TBE/iStock Editorial via Getty Images

Published on the Value Lab 4/10/22

Thyssenkrupp (OTCPK:TYEKF) (OTCPK:TKAMY) is a classic German industrial player. While they have their fingers in lots of pies, the big drivers as of today and for any foreseeable future are the materials services segment and the European steel segment. The company trades at the multiple of a steel company, where markets have set a consensus that forward earnings are essentially non-existent. It’s not a crazy view, but we think the materials services business is making a legitimate transformation into more services, and that angle is not being appreciated by markets. Nonetheless, this is a volatile stock in the current macro environment.

Q3 Comments

Let’s take the opportunity to first break down the several Thyssenkrupp segments and get an idea of what their exposures are.

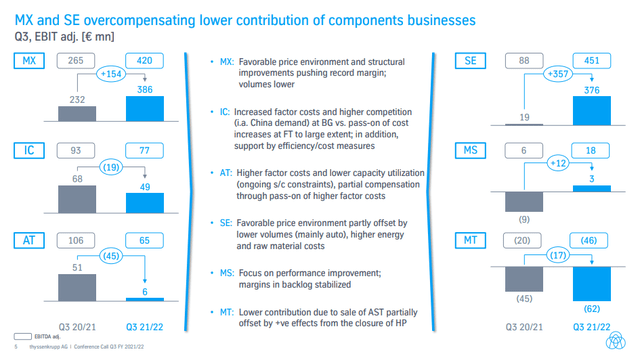

The chart above shows that the segments that really matter in terms of EBITDA are the materials services segment (MX) and European Steel (SE). Let’s quickly run through the others first.

Industrial components is seeing a lot of pressure from raw materials and logistics inflation. Sales are actually growing substantially as the company tries to achieve pass-through in this segment, but it’s not really working fully because of the bearings subsegment which is seeing a collapse in Chinese demand. The wind energy exposures in bearings are a bright spot, but for the most part, declining industrial demand and output in China are a problem here for scale. Forged technologies are seeing improvement in contrast to bearings which are driving segment EBITDA declines, and again it’s thanks to hold-out demand in the EV world in powertrains.

Marine services is marginal but has won recently 3 billion EUR in backlog of contracts. Multi-tracks is doing some disposals, but the Nucera business is also coming up where Thyssenkrupp is trying to get their foot into the supply of machinery and services to set up green hydrogen plants. Backlog is 1.4 billion here which is almost 20% of the overall order intake this quarter. Still small relative to the built-up backlog but not bad.

Automotive technologies has been stronger in the past but again issues with raw materials but also inconvenient bottlenecks that limited utilisation was a problem for this segment. EBITDA went from 51 million EUR to 6 million EUR on account of scaling difficulties and the input inflation.

Remarks

So what’s left is European Steel and the materials services business. European steel is relatively straightforward, the increase in scale created profits through operating leverage. The margins remain low and volumes close to breakeven. Input inflation is also an issue for this segment, although high operating leverage means that fixed costs are mattering more here. The movement from negative to positive territory is why markets are giving such a discount to the stock. The multiple trades at 1.7x PE considering only these first 9 months of income. Annualizing it, you get a 1.3x PE which is in line with what a lot of steel producers are trading at nowadays, actually a lot less than US peers and closer to Ukraine located ones. With the recession incoming and Europe being especially vulnerable due to the reliance on Russian power and the potential for real demand destruction this winter, things don’t look so great and that operating leverage could sting again in the opposite direction.

The thing is that materials services is a lot less volatile. The whole concept of this segment is to do both procurement of raw materials but also close deals with warehouses and facilities for procurement management systems and other services related to supply chain. While higher material prices have given them scope for margin expansion as materials become more scarce, the services businesses offer margin stability and smooth out earnings as opposed to a totally commodified exposure like SE. The more recurring and stable nature of these services, which do account for between 40 and 50% of EBITDA, is not being priced into a 1.3x multiple which would account for very volatile and high operating leverage steel exposures, with key inputs like energy inflating and making the situation admittedly much worse for steel producers.

Thyssenkrupp looks like it has a pretty clear value angle, but the exposure to production levels in Germany, and general industrial levels in Europe and China, give us great pause as winter comes. There is going to be a lot of volatility here, and Thyssenkrupp is not in a great local market compared to many other steel players, although better than having plants in Ukraine. Overall, a very interesting idea it seems but to be waited for.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment