Andreas Rentz/Getty Images News

I don’t want any sympathy from you as my Bayer (OTCPK:BAYZF) (OTCPK:BAYRY) position gained about 40% in value since I purchased the stock in October 2020, but, in general, Bayer shareholders should not be envied. The last few years have been basically one string of negative news, and the stock continued to decline from an all-time high of €144 to only €40 in October 2020 – hitting a 9-year low (and coming close to the lows of the Great Financial Crisis).

But over the last few months, it seems like the picture is improving again. Not only did Bayer report solid fiscal 2021 results a few weeks ago, but the stock is also moving higher. In this article, we take another look at Bayer, and we start with the company’s chart.

Technical Picture

The technical picture of Bayer is clearly improving, but Bayer is still not in an upward trend, and we can’t rule out even lower lows in the coming quarters. However, the stock already has managed to take a few important steps. It moved above the 200-week simple moving average, and it also broke a major declining trendline that was in place since 2017 and a major resistance level for the stock, in the last few years.

Like I said, it seems like Bayer is finally moving higher, and €40 in October could have been the bottom. But we should not be too optimistic yet, as Bayer is not technically in an upward trend before the stock moves above the last high of €73.50 (set in June 2020) and, ideally, also above the pre-pandemic high of €78 set in February 2020.

And even if Bayer should manage to return to an uptrend, there are several resistance levels before Bayer could reach its all-time high of €144 again and finally move higher. Around €83, we have a declining trendline that could be a resistance level (as the trendline is declining, the stock will hit that trendline probably at a lower level in a few months from now). And around €85, we have a strong resistance level, which is set by previous lows of 2016 as well as the down gap set in 2018.

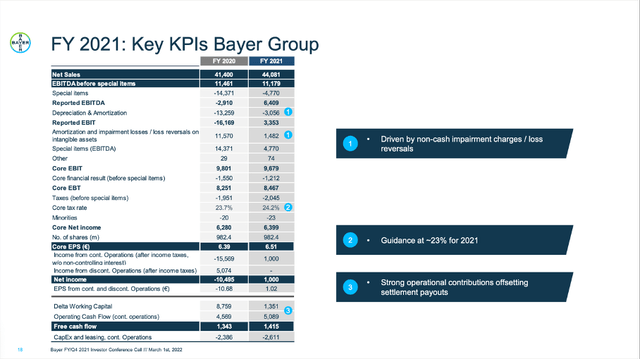

Annual Results

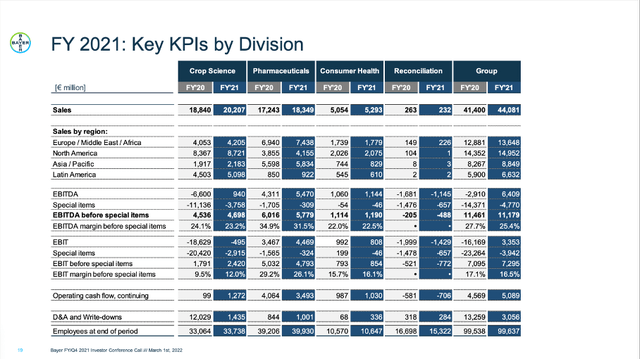

But not only the chart is improving but Bayer also reported solid fiscal 2021 results at the beginning of March 2022. Sales increased from €41,400 million to €44,081 million – this resulted in a solid 6.5% year-over-year growth (FX and price adjusted sales increased even 8.9% YoY). Earnings per share (from continuing and discontinued operations) were €1.02 in fiscal 2021. We cannot really compare the results to fiscal 2020, when Bayer reported a loss per share of €10.68. Instead, we can look at the core earnings per share (from continued operations), which increased from €6.39 in fiscal 2020 to €6.51 in fiscal 2021 – resulting in 1.9% year-over-year growth.

When looking at the different regions, it was especially Latin America that contributed to growth (12.4% year-over-year reported growth and 17.1% FX and price adjusted growth) while the biggest part of revenue still stemmed from North America (€14,952 million). When looking at the different segments, all three regions contributed to sales growth. While “Consumer Health” increased revenue 4.7% year-over-year, “Pharmaceuticals” could grow 6.4% YoY, and “Crop Science” increased revenue 7.3% YoY.

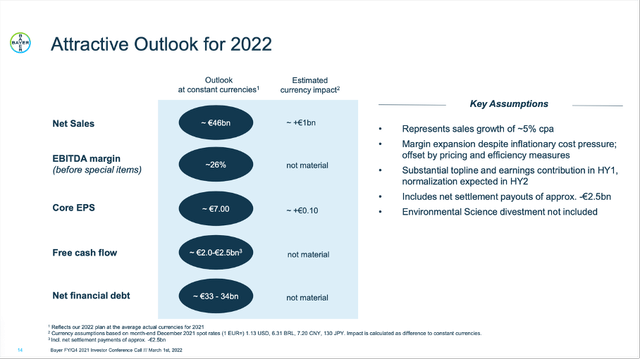

When looking at the guidance for fiscal 2022, Bayer is expecting sales to increase about 4% to €46 billion (with Crop Sciences growing 7% year-over-year). The core EPS is expected to grow about 7.5% year-over-year to €7.00 in fiscal 2022. Free cash flow is expected to increase to a range between €2.0 billion and €2.5 billion. And the guidance for fiscal 2022 is including net settlement payments of approximately €2.5 billion. Without settlement payments, Bayer would be able to generate about €4.0 billion to €4.5 billion in free cash flow.

Patents and Pipeline: Problem?

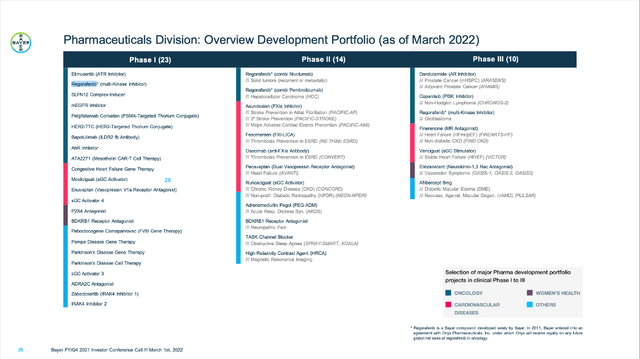

When looking at Bayer’s sales, the pharmaceutical business is contributing almost 42% of total sales, and when looking at the pharmaceutical sales, we have three blockbuster products, that are each contributing more than €1 billion in sales. Xarelto reported €4,735 million in sales (4.9% YoY growth), Eylea reported €2,918 million in sales (18.2% YoY growth) and Mirena/Kyleena/Jaydess reported €1,170 million in sales (8.2% YoY growth). But we also must keep in mind that patents for the active ingredients of Xarelto will expire in 2024 or 2025 in most countries, and patents for the active ingredients of Eylea will expire in 2025 in most countries. When patents expire, sales don’t have to fall off a cliff right away. However, when competitors are able to create a biosimilar for example, which is much cheaper, sales usually decline after patent expiration.

Pharmaceutical companies constantly must try to replace patent-protected products with new and better pharmaceuticals. And it is reassuring that Bayer recently announced a €2 billion investment to bolster drug production. It will invest about €1 billion in its core manufacturing plants and the Supply Center in Berlin, Germany as well as in the Supply Center in Bergkamen, Germany (each will become a “Center of Excellence”). Additionally, Bayer will invest in its manufacturing site in Berkeley, U.S.

Bayer also had a successful launch of Nubeqa, and the roll-out will continue in 2022. In fiscal 2021, this new prostate cancer drug generated already €219 million in sales, and Bayer increased peak sales expectations from more than €1 billion before to more than €3 billion now. Aside from Nubeqa, Bayer also launched Kerendia last year, and although management presented no sales numbers, it seems satisfied with the roll-out. In the past, peak sales were estimated to be around €1 billion. And finally, Bayer also launched Verquvo, which is also projected to reach peak sales of around €1 billion (according to management). Analysts are a little more cautious and expect only about €300 million in sales.

And aside from the already-launched products that might contribute between €3 billion and €5 billion annually in the years to come, Bayer also has its pharmaceutical pipeline with promising products that are currently in phase III. Elinzanetant is one of the products in the pipeline for which Bayer is also expecting sales of at least €1 billion. During the last Capital Market Day, Bayer underlined once again that it is seeing blockbuster potential for several of its products.

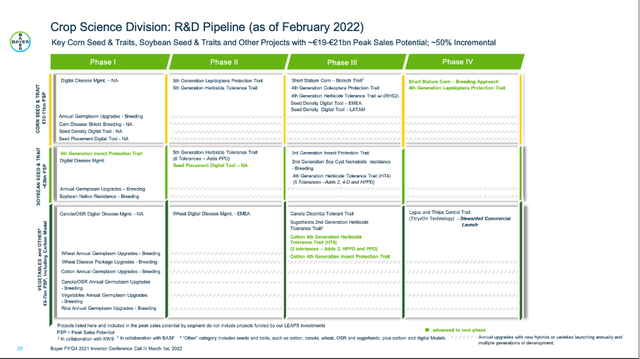

When looking at the “Crop Science” segment, which is contributing almost 46% of total sales, we can be reassured about continued and solid growth in the years to come. Not only could the “Crop Science” segment report strong growth rates despite the constant coverage of “Round Up” and the danger of glyphosate, Bayer could increase its herbicide sales by 12.4% YoY to €5,328 million. And the segment’s pipeline is also strong. When looking at the pipeline and combining key corn seed & traits, soybean seed & traits and “other projects,” the peak sales potential is somewhere between €19 billion and €21 billion.

At this point, I am confident that Bayer can continue to grow at a solid pace in the years to come in all three segments. And Bayer will also be able to manage the patent loss of Xarelto and Eylea.

Balance Sheet

But I am still a bit worried about Bayer’s balance sheet, which is still not great. On December 31, 2021, Bayer had €4,391 million in short-term financial liabilities as well as €36,481 million in long-term liabilities. When comparing the total debt to the total equity of €33,168 million, we get a debt-equity ratio of 1.23. Additionally, we can compare the total debt to the operating income Bayer can generate in a single year. When using the operating income of fiscal 2021 (€6,909 million), it would take almost 6 years to repay the outstanding debt, which is a rather long timeframe and reason for concern.

We also must point out that Bayer has €4,564 million in cash and cash equivalents on its balance sheet, which could be used to repay the outstanding debt. But even when subtracting this amount from the total debt, it would still take about 5.25 times the annual operating income to repay the outstanding debt. And in combination with €40,106 million in goodwill on the balance sheet, solvency is an issue to which we should still pay close attention. I am not worried that Bayer might go bankrupt, but management should not make huge mistakes in the next few years.

Monsanto Settlement

One of the reasons for the stretched balance sheet is the Monsanto settlement, which is another problem for Bayer. Although it seems like Bayer is not constantly making negative headlines with its Roundup litigations anymore, it is still an issue and remains an unresolved problem – at least in part. In Bayer’s Annual Report we can find the following statement:

In 2020, Monsanto reached an agreement in principle with plaintiffs, without admission of liability, to settle most of the current RoundupTM litigation and to put in place a mechanism to resolve potential future claims. As of February 1, 2022, Monsanto had reached settlements and/or was close to settling in a substantial number of claims. As we now have greater visibility regarding the number and quality of claims made, we consider that, of the approximately 138,000 claims in total which have been brought, approximately 107,000 have been settled or are not eligible for various reasons.

Overall, I remain optimistic that Bayer will resolve the remaining issues and can finally move forward in the years to come.

Dividend

Bayer also declared a dividend of €2.00 once again. Last year, Bayer had to cut the dividend from €2.80 to €2.00 – a move that was reasonable considering the huge liabilities due to the Monsanto acquisition. It was the first time Bayer had to cut the dividend since 2003. Similar to many other German companies, Bayer did not increase the dividend every single year, but it kept the dividend at least stable each year since 2003.

The dividend will be paid at the beginning of May after the shareholder meeting. When using current share prices, we get a dividend yield of around 3%. And, while this is a solid dividend yield, investors could probably see increasing dividends again in the years to come. As management seems to be more optimistic about its future and is investing in its pipeline, Bayer might also increase the dividend again. The company is targeting a payout range between 30% and 40% of the core EPS and, considering the guidance of €7.00 for fiscal 2022, the dividend should be at least €2.10 to get a payout ratio of 30%.

Intrinsic Value Calculation

When looking at the reported earnings per share (€1.02), we get a P/E ratio of 65, which seems extremely high and would make Bayer extremely overvalued at this point. And, usually, I am not a big fan of adjusted numbers, but in the case of Bayer, we should rather use the core EPS to calculate a price-earnings ratio to get a realistic picture of the business. When using the core EPS of €6.51, we get a P/E ratio of 10 right now, making Bayer still rather cheap.

If you are familiar with my articles, you know that P/E ratios or P/FCF ratios are just supporting valuation metrics, and I almost never would base an investment decision just on these simple valuation metrics. Additionally, I use a discount cash flow calculation to determine an intrinsic value for the stock. In my last article about Bayer, I stated that the intrinsic value should be somewhere between €70 and €80, and although I will calculate with more or less similar assumptions, we have to update (and increase) the intrinsic value of Bayer.

Management is expecting between €2 billion and €2.5 billion in FCF in fiscal 2022, and we will use the midpoint of that guidance. For fiscal 2024, management is expecting free cash flow being at least €5 billion. We have no guidance for fiscal 2023, but I would expect at least €4 billion, as Bayer would already generate between €4 billion and €4.5 billion this year without the settlements and litigations. For 2025 and the following years, I assume 5% growth, which seems like a realistic and achievable assumption for Bayer.

When calculating with these assumptions (and a 10% discount rate as well as 982 million outstanding shares), we get an intrinsic value of €89.61 right now, and the stock is still undervalued.

Conclusion

In my opinion, it is not too late to buy Bayer. To provide a different point of view: Bayer is still trading more than 50% below its previous all-time high and it is still trading below its intrinsic value. We should not ignore the risks still surrounding Bayer – Monsanto and the stretched balance sheet for example – but the improving growth potential in the years to come is still making me bullish about Bayer.

Be the first to comment