yield is 4.3% and analysts are forecasting growth of 3% in 2023 and 2024. iREIT’s quality score is “95.”

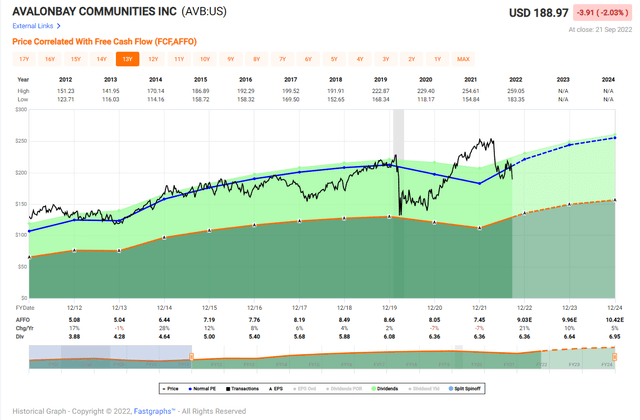

AvalonBay Communities, Inc. (AVB) is a multifamily REIT that owns 299 apartment communities containing 89,037 apartment homes in 12 states and the District of Columbia, of which 17 communities were under development and two communities were under redevelopment. The REIT has benefited greatly under recent inflationary market conditions. The demand for apartment rentals has increased driving up the price of rents.

During the company’s most recent quarter, AVB saw rental revenues for same-store communities rise 13%. Much of this was directly related to lease rates rising 7.6% during the quarter when compared to prior year. Net Operating Income was positively impacted as well, as NOI increased 17% year over year.

Occupancy during the quarter remained above 96%, ticking higher by 10 basis points over Q1. Turnover remained below historical norms and uncollectible leases remained very low, all pointing to a very strong tenant base as it currently stands.

AVB is not only one of the best apartment REITs you can buy, but they are also one of the highest quality REITs in general. In terms of valuation, AVB shares are trading at $188.97 with a P/FFO multiple of 21.9x and dividend yield of 3.4%. Analyst growth estimates for 2023 is 10%. iREIT’s quality score is “94.”

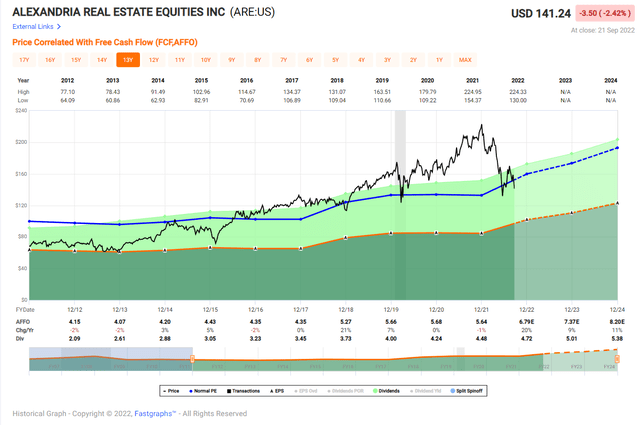

Alexandria Real Estate Equities, Inc. (ARE) is a Life Science REIT that owns around 426 properties with GLA of 47.4M square feet, and the occupancy of this space at the latest quarter was 94.7%.

The company has some extremely strong companies that aren’t going anywhere occupying the top of its ABR (annualized base rent) list. These include Bristol Myers Squibb (BMY), Moderna (MRNA), Eli Lilly (LLY), Sanofi (SNY), and Takeda Pharma (TAK).

ARE began by focusing only on life science and tech, and then further by leasing significant amounts to only the best in the business, and then even more by diversifying to where its top tenant, BMY, is less than 3.6% of the REITs total ABR.

ARE has an impressive balance sheet with $5.5 Billion in liquidity (as of Q2-22) and solid credit metrics including 5.1x Net Debt and Preferred to Adjusted EBITDA and no debt maturities until 2025. ARE also has strong credits ratings from Moody’s (Baa1) and S&P (BBB+).

ARE trades at $141.24 with a P/FFO of 21.8x (normal range is 27.5x). The dividend yield is 3.1% and well-covered (with a AFFO payout ratio of 70%). iREIT’s quality score is “100.”

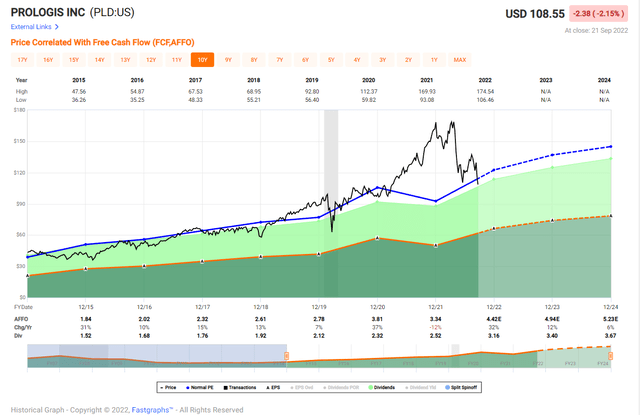

Prologis, Inc. (PLD) is an industrial REIT that was founded in 1983 and owns over 1 billion square feet of space on four continents (19 countries). On July 13th the company announced it was merging with Duke Realty (DRE) in a deal in a $26 billion all-stock transaction.

PLD noted it plans to hold about 94% of Duke’s assets and will divest assets in one key market. The deal adds 1,228 acres to PLD’s land bank and 165 million square feet of industrial assets. Duke’s buildings have a 98.4% occupancy ratio, so the move will provide reliable cash flows from the start. The merger also provides Prologis with nice exposure to markets in the Southeast, the New Jersey coast and Southern California.

PLD also has a significant “wide moat” cost of capital advantage, which is reflected in iREITs perfect “100” quality score and A-ratings from two agencies (Moody’s and S&P).

PLD’s balance sheet remains strong with 4.9x Debt/Adj. EBITDA excluding development gains (+20bps q/q). During Q2-22, PLD and its JVs issued $5.1B of debt at a weighted average interest rate of 1.4% ($4.0B refinancing/$1.1B new issuances) and the company has $5.2B in cash and availability.

Shares are now trading at $108.35 with a P/AFFO multiple of 27.6x (in-line with normal) and a dividend yield of 2.7% (71% payout ratio based on AFFO).

Realty Income Corporation (O) is a net lease REIT that owns 11,427 commercial real estate properties in 50 states and Europe. The company has been known for owning top notch real estate in the U.S. and in recent years the company has taken advantage of this expertise, combined with low rates across the Atlantic, to build out a European portfolio as well.

At the end of the second quarter, O owned more than $5 billion worth of European real estate investments, increasing its overall diversification.

Overall, 43% of Realty Income’s tenants carry investment grade credit ratings, providing peace of mind during markets like this when more and more investors are talking about an impending recession.

O also maintains a fortress balance sheet (A3 with Moody’s and A- with S&P) – one of only seven S&P 500 REITs with to A3/A- ratings or better. This means that the company has significant liquidity ($3.25 billion) and low borrowing costs that support enhanced financial flexibility.

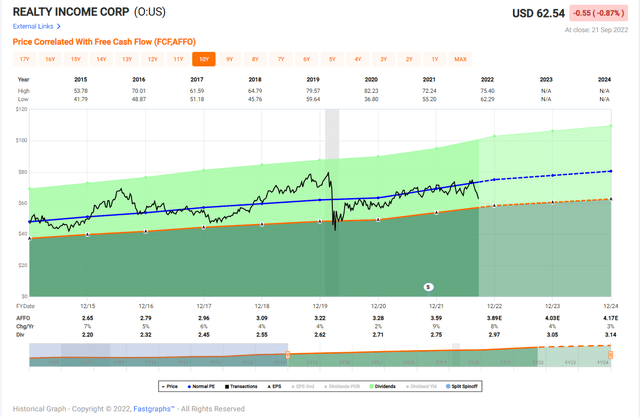

With all of that in mind, you’d think that the market would be willing to pay a premium for O shares; but, as you can see below, O is currently trading at a discount to its long-term average P/AFFO multiple.

Shares are now trading at $62.54 with a P/AFFO multiple of 16.4x (normal is 19.3x) with a dividend yield of 4.7%. Analysts are forecasting 8% growth in 2022 and 4% in 2023. iREIT’s quality score is “100.”

In Closing…

This concludes my article, 10 REITs For The Silent Generation, and I worked hard on the list because it’s also a shopping list for my mother, who is part of this distinguished classification.

This week, I’m in West Palm Beach, and I took my mother. I wanted her to use this article as a source to enable her to continue to purchase shares in some of the highest-quality REITs that have been beaten down as a result of market sentiment.

We will be including all of our generational picks at iREIT on Alpha as we’ll be monitoring them closely to see which generation fares the best. I have a feeling that these 10 picks (in this article) will perform just fine. As my mother always says, “the cream will always rise to the top.”

Be the first to comment