Thinkhubstudio/iStock via Getty Images

Elevator Pitch

My investment rating for WuXi Biologics (Cayman) Inc.’s (OTCPK:WXXWY) [2269:HK] stock is a Hold.

I previously wrote about WuXi Biologics in an article published on September 10, 2021, where I highlighted that “geopolitical tensions between China and other countries” were one of the key risk factors for the stock.

Recent events have prompted me to provide an update of my thoughts on WuXi Biologics as a potential investment candidate. On the negative side of things, the new Biden executive order shines the spotlight on the company’s geopolitical risks. On the positive side of things, WuXi Biologics has been diversifying its geographical footprint, and it also recently announced share repurchases that are indicative of the management’s views on the stock’s undervaluation. In conclusion, I deem a Hold rating for WuXi Biologics to be fair.

Readers should note that WuXi Biologics are traded on both the OTC market and the Hong Kong Stock Exchange. WuXi Biologics’ OTC shares with the WXXWY ticker are reasonably liquid, boasting a three-month average daily trading value of approximately $2 million. Investors who demand greater trading liquidity can consider dealing in WuXi Biologics’ Hong Kong-listed shares with the ticker 2669:HK, as their three-month average daily trading value is in excess of $20 million. Readers can trade directly in shares listed on the Hong Kong Stock Exchange with selected US stockbrokers such as Interactive Brokers.

New Biden Executive Order

The White House issued a statement on September 12, 2022 highlighting that “President Biden signed an Executive Order to launch a National Biotechnology and Biomanufacturing Initiative.” The aim of this new Biden executive order is to “ensure we can make in the United States all that we invent in the United States” as per the White House’s press release.

This announcement had a negative impact on WuXi Biologics’ stock price. The company’s OTC shares saw a -23% drop from $16.99 as of September 12, 2022 to $13.12 as of September 13, 2022. Similarly, WuXi Biologics’ Hong Kong-listed shares fell by -20% to close at HK$53.40 at the end of the September 13, 2022 trading day. The last traded prices of WuXi Biologics’ shares traded on the OTC market and the Hong Kong Stock Exchange were $12.66 and HK$49.75, respectively as of October 6, 2022. In other words, the company’s stock price hasn’t recovered to where it was prior to announcement relating to the new Biden executive order.

It is reasonable to assume that the new executive order signed into effect by Biden with respect to biomanufacturing is targeting China specifically. In August 2022, the CHIPS and Science Act also came in effect with the White House’s media release specifically stating that this act aims to “counter China” by pushing for semiconductor production in the US. Although the White House’s September 2022 press release in relation to biomanufacturing doesn’t mention about China, it is very likely that this new Biden executive order signed in September serves a similar purpose as the CHIPS and Science Act.

Notably, the September 12, 2022 White House statement stressed that the US “has relied too heavily on foreign materials and bioproduction”, and emphasized that there is a need for “mitigation measures for risks posed by foreign adversary involvement in the biomanufacturing supply chain.”

In my earlier September 2021 article, I had noted that “WuXi Biologics is the largest biologics outsourcing company in China, and among the top three industry players in the world.” WuXi Biologics earned more than half or 54% of the company’s revenue for the first half of 2022 from the North American market (segmented based on where its clients operate), as disclosed in its interim financial report. In other words, it is possible that WuXi Biologics’ future financial performance might be adversely affected, if the US is determined to restrict and limit the outsourcing of biomanufacturing activities to China.

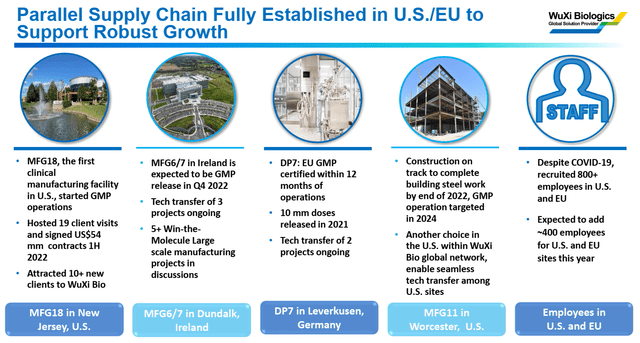

A key mitigating factor for WuXi Biologics is that the company has been building manufacturing sites in foreign locations outside of China, including the US, as highlighted in the chart presented below. This should help to mitigate geopolitical risks and the potential impact of the new Biden executive order to some extent.

WuXi Biologics’ Foreign Supply Chain Expansion Plans

WuXi Biologics’ 1H 2022 Results Presentation

Nevertheless, this isn’t a perfect solution for two key reasons. Firstly, it will take time for WuXi Biologics to shift the company’s supply chain mix outside of China in a meaningful way. In the meantime, WuXi Biologics’ US rivals might be able to gain market share at the expense of the company, assuming that its current North American customers turns to local firms which have larger capacities in the US. Secondly, it will be tough for WuXi Biologics’ non-Chinese operations to generate a similar level of profitability as its operations in China, due to cost differentials (in Chinese and European/US markets) and a lack of scale (during the initial stages of diversifying its supply chain mix) in foreign markets.

WuXi Biologics Share Buybacks

WuXi Biologics issued an announcement on September 26, 2022 noting that it plans to “repurchase (its Hong Kong-listed) Shares in the open market from time to time at an aggregate price up to US$300 million.”

There are a couple of things that investors should focus on in relation to the company’s share buyback announcement.

Firstly, the timing of this share repurchase announcement comes roughly two weeks after the new Biden executive order was signed. Therefore, it is very likely that WuXi Biologics has made the decision to embark on share buybacks in view of the company’s share price weakness with geopolitical risks back in the limelight.

Secondly, WuXi Biologics specifically noted in the late-September announcement that “the current trading price of the Shares does not reflect their intrinsic value or the actual business prospects of the Group.” As per S&P Capital IQ valuation data, WuXi Biologics currently trades at a consensus forward next twelve months’ normalized P/E multiple of 34.3 times. In comparison, the sell-side analysts see WuXi Biologics delivering a robust bottom line CAGR in excess of +30% for the FY 2022-2025 period based on consensus financial estimates. If geopolitical tensions don’t affect the company’s future business outlook, the stock’s current P/E multiple appears to be reasonable after considering its growth prospects.

Thirdly, the company’s target of executing on as much as $300 million in share repurchases is decent, as this is equivalent to about 1% of its market capitalization. It is important to note that WuXi Biologics can potentially repurchase a maximum 10% of its shares outstanding under its current share buyback mandate. In other words, the company has the choice of carrying out a larger amount of share repurchases (exceeding $300 million) if it wishes to do so.

Closing Thoughts

My rating for WuXi Biologics is a Hold. Geopolitical issues suggest that there is potential downside to the company’s future revenue and earnings. On the other hand, WuXi Biologics’ share price might be supported in the near term thanks to the company’s ongoing share buybacks.

Be the first to comment