Mystockimages/iStock via Getty Images

Investment Thesis

So far, in 2022 US Treasury Bonds have been in a relentless downtrend; but now they may reverse course. Recently, a couple of Seeking Alpha contributors rated TLT, the 20+ Year Treasury Bond ETF as a BUY.

In a recent Seeking Alpha article, Tariq Denison makes the argument that the long-term Treasury yields are temporarily too elevated and that they will collapse back down. If his thesis holds, then TLT price increases.

Kirk Spano argues that because the US Leading Economic Indicators have declined so much that they are signaling that a recession is imminent, the FED will slow down tightening to avoid making a policy mistake. Here is a quotation from Spano’s article:

“The eventual reversal of hawkish Fed policy sometime next year will lead to a major rally in 20-year treasury rates which will fall below 3% again. That makes the iShares 20+ Year Treasury Bond ETF TLT a buy soon.”

In a previous article, I rated TMF a SELL, and TMV a BUY. In this article I reverse the ratings: TMF is a BUY and TMV is a SELL.

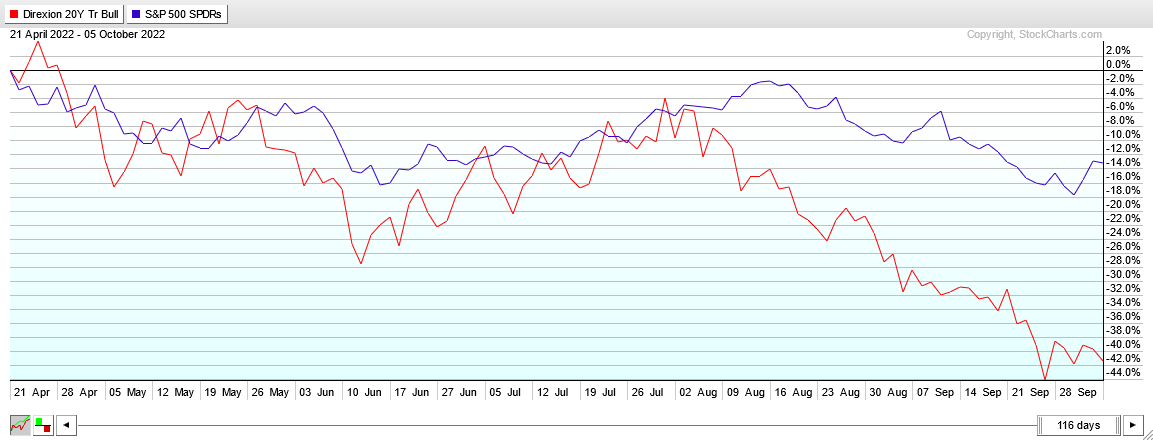

Since my recommendation of selling TMF on 4/21/22, the fund had a loss of -41.50%.

StockCharts

TMF and TMV

The Direxion Daily 20+ Year Treasury Bull 3X Shares (NYSEARCA:TMF) has been available since April 2009. It currently yields 0.42% and has a net expense ratio of 1.00%.

The Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV) has been available since April 2009. It does not pay any dividends and it has a net expense ratio of 0.93%.

Currently, TMF has about $400M net assets while TMV has $505M. Both funds trade in large daily volume.

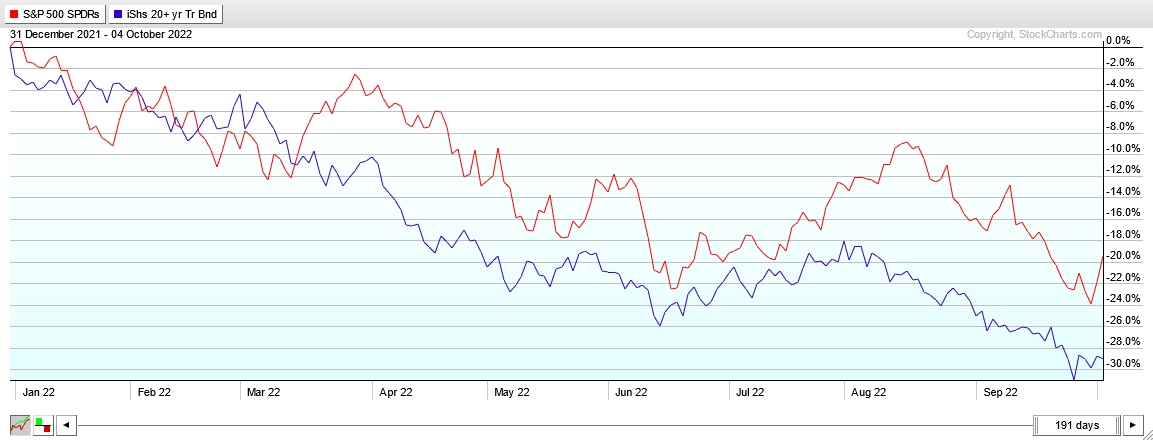

All Treasury Bond ETFs are, on average, negatively correlated to US equities; during the 2022 equity bear market, they have been positively correlated. This is illustrated in the chart below, showing the total returns of SPY and TLT in 2022.

StockCharts

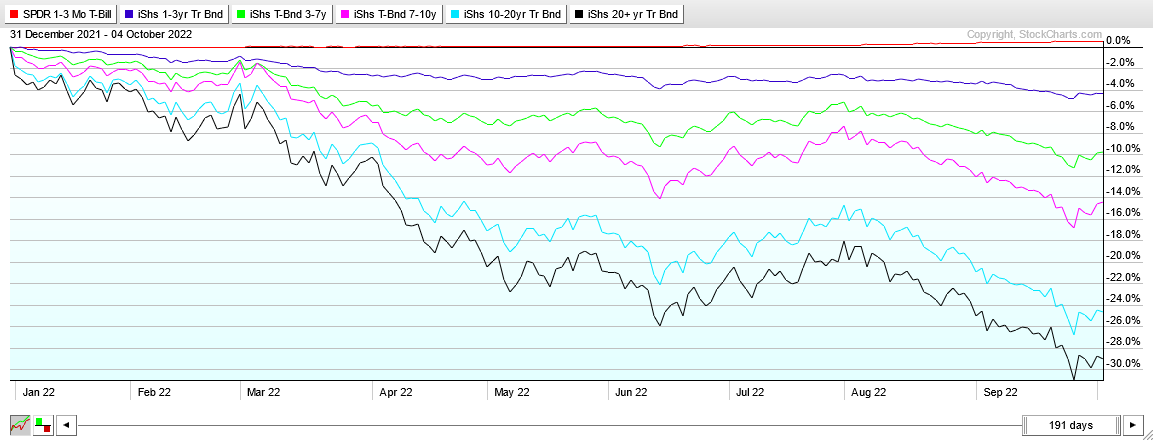

All Treasury Bond ETFs, with the exception of the 13-week TBills, BIL, have incurred significant losses in 2022, as shown in the next graph.

StockCharts

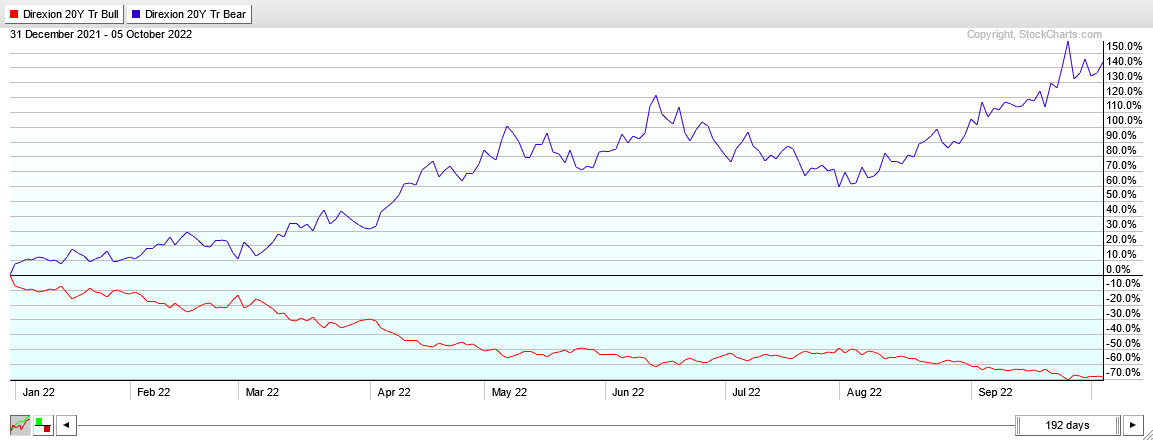

Since TMF and TMV are 3X leveraged, their gains/losses are about three times larger than those of TLT.

Example of TMF – TMV trade

A simple trade that invests equally in TMF and TMV and holds the funds without any rebalancing, is shown in the next graph. The trade initiated at the market close of the last trading day of 2021 with an initial balance of $2000. At market close on October 5, 2022 the balance is $2744, that is a return of 37.20%.

StockCharts

Conclusion

The current weakness in the US Leading Economic Indicators, coupled with the recent rapid increase in the Fed interest rates to fight inflation, has made the chances of a recession very real. Under this scenario, the Treasury Bond yields are expected to stop increasing. TMF, a 3X leveraged 20+ Year Treasury Bond ETF, is likely to stop the steep decline, consolidate for a couple of months, then rally.

My TMF rating is a BUY.

Be the first to comment