designer491

By Rob Isbitts

Summary

SPDR® Bloomberg 1-10 Year TIPS ETF (NYSEARCA:TIPX) aims to provide access to the Treasury Inflation Protected Securities market. While the idea of investing in a TIPS fund seems like an easy decision in an inflationary environment like we currently have, the devil is in the details. And oh, are there details! We rate TIPX a Hold. We don’t mean like a Wall Street brokerage firm “hold rating” which really means “sell.” If you own this fund, holding it in the current, wacky bond market environment is a reasonable decision. However, we think it’s best if many investors were not in a TIPS fund, to begin with. They may not be worth the complexity involved with holding them in an ETF package.

Strategy

TIPS, as they are commonly known, are bonds issued by the U.S. Treasury. Their distinguishing feature is that their principal value is “indexed” to inflation. That means when economic inflation as measured by the U.S. Consumer Price Index (‘CPI’) is rising, the principal value of TIPS adjusts upward. The opposite occurs during periods of deflation.

The bonds’ coupon interest rate is fixed, and typically below that of similar non-TIPS bonds. But when inflation rises, the interest paid is calculated by multiplying that base rate times the adjusted principal of the bond. Bottom line: what a TIPS bondholder receives every 6 months in interest will fluctuate with inflation. And they will get their principal back if they hold to maturity.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds/Cash

-

Sub-Segment: TIPS

-

Correlation (vs. S&P 500): Very Low

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

As of this writing, TIPX held 34 different TIPS bonds. Their coupon rates ranged from 1/8 of 1% (the minimum permitted, and the prevailing rate for several years due to the absence of inflation) to just under 4%. Given that extended period of low inflation prior to this year’s burst higher in prices, TIPX has an average coupon of just 0.80%. The 12-month yield is over 7%, but that has consistently been exceeded this year by the decline in principal value. That’s not very happy math for TIPX holders.

Strengths

These are still U.S. Treasury securities, so the risk of default is low. Or, let’s hope it is. Because if Treasuries become bad credit, the world has bigger problems than how to calculate the yield on a TIPS bond!

Weaknesses

And, while 2022 has been a case where TIPS did not rise to the occasion, there’s a decent excuse for that. The Fed’s massive case of overstaying their welcome by buying up big chunks of U.S. Treasury securities included TIPS. In fact, the Fed at one point owned a pretty large part of this market. In 2022, the Fed went from QE to QT. That is, they stopped buying more and more bonds, and started to sell bonds. There’s a good reason to believe that some of the downward pressure on TIPS this year was that huge dollop of Fed selling. The absence of this supply-demand disruption could “clear the market” and make TIPS more viable at some point. But I classify this whole situation as a weakness, because there’s nothing to stop the Fed from intervening in this market again, to add liquidity but crush investors holding TIPS. Again, if you’re going to “follow the Fed,” it’s better to do so with securities that don’t have the bells and whistles that TIPS do. That’s what 2022 proved to me.

Opportunities

TIPS’ payments fluctuate, sometimes wildly. This is not a strength on its own merit. In the current, toxic environment for bonds, and with inflation potentially running up much further for a while, that yield might spike to a very high level. But even if it does, there’s no certainty that the principal fluctuation won’t continue to cut into it.

However, there’s at least a possibility that things will come together for TIPS later in the current inflation cycle. TIPS might offer a unique style of positive return that is not correlated to traditional stocks and bonds. But this is not a prediction. It is closer to a “wait and see” with a modest possibility of occurring.

Threats

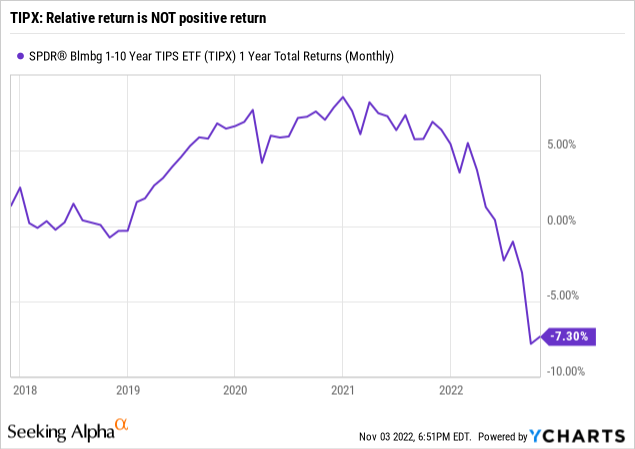

Look no further than this chart showing the performance of TIPX so far in 2022. The ETF’s trailing 12-month dividend yield has spiked, as you would expect with the dramatic lift in inflation we’ve seen. But the purple line makes all of that nice yield pickup less exciting. The price of TIPX (excluding dividend payments from the ETF) is down similar to their non-TIPS Treasuries peers. Net result: TIPS have outperformed other types of bonds. But they have not protected investors from inflation in a total return sense. And I suspect a positive total return is the number one thing investors are aiming for when they buy an ETF like this one.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

Despite my severe reservations about TIPS as an asset class in ETF form, this is one of those where I don’t mind keeping TIPX at the very far end of the watchlist. What does that mean? I won’t ignore it completely, and if my technical signaling prompts a wake-up call to focus some additional attention on TIPX and/or other TIPS ETFs, I may reconsider. Never say never, in this case.

ETF Investment Opinion

I’ve been managing money professionally since the early 1990s, just before TIPS made their debut in the bond market in 1997. And I will readily admit that while I understand them, I’m no expert. But I will say this: there is a level of complexity with these instruments that make them a risk for many investors. The risk is partly the opportunity cost of owning TIPS versus other types of investments. But it is also the risk of being thoroughly disappointed when they don’t perform when you think they should. The headline here is “Inflation-Protected Securities,” which is what TIPS does over the life of the bond. But owning them in a packaged ETF with the goal of holding it for a long time? There is too much “noise” and quirkiness attached here to make me a fan.

Be the first to comment