skynesher/E+ via Getty Images

The first quarter of 2022 is in the books. It’s beginning to feel like the market has picked up where we left off last year. Nearly every day brings more concerning news, and the market shrugs it off and keeps going up! The market’s ability to ignore deteriorating economic conditions is a disappointing turn of events for the patient dividend growth investor. Just a few weeks ago, several nice bargains were appearing, but now it’s pretty slim pickings.

So far this year, my portfolio has hit record value on five separate days, three of which occurred to close out March. Year to date, I’m up 1.3%, handily exceeding the S&P 500. Of course, as a dividend growth investor, my goals have nothing to do with beating the market. My goal is to grow my income year over year consistently. More specifically, the goal of this portfolio is to increase income by 10% annually with dividends reinvested and 7% without reinvesting.

Back in the day, I used to be a total return investor. But I was not too fond of trying to save up to some magical number and then one day live off the funds, hoping they didn’t run out before I died. However, I did know exactly how much my living expenses were. I realized that I didn’t need to hit some magical number to retire, but instead, I just needed to find a way to create the income I needed to pay my bills—preferably without working.

I reached this conclusion during the GFC, at which time I decided to focus on dividend growth investing. From then to now has included a lot of learning and several mistakes. Yet income has grown at a predictable 10% per year despite it all. It’s important to note that this portfolio has been closed to new capital since 2016, so I can better judge the overall income growth. I even took two years off, 2017 and 2018, from reinvesting to evaluate the organic dividend growth.

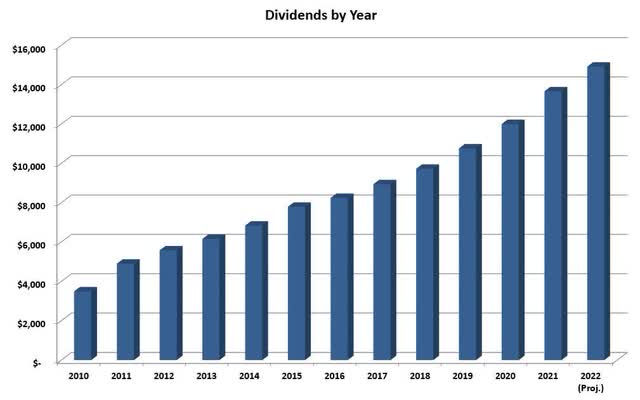

The chart below shows the income growth by year since 2010. This year’s total forecast stands at $14,919, but the projection is always low as I don’t project reinvestment of dividends and am conservative on my dividend increase estimates. So, this number should be higher by the end of the year.

Income received by year (Wyo Investments)

While I don’t have specific rules for this portfolio, I do have guidelines:

- Target investment is a 3% yield with an expectation of 7% dividend growth.

- I prefer companies with a 15-year plus dividend growth streak.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio that has grown from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not.

- I like to see a reasonable expectation for at least high single-digit growth in long-range estimates, for what they are worth.

It’s important to remember that these are just guidelines. These are in place to help me meet my 10%/7% income growth goals. In addition, I do maintain a portion of the portfolio in high yield, which I buy under a completely different set of rules. Plus, I keep high-yield positions small to minimize risk.

How is 2022 Shaping Up?

As mentioned above, the current projected income stands at $14,919, a 9.2% increase over last year. A large chunk of this was the massive Q1 increase by Blackstone (BX). Because of this and the sale of Preferred Apartments (APTS), I have been able to focus on faster-growing dividend companies while hitting my overall goal of 10% income growth for the year. This year will be another year of positioning the portfolio into higher quality and faster-growing names, fortifying it for future income growth.

March Dividend Increases

There was one increase at the beginning of March, Best Buy (BBY). I included this increase in February’s update. Best Buy increased by a whopping 26% for anyone who missed it!

April’s Expected Increases

This month is an important one for dividend increases. The three largest positions by dollar value should be announcing raises, Apple (AAPL), Ameriprise (AMP), and Blackstone. Additionally, Johnson & Johnson (JNJ) should be increasing as well.

Johnson & Johnson

Having recently announced plans to split the company into two separate entities, anything is possible with the dividend. However, I expect the company to continue the 6% dividend increases as they have for years, although this year will likely be closer to the 5% we saw last year. The company has a dividend growth record of 59 years, with 5 and 10-year dividend growth of both around 6%. If anything, JNJ is consistent.

Johnson & Johnson is a mid to smaller-sized position in the portfolio at about 2% of the value. It accounts for 1.8% of the income. While it doesn’t have a massive yield or fast dividend growth, it is a company that doesn’t require any work to hold in a dividend growth portfolio. I will be excited to see the details of the upcoming spinoff, as spinoffs have generally been good to me.

Apple

Apple has a remarkably consistent dividend growth record of providing investors with 7% increases. Look for another 7% increase this year. The company hit a decade of dividend growth last year and will look to build upon that this year.

Apple is the largest holding in this portfolio, at nearly 11% of the total value. However, the company only accounts for 2% of the total income. This position was established in 2013 and along with Microsoft (MSFT), is up over 1000%!

Ameriprise

The increase by Ameriprise is significant because the company is not only the third-largest holding, at over 6% of the portfolio, but it is also one of the biggest income producers. With this year’s increase, the company will leapfrog Omega Health Care Investors (OHI) to become the 5th largest income producer at 3.5% of the total income. OHI will fall again later this year when Lockheed Martin (LMT) increases, showing once again that growing dividends are superior to non-growing high yield.

Ameriprise has been growing the dividend for over 18 years. The company has a 5-year dividend growth rate of 8.7%. However, I expect to see closer to 15% this year, which will be massive! A larger increase is likely due to last year’s earnings, the current forecasts for 2022, and weighing the increases by T. Rowe Price (TROW) and Blackrock (BLK) seen earlier this year.

Blackstone

Last year, Blackstone surprised with a nearly 80% increase. They continued the trend with a 50% increase in Q1. (vs. Q1 2021). Because Blackstone pays a variable dividend, it is appropriate to compare year versus year or quarters from the prior year versus current-year quarters. Again this quarter, I expect to see an increase of nearly 50% over the same period a year ago. This would put the expected dividend at $1.20 for the quarter. It’s important to note that the news will report a dividend cut when it’s announced, but due to the variable nature of the dividends, it will be an increase.

Blackstone is the second-largest position in the portfolio at slightly over 7% of value. It currently projects to be the 3rd largest income producer at just under 8% of the total income. However, should the 50% increases continue all year long, it will challenge Altria (MO) for the top spot at over 10% of the income produced.

Preferred Apartments Buyout

As I wrote about last month, Blackstone acquired APTS at $25 per share. I disposed of most of my shares last month. However, I had a final call exercised in March at $20 a share. As the yield was low enough, I had sold the options because better alternatives existed.

Last month, I invested the proceeds into Realty Income (O) and National Retail Properties (NNN). This month’s proceeds were placed into a new position, STORE capital (STOR). Additionally, as discussed last month, a tiny portion of the proceeds was invested into Diamond Hill Investment Group (DHIL) as a bit of a gamble.

As APTS was considered a high yield position in the portfolio and was not offering any dividend growth, the new positions achieved multiple objectives. By spreading the proceeds into three positions, the risk of any single cut having a significant impact is reduced. Additionally, all of these companies have growing dividends, which is a plus in the high yield piece of my portfolio. Thirdly, the new positions have higher yields than APTS was offering. And most importantly, I believe these are higher-quality companies, improving the overall quality of my portfolio.

Other Sales in March

Because of the massive increase by Blackstone in the first quarter and the ability to replace Preferred Apartments with higher-yielding companies, I have some flexibility this year. I took the opportunity to dump Annaly Capital (NLY) from the high yield portion of the portfolio.

Annaly was a micro-position in the portfolio at under 0.5%. Generally, I will only hold such small positions with high-yield companies to minimize risk. The holding was established in 2014 at a whopping $11.61 a share and closed out at $7.04. Over the years, I did collect a total of $7.94 a share in distributions. Overall, this was one of my worst investments of all time in this portfolio. The only redeeming factor is the dividends went towards purchasing high-quality dividend growth companies.

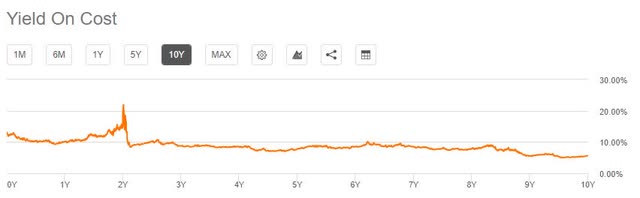

The chart below shows the declining yield on cost of Annaly. The longer you hold it, the worse your distribution yield becomes.

Annaly provides a smaller dividend return the longer you hold the company. (Seeking Alpha)

Regular Purchases

Because the dollar value of the Annaly sale was so small, I just lumped the proceeds into my regular purchases. At the beginning of the month, it appeared that many bargains were becoming available. By the end of the month, these had all but evaporated.

I thought I would hold funds waiting for better entry points. But, when consumer discretionary dropped towards the end of the month, I used the opportunity to open a new position in Home Depot (HD). This is a company that I had wanted to add for a long time, but it had never quite made the top of my buy list.

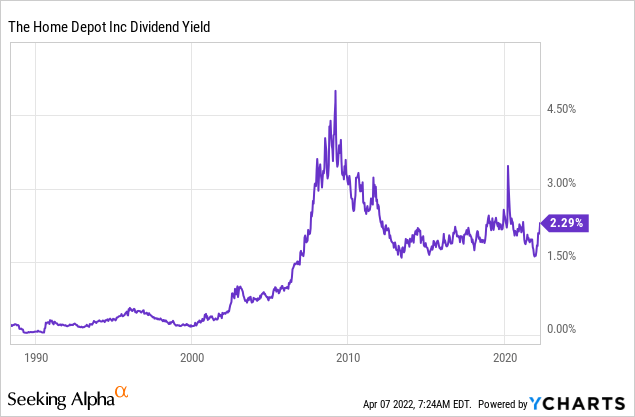

Home Depot has a 13-year dividend growth streak; however, it has maintained the dividend for much longer without a cut. The company did freeze the distribution coming out of the GFC. HD has a 5 and 10-year dividend growth rate of nearly 20%; the last couple have been smaller but still double digits. I am optimistic with higher mortgage rates that people will opt to stay put and renovate their houses, continuing the strong growth into the future.

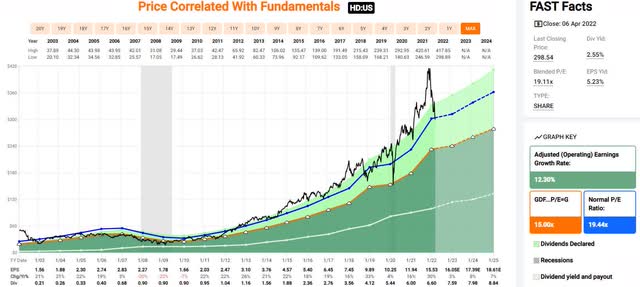

I maintain three buy points on companies on my watch list. These are generally based on the historical frequency of a given yield on a company. For Home Depot, these buy points are 2.5%, 2.75%, and 3% yields. I jumped the gun a bit and added eight shares at an average price of $309, equating to a yield of 2.46%, which is still a great entry point by historical yield standards. This can be seen in the chart above. However, as the FAST Graphs chart below shows, HD is closer to fairly priced by historical PE ratios.

The FAST Graph shows that the historical PE of Home Depot now is just around a normal range. (fastgraphs.com)

Other purchases throughout the month included two shares of Best Buy at $93.37 and one share each of O and NNN at $66.68 and $43.60, respectively. Best Buy remains one of the “best buys” available today.

As the market seems to be shrugging off any bad news, I will be letting dividends accumulate in this portfolio. I am still looking to add to my Snap-On position below $200 and will add to Home Depot below $300. These positions are still below the minimum I like to hold of 1% of the portfolio.

As always, I will consider any company that I already hold should it reach an attractive buy point. Right now, Best Buy is the only company in the portfolio that is looking like a bargain, and I will continue to add when it reaches close to a 4% yield.

April’s dividend increases will tell me a lot about what kind of flexibility I have with the remainder of the year. Large increases will likely put me over the year’s 10% income growth goal. Should this occur, I will be comfortable waiting longer and continuing to focus on faster dividend growth over current yield.

What Else Am I Looking At?

Most of my purchases were early in the month at much better prices than are available now in my other portfolios. The most significant investment was adding ten Prudential (PRU) shares at $102.85. All the rest of my purchases were single shares as I was waiting for companies to hit my second buy points, which everything is moving away from now.

The other piece I put on hold last month was my weekly selling of covered calls and cash-secured puts in AT&T (T). I don’t want any options outstanding when the split occurs, as the initial price action in the new companies will likely take some time to settle down.

Starbucks (SBUX) had reached my second buy point in early March at a yield of 2.25%, then moved well away from it at the announcement of the return of Howard Schultz. Of course, they announced the buyback suspension, tanking the recent gains and sending the company back into my second buy zone. However, I’m taking a wait-and-see approach with this one as I’m concerned about what implications the change in buyback policy might mean for the dividend policy.

Thanks for reading, and as always, I’m looking forward to any thoughts!

Be the first to comment