AscentXmedia/E+ via Getty Images

Tilray (NASDAQ:TLRY) jumped slightly after releasing third quarter fiscal 2022 results. The headline showed a jump in profitability courtesy of strong progress on synergies from its acquisition of Aphria. Yet a closer look shows that gains in profitability might be more aesthetic than practical, and the company continues to drive the majority of revenues from sources other than cannabis sales. The stock trades attractively relative to Canadian peers, but not necessarily relative to American peers. I rate the stock a buy, but note the better opportunities south of the Canadian border.

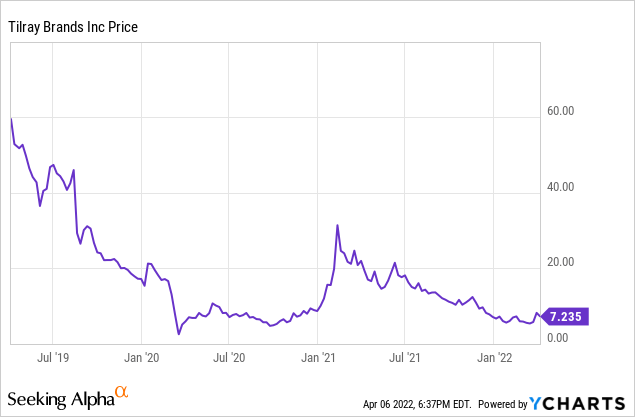

TLRY Stock Price

I last covered the stock in January, when I rated the stock a buy due to the reasonable valuation as compared to Canadian peers. TLRY traded as high as $60 per share only a few years ago and now trades at a fraction of that price.

The bad news is that the stock is unlikely to go back to all-time highs in the near term, as those prices reflected bubbly valuations. The good news is that the stock is trading at reasonable valuations here, offering the average investor a way to invest in the long term cannabis growth story at a reasonable price.

TLRY Stock Earnings

On the surface, this looked like a spectacular earnings report across the board. The company reported 23% net revenue growth to $152 million with $52.5 million of net income. The company cited having achieved $76 million of cost synergies (on a run-rate basis) and guided to reach $80 million of cost synergies by May which would be five months ahead of schedule. The company expects to achieve another $20 million of cost synergies in the next fiscal year.

Under the surface, though, the numbers were not as optimistic. I scratch my head at the calculation of year-over-year revenue growth, as my calculations show $211 million of prior year’s revenue based on $154 million of net revenue from Aphria last year and $57 million of net revenue from Tilray last year. At the very least the $152 million number was lower sequentially than the $155.2 million reported last quarter.

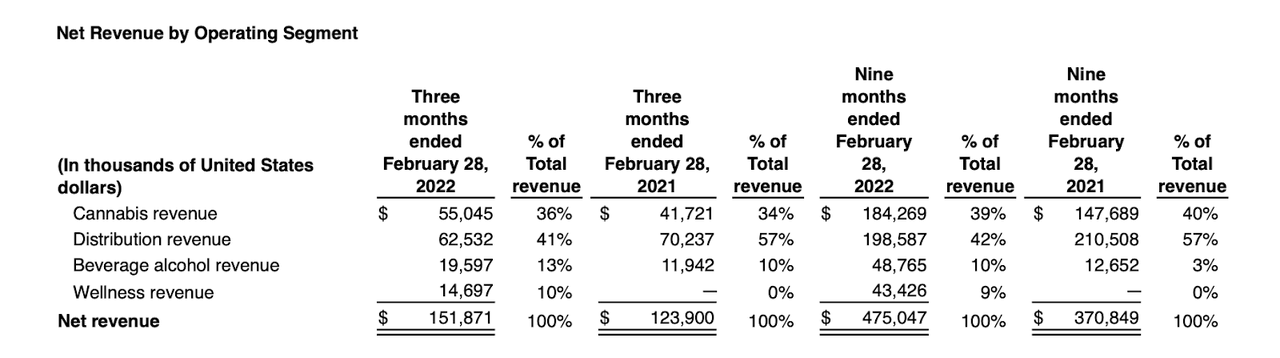

Like in past quarters, there’s a clear argument to make that TLRY is not really a cannabis company, as most of its revenues come from other segments. We can see below that only 36% of revenue came from cannabis sales.

Tilray FY22 Q3 Release

This is an important detail because cannabis sales tend to have stronger margins. Whereas cannabis revenues had 33% adjusted gross margins in the quarter, distribution revenue gross margin was only 8%.

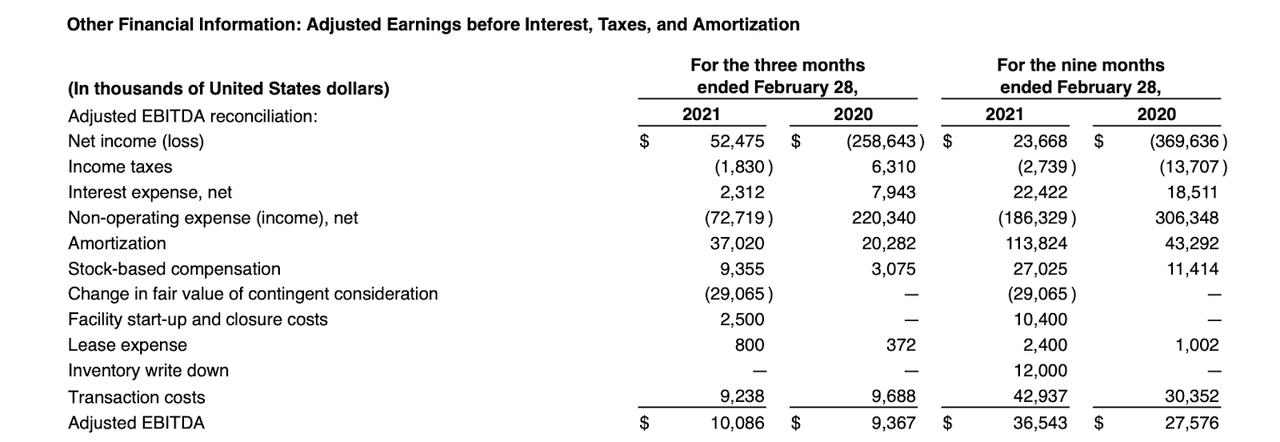

Finally, the headline profit number included $72.7 million in “non-operating income” which primarily refers to the fair value fluctuations of outstanding convertible notes and warrants. Because TLRY stock fell in the quarter, it recognized a non-cash gain, but clearly this should be excluded to better understand run-rate profitability. We can see adjusted EBITDA below, which shows a slight gain over the prior year.

Tilray FY22 Q3 Release

Yet even here, we can see that stock-based compensation made up $9.4 million of the $10.1 million in adjusted EBITDA, vs. only $3.1 million in the prior year. After adjusting for stock-based compensation, TLRY was less profitable than last year.

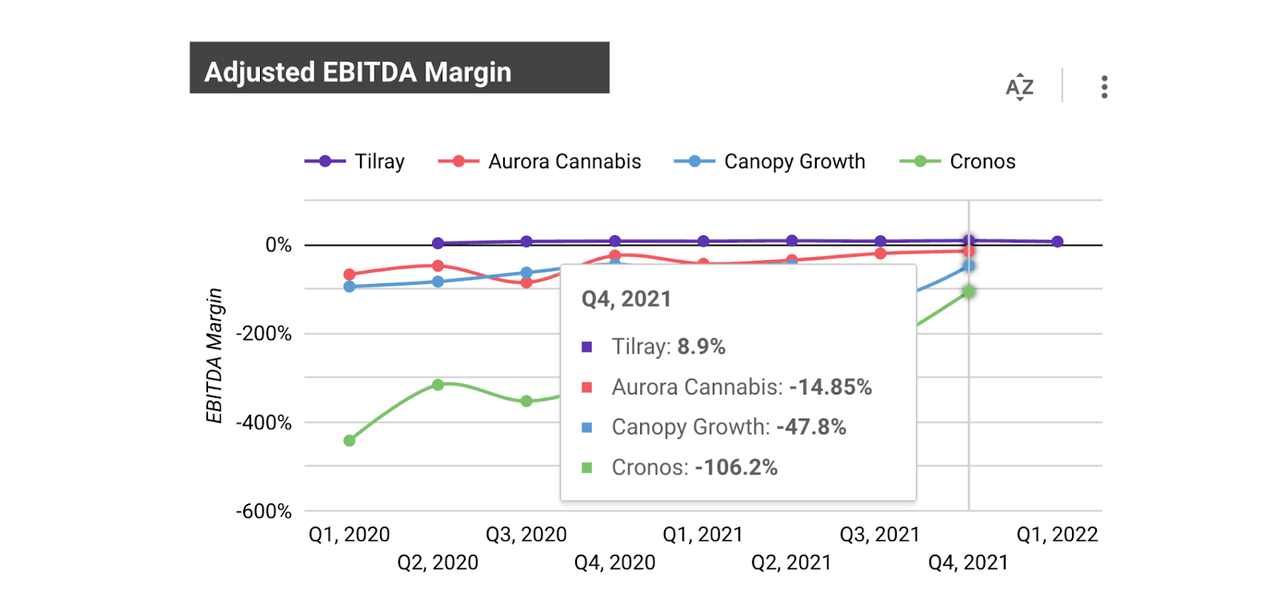

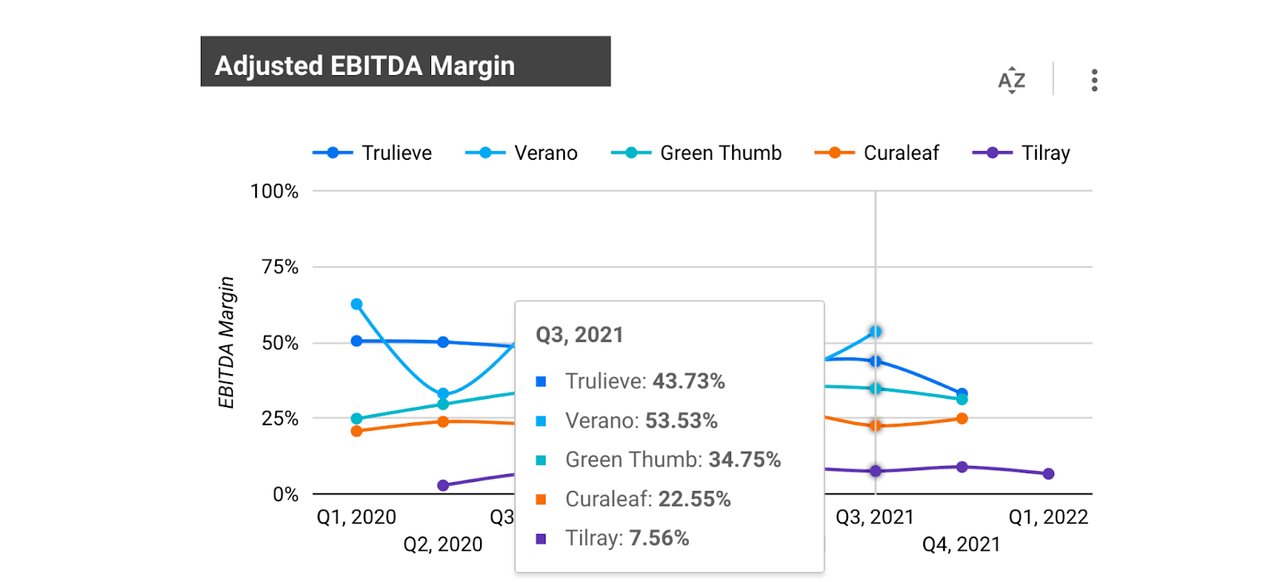

Luckily for TLRY, the standards for profitability are quite low. TLRY is still generating the best profit margins as compared to large Canadian peers.

Cannabis Growth Portfolio

Yet when compared against American peers, TLRY’s EBITDA margin cannot keep up.

Cannabis Growth Portfolio

Most institutional capital can only invest in Canadian names due to cannabis being illegal at the federal level. That means for now, TLRY will be compared largely against Canadian peers, though that might not always remain the case over the long term.

Is TLRY Stock A Buy, Sell, or Hold?

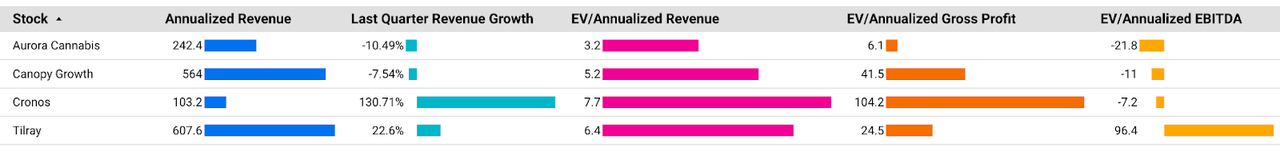

At recent prices, TLRY appears to trade at reasonable valuations. Canadian peers like Canopy Growth (CGC), Aurora Cannabis (ACB), and Cronos (CRON) all are guzzling cash on an EBITDA basis, but TLRY nonetheless trades at comparable valuations.

Cannabis Growth Portfolio

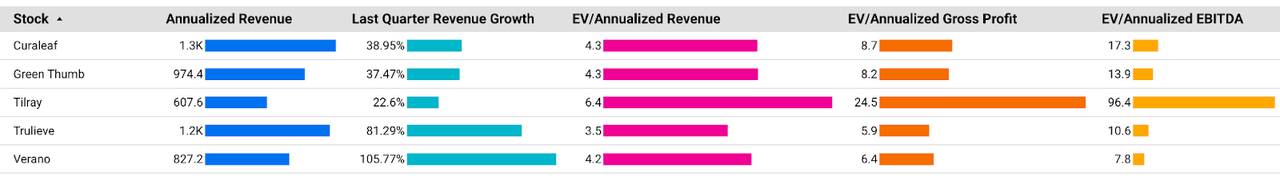

While ACB and CGC might be cheaper on a price to sales basis, I’d still prefer TLRY stock due to the stronger profit margins. That said, the stock does not look very compelling when compared against American peers like Verano (OTCQX:VRNOF), Trulieve (OTCQX:TCNNF), Curaleaf (OTCPK:CURLF), and Green Thumb (OTCQX:GTBIF). TLRY trades higher on a price to sales multiple basis yet has significantly weaker profit margins and growth prospects.

Cannabis Growth Portfolio

Here’s another way to understand the valuation discrepancy. TLRY and other Canadian operators are blocked out of either directly selling cannabis in the United States or making direct investments in operators that sell cannabis in the United States. Instead, they have invested in the country through complicated convertible notes which have clauses based on the federal legalization landscape. This is seen from TLRY’s investment in Medmen (OTCQB:MMNFF), CRON’s investment in Pharmacann (private), and CGC’s investments in Acreage (OTCQX:ACRHF) and Terrascend (OTCQX:TRSSF). Yet unlike these Canadian operators, retail investors are able to invest directly in US names like those listed above. Why would one want to invest in TLRY which is more expensive and less profitable than US cannabis stocks, even if it has some investment ownership in US operations? Unless you’re managing institutional capital with restrictive mandates, it makes more sense to forego the middleman and invest directly in the US sector. I rate TLRY a buy due to its reasonable 6.4x EV to sales multiple because I expect the Canadian legal market to continue taking market share from the illicit market. That said, I greatly prefer investing in US names due to the stronger fundamentals and better value proposition.

Be the first to comment