redtea

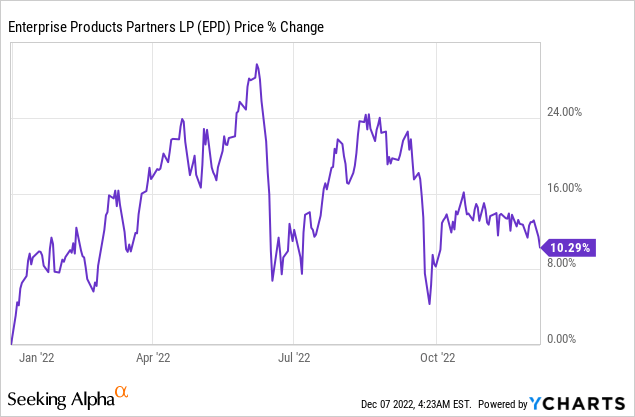

Petroleum prices have fallen into a down-trend lately and WTI is currently trading at just $74 a barrel, reflecting a decline of approximately 43% since WTI soared past $130 a barrel in March 2022, at the very beginning of the outbreak of the Russia-Ukraine war. With price risks rising for producers in recent months, midstream firms like Enterprise Products Partners (NYSE:EPD) have unchanged cash flow prospects and increasingly attractive risk profiles: midstream companies like Enterprise Products Partners rely heavily on fee-based contracts for their cash flows which protects them from a potentially devastating down-leg in petroleum prices. Since EPD’s units also dipped recently in price, I believe the risk profile is very favorable and the units are in a buy the dip situation!

The case for Enterprise Products Partners

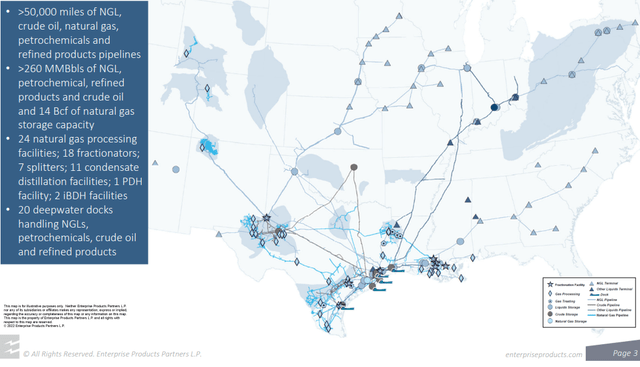

Enterprise Products Partners is a leading midstream firm whose pipeline network stretches across more than 50 thousand miles. The firm transports raw materials — crude oil, natural gas, NGL, petrochemicals and refined products pipelines — for its upstream customers and charges a fee for doing so. Additionally, Enterprise Products Partners’ footprint includes storage capacity, processing facilities and deep water docks that allow for the export of energy products at the gulf coast.

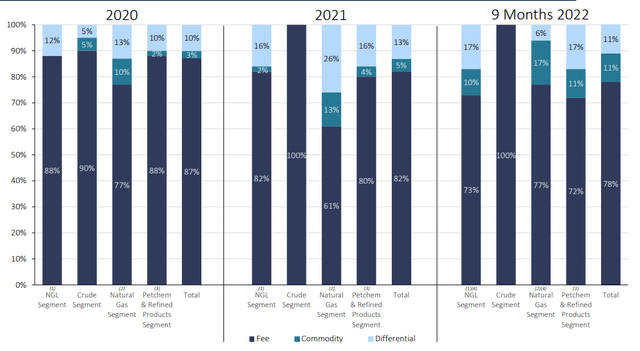

Enterprise Products Partners is one of largest midstream companies in the US and generates — and this is key — the majority of its operating margins from fee-based contracts that are not dependent on the unpredictability and volatility of energy market prices: 78% of EPD’s gross operating margin was derived from fees in the first nine months of FY 2022. The representation of fee-based delivery contracts is most pronounced in the crude oil business where 100% of contracts are based on pre-determined fees.

Strong free cash flow

Enterprise Products Partners generates strong and predictable free cash flow from its pipeline network and other energy infrastructure assets. In the last twelve months (TTM column on the very right in the chart below), Enterprise Products Partners generated $2.6B in free cash flow, $576M of which was contributed by the third-quarter.

|

$m |

FY 2017 |

FY 2018 |

FY 2019 |

FY 2020 |

FY 2021 |

TTM FY 2022 |

|

Adjusted EBITDA (non-GAAP) |

$5,615.30 |

$7,222.90 |

$8,117.30 |

$8,057.00 |

$8,381.00 |

$9,045.00 |

|

Net cash flows provided by operating activities (GAAP) |

$4,666.30 |

$6,126.30 |

$6,520.50 |

$5,891.50 |

$8,513.00 |

$7,440.00 |

|

Cash used in investing activities |

($3,286.10) |

($4,281.60) |

($4,575.50) |

($3,120.70) |

($2,135.00) |

($4,723.00) |

|

Correction for noncontrolling interests |

($48.80) |

$156.50 |

$526.60 |

($100.40) |

($82.00) |

($101.00) |

|

Free Cash Flow (non-GAAP) |

$1,331.40 |

$2,001.20 |

$2,471.60 |

$2,670.40 |

$6,296.00 |

$2,616.00 |

(Source: Author)

Free cash flow is what ultimately backs the firm’s distribution… which Enterprise Products Partners has grown for 24 years to an annualized rate of $1.90 per-unit. Management also returns the majority of its free cash flow to shareholders which is what will continue to aid EPD’s distribution growth moving forward.

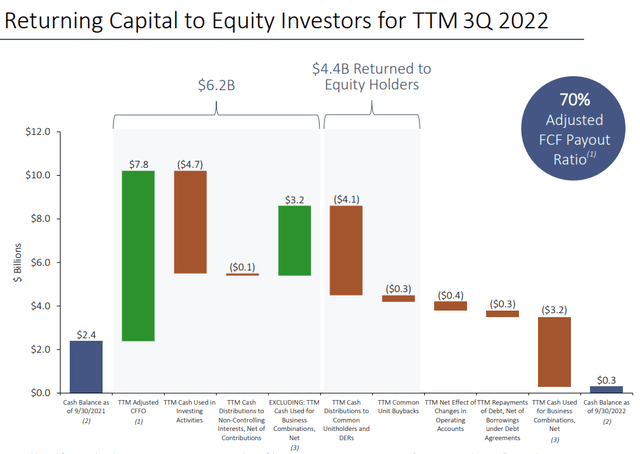

In the last twelve months, Enterprise Products Partners paid its unitholders a total of $4.1B in cash distributions which calculates to a 66% free cash flow payout ratio. Including unit buybacks of $300M, Enterprise Products’ FCF payout ratio rises to approximately 70%.

Valuation: Enterprise Products Partners vs. other midstream companies

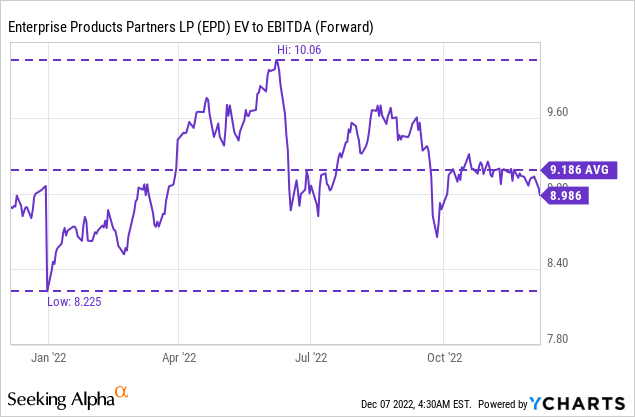

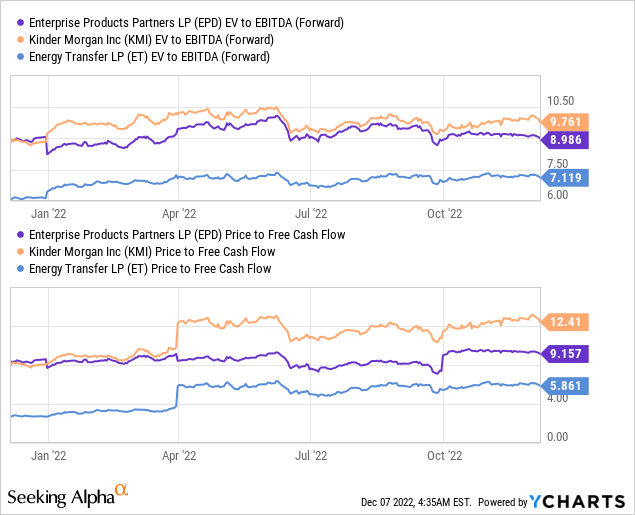

Enterprise Products Partners is valued at an EV/EBITDA (forward) ratio of 9.0 X which is just below the firm’s 1-year average ratio of 9.2 X.

Kinder Morgan (KMI) has an EV/EBITDA ratio of 9.8 X while Energy Transfer (ET) trades at an EBITDA valuation multiplier factor of 7.1 X. I believe the EV/EBITDA ratios for both EPD and KMI are attractive, although they are higher than for Energy Transfer given that both companies offer strong yields and a long history of growth. Based off of free cash flow, EPD is trading at a P/FCF ratio of 9.2 X which I consider also to be attractive.

Risks with EPD

With cash flows protected by fee-based energy delivery contracts and market risk not a big issue for midstream firms, risks for Enterprise Products Partners largely come from the government and regulatory side. The US government is currently not in favor of supporting the growth of fossil fuel companies which is limiting the sector’s full long term potential. A hostile regulatory environment has the potential to stifle Enterprise Products Partners’ free cash flow and distribution growth which could result in investors applying larger valuation discounts to the company’s units in the future.

Final thoughts

I like Enterprise Products Partners, especially in an environment that is characterized by falling petroleum prices. Falling WTI prices put pressure on the free cash flow and the margins of upstream companies which could result in more capital leaving the upstream sector and finding a new home in the midstream segment. Since Enterprise Products Partners also has solid free cash flow and relies on fee-based contracts to make money, I believe EPD can flourish even in a market that sees significantly lower WTI prices. Because Enterprise Products Partners also has a long running history of growing its distribution, I believe that EPD is in an attractive buy the dip situation!

Be the first to comment