vitranc

Introduction

Let’s get the well-known facts out of the way. Inflation is uncomfortably high on a YoY basis. The Fed, slow to raise rates on the assumption that inflation was transitory, is catching up. The Fed Funds rate is expected to be at 4% by the end of the year, from close to zero at the beginning. There are only certain items whose demand can be controlled by higher rates. People are not going to eat less food, for instance, just because rates are higher. The two primary rate-sensitive items are housing and autos, since they are usually bought on credit. So the Fed mainly relies on demand for housing and autos going down, and this is having a spillover effect on other goods and services.

Louisiana-Pacific (NYSE:LPX) sells products that are exposed to the housing market, and thus is not of much interest to investors looking at thematic plays. However, the company is nicely profitable, has excess cash, is buying back a fifth of its stock annually, and has done a good job of capitalizing on market conditions on the way up. Even if earnings halve from their current level, (and I expect they will), the stock is still cheap.

Company background

LPX is headquartered in Nashville, Tennessee, not Louisiana, and far from the Pacific. It manufactures building products for use in new home/outdoor structure construction, repair and remodeling. It operates in the US, Canada and South America in the following segments:

Siding: Manufactures wood siding, trim and fascia. 32% of revenue, 16% of EBITDA for the latest quarter.

OSB: Manufactures OSB (oriented strand board – think of it as plywood) panels. 60% of revenue, 82% of EBITDA.

South America: Manufactures OSB panels and siding products in Chile and Brazil for sale in South America. 6% of revenue, 5% of EBITDA.

Other: A framing operation and some timberlands. 2% of revenue, -3% of EBITDA.

As you can see, most of the company’s profits come from the OSB segment (I don’t believe EBITDA is a good proxy for profits and would have preferred to look at operating income by segment, but this is the information the company provides. Depreciation is less than 10% of EBITDA, so it is a good approximation). The company has benefited from the booming housing market in the last two years. Wood fiber is the company’s primary input in its products. Lumber prices (as a proxy) have seen record highs in the last year, though they have recently receded to a low level. The company has faced cost increases for wood fiber and resins. However, the company and others in the industry have successfully raised the prices of their products as well. The company classifies 45% of OSB sales as commodity products, with the rest having some specialized characteristics like water or fire resistance.

According to third-party research, the company is the second-largest OSB manufacturer in North America behind West Fraser (WFG), with Weyerhaeuser (WY) and Georgia-Pacific behind it.

Financial overview and outlook

For the quarter ending June 30, 2022, the company reported $1.13 billion in revenue and $0.5 billion in operating income. Revenue was 3% lower than the prior year’s level and operating income was down 27%. The company has no net debt, and after taxes reported $348 million of net income. This was $4.30 for each of the 81 million diluted shares. Of note, the share count was down 20% YoY as the company has been using its free cash flow to buy back stock at a low valuation. The numbers were clean, without any of the pro forma add-backs that so many companies today specialize in. Free cash flow was in line with net income as receivables went down, with capex running higher than depreciation. The company used its free cash flow to pay a small dividend and repurchase shares.

For 2022, the consensus estimate is for the company to earn $12.81 per share as market conditions normalize in the second half. For 2023, expectations are that revenue will fall 23% and EPS will halve. There is considerable uncertainty in these numbers as much will depend on how housing will perform over the next year. It is certain that there will be a continuing slowdown in response to higher interest rates. I would regard the consensus estimates to be reasonable, with some margin of safety.

The company has a market cap of $4 billion and $0.2 billion of net cash for an enterprise value of $3.8 billion. I believe this conservative capital structure is sensible, lowers risk, and will allow the company to weather an extended downturn if it faces one. The company recently sold its engineered wood products business for $210 million.

Where will the housing market go?

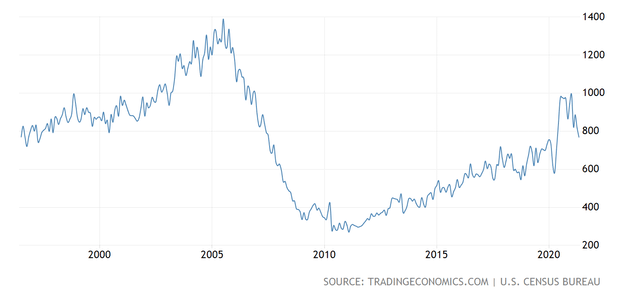

The most important driver of the company’s revenue is the strength of the housing market. The hot housing market is cooling rapidly, with higher prices and mortgage rates constraining demand. After the housing boom in the 2000s and the subsequent bust, new home sales are back to the level of the 1990s. I believe this pace is sustainable with a larger and growing population. The chart below shows seasonally adjusted annualized single-family new home sales in ‘000s.

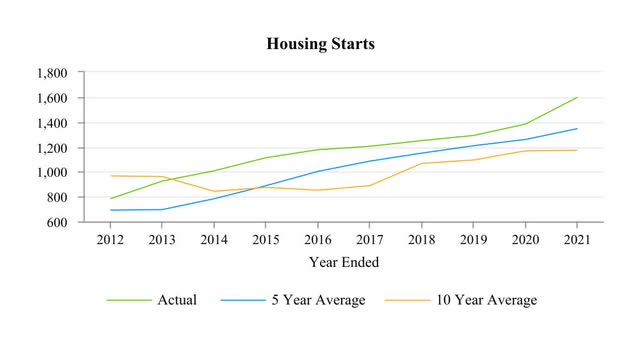

While the longer-term chart looks reassuring, data for a shorter time frame is more concerning. Here is a chart of housing starts (single and multi-family):

It seems like a 10% drop in housing starts over the next year would be reasonable. I do not regard a 6% mortgage rate as a housing killer. Long-term rates are not likely to go up much more in response to well-telegraphed short-term rate increases. The spread between mortgage rates and the 10-year Treasury yield has recently gone up as risk assets have sold off, and there is room for this to decrease.

If you can look beyond next year, after inflation is controlled and the economy weakens, the Fed is likely to lower rates, giving a boost to the housing market. The US also has a growing population, aided by immigration, leading to a base demand for new housing. And weather events like hurricanes cause extensive localized damage that needs to be restored.

Valuation: Fair value of $72 for the stock

I will assume that the company can do $3.2 billion of revenue next year (down 23% YoY), in line with consensus, and margins halving from the current quarter’s 40%. The company would then have $640 million of operating income and $480 million of net income at a 25% tax rate. Some more stock being repurchased by the end of this year will result in 80 million diluted shares for next year. That would result in $6 of EPS for next year, so I consider the $6.03 consensus estimate to be reasonable. I will apply a conservative below market 12x multiple on this to arrive at a $72 target price. Thus, the stock offers 45% upside from the current $49 price, with a 1.8% dividend yield while you wait. Also, the company’s net cash position, cash generation and reasonable valuation put it in a good position to buy back stock and limit downside during periods of market turmoil.

In a bull case, the Fed will engineer a soft landing, inflation will recede, long-term rates will stabilize at the current level, and the housing market will remain strong. In this scenario, I can see the company earning $8 per share next year and a $96 stock price for 95% upside.

In a bear case, the company’s revenue and operating income will come in lower than expected and the company will miss estimates, generating only $3 of EPS. A 12x multiple would result in a $36 stock price for 27% downside.

At a $4 billion enterprise value, the company can be the target of another firm or private equity looking to spend the money they’ve raised.

There are no good comps for the company. West Fraser trades at 8x next year’s EPS, but it includes a large lumber operation. Weyerhaeuser is at 18x next year’s EPS. It owns a lot of timberland. Georgia-Pacific is a private company.

External ratings

Seeking Alpha’s quant ratings on the company are mixed, with an overall rating of 2.9, equating to a hold. It garners a B- for valuation and A+ for profitability, but an F for growth. I believe this is unnecessarily harsh, ignoring the recent high growth over the prior year.

Not surprisingly, the sell side is more positive on the company, with a rating of 3.66, close to a buy. The average price target is $69.

Risks are moderate

The biggest risk here is that the company’s earnings will come in lower than expected due to macroeconomic (housing), competitive, or execution factors. The company’s products are largely commodity like.

As an industrial manufacturer, the company is exposed to the risk of a catastrophic accident at one of its plants.

With operations in the US and Canada, the company is exposed to geopolitical risks, including the imposition of new tariffs that may impede the free flow of its primary input (wood fiber).

Shareholders depend on a company’s management being good stewards of their capital. There is a risk that the company will make an overpriced acquisition that is material or otherwise not be good agents of the owners.

Conclusion

An investment in LPX offers an opportunity for reasonable upside with a margin of safety. The company’s cash position and continued share buybacks offer downside protection.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment