jetcityimage/iStock Editorial via Getty Images

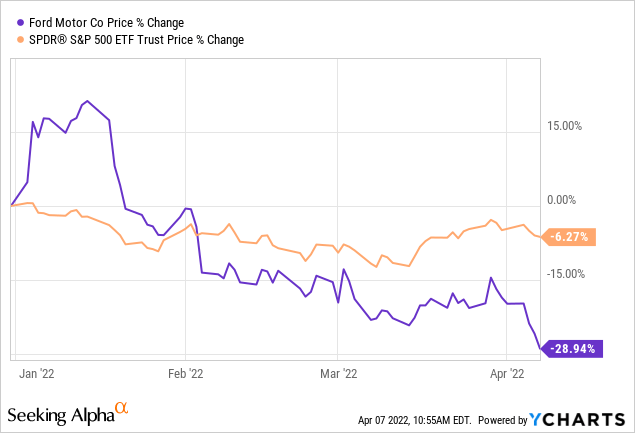

We may have been early, but we were not wrong. We’ve been bearish on Ford (NYSE:F) for quite some time now, and it’s finally paying off. Since our last article, Ford stock has pulled back by nearly 15% and has been subject to a downgrade by Barclays recently. Brian Johnson of Barclays covered the stock and said that “Despite the selloff, we believe investors are still underestimating risks to the sector – and in particular to suppliers – from inflation and production pressures – as well as the impact of interest rate hikes on portfolio allocations,”.

We think the cyclical effect has finally kicked in, and Ford stock could be set for a prolonged bearish run; here’s why.

Economic Slowdown

Ford’s Earnings Slowdown

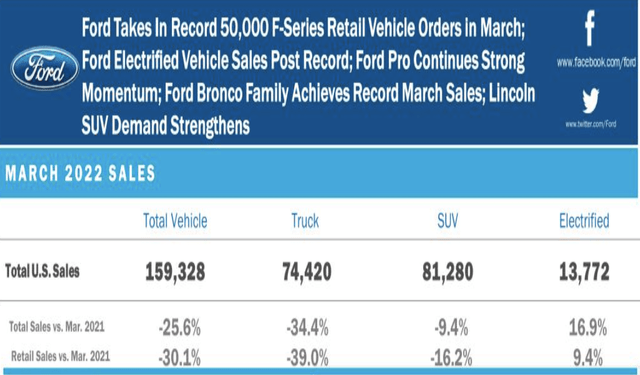

Ford’s March sales in the U.S. capitulated by 25.6%. The company’s year-over-year truck sales have now decreased by 34.4%, and its car and SUV sales also decreased by 67% and 9.4%, respectively.

However, the firm managed to build on its EV momentum by clearing a 16.9% increase in its sector growth versus the previous year.

The company’s fourth-quarter earnings came in soft. It did beat its revenue estimate by $2.08 billion; however, its earnings came in weak and missed its target by 26 cents per share.

What’s Been The Root Cause Of Ford’s Struggle?

Stocks, companies, industries, sectors, nations, and the world is all cyclical. Automotive companies do well whenever we’re in an expansionary environment with low-interest rates, but they underperform whenever contractionary policies are in the offing. The federal reserve has already raised interest rates by 25 basis points, and European nations are also in contractionary environments.

I don’t think I need to explain why the above equates to a consumer slowdown, especially when it comes to more expensive goods such as vehicles (obviously barring Veblen goods). However, there’s another issue here, and that’s the factor of push inflation. You see, it’s one thing to raise interest rates in a hot economy in which prices have surged as a result of spending power only, but another when push inflation is involved.

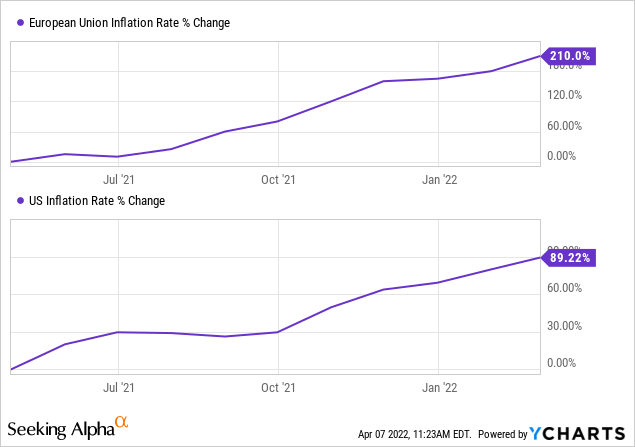

The chart below shows Ford’s largest markets’ inflation rate growth during the past year. Push inflation has resulted from pandemic lockdowns, which caused supply chain bottlenecks, thus creating a short supply of goods, which caused prices to rise significantly.

As if the initial supply chain matters weren’t enough. The geopolitical tensions between Russia and western nations have exacerbated push inflation as it’s applied pressure to non-core inflation, thus raising input costs for Ford and eroding the spending power of its customers.

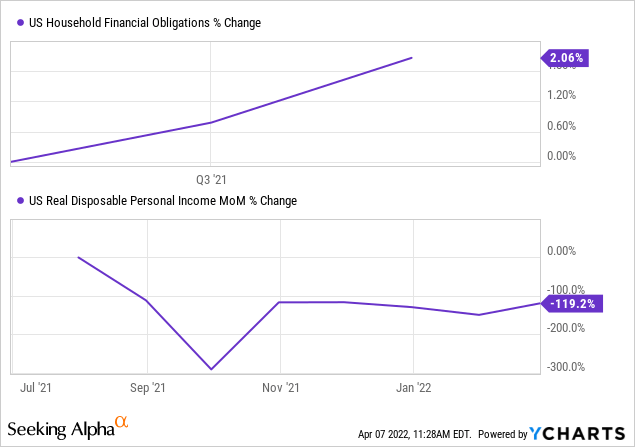

The final spending matter I’d like to outline is the rise in household obligations. The declining U.S. disposable income and rising household obligations erode discretionary spending power among the U.S. population. I couldn’t find up-to-date data on Ford’s other target markets but based on the macroeconomic factors mentioned earlier; you’ll likely witness the same picture.

In a nutshell, Ford’s consumer base is headed for a cyclical downturn, and this is only natural. The economy has its peaks, troughs, and bottoms, and unfortunately, automotive companies generally don’t do very well unless the economy is expanding or peaking.

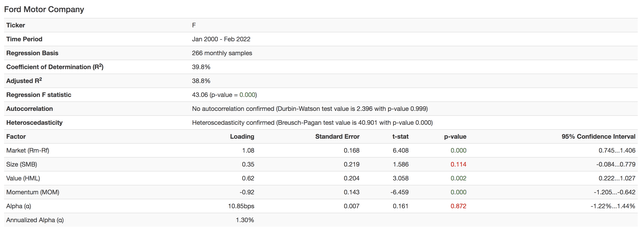

Stock Pricing Metrics

I ran Carhart’s 4-factor model in Portfolio Visualizer to see whether I could find out more about the market circumstances that drive Ford’s returns. I know the image is a bit blurry, but just enlarge it by clicking on it, and you’d be able to see it more clearly.

The 4-factor model explains a stock’s excess returns over the broad-based stock market by observing its performances in stages of market momentum (Versus Previous 12-months), Value (High minus Low Book Value), Size (Small minus Large M.Cap), and CAPM (A linear regression measuring the stock’s sensitivity to the market premium and the risk-free rate).

The stock tends to perform better when small-cap stocks do well, which is understandable considering its Beta of 1.11x, and it performs well when the market is undervalued. There are also gains attributable to the CAPM, which requires a low-risk premium.

With all factors combined, I can’t see Ford doing well, and here’s why. Small-cap stocks are struggling this year with inflation (referring to the model, not saying Ford is a small-cap), the S&P 500 is trading at a 4.54x premium, and the risk-free rate of the market is increasing as the 10-year yield is gaining momentum. Thus, leading me to the conclusion that Ford’s stock will underperform in the near term.

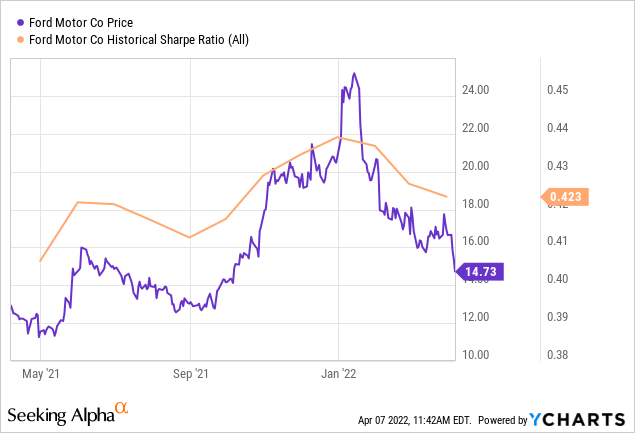

The final matter to consider here is that Ford’s Sharpe ratio has decreased dramatically during the turn of the year. Although a lagging indicator, the Sharpe ratio still adds substance to risk-reward judgment, and you usually want to see a Sharpe Ratio of above 1.00 as an investor.

A Few Positives Remain

The one aspect that could trump our bearish analysis is the company’s growing EV segment. We recently analyzed Tesla (NASDAQ:TSLA) and explained how the EV industry could be separated from automotive cyclicality in the near term.

Ford has separated its business into two segments. The first is Ford Blue, which will focus on the existing ICE products, and the latter is Ford Model E, which is focused on EVs exclusively. Furthermore, Ford owns approximately 12% of Rivian (NASDAQ:RIVN), which is an EV company with promising prospects in the passenger pick-up truck space.

Although EV could provide a systemic boost to the stock, its segment sales still only account for 8.64% of Ford’s revenue mix, leaving much to be done before it could yield significant economic influence.

The Bottom Line

Almost every asset on this planet is cyclical. Ford has amassed a great run during an expansionary economic climate, but it seems as though that has ended. The stock is overpriced and provides a poor risk-return profile amid a slowdown in sales and deteriorating consumer spending. We love the company; however, the stock is in poor shape at the moment.

Be the first to comment