Love Employee

Shares of antibody drug conjugate (ADC) developer BioAtla (NASDAQ:BCAB) have risen by 85% since I sold my position for a 78% loss on March 28th. Over the past three years, shares have lost nearly 3/4 of their value as well.

Back in March, I exited this name as mentally I was having a hard time with the constant weakness in the stock as well as with the less than forthcoming management team that was doing a poor job of keeping the lines of communication open with both shareholders and Wall Street. As I recall, management credibility also received a black mark for the vague manner in which they disclosed a patient death and overall safety profile of lead 2 ADC candidates.

From there, I felt my decision was confirmed with mediocre data for AXL-targeting ADC Mecbotamab Vedotin disclosed in the Q1 report (mild PFS advantage in a couple cohorts along with scattered responses, signal was hard to interpret given low number of patients recruited).

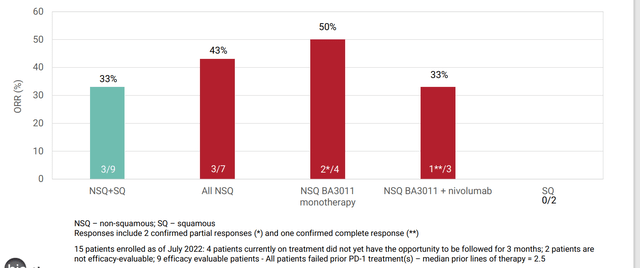

On the other hand, shares more than doubled from lows after Q2 report disclosed clinical responses in advanced AXL-positive non-small cell lung cancer (NSCLC) patients (previously experienced failure on PD-1/L1, EGFR, or ALK inhibitor therapy, average 2.5 lines of therapy). The fact that we saw monotherapy activity (2 partial responses) as well as a PD-1 combo complete response was promising, but on the other hand skepticism merits pointing out 33% ORR equated to 3 of 9 patients responding (hard to tease out a single with such a low number to go on).

While my ego did not relish the thought of revisiting a prior loser for me, I’m trying to do a better job of evaluating such names in an objective manner as if it were for the first time.

Let’s dig deeper and see how the story has evolved.

Chart

FinViz

Figure 1: BCAB weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shareholders went for an abysmal ride with price falling from above $30 to a low in the $2 range as Wall Street gave up and left the company for dead during a long period marked by lack of communication followed by disappointing clinical data in sarcoma. From there, with Q2 report and news of signal observed for the NSCLC indication, share price quickly rebounded to the low teens and is currently consolidating below $9. My initial take is that for readers who are very risk-tolerant and don’t mind holding speculative names in their portfolios, near term dips are worth accumulating in anticipation of updated NSCLC data expected by year end.

Overview

Here is my background on the company as well as prior highlights from initial article:

- California-based ADC developer extols the benefits of the company’s conditionally active biologic or CAB technology, making the grandiose claim that BioAtla has solved the problem of systemic toxicity inherent in ADC (antibody drug conjugate) predecessors. Such a claim would prove quite lucrative, should they be able to back it up (allows them to unlock new targets). They go further to state that not only is safety enhanced, but also efficacy is improved (CABs enable treatment at higher doses and greater potency). While the technology appears quite complicated at first glance, the premise is simple (CABs are engineered to bind to their target in tumors, deactivate if they leave the tumor site and reactivate once more in the presence of tumor). Tumor cells have localized pH, CABs activate in low pH microenvironment and deactivate in healthy tissue (such an approach would seem to have merit when contrasted to blockbuster ADC drugs like SeaGen’s Padcev and Gilead’s Trodelvy, both of which are quite potent yet suffer from some pretty harsh side effects in at least some patients). I note that the latter was acquired when Gilead bought out Immunomedics for $21 billion last year, a token of the kind of value creation potential that can take place in the ADC space and one reason I’m keen to own multiple names in this arena.

Corporate Slides

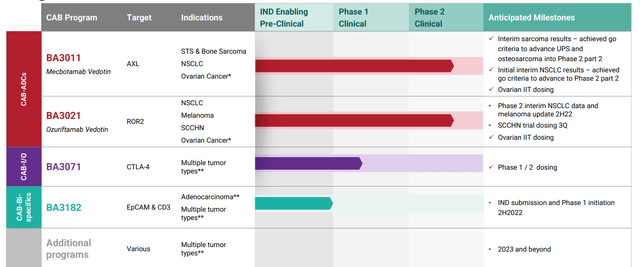

Figure 2: Pipeline (Source: corporate presentation)

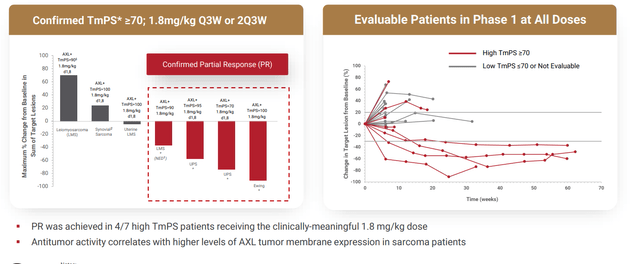

- Initial focus was on the AXL program, where the company’s mouse data showed that its first drug candidate had 4-6 times greater selectivity for tumors in vivo and over 10 times the therapeutic index. This is one reason that explains how they were able to experience success in targeting AXL, which prior has been a graveyard for cancer drug development. BA3011 is pursuing the AXL target as it’s highly expressed on many solid tumors including sarcomas and NSCLC. Uniquely, the company is leading the way forward with a quantitative biomarker assay called the AXL Tumor membrane Percent Score or TmPS (measures level of target expression on tumor membrane to identify patients most likely to respond). Phase 1 dose escalation study has been completed, recommended phase 2 dose identified and phase 2 study is ongoing in soft tissue and bone sarcoma. Also, another phase 2 study is ongoing in PD-1 refractory NSCLC (a particularly lucrative indication). The initial study has too few patients to really get a clear signal of any kind, but responses in a few sarcoma patients with higher AXL scores looked promising.

Corporate Slides

Figure 3: Encouraging early data for sarcoma (Source: corporate presentation)

- Additionally, zeroing in on the more lucrative indication of NSCLC, four patients were enrolled in the phase 1 study. However, of these 4, two were AXL negative with TmPS of 0% (and thus would not expect them to respond). One was not evaluable. However, the one patient who was AXL positive (TmPS of 80%) achieved partial response with 70% tumor shrinkage (1.8 mg/kg study drug on days 1 and 8, every 3 weeks). Interestingly, the patient had stage IV disease and experienced failure from prior treatments including PD-1 inhibitor pembrolizumab. To further pursue this hypothesis and follow where the data is leading, the open label phase 2 study was designed to evaluate BA3011 alone and in combination with anti-PD-1 agent in patients with AXL-expressing TmPS 50%. To enroll, patients must have prior disease progression on a PD-1/L-1 inhibitor. Part 1 of the study will enroll 20 patients, while part 2 could enroll up to 200 additional patients depending on observed efficacy at interim analysis in part 1. Of note, while since my initial article the early signal in sarcoma appears to have fizzled out to a degree, the market was clearly surprised by promising early responses in PD1-refractory NSCLC.

Corporate Slides

Figure 4: Promising early signal for BA3011 in NSCLC (Source: corporate presentation)

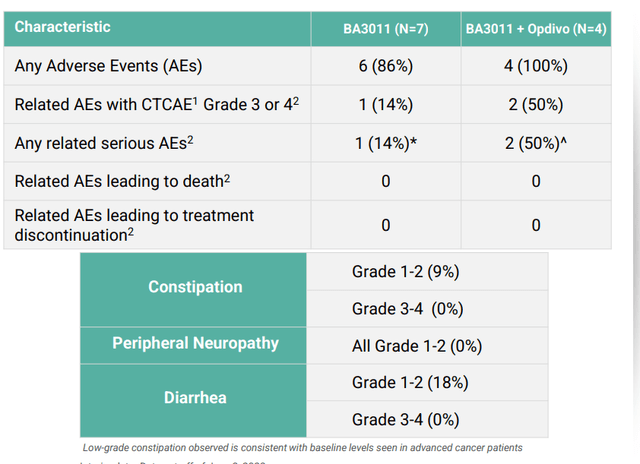

- In the past, AXL programs from competition including pharmaceutical companies have floundered and failed due to challenging safety profile, so it was encouraging that so far BA3011 appeared generally well-tolerated with adverse events not appearing related to on-target injury of normal, AXL-expressing tissues. Toxicities observed were consistent with other MMAE-based ADCs and estimated half life was 4 days, twice that of enapotamab vedotin (non-CAB ADC targeting AXL). Management believes this difference is due to decreased TMDD resulting from lack of binding of BA3011 to AXL outside of tumors (in other words, CAB technology doing what it’s supposed to). At recommended phase 2 exposure level (1.8 mg/kg Q2W), treatment related Grade 3-4 AEs occurred in 22% (2/9) of patients, vomiting and neutrophil count decrease. One key risk factor here to keep an eye on is how safety profile evolves as higher numbers of patients are treated. AEs seen at other doses include neutropenia, hypokalemia, hyponatremia, anemia, blood bilirubin and lipase increases. Importantly, none of related AEs or SAEs led to treatment discontinuation. Of note, constipation is believed to be an on-target delivery of MMAE to normal gut tissues that express AXL- despite risk mitigation plan, Genmab’s enapotamab vedotin showed Grade 1-2 events of 49% (9% Grade 3-4). For BA3011, rate of constipation was 2 to 3 fold lower for both Grade 1-2 and Grade 3-4 TAEs. Peripheral neuropathy reported for BA3011 of 18% was half of that reported for enapotamab vedotin (believed to be due to advantageous PK characteristics of CAB ADCs vs non-CAB).

Corporate Slides

Figure 5: Safety profile for BA3011 in NSCLC looks quite manageable as monotherapy but challenging for Opdivo combo (Source: corporate presentation)

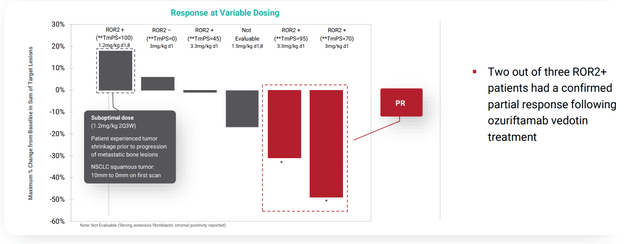

- Moving onto perhaps a more interesting opportunity than AXL, BA3021 is going after ROR2 (target associated with tumor progression, metastasis and development of resistance to conventional therapies and immuno-oncology targets). ROR2 is commonly overexpressed in multiple solid tumor types including breast, lung, pancreatic, renal, colorectal, head and neck and melanoma. As an example, ROR2 was found to be expressed in the majority of breast cancer patient samples and those expressing ROR2 had decreased overall survival. Similar correlation between ROR2 expression level and overall survival was observed in NSCLC and metastatic melanoma. In a similar fashion to clinical plans for AXL, TmPS quantitative assay is being employed to identify patients most likely to respond to therapy. Phase 2 studies are ongoing in PD-1 refractory melanoma and NSCLC with interim analysis expected 2H 2021 with full data set in 2022. In regards to POC data and derisking, treatment with BA3021 at various dose levels results in 4 partial responses, 2 NSCLC patients (~31% and ~49% tumor reduction), 1 in a patient with metastatic melanoma (~80% tumor reduction) and 1 in a patient with advanced head and neck cancer (~54% tumor reduction). Digging deeper into the NSCLC subset, of 6 patients enrolled, two achieved durable partial response and third experienced lesser degree of tumor reduction. Keep in mind that they were not able to characterize ROR2 TmPS for the third patient and the fourth patient (bone mets, ROR2 TmPS of 100%) was treated with suboptimal dose (1.2 mg/kg 2Q3W). All NSCLC patients who enrolled in this study were previously treated with PD-1 therapy.

corporate slides

Figure 6: Encouraging activity for BA3021 in refractory NSCLC patients (Source: corporate presentation)

- While they were not able to characterize ROR2 surface expression in two metastatic melanoma patients, one achieved an 80% reduction in tumor volume and remains on therapy for over a year. Keep in mind this patient failed on both nivolumab and nivo plus ipilimumab. BA3021 was generally well tolerated, with Grade 3 or greater AEs consistent with MMAE-based toxicities and were generally reversible or transient. AEs included neutropenia, anemia, transient liver enzyme elevation and metabolic disturbances. Few patients had serious adverse events (infected biloma, pyrexia, and hyperglycemia). However, I did consider it a red flag of sorts that the Grade 5 event (patient death) did not appear in corporate slides and was merely included in 10-K filing. That seems less than forthcoming in an area of key concern for investors and patients.

Let’s move onto the Q2 report and why it sparked positive sentiment returning to this under-the-radar small cap name.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $202M (which puts current enterprise value at ~$150M). On the con side, BioAtla is burning through cash at a rapid rate with net loss for the quarter totaling nearly $29M and net cash used in operating activities in the first six months of 2022 totaling $42M. I would expect this number to rise significantly, given that the second portion of planned trials in AXL and ROR2 calls for a much higher number of patients to be enrolled.

Research and development expenses rose to $20.7M, while G&A was cut in half to $8.3M.

As for key developments, the press release wastes no time in focusing on newly disclosed phase 2 data for mecbotamab vedotin (BA3011) in AXL-positive NSCLC. The trial is still ongoing and enrolling patients who previously experienced failure of typical first line options such as PD-1/L1, EGFR, or ALK inhibitor therapy (average failure 2.5 lines of therapy; 2 prior lines for non-squamous, 4 prior lines for squamous). While 15 patients were enrolled, only 9 were evaluable for efficacy (very hard for me to see how management can claim much of a signal with so few patients’ worth of data to go on). Of the 9, ORR was 33% with two monotherapy partial responses and one PD-1 combo complete response. With the caveats that come with subgroup analysis, for the non-squamous group ORR improved to 43% or 3 of 7 patients. While it is encouraging that the company is initiating discussions with the FDA for the registrational part 2 of trial, I still think they need to derisk the story further. If I were management, I would enroll another 40 patients of this population in the open label P2 portion to further tease out the signal and gain greater clarity. It might not be a popular decision, as it requires more resources, but it’s far less risky than going straight into a 100+ patient pivotal study. Full interim data set of approximately 20 patients is expected by year end and at the current valuation clearly meets the definition of a needle-moving catalyst. As for context for market opportunity and unmet need, there are around 200,000 patients diagnosed in the US each year of which 75% are non-squamous. First line patients typically get treated with chemotherapy & immune checkpoint inhibitor combination which results in 50% ORR, while 2nd line therapy of standard of care yields a measly 10% to 20% ORR.

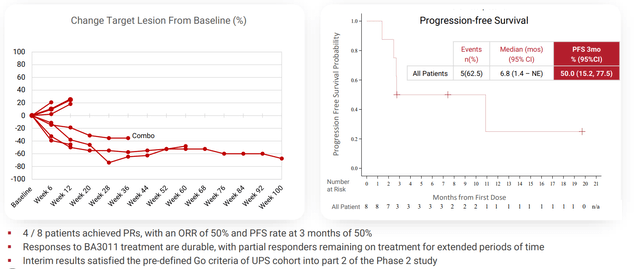

Management also states that for the sarcoma studies, UPS and osteosarcoma indications are advancing as separate cohorts into part 2 of phase 2 study, while next steps for liposarcoma and synovial sarcoma are under evaluation (I assume they get discontinued). The signal they are going on for two lead indications is nothing special in my opinion with 50% ORR and 50% PFS rate at 3 months for UPS. For osteosarcoma, ORR is conveniently left out and they are going on 3 month PFS rate of 57%. Honestly, from what we’ve seen so far I wish they’d discontinue sarcoma indications and focus purely on NSCLC for the AXL program.

Corporate Slides

Figure 7: Initial UPS data satisfies go/no criteria although we can’t know how low the bar has been set (Source: corporate presentation)

As for BA3021 (ROR2) phase 2 NSCLC study is ongoing with update planned for later this year. Trial enrollment status update for melanoma study is expected in Q4 (sounds like we can’t expect efficacy/activity data here until next year). For both of these indications, I don’t like how trial timelines continue to be pushed out (all of them for that matter). Management really needs to do a better job of communicating and underpromising/overdelivering as opposed to the alternative which they’ve been doing since Day 1 that I’ve been following.

As for institutional investors of note, Tang Capital owns a 6.4% stake and Cormorant Asset Management owns 5.7% stake.

As for insiders, it’s encouraging to see that Founder and CEO Jay Short has skin in the game with ownership of 7.5% of the company. Also, there was significant insider purchasing activity in June and August (likely in anticipation of the recently disclosed lung cancer data).

As for leadership team, above I pointed to key hires from the likes of Celgene and Seattle Genetics as green flags for a company this size. BioAtla’s chief of clinical development operations Philippe Martin also hails from Celgene (led the development and commercialization of the blockbuster drug OTEZLA and as Corporate Vice President oversaw the Inflammation & Immunology Franchise). The board of directors seems stacked as well, including investment advisor from HBM partners, Guy Levy (founder & managing member of Soleus Capital). The company also counts Dr. Michael Manyak (Executive Director for Global Medical Affairs for the urology franchise of GlaxoSmithKline) as one of its scientific advisors.

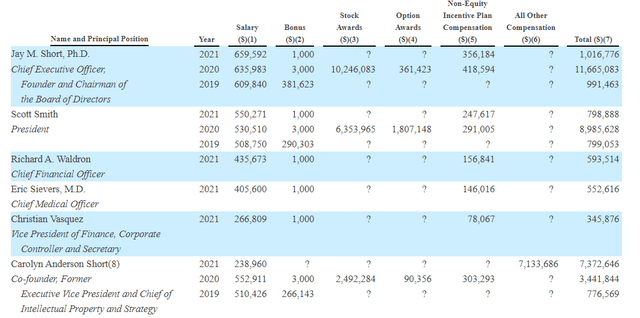

As for executive compensation, cash component seems on the excessive side at over $600,000 (for a company this size). $10M worth of stock awards for CEO and $6M for president are also a bit on the high side, though not overly excessive.

Proxy Filing

Figure 8: Executive compensation table (Source: proxy filing)

The important thing is to avoid companies where the management team is enriching itself while shareholder value isn’t being created. Looking at compensation is one of several indicators in that regard.

As for manufacturing, CAB antibodies are designed and produced via patented Comprehensive Integrated Antibody Optimization (or CIAO) technology. A key element of this tech is that all design and development of the antibody is conducted in a mammalian cell line such as Chinese hamster ovary. This host cell is essentially identical to that used for manufacturing the majority of antibodies. This integrated and efficient approach is designed to provide consistency of the folding. However, while I consider the simplified manufacturing process to be a plus, I have to acknowledge that the company does not own or operate manufacturing facilities (instead relies on third party manufacturing organizations). Also, raw materials for product candidates in some cases may be sourced from a single-sourced supplier. These are unique risk factors that should not be ignored, as opposed to companies that take charge of and integrate their manufacturing process. They also contract additional third parties for filling, labeling, packaging, storage and distribution of investigational drug products. BioAtla views this choice as a plus, allowing them to maintain a more efficient infrastructure, eliminated need to invest in own manufacturing facilities and personnel and allowing them to focus expertise on development of product candidates.

As for useful nuggets of information from members of the ROTY community, Saguaro915 acknowledges that NSCLC signal was nice but company is still burning a lot of cash and management execution (and communication) in the past has been questionable at best. He also shared his concern regarding the AXL biomarker and asks why the company dropped the cutoff for NSCLC from 50% to 1% and started stratifying by tissue type (squamous or non-squamous). Likewise, the optics behind stratifying sarcoma by subgroups do not look good (suggests the biomarker is not a good one and they are just “throwing a ton of subgroups against the wall to see what sticks”).

BigPharmaGuy on Biotwitter posted helpful skeptic commentary on this name in the past as well, including the suggestion (which I agree with) that BioAtla is way too enthusiastic and significantly overstating market opportunity for AXL ADC (cites competitor Bergenbio biomarker data showing just 2 of 35 lung cancer patients scored high on AXL TPS score).

As for prior financings, it’s hard to believe that in September of last year key institutional holders ponied up $75M at $28 per share in a private placement (3x higher than current levels).

Accumulated deficit is just $186M, which I consider to be on the light side for a company founded back in 2007.

Moving on to IP, it looks quite solid here with BA3011 composition of matter claims set to expire in 2037. BA3021 composition of matter claims likewise will not expire before 2037. BA7031 composition of matter claims from pending application would not expire before 2039. Preclinical CAB antibody programs including EpCAM and Nectin-4 are covered by pending provisional applications (composition of matter claims arising from these would not expire before 2040 to 2041).

Final Thoughts

To conclude, it’s clear there are several positive and negative aspects of the story for this aspiring ADC player. Starting with the latter, management really needs to do a better job of projecting realistic timelines that they can achieve instead of continuously postponing them (or delivering data in fewer patients than anticipated making activity signal hard to decipher). On the pro side, the signal in NSCLC for AXL program appears real and this could be a lucrative indication relative to current $150M enterprise value. Questions still remain on the actual size of this market opportunity, but we should be reminded that there are multiple shots on goal here including ROR2 in NSCLC and melanoma as well.

For readers who are interested in the story and have done their due diligence, BCAB is a Speculative Buy and I suggest accumulating dips in the near term ahead of NSCLC year end data update for both AXL and ROR2 programs.

Again, I want to stress that this name has substantial risk involved and position size should be limited relative to an investors’ other cornerstone positions as part of a well-rounded portfolio.

Key risks include dilution in the next quarter or two (I expect a secondary offering of perhaps $75M to $100M in size, which would potentially be up to 30% dilution at current levels). Disappointing data for NSCLC readouts whether ROR2 or AXL would weigh on share price, as would any additional delays in the clinic including not having all patients evaluable for readout or postponing data presentation until next year. Competition in oncology and ADC space is quite fierce as well, with many companies pursuing lucrative niches of high unmet need in the post PD-1 setting.

From an ROTY perspective (focus on next 12 months), while I acknowledge lucrative upside potential if NSCLC signal pans out in higher number of patients, I cannot justify owning the name in our portfolio as other attractive names on my radar sport significantly better risk/reward profile (including less binary risk). Also, having been burned by this management team in the past I need to see more signs of execution from them in the clinic to get me off the fence.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. Consider clicking “Follow” next to my name to receive future updates and look forward to your thoughts in the Comments section below. Lastly, be aware that most of my articles appear first to members of the ROTY community.

Be the first to comment