Douglas Rissing

“The division of the Roman world between the sons of Theodosius marks the final establishment of the empire of the East, which, from the reign of Arcadius to the taking of Constantinople by the Turks, subsisted one thousand and fifty-eight years in a state of premature and perpetual decay.” – Edward Gibbon

Watching with interest the European Parliament condemning by a convincing majority the abolition of the constitutional protection of abortion in the USA and called for the inclusion of such a protection measure in the EU Charter of Fundamental Rights, when it came to selecting our title analogy, we reminded ourselves of the fall of Constantinople in May 1453. On May 29, 1453, the city of Constantinople was besieged by the Turks. The city, “second Rome”, then acted as a bulwark for Christianity against the advance of Islam. It is said that at the emperor’s palace, the Orthodox priests and people of the court were so busy discussing the theological question of the sex of the angels that the capture of the city would have been facilitated. This is also where the expression “Byzantine quarrels” comes from, which refers to superficial debates.

We find the similarities interesting given “pitchforks risk” rising significantly as can be ascertained from the fall of Sri Lanka’s government, farmers’ demonstrations in Holland spilling onto Germany and Italy and not to mention troubles in Africa such as in Ghana. We find it interesting to see that, in similar fashion to what happened in terms of “discussions” during the siege of Constantinople, European members of parliament decided to focus their attention on a mostly US “debate” rather than on the pressing issues such as the impending collapse of large parts of the European economy, Germany included. But we might be too harsh, after all, regaining somewhat some form of lucidity, the European Parliament backed listing nuclear energy, gas as ‘green’ yet we would not call it a glimmer of hope in this “ineptocratic” world of ours.

On a side note, our quote comes from Edward Gibbon. He was an English historian, writer, and member of parliament. His most important work, The History of the Decline and Fall of the Roman Empire, published in six volumes between 1776 and 1788, is known for the quality and irony of its prose, its use of primary sources, and its polemical criticism, that is polemics, of organized religion. He was inspirational to both Isaac Azimov and Winston Churchill but we ramble again. Following the G20 meeting of foreign ministers in Bali, we think our quote is somewhat relevant to what we pointed out in our previous conversation, namely that we are seeing an acceleration of the world’s center stage from the West towards the East part of the world in true Angus Maddison fashion. The “Balance of Power” is shifting.

In this conversation, we would like to look at the importance of this balance of power shift towards the East part of the world, which can be seen in the different trajectories taken this year so far in both US and Chinese CPI as well as respective TECH markets. After all “Macronomics” is about “Macro” and long-term views.

US passing the baton to China?

As per the last bullet point of our previous conversation, recent events in 2022 such as the war in Ukraine have triggered an acceleration of the shift of power from the West to the East where Russia has found new avenues for its oil with China and India. No wonder NATO is pivoting at a rapid pace towards Asia and as per the recent meeting in Madrid where NATO has taken a very aggressive stance towards Russia in particular and China in general.

In true “Fourth Turning” fashion à la Neil Howe, we are more and more moving towards more social unrests and more confrontations with a significant uptick in defense spending on a global scale. It is interesting to notice though that United States is lagging behind in the hypersonic race while China is busy increasing significantly its military navy potential while Russia just launched its latest “doom machine” with the launch of its giant ballistic submarine Belgorod. Meanwhile, Europe is mired in “Byzantine quarrels”.

US CPI vs. China PPI. Draw your own conclusions.

China Shenzhen index rebound looks like powerful V shape recovery. After months-long of tech crackdown, China seems more friendly towards its BIGTECH industry. Good sign for Asia Tech stocks.

No wonder Alibaba $BABA rallied hard the last couple of weeks:

Alibaba (Macronomics – TradingView)

Alibaba 5 years chart looks enticing from a valuation perspective:

Alibaba (Macronomics – TradingView)

ETF KWEB vs ETF XLK – China TECH vs US TECH YTD Performance:

KWEB vs XLK (Macronomics – TradingView)

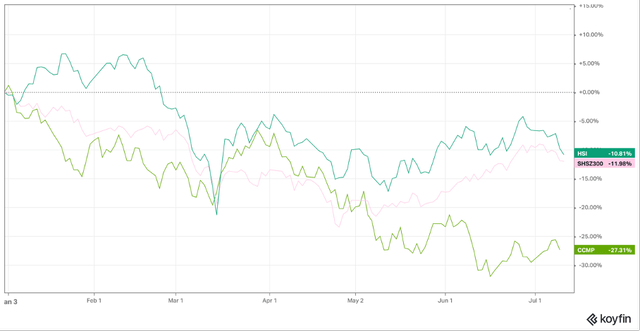

YTD Hang Seng -9.7%, Shanghai Shenzen -11.9%, Nasdaq -27.3%:

Equities (Macronomics – Koyfin)

Facebook is facing increased competition from Chinese rival TikTok. For instance, TikTok and its domestic version Douyin raked in USD283 million in June, remaining the highest-grossing app, followed by YouTube and Tinder, according to Sensor Tower. Nearly half of its total income came from the Chinese market, while 16.7% from the US market. Deglobalization is already playing in the luxury markets where for instance in China, local luxury brands are benefiting from their domestic markets whereas some Western brands do not shine as they used to locally.

China is the second-largest art market in the world, accounting for 20 percent in value, behind the US at 43 percent, according to “The Art Market 2022” report published by UBS and Art Basel. More and more you are seeing Chinese artists establishing new records. The US Art market is facing increasing competition from Asia given the significant rise in wealth in China. In 2000, China accounted for less than one percent of the global art market – now it makes up a full one-fifth, according to the Global Art Market Report sponsored by Art Basel and UBS.

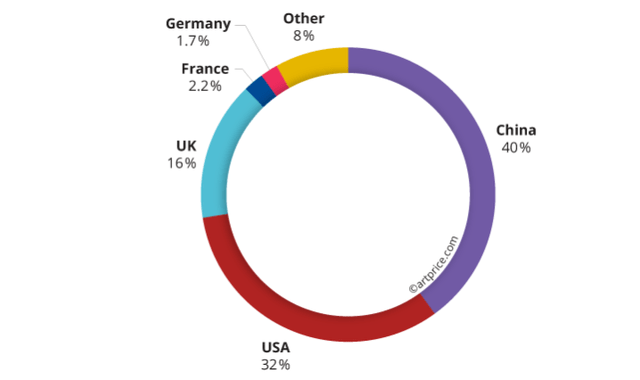

When it comes to “money flows” and the Art market, it is as well shifting East as indicated by Artprice.com – Asia: the Art Market’s centre of gravity is heading East:

“After a very difficult year in 2020, China, Hong Kong and Taiwan all posted outstanding performances in the latter half of the year and the first half of 2021. Their combined contribution to the global Contemporary market (approximately $1 billion) represented 40% of its value. The Asian market has therefore effectively become the world’s primary zone for the exchange of Contemporary artworks, and not just for Asian artists, but also for a growing number of Western artists. In short, the Art Market is increasingly solid and active in the East (as we have predicted for many years).”

Provenance of Contemporary Art auction turnover (2020/21):

This trend is indicative of the shift of “power” and “money flows” from the West towards the East. No wonder the United States and its NATO “sales representatives” are pivoting towards the “East”.

In our previous post, we mentioned “deglobalization” going hand in hand with inflation, and we also questioned ourselves for the future of “money flows”:

“If indeed, “savings” stays more “local” then indeed, the whole “recycling” of flows of money from the East to the West is going to “shift”.” – Macronomics June 2022.

Already we are seeing shift not only in the art market but in the energy space where there is a growing competition between Asia and Europe for LNG shipments, given Europe’s willingness in cutting its dependence towards Russian gas.

Given the shift in the macro narrative, one can rightly ask if the United States and China are going to avoid the Thucydides Trap.

Unfortunately in the current context, we are not seeing any willingness to “de-escalate” global tensions. We are only seeing them going up in true “Fourth Turning” fashion.

Disturbance in the “Credit” forces

For all the Star Wars fans out there, a disturbance in the Force, also known as a disruption in the Force, a Force Disturbance, or a tremor in the Force, was an anomaly in the currents of the Force, the powerful energy field which bound all beings, that could be sensed by Force-sensitives, such as Jedi and Sith.

But in our “Credit” world, Force-sensitives macro players like ourselves are seeing tremors building up in credit markets such as in our CCCs “credit canary”:

High Yield (Macronomics – Koyfin)

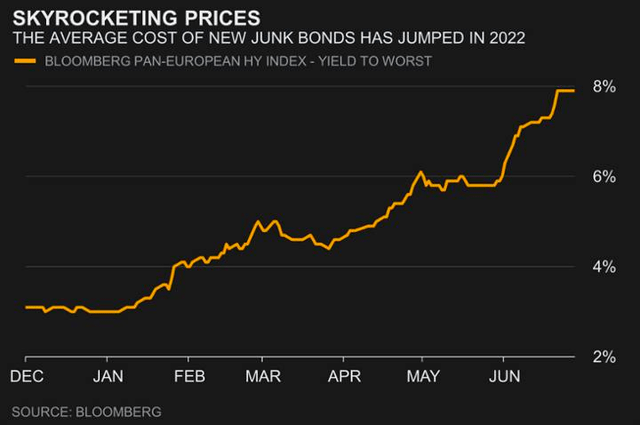

Cost of funding in the High Yield space is rising:

High Yield cost (Bloomberg – Twitter)

As well, in relation to the “Eastern” shift in markets, it is interesting to see that in Emerging Markets Credit land, Asia is faring way better than EMEA:

High Yield (Macronomics – Koyfin)

But, High Yield, remains High Yield and to that effect Emerging Markets have not bucked the trend, and performance wise, YTD Asia is faring worse than US or European High Yield markets:

High Yield (Macronomics – Koyfin)

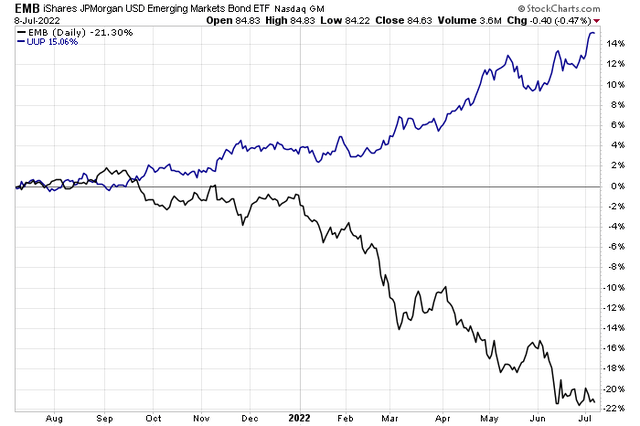

Emerging Markets ETF $EMB has been smacked thanks to the lethal proficiency of Mack The Knife (US dollar + Real Yields):

EMB vs Dollar (Mike Zaccardi CFA – Twitter)

The rising US dollar has indeed been crushing $EMB Emerging Markets bonds:

US Dollar haven (Bloomberg – Twitter)

As well, Emerging Market Currency index, a popular benchmark, has now dropped below 50 for the first time since it was initiated in 2010, when it was worth 100:

Emerging Currencies (Bloomberg – Twitter) Emerging Markets (Bloomberg – Twitter)

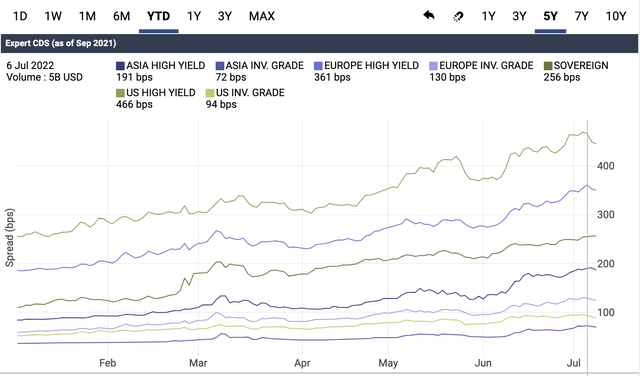

When it comes to the cost of protection (CDS 5 years spreads) we are seeing difference in the rise in spreads. For instance, Asian Investment Grade credit is faring better at 72 bps for the cost of protection than US Investment Grade (94 bps) and worse is Europe with 130 bps.

It is also worth noting that $237 BN of the $1.4 TN EM Sovereign Debt market is now trading at *Distressed* levels. The number of Emerging Markets with sovereign debt trading at distressed levels has more than “Doubled” in the past 6 months.

CDS (Macronomics – Datagrapple.com)

European countries are facing a massive energy stock given that latest rumor is that Russia might cut entirely the supply of natural gas to Europe, which will further increase inflation in the region and push the eurozone’s largest economy, Germany, into recession, and trigger as we discussed in our previous conversation, more social unrests on the horizon.

Already we have seen some government falling: Estonia, Bulgaria to name a few. We remind you that next year will see elections in Italy and in its current state of affairs, France is in dire straits, not only politically but also economically. The French geniuses at the French Ministry of Economy and Finance issued bucketloads of OATi aka linkers with long maturities. The interest bill in 2022 will be €17bn higher due to the rise in government bond yields but also because of the rise in inflation including €15 bn just for linkers (weight 10% of debt outstanding). What were they thinking? End of the rant.

“It’s never happened in history that every region in the world could affect every other region simultaneously. The Roman empire and the Chinese empire didn’t know much about each other and had no means of interacting. Now we have every continent able to reach every other.” – Henry Kissinger

Be the first to comment