JimVallee/iStock via Getty Images

Opportunity (from a volatility or fear perspective) has definitely cropped up in Tilray Brands, Inc. (NASDAQ:TLRY) (medical cannabis firm). Option sellers are constantly on the hunt for stocks trading with high levels of implied volatility. Through this mean-reverting metric, we measure how expensive a stock’s associated derivatives are relative to their average values. The key phrase above is “mean reverting”. This really is the key to selling volatility in that sooner or later, we expect Tilray’s volatility to contract to its historical average over time. This in essence is the foundation of volatility-based option trading.

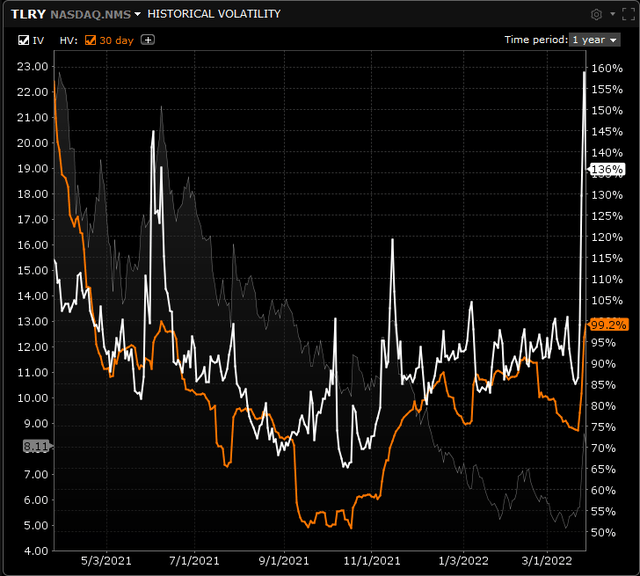

In saying this, implied volatility is not the same as a stock’s historical volatility, and here is where the opportunity lies in this play. Implied volatility or IV for short is basically the expected move going forward in the share price whereas the historical reading (HV) is actually backward-looking in nature and is the actual volatility of the underlying.

Suffice it to say, options sellers gain an edge when:

- Implied volatility is trading well above its 52-week range (which is so in Tilray).

- The extra implied volatility is not being accompanied by extra historical volatility. (Which we also have in Tilray as we can see below.)

IV trading higher than HV in TLRY (Interactive Brokers)

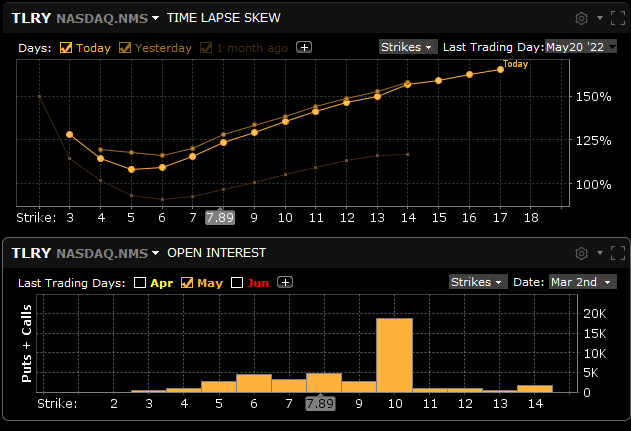

When we delve into the implied volatility of Tilray’s individual strike prices in the May expiration cycle, we see there is significant skew present on the call side compared to the associated put options. This basically means that Tilray’s call options are trading at much higher IVs than their put counterparts. Furthermore, as the chart shows below, there is significantly more open interest above the current share price (approximately $8 a share) of Tilray which basically means that far more calls have been bought compared to puts

Call Skew In TLRY (Interactive Brokers)

In the S&P 500 for example, and in financial markets in general, put skew (more expensive puts) is usually the order of the day as investors hedge their positions by buying put options to protect against a sharp move downward. However, as we can see above in Tilray Brands, all of the fear is actually on the upside which is interesting.

So how do we use the above information to our advantage? Well, since Tilray’s call options are highly inflated, the play here is to go where the fear is and sell those call options naked. Although this obviously brings risk to the table due to the unlimited risk of selling naked calls, one can sell those options way out of the money due to that increasing IV, the further one goes out of the money.

The problem with strong call skew is that call spreads (one way of defining risk in a position) trade very cheap due to the increasing implied volatility the further you go out of the money. A call spread is the purchase of a call and then the simultaneous sale of another call option further out of the money. Call spreads are recommended in environments of high implied volatility but not with this much call skew.

Therefore, here is what we would recommend in Tilray for example whether you are bullish or bearish on the stock

- Bullish (Call Debit Spread or Broken Wing Call Butterfly)

Given the rich extrinsic value in the at-the-money options in the May cycle, for example, one could put on a debit spread and have a very low breakeven if enough delta is bought on the long side of the spread.

Otherwise, one could go with a broken wing call butterfly where due to the skew, one could put on the butterfly well out of the money and still bring in a credit. The broken wing butterfly would have a much higher probability of profit over the debit spread but the stock would have to move northward to your short strikes in order to realize a significant profit.

- Bearish (Reverse Jade Lizard)

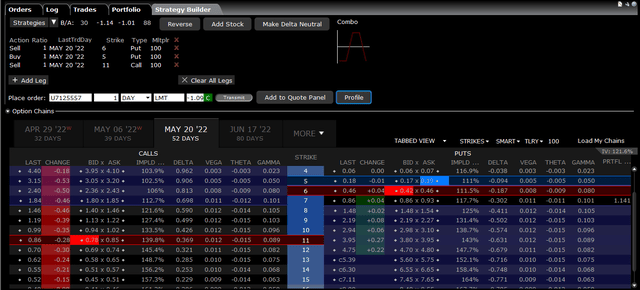

By selling an out-of-the-money call along with an out-of-the-money put spread, as long as more credit is collected than the width of the put spread, one has no risk to the downside. The problem here though for some is that naked call which brings unlimited risk to the upside. One could buy a further out wing to define this risk, but as mentioned earlier, it would not be cheap to do so. However, something like what we have depicted below takes advantage of the call skew in TLRY and is also a high probability of profit strategy.

Reverse Jade Lizard In TLRY (Interactive Brokers)

Therefore, to sum up, there is plenty of opportunity in TLRY at present due to the inflated premium of its derivatives, especially on the call side. We will look to put on a position here shortly. We look forward to continued coverage.

Be the first to comment