Drew Angerer

Federal Reserve Chairman Jerome Powell (“JPOW”) just raised the Fed Funds Rate another 75 basis points to sit in the 3% to 3.25% range. Historically speaking, that’s still below normal. Since the Great Recession, though, it’s sky high.

Powell has one simple goal: to break inflation.

And, he’s willing to accept a recession to do it.

The stock market finally started to become a believer in Powell’s resolve by sending the large cap S&P 500 (VOO, SPY) down 5% last week. Many investors have suddenly been scrambling for cash and looking into various fixed income investments. The TINA trade (There Is No Alternative) to stocks appears to be dead.

At the moment, cash seems to be the alternative to stocks and other risk assets. It is rare that lasts long. Soon, there will be a great position trade (lasting quarters to years) 20+ year duration bonds. Asset allocators will be able to buy the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) soon.

The Fed’s Blunt Tool

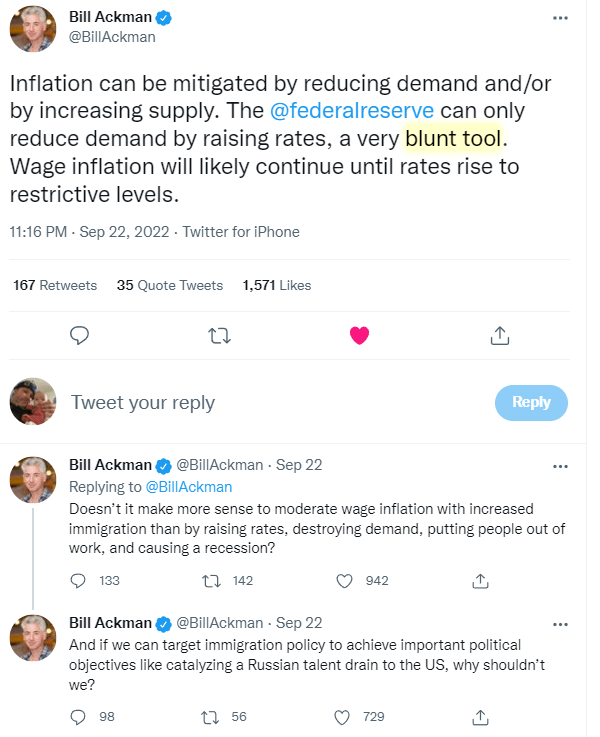

Bill Ackman recently said a few things that watchers of my webinars know I’ve been saying for about a year now.

First, that the Fed raising interest rates and engaged in large quantitative tightening to cause a recession, to kill demand, to raise unemployment, to kill inflation is a difficult task. Frankly, I think it is a simplistic approach that is bad for most Americans. Ackman called it “a very blunt tool.”

Rather, I believe that we should be doing all that we can to increase supply. The Fed tightening runs counter to this goal, which is why I discussed last week that the Federal Reserve might be on the verge of causing stagflation:

Macro Dashes – The Fed Could Cause Stagflation Next

Increasing supply also requires good legislation, the right incentives, and time. While the Biden administration has done well to help two of our most important industries, clean energy and semiconductors, there is still more to do.

Increased targeted immigration would be great way to alleviate labor stresses in the economy. This is another point that Ackman made in his mini-tweet storm. On several occasions, Elon Musk has also pointed out that we need more young people to drive the economy. I agree. After all, “demographics are destiny.”

A very blunt tool. (Bill Ackman)

Jerome Powell, though, is choosing the recessionary route. He does not have much choice. He does not make public policy. So, he does what he can, when he can.

Valuations Vs Interest Rates

There is an inverse relationship between stock market valuations and interest rates. Historically, higher interest rates have led to lower stock prices as valuations contract.

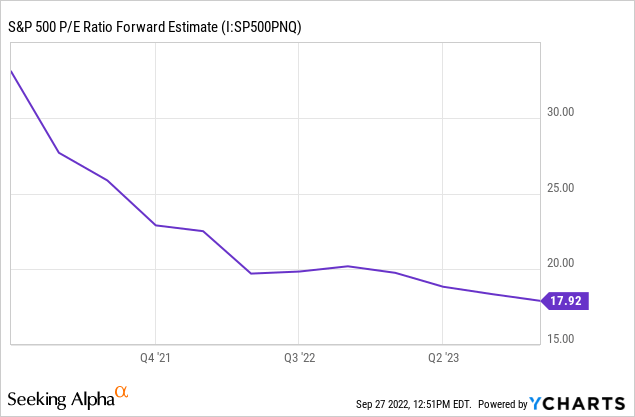

Valuations started very high this cycle and have plenty of room to fall. Whether we will see forward P/E ratios around the typical trough level of a 10-12 range is hard to know. Certainly, we will see lower than the current level near 18.

S&P 400 P/E Forward Estimate (YCharts)

Here’s a brief on what I have chronicled and forecast the past 3 years:

- In September 2019, we got a stealth round of QE to bailout the Repo market. That seeped into stocks driving overvaluations even at low interest rates.

- In early 2020, Covid-19 hit and took attention off of stock overvaluations as they sold off fast and heavy on “end of the world” fears.

- Massive QE and government bailouts drove stocks right back up after the Covid-19 Crash and investors never really got the message that stocks were getting historically overvalued again by mid-2021.

- By late 2021, the Federal Reserve was warning it would be tightening in 2022, but still had not fully appreciated inflation. Valuations were high, markets were overbought, and the Fed was about to start stomping on the brakes.

Now, as interest rates rise, we are finally seeing valuations plummet across the S&P 500. JPOW’s money printer no longer “go brrrr.” TINA is at least in a coma, if not dead.

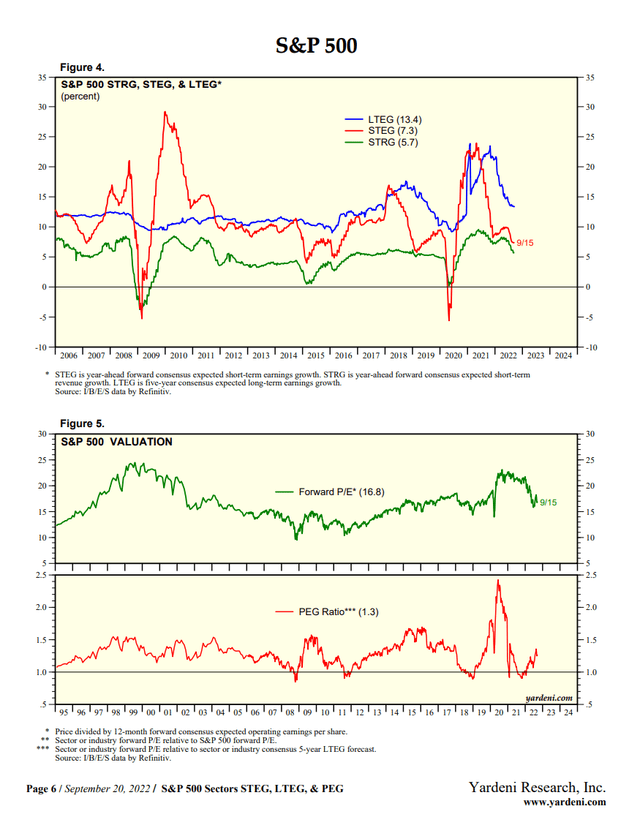

S&P 500 Valuations (Yardeni Research)

What we can see in the charts above is that stock valuations are approaching more normal historical levels, though not quite there yet. At least a big piece of the valuation damage has been done.

But, what if earnings fall more?

I would argue that the LTEG (5-year consensus long-term earnings growth) has a lot more room to come down, as I believe that many of the long-term earnings forecast still need to come down substantially.

The short-term measures I believe are also skewed and have plenty of room to come down, and with them stock prices. We have to consider the impact on the equation if the E (earnings) comes down further.

A lower denominator means that all of the ratios are currently understated and valuations remain dangerously high. I recently said this:

Macro Dashes: SPY Should Double Bottom Or Worse

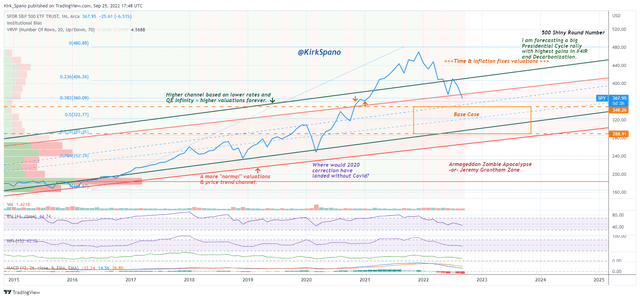

We are at the double-bottom just two weeks later. I am now in the camp that we see an ultimate bottom somewhere closer to 3000 on the S&P 500.

What is more worrying than that is we could see a much worse outcome if there are any contagious problems in the global financial system, another energy shock, or if supply chains break down instead of strengthening. If any of that happens, we could see stock prices make a run at 2016 levels.

S&P 500 Scenarios (Kirk Spano)

Cash Wasn’t Trash In 2022

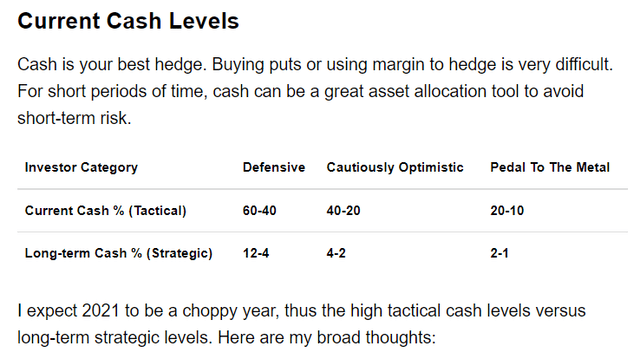

If you are a regular reader and follower of mine, then you know I have been advocating raising cash on rallies since late last year. Here was my advice to subscribers of my service on January 12th, 2022:

Cash Level Recs January 2022 (Margin Of Safety Investing by Kirk Spano)

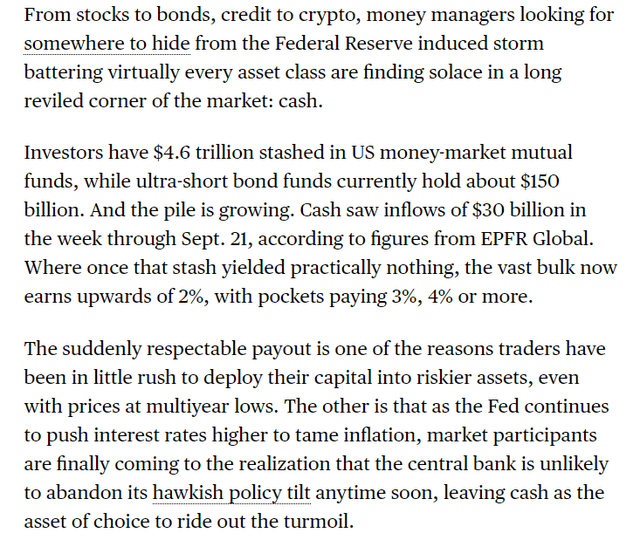

So, what are investors doing now with their money? Many are finally moving to large cash positions. Bloomberg discussed this a few days ago:

Rising Cash Levels (Bloomberg)

Goodbye, TINA.

My Futile Fed & Economic Forecast Now

In a MarketWatch article a long time ago, far, far away from today, I discussed a concept called the “Slow Growth Forever Global Economy.”

In short, the thesis was that, due to aging demographics, with fewer people being moved out of poverty than in decades past, global debt and technological change, global growth will (probably) never be as high as it was in the post WWII to Great Recession era.

You can get a summary of the “Slow Growth Forever Global Economy” in this 2016 Seeking Alpha piece:

Understanding The ‘Slow Growth Forever’ Global Economy

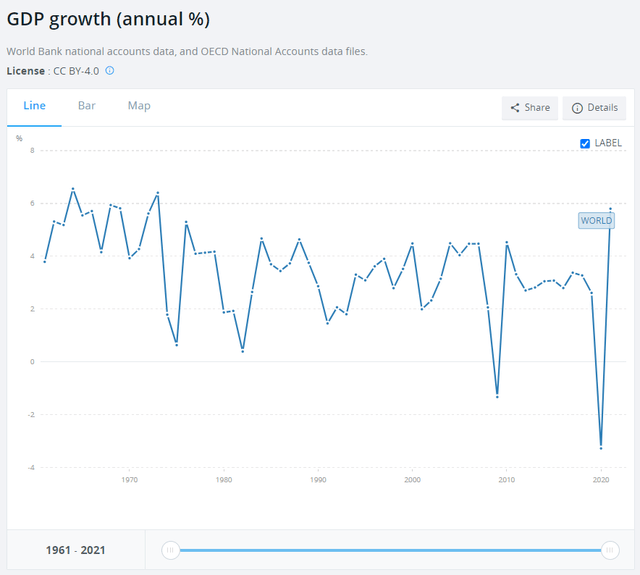

It is important to understand and accept this economic thesis. It is what is driving much of the monetary and fiscal policy actions for the long-term. Policy is a reaction to this slowing GDP growth reality:

Global GDP Growth (World Bank)

As you can see, global GDP growth trends have fallen over the decades from 4-6% being normal to today’s post-Great Recession levels of 2-3%. We have only seen spikes in growth after the Great Recession and Covid-19 Crash.

It is “slow growth forever” that will make the Fed pull back sooner than later on rate hikes and quantitative tightening.

Since early this year, I have said the Fed will have to back off by the end of the year. In one webinar, I said the Fed is going to hit us “fast and hard” for a few months before backing off in Q4.

I still think that is exactly what is going to happen.

The Conference Board’s Leading Economic Indicators (“LEI”) are mostly turning over already. That means the Fed has a narrow window for avoiding a costly policy mistake of over-tightening.

That is why, barring some international event[s], I think the Fed’s reloading of their bazooka is almost complete:

Macro Dashes – The Fed Is Reloading Its Bazooka For Next Time

Current Bond King Jeff Gundlach recently warned that the Fed needs to slow down tightening. And, as of the past few days, he has begun to buy U.S. Treasuries on belief they will in fact do so.

Gundlach says the Fed should slow down rate hikes because it is pushing the economy into a recession

TINA?

TLT Will Be A TINA Alternative Soon

If I am right that inflation has in fact started to turn over as I forecast it would a few quarters ago, then the Fed is going to get an opportunity to slow down or outright pause on rate hikes soon. I don’t know if that will be in November or December, but expect it will be one or the other.

One scenario that seems plausible is that the Fed could do a 75 basis point hike in November, which Powell’s last commentary implied, while taking a wait and see approach for December that could lead to a pause or only 25 basis point increase then. We’ll see.

Regardless, we are close to 20+ year treasury rates bottoming out in my opinion. That means the iShares 20+ Year Treasury Bond ETF (TLT) is very close to being a buy. Gundlach is already in the bond market buying.

My analysis is derived from fundamental economic analysis and backed up by technical and quantitative data. My buy zone for TLT falls between an unusually wide range of $106 (which it just broke below) to $87.

The wide range takes into account the possibility of external factors adding one more wave of inflation. An energy shock is the most obvious potential inflationary push. Such a wide range necessitates slowly scaling in.

My Elliott Wave analyst summarizes it this way. The target pivot point for TLT is about $97-98. If inflation surprises to the upside, though a month or two out, then there is potential for a decline to about $85.

TLT Elliott Wave (Scott “Shooter” Henderson)

As you see, two different approaches are landing in about the same places. The wildcard being whether or not we see another inflationary catalyst.

If we see another inflationary catalyst, which I put at about 50/50 of happening, and TLT falls into the $80s, we will then start to look at long option trades in calls as well. It is too early to consider call option trades, in my opinion, as TLT is not yet at an extreme level. For me, it only makes sense to take the risk of long calls from the extreme oversold edges of a market.

The margin of safety to scaling into TLT, starting soon, is that eventually, due to “slow growth forever,” the Fed has to back off so growth can return.

Investment Quick Thoughts

It seems to me with most of the leading economic indicators already heading down, that the Federal Reserve is closer to the end of its hawkish stance than many currently believe.

I think the current hawkishness is designed to get the stock market and real estate (both components of LEI) to correct downward in the next few quarters. During that time, energy development and North American supply chains will continue to improve, reducing inflationary pressure from energy and supply chains.

By early next year, and quite possibly the December Fed meeting, I think the Fed pauses raising interest rates. I also believe that sometime next year they reduce quantitative tightening and quite possibly stop it altogether on net (I’ll explain “on net” in another piece, so please do follow me).

The eventual reversal of hawkish Fed policy sometime next year will lead to a major rally in 20-year treasury rates which will fall below 3% again. That makes the iShares 20+ Year Treasury Bond ETF TLT a buy soon.

Members will get buy alerts and potential option trades as we get closer to trigger prices. For those of you who are accredited investors, I will also be discussing private equity and real estate limited partnerships opportunities.

Be the first to comment