ipopba

The Quarter

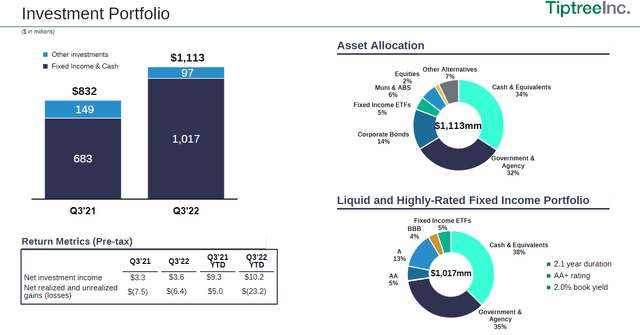

I must admit I was a bit nervous heading into the Tiptree (NASDAQ:TIPT) third quarter report. I thought a slowdown in some consumer activity might hurt the Fortegra warranty business and that higher interest rates would lead to significant mark-to-market losses in the hold to maturity bond portfolio. I had nothing to fear on the former with unearned premiums and deferred revenue growing 26% year-over-year and the latter was not terrible. Moreover, given the short 2.1-year duration and hold-to-maturity nature of the bond portfolio, losses suffered so far this year will come back and then some as gains from higher yields in the bond float. Quick math using the current (as of this writing) 4.71% yield on two-year government bonds on a $1 billion bond float means $47 million annual pre-tax earnings potential over the next two years available to 36.78 million diluted shares or $1.28/share. I repeat, this is just earnings potential from the bond portfolio.

Tiptree Investment Float (Q3 Company Presentation)

Other terrific developments were the closing of the sale of the dry bulk ships and the scheduled sale of the product ships for $49 million and a gain of 44% over book value. The realized gain from the sale of the bulk ships of $14 million largely offset this quarter’s mark-to-market losses from the bond portfolio. Gains from the product tankers will likely do the same this fourth quarter.

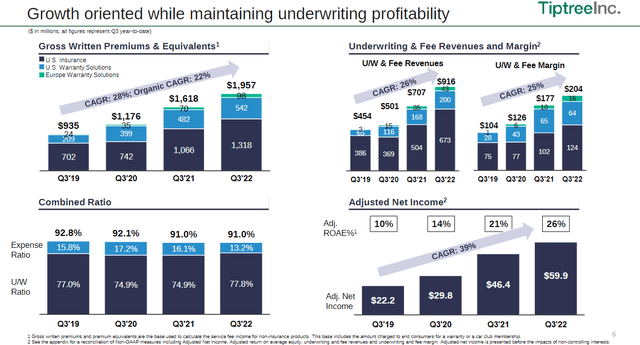

Back to Fortegra, as I mentioned the revenues were excellent while the combined ratio remained stable at 91.5% and adjusted ROAE’s remain above 20%.

Fortegra Underwriting Performance (Q3 Company Presentation)

The mortgage business is obviously slowing down dramatically but the MSR’s (mortgage servicing rights) are growing nicely and represent a tailwind for the company while mortgage volumes remain pressured.

Lastly, the Invesque (OTCPK:MHIVF) investment is a small bleed but a rounding error at this point.

Valuation

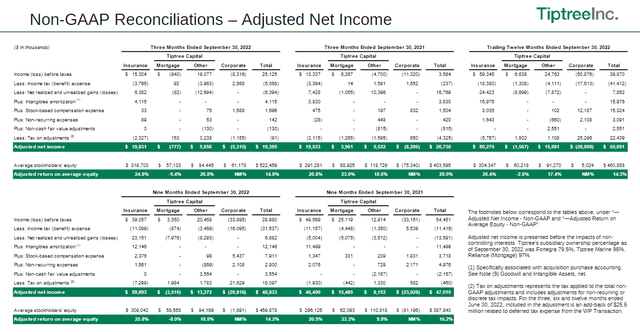

There are a ton of moving parts within TIPT given the embedded complexities of an insurance business, the investment by Warburg in Fortegra, and the sale of the ships. In previous writeups, I have used the SotP (sum of the parts) calculation the company provides showing the value exceeding $26/share. I still think that’s useful just from an asset value perspective, but this is also a company that is starting to generate meaningful earnings. I demonstrated the pre-tax earnings potential from the float above, but there is also just core underwriting profitability that the company is already generating. The company breaks it down well in the appendix of the quarterly presentation.

Tiptree non-gaap earnings reconciliation (Q3 Company Presentation)

Even normalizing the tax issue and with a pretty high corporate overhead line, the company is clearly capable of earning over $15 million per quarter. Annualizing that at $60 million and the company can conservatively do at least ~$1.66 of earnings. Say what you will about SotP or book value per share, a P/E or 7x for a business that is mostly comprised of a nicely growing insurance company is just too low.

Personnel Changes

The company announced during the quarter that Scott McKinney is taking over as CFO from Sandra Bell when she retires in March. This move is clearly well planned and well-telegraphed. Scott has been with the company for years, knows it extremely well, and I expect the transition will be seamless. Scott presents well and should be an effective face for the company at conferences.

Risks

I still think a recession could dent Fortegra’s growth but shouldn’t lead to any underwriting declines and the insurance business is much less economically sensitive than shipping, which I am so glad is gone. Moreover, higher earnings from higher interests rates in the bond portfolio adds a big tailwind to the business.

Conclusion

I consider TIPT an underfollowed and underappreciated story where the complexity that has been hiding the diamond that is Fortegra is being stripped away. Strong organic growth in Fortegra should allow for another shot at doing an IPO sometime over the next 12-18 months where the company will have options to realize that value for investors including spinning off a future independent Fortegra’s shares to TIPT shareholders. This stock will move with the market but the value creation happening here is undeniable.

Be the first to comment