Lisa Lake

Monster Beverage is enjoying strong growth and there is room for further growth in the long run. However, health concerns over energy drinks and regulatory scrutiny could stymie growth prospects.

Strong growth momentum

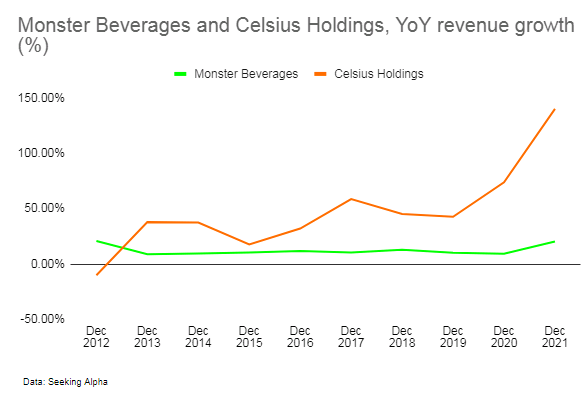

Energy drinks giant Monster Beverage (NASDAQ:MNST) continues to grow. Net sales rose 20.5% YoY to USD 5.54 billion for the fiscal year ended December 2021 (its fastest growth rate since 2013) driven by a 21.5% YoY growth in case sales which reached 613.4 million.

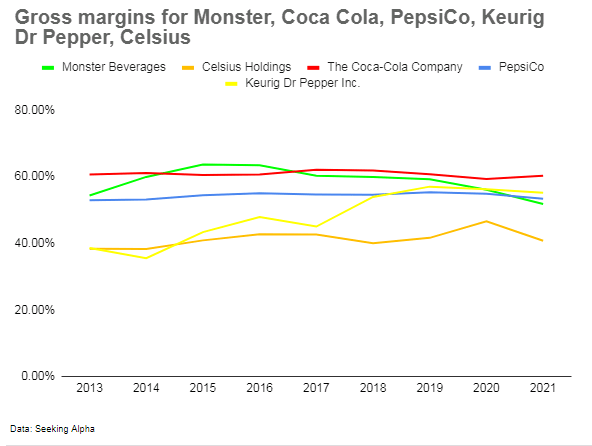

Gross profits climbed 14% YoY to USD 3.1 billion however gross margins dropped to 56% from 59% in 2020 as a result of inflationary pressures.

Author

Cloudy near term prospects

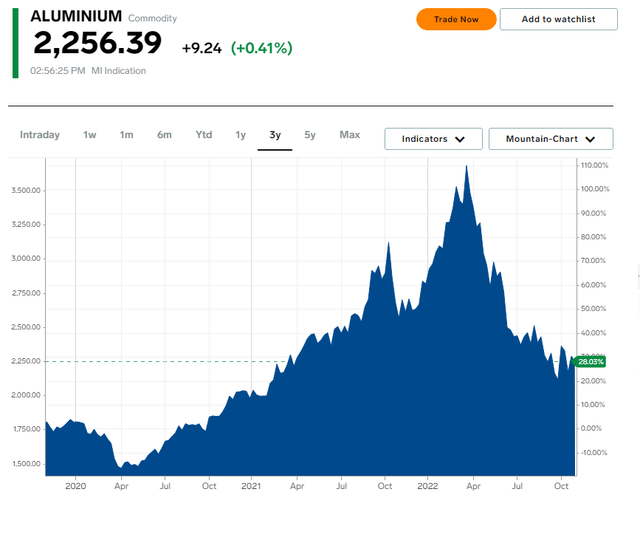

Monster’s growth momentum continued in 2022 with the company seeing consistent revenue growth over the past three quarters so far. Net sales rose 15.2% YoY to USD 1.62 billion in Q3 2022 helped by volume growth (case sales rose to 182 million in Q3 2022 from 159 million the same quarter a year earlier) and although gross margins continued to drop as a result of continued cost pressures for key inputs such as ingredients, aluminum cans, and logistical costs, they improved sequentially as a result of pricing actions in the U.S. (implemented nationwide in September 2022), and in certain international markets, as well as cost control efforts (promotional expenses were cut); Q3 2022 gross margins dropped to 51.3% from 55.9% in Q3 2021, but improved compared to 47.1% the previous quarter.

|

Revenues (USD billions) |

Gross profit (USD millions) |

Revenue growth YoY % |

Gross margin % |

Operating margin % |

Net margin % |

|

|

1.52 |

776 |

22.1% |

51.1% |

26.3% |

19.4% |

|

|

1.66 |

779 |

13.2% |

47.1% |

22.5% |

16.5% |

|

|

1.62 |

833 |

15.2% |

51.3% |

25.7% |

19.8% |

Near term prospects are cloudy; although price hikes have so far had limited impact on demand for Monster’s beverages, it remains to be seen whether consumer spending power can hold up given near term recession expectations.

High inflation and supply chain bottlenecks continue to challenge the industry, although proactive responses by the company should help support margins in the near term barring any major change in inflation trends; pricing actions were implemented in the middle of Q3 2022, and the result of those actions should fully flow through in the coming quarters. Further pricing actions are planned for 2023 in selected international markets which should help offset cost pressures. Monster also continues to deplete its costly imported aluminum can inventory in the U.S. and EMEA, with management highlighting that cans used for a major promotion during the quarter were sourced locally. There are also signs of moderating inflation for some inputs such as aluminum for instance with aluminum commodity prices trending downwards. Freight costs are also moderating according to Monster’s management.

Longer term, Monster is positioned to benefit from several growth drivers.

Favorable growth prospects in its biggest market

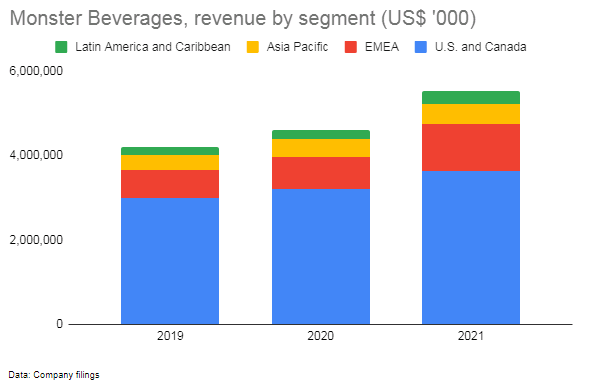

North America is Monster’s biggest market, accounting for around 66% of the company’s total net sales. This region has seen revenues grow along with rising energy drink consumption as consumers, particularly American millennials and Generation Z consumers increasingly swap sugar-loaded sodas for vitamin-infused energy drinks.

Author

Yet, there is still room for growth with energy drinks accounting for a fraction of beverage consumption in the U.S. at just 1.3% versus 18.4% for carbonated soft drinks. According to research firm Research and Markets, the U.S. energy drink market is expected to grow at a CAGR of 6.87% between 2020 and 2026, by which time the market is expected to be valued at USD 21 billion, up from USD 14.3 billion in 2020. Monster, America’s second biggest energy drinks player is poised to benefit.

International expansion

Monster’s drinks are sold around the world and international sales currently account for around 34% of revenues. That share however has been growing as the company ramps up international operations (international sales’ share of total net sales rose to 34% in 2021 from 28.7% in 2019). There is room for further growth; global energy drink sales are estimated to reach USD 53.1 billion by 2022, and are forecast to grow to USD 86.1 billion by 2027, representing a CAGR of 7.1%.

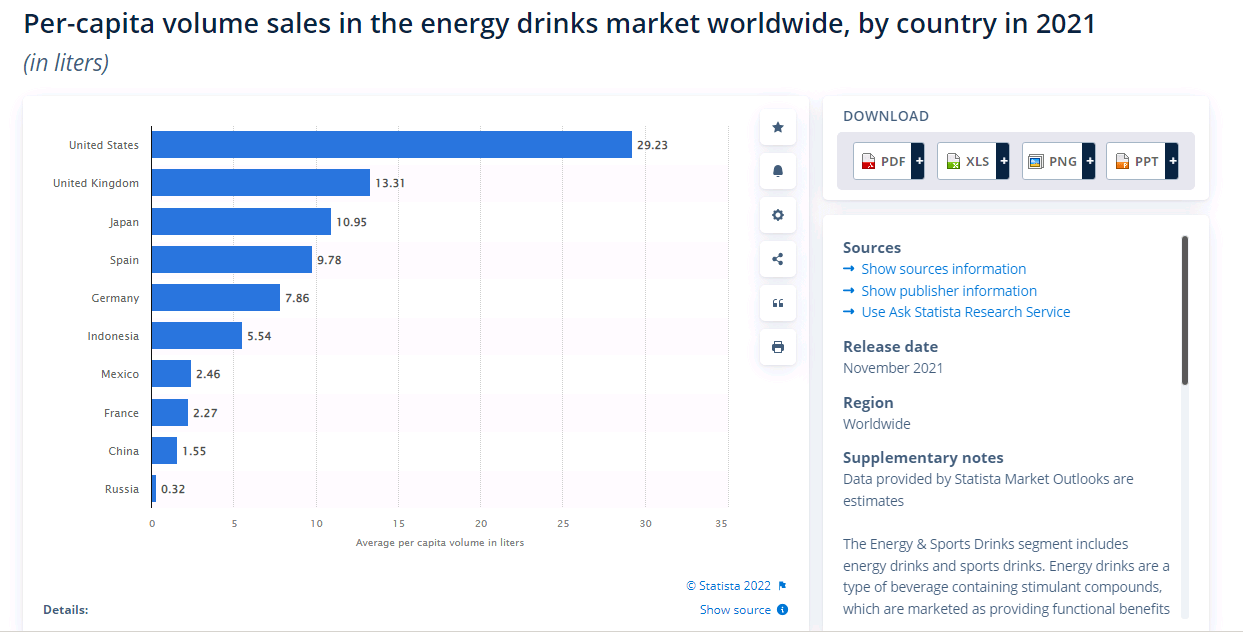

The United States, the world’s biggest energy drinks market also has the highest per capita consumption with an average consumption of 29 liters per person, more than double that of second-placed United Kingdom, and nearly triple that of Japan. Over in China (a key market whose prospects Monster management is particularly optimistic about), per capita energy drinks consumption is just a fraction of the U.S.. This reflects significant growth potential outside the U.S.

Statista

Bang Energy bankruptcy a potential boost for Monster’s Reign

Bang Energy’s parent VPX, saddled with millions of dollars in dues, recently filed for bankruptcy. Bang Energy, which was seen as a potential rival to Monster’s Reign, has a market share in the high single digits, and Reign (which has a market share of around a third that of Bang) could be well positioned to capitalize on Bang’s demise; like Bang, Reign has a caffeine content of 300mg per 16-ounce can (higher than Monster’s 160mg and Red Bull’s 151mg), and both Bang and Reign are positioned as relatively “healthy energy drinks”, with both claiming to have zero sugar and both relying on artificial sweeteners instead.

Although VPX has managed to secure USD 100 million in funding, it remains to be seen whether the company can rescue itself (Bang’s liabilities include USD 293 million due to Monster and USD 150 million owing to former distributor Pepsi), and even if they manage to stay afloat, their brand is likely to have lost considerable brand equity and consumer trust after being defeated in a false advertising lawsuit served by Monster (who proved Bang’s “Super Creatine” does not contain real creatine or provide the benefits of creatine; meanwhile this independent lab test by energy drink influencer reizeclub revealed startling discrepancies between Bang’s ingredients advertised on the can and the product’s actual contents). Bang also no longer has the advantage of PepsiCo’s distribution, after the two clashed and ended their agreement in June 2022. Bang’s total distribution points increased 50% under PepsiCo’s (PEP) distribution and although the fallout could see brands such as PepsiCo’s new “healthy” energy drinks partner Celsius (CELH) fill the vacuum in shelf space left by Bang’s exit, Celsius is arguably not an ideal alternative for Bang customers; Celsius tends to command a higher price point than both Reign and Bang, and Celsius’ brand positioning arguably caters to a more health conscious, and perhaps feminine demographic compared to Bang and Reign which suggests an opportunity for Reign to capture some market share.

Risks

Competition is heating up in the energy drinks space with new entrants as well as established beverage giants ramping up their presence. New entrants include Rowdy Energy Drink (co-founded by American race car driver Kyle Busch), ZOA (created by Hollywood star Dwyane ‘The Rock’ Johnson), and Baya (owned by coffee giant Starbucks (SBUX)) launched in 2020, 2021, and 2022 respectively. Meanwhile, a few months ago, beverage giant PepsiCo, which has been doubling down on energy drinks, invested half a billion dollars into “healthy” energy drink brand Celsius (in return for an 8.5% stake), after shelling out USD 3.9 billion on energy drinks maker Rockstar Energy. Although competitors may nibble at Monster’s market share, the company’s distribution agreement with Coca-Cola (KO) does give Monster an edge and could help ease some competitive pressure. Meanwhile smaller rivals such as Celsius are gaining significant traction, and Celsius’s tie-up with PepsiCo could turn them into formidable rivals.

Author

Growing health concerns and regulatory scrutiny are long term risks that could potentially stymie the industry. Health experts say the energy drinks industry should be regulated and even “zero sugar” energy drinks are viewed with skepticism by doctors as such products are usually sweetened with artificial sweeteners which have uncertain long term effects. Wales is proposing banning energy drink sales to children, following in the UK which put forward a similar proposal (but has yet to pass a law). Monster’s target market is largely comprised of teenagers and young adults and thus such regulations could potentially hit Monster relatively hard compared to rivals such as market leader Red Bull for instance, whose generally higher-priced products are likely to cater to a wealthier (and therefore arguably more mature) demographic.

Summary

Monster Beverage continues to see robust growth. Near term prospects are cloudy as inflation and supply chain challenges continue cutting into margins although margin pressure is being offset by price increases and cost cutting efforts. In any case, these challenges are transitory and should recede over time. Some see inflation moderating next year.

Longer term the company is poised to benefit from the industry’s growth in North America, its biggest market, as well as internationally where Monster has a growing presence. Meanwhile, rival Bang Energy’s bankruptcy can help Monster’s Reign brand capture some market share.

Competition however is on the rise, and energy drinks, which are generally loaded with artificial sweeteners, flavorings, colorings, caffeine, and other additives, pose uncertain long term health risks, and the industry is increasingly attracting regulatory attention.

Heightening competition amid an inflationary environment suggests continued near term challenges, and although the industry is anticipated to see strong long term growth, growing health concerns and regulatory scrutiny are long term risks which could stymie growth prospects. With a P/E of 39.6 Monster company is quite pricey.

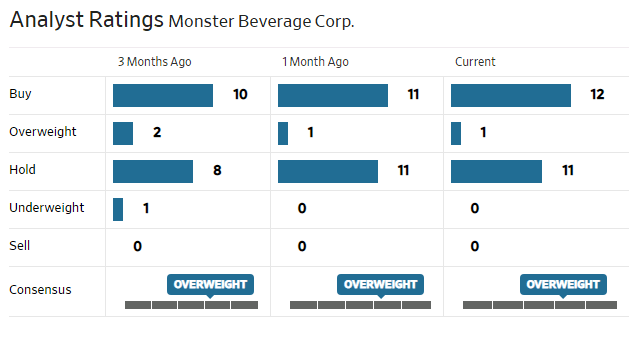

Analysts are split between buy and hold.

WSJ

Be the first to comment