domoskanonos/iStock via Getty Images

Stocks gave back some of last week’s gains, as investors fret about this week’s Consumer Price Index report on Wednesday, which the consensus expects to show an increase in the rate of inflation to 8.8% for June. Yet a higher print would likely be the result of $5 gasoline, which is well behind us now, but that isn’t easing concerns. The earnings parade is also about to begin for the second quarter with several of the nation’s largest banks scheduled to report later this week. Adding to the trepidation, another case of the latest Covid-19 sub-variant in Shanghai has investors concerned about more lockdowns just as the government is rolling out new stimulus measures.

Finviz

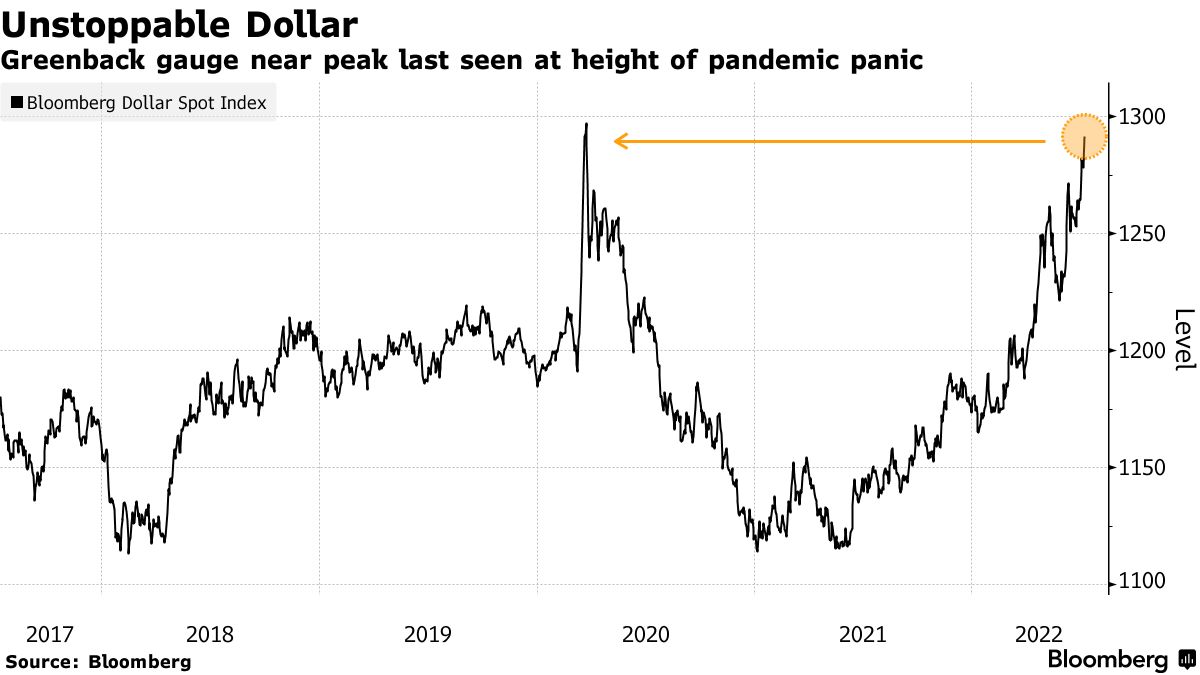

All of this uncertainty has fueled a rally in the safe haven of the dollar to levels not seen since the depths of the pandemic in 2020. A stronger dollar is a headwind for the profits and revenues of multi-national companies, but I expect much of today’s uncertainty to subside as we move through earnings season and realize more signs that the peak rate of inflation is behind us. If the dollar does peak this week, it will increase the likelihood that June 16th marked the low for this bear market.

Bloomberg

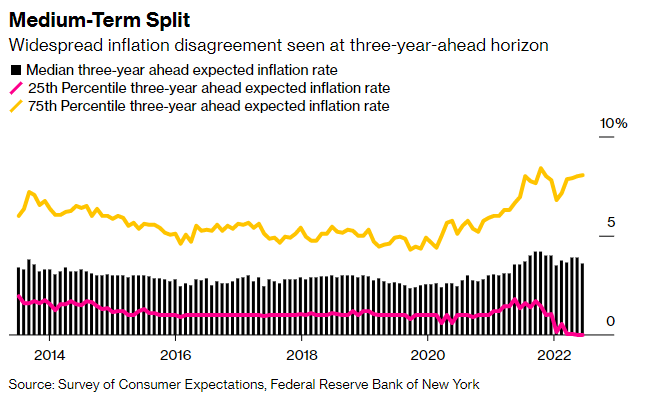

Looking forward, the New York Fed released its latest Survey of Consumer Expectations, which showed that consumers think the rate of inflation three years from now will be 3.6%. That is down from 3.9% in the month prior and the peak of 4.2% in August of last year. This is a move in the right direction and far more important than the print for last month. Near-term expectations one year out remain elevated at 6.8%, which is why the Fed is expected to continue raising rates, but as the monthly prints for CPI come down, so should shorter-term expectations. There is a wide disparity in longer-term expectations among consumers, which ranges between 8% and a decline of -1%. That obviously feeds into the uncertainty that investors have about the future.

Bloomberg

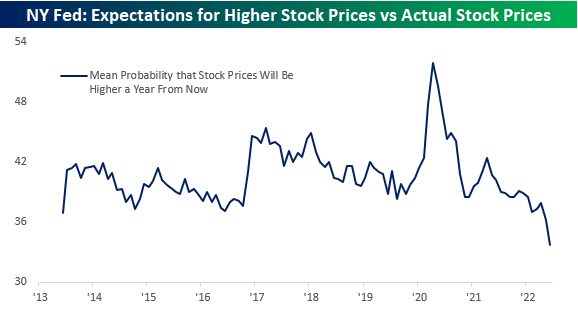

Markets don’t like uncertainty, which is why they remain depressed today. Investors’ expectations for stock prices in the year ahead sits at its worst level since the survey began in 2013, but I view this as positively as the peak in the survey back in early 2020 was a negative for the market in the year that followed.

Bespoke

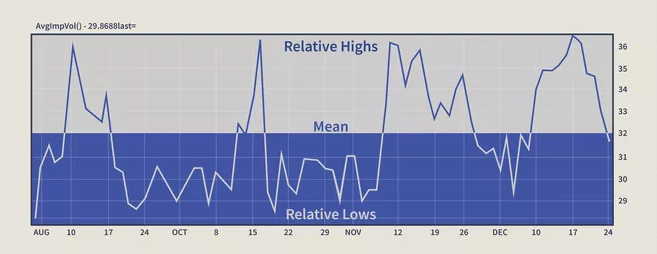

This is why contrarian indicators work so well over time. When sentiment is near its historical lows and expectations are miserable, the selling has typically exhausted itself. It feels horrible buying stocks. At the end of 2019 and very beginning of 2020, investors were as ebullient as ever, and it was very easy to buy stocks. We can always push to further extremes in both directions, but when we are at the outer bounds of either direction, there is always a reversion to the mean. That applies to confidence, sentiment, and prices.

Investopedia

The Portfolio Architect was defensively positioned at the beginning of this year in anticipation of the bear market that has come to pass, but were you? Most pundits were riding the bull as the market hit all-time highs, while we were heavy in cash, but now that fear is reaching extremes, opportunities abound. Join us as we look to slowly position for the next bull market run.

Be the first to comment