harmpeti

Investment Thesis

At the time of writing, Tilray Brands (NASDAQ:TLRY) had lost -85.2% of its value since hitting its peak in June 2021 with the massive hype surrounding cannabis legalization. By now, it is apparent to most investors, that the high has been long gone, with the stock stagnant at current floor prices of $3s. However, we would warn investors from adding at these levels, since there is no clear trajectory in its profitability with the massive M&A and partnership deals the management has been embarking on.

Combined with TLRY’s notable debts and massive Share-Based Compensation/ share dilution, there are many reasons why no one is happy indeed.

TLRY’s Profitability And Cash Flow Remain A Problem, With More Dilution In Sight

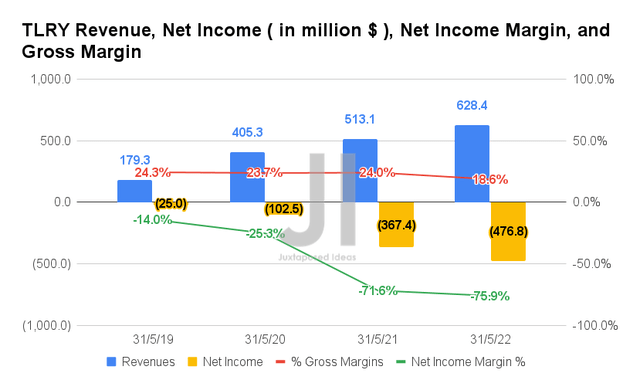

In FY2022, TLRY reported revenues of $628.4M and gross margins of 18.6%, representing an increase of 22.4% though a decrease of -5.4 percentage points YoY, respectively. In the meantime, the company continued to report unprofitability despite the hyper-covid-demand in the past three years, with a net income of -$476.8M and net income margins of -75.9% in the latest fiscal year. Otherwise, an adj. net income of -$98.55 and adj. net income margins of -15.6%, after adjusting for impairment costs and asset write-down.

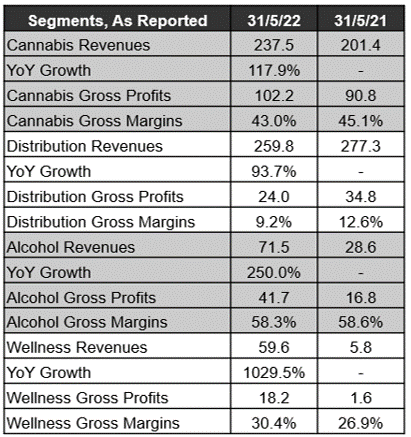

TLRY’s Revenues By Segment

S&P Capital IQ

Nonetheless, other than TLRY’s Distribution segment, its cannabis, alcohol, and wellness revenue segments have grown impressively YoY in FY2022, despite the difficult YoY comparison. The three segments reported a remarkable increase of 17.9%, 250%, and 1029.5% in revenues YoY, with decent gross margins of 43%, 58.3%, and 30.4%, respectively, despite the rising inflation and FX headwinds. Thereby, pointing to TLRY’s potential revenue driver over the next few quarters, especially with the increased adoption of medical use cannabis in the EU.

Nonetheless, it also remains uncertain how TLRY plans to achieve its $4B revenue by 2024, since the cannabis market is somewhat saturated in Canada, the US, and the EU.

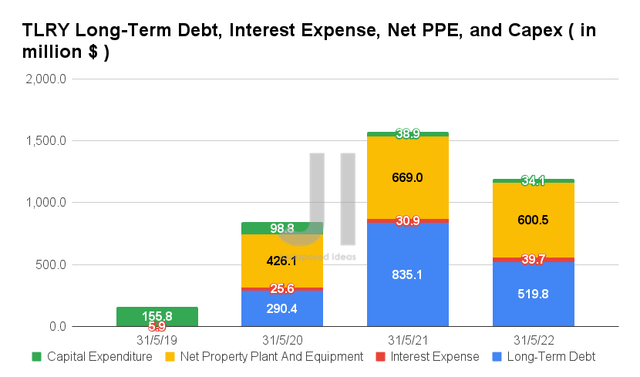

By the end of FY2022, TLRY reported long-term debts of $519.8M and interest expenses of $39.7M, comprising $187.15 of capital debt and $401.94M of Notes. Notably, $53.7M will be due by November 2022 and $91.49M due in 2023, with the 2023 notes from HEXO bearing the original conversion rate of $167.41 per share for a 0.2% dilutive effect of 1.1M shares. Otherwise, an 11.4% dilutive effect of 58.4M shares, based on current share prices and count. The 2024 notes also carry a potential share dilution of 13.4% based on 68.3M shares, based on current conditions.

Investors take note, since TLRY just took on even more debt of $39M on 02 September 2022, with up to ~999M share issuance previously approved in September 2021. The notable increase in its Stock-Based Compensation by 207.4% YoY to 35.99M does not help matters as well, given the drastic 55.9% increase in its diluted shares outstanding, from 326.1M since the close of its Aphria/ Tilray merger in May 2021 to 508.67M in FQ4’22. Thereby, further diluting its long-term investors since the company may not be reporting profitability for the next two years.

In the meantime, TLRY continues to invest in its production and manufacturing, with total net PPE assets of $600.5M and capital expenditure of $34.1M in FY2022, despite the massive non-cash impairment cost of $395M reported thus far. Thereby, indicating further headwinds in its bottom line growth ahead.

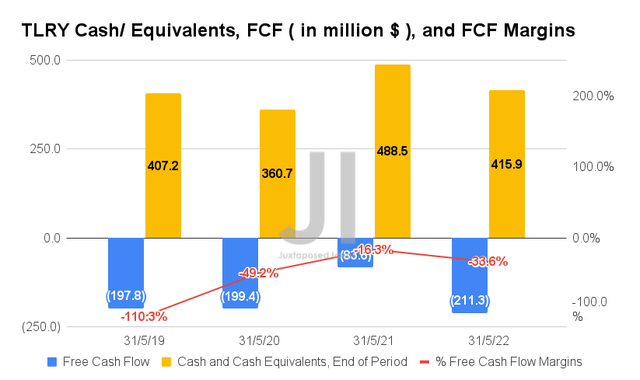

Naturally, this affects TLRY’s cash flow, with a Free Cash Flow (FCF) generation of -$211.3M and an FCF margin of -33.6% in FY2022, representing a decline of -252.7% and -17.3 percentage points YoY, respectively. Still, the company appears to have sufficient cash and equivalents of $415.9M on its balance sheet to last a few quarters before it needs to raise additional capital.

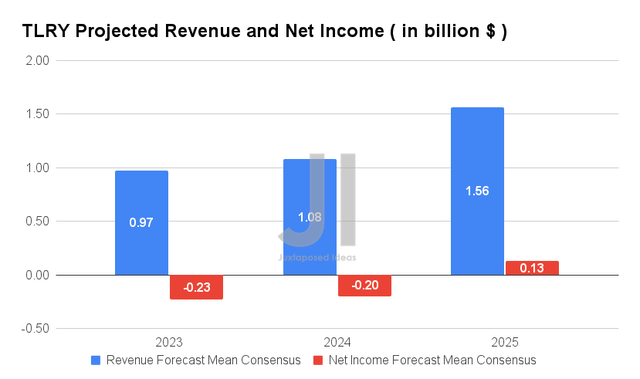

Over the next three years, TLRY is expected to report revenue growth at an impressive CAGR of 35.4%, while speculatively reporting net income profitability from FY2025 onwards. It is important to note that these numbers represent a notable upgrade of 20.5% from consensus estimates in February 2022 and 24.1% since April 2022. Thereby, pointing to Mr. Market’s optimism on TLRY’s forward execution.

For FY2023, TLRY is expected to report revenues of $0.97B and net incomes of -$0.23B, representing an excellent YoY growth of 54.3% and 207.3%, respectively. We must also highlight that these numbers represent a tremendous increase of 52.99% from previous April estimates, indicating the massive demand in the cannabis market moving forward. Furthermore, investors must not ignore the management’s relatively optimistic guidance of FCF positive and $100M in cost synergies by FY2023. We shall see.

In the meantime, we encourage you to read our previous article on TLRY, which would help you better understand its position and market opportunities.

- Trulieve Vs. Tilray: Legalization May Not Be A Game Changer After All

- Tilray Brands: The Big Money Is Still In The US

So, Is TLRY Stock A Buy, Sell, or Hold?

TLRY 5Y EV/Revenue and P/E Valuations

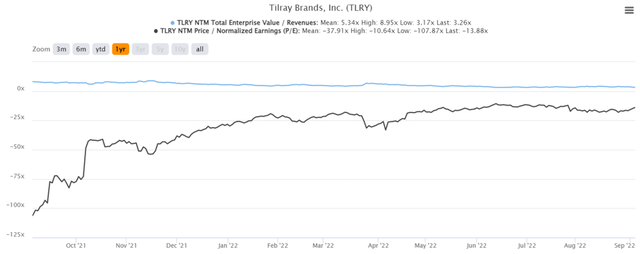

TLRY is currently trading at an EV/NTM Revenue of 3.26x and NTM P/E of -13.88x, lower than its 1Y EV/Revenue mean of 5.34x though massively improved from its 1Y P/E mean of -37.91x. The stock is also trading at $3.22, down -77.2% from its 52 weeks high of $14.16, nearing its 52 weeks low of $3.00.

TLRY 1Y Stock Price

At this time of maximum pain, consensus estimates remain bullish about TLRY’s prospects, given their price target of $6.72 and a 111.99% upside from current prices. In the short and intermediate term, it is unlikely that we will witness 2021’s highs again, given the upcoming Mid-Term US election, erratic geopolitical conditions, and pessimistic economic markets ahead. Legalization has also been placed on the back burner, with the rising inflation and the Fed’s aggressive rate hikes through 2023.

Therefore, we rate TLRY stock as a Hold for now, since the company will continue to report unprofitability and, consequently, impact its stock performance negatively.

Be the first to comment