Man”s hand with vitiligo Drs Producoes

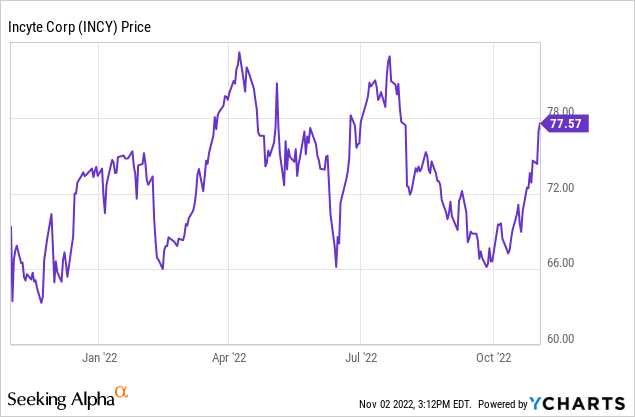

Incyte (NASDAQ:INCY) is a large-cap pharmaceutical company known mainly for Jakafi, a JAK inhibitor prescribed primarily for myelofibrosis, but also for polycythemia vera and GVHD (graft versus host disease). Q3 2022 results were announced on November 1 and showed 20% y/y product revenue growth. Because of the ramp of Opzelura, the cream form of Jakafi, I believe Incyte is undervalued. The current price of the stock makes it a good time to buy, despite a recent ramp in the stock price. The 52-week low was $62.31, but the stock closed at $76.95 on November 1, reasonably close to the 52-week-high of $84.86. The current P/E ratio (TTM/GAAP) is 17.5, which is very reasonable for a company that is rapidly growing revenue.

Q3 2022 Results

Q3 2022 revenue was up just 1% y/y, but the Q3 2024 Incyte press release emphasizes 20% y/y net product revenue growth. That is not really deceptive. Q3 total revenue was $823 million, down 10% sequentially from $911 million, and up just 1% from $813 million in Q3 2021. The swing factor was milestone revenue (payments by other companies made when licensed therapies hit prespecified goals). In Q3 2021 milestone revenue was $35 million. In Q2 2022 it was unusually large at $130 million. It tends to be lumpy, and in Q3 2022 no milestone revenue was recorded. The following table shows revenue by therapy or type:

|

Incyte Revenue by Type |

||||

|

(in $ millions) |

Q3 2022 |

Q2 2022 |

Q3 2021 |

y/y |

|

Jakafi product |

620 |

598 |

547 |

13% |

|

Jakavi royalty |

86 |

84 |

95 |

-9% |

|

Iclusig product |

26 |

26 |

29 |

-9% |

|

Pemazyre product |

23 |

19 |

18 |

33% |

|

Minjuvi/Monjuvi |

6 |

4 |

1 |

967% |

|

Opzelura product |

38 |

17 |

0 |

na |

|

Olumiant royalty |

20 |

30 |

87 |

-76% |

|

Tabrecta royalty |

4 |

4 |

3 |

50% |

|

Milestone, other |

0 |

130 |

35 |

-100% |

|

Total revenue: |

823 |

911 |

813 |

1% |

Source: data in Q2 and Q3 2022 Incyte press releases, compiled by author.

It is clear from the table that Incyte derives most of its revenue from a single therapy, Jakafi. Outside the U.S., Jakafi is marketed by Novartis (NVS) as Jakavi and Incyte received royalties. The revenues and royalties from other products tended to be relatively small, and in some cases are declining, even though these are newer drugs than Jakafi. The one rising star is Opzelura, which will be treated in its own section below.

Non-GAAP net income was $113 million, down 30% sequentially from $161 million and down 38% from $182 million in Q3 2021. That resulted in a non-GAAP diluted EPS of $0.50, down 31% sequentially from $0.72, and down 39% from $0.82 a year earlier. On a non-GAAP basis, net income was $134 million, down 41% sequentially from $226 million, and down 49% from $262 million a year earlier. Diluted non-GAAP EPS was $0.60, down 41% sequentially from $1.01, and down 49% from $1.18 a year earlier. For both the GAAP and non-GAAP profit numbers, the main explanation for the downward trend was the absence of milestone revenue in Q3 2022.

In contrast to many of the large-cap pharmaceutical companies, Incyte carries no debt. At the end of Q3, the balance of cash and equivalents was about $3 billion, up sequentially from $2.72 billion. This gives Incyte the ability to acquire additional development assets. In Q3, In October, Incyte announced an agreement to acquire Villaris Therapeutics, a biopharmaceutical company focused on the development of therapies for vitiligo, including its lead asset, auremolimab. IND-enabling studies are currently underway, with clinical development expected to begin in 2023. The amount of cash to be used for the acquisition, which requires regulatory approval, was not disclosed.

Opzelura Ramp

Opzelura is a formulation of Jakafi (ruxolitinib) for application to the skin. In late 2021 it was approved by the FDA for treating atopic dermatitis. In July 2022 it was approved for vitiligo. In Q3 2022 it had sales of $38 million, more than doubling its Q2 sales. Considerable time was devoted to discussing its sales ramp during the Q3 Incyte Analyst Conference. The number of potential patients with vitiligo may be well over 1 million. The company is currently going through the usual reimbursement curve: most patients are started on free Opzelura while they wait for their insurer to approve reimbursement. Most patients with commercial insurance now have access to reimbursement. The percentage of paying patients, versus free drug patients, has been improving at the same time new patients are being rapidly added. Over 62,000 units of Opzelura were shipped in the quarter. Incyte has retained worldwide rights to Opzelura. The trajectory is for rapid growth in Opzelura revenue in Q4 2022 and then in 2023 and likely beyond.

Pipeline Progress

Incyte has an extensive pipeline of potential therapies, ranging from those still in preclinical trials to those in Phase 3 trials with the potential of becoming commercial products relatively soon. For an overview, see the Incyte pipeline. Many of the trials underway are for indications that amount to label expansions for the drugs already generating income (see table above). Here I will just mention what I see as highlights, given that I see the main propeller of value in 2023 as Opzelura.

Povorcitinib (INCB54707) is currently in Phase 2 trials for HS (hidradenitis suppurativa), vitiligo, and prurigo nodularis. Based on results for HS released in August 2022 from the Phase 2 trial, Incyte intends to initiate a Phase 3 study in HS later in 2022.

Once daily ruxolitinib has an FDA PDUFA target action date of March 23, 2023. While this extended-release formulation will doubtless ease administration, and extend patent life, I do not expect it to have a major effect on product revenue.

For chronic GVHD, Incyte is developing Axatilimab. The Phase 2 trial results are expected in mid-2023. Incyte will also try it in combination with ruxolitinib in a Phase 1/2 trial scheduled to begin in Q1 2023.

Monjuvi (tafasitamab) is being tested in multiple label-expanding cancer indications. Phase 3 trials are underway in DLBCL (diffuse large B-cell lymphoma), follicular lymphoma, and marginal zone lymphoma. Earlier stage trials are underway in other indications.

Incyte is developing four cancer antibody therapies licensed from Agenus (AGEN): INCAGN1876 (targets GITR), INCAGN2385 (targets LAG-3), INCAGN2390 (targets TIM-3), INCA00186 (targets CD73). No specific timeline for data releases has been given, but they are likely to be used in combination therapies rather than as single agents.

Conclusion

Incyte is rapidly ramping up its revenue. The newer Opzelura indications appear to be capable of keeping that ramp going nicely. Other current commercial therapies may receive label expansions, which would also help them to increase revenue. Behind this current crop, we have an extensive pipeline that should produce some winners in the second half of this decade. Despite that, the stock price appears quite reasonable. I already own some Incyte, but it is not a large percentage of my portfolio, so I can see accumulating more as cash becomes available. On the other hand, like all pharmaceutical companies, there are risks, including competition and the possibility that some pipeline drugs will fail to produce positive results. In fact, with a pipeline as large as Incyte’s, we are likely to see poor data from time to time. We just do not know which therapies in which indications will work. That is why we conduct trials.

Be the first to comment