izzetugutmen

Everyone should be familiar with the Yellow Pages, a thick yellow book beside our phones, where our parents have to flip across many pages to find a number of your local tailor or eatery. Although this physical copy of the Yellow Pages is a distant memory from the past, the acquirer of the now-defunct Dex Media, YP Holdings, is one that we think has tremendous value to provide. Perhaps the name Thryv Holdings (NASDAQ:THRY), a company that went public in October 2020 after its merger with Dex Media in 2016, would be more appropriate. The company rebranded itself a year before its IPO, to focus on providing entrepreneurs with software to run their businesses on top of its traditional Yellow Pages business. Since then, the company has also pivoted greatly from Printed Yellow Pages (PYP), providing digital solutions such as Internet Yellow Pages (IYP), Search Engine Marketing [SEM], and other Search Engine Optimisation [SEO] tools. As such, we think that what makes THRY such a valuable stock is its ability to provide value to an important and growing market of entrepreneurs, leveraging on its strengths and not taking on larger competitors. Our valuation implies a relatively huge upside for this forgotten but still surviving stock.

Value Proposition

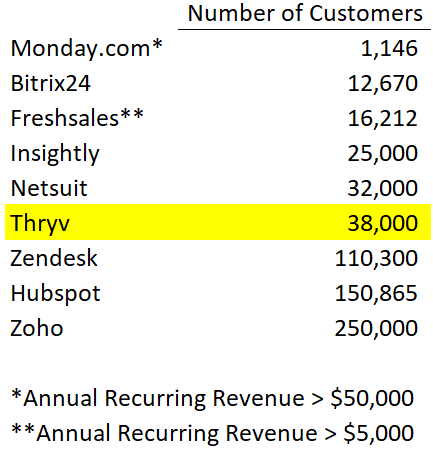

THRY’s integration of its marketing solutions and SaaS business positions the company to be easily adopted by small-and-medium businesses (SMBs). Currently, small businesses (defined by <500 employees) make up 46.4% of the US workforce and have seen a considerable double-digit percentage growth in the past five years. We think that SMBs will remain an integral part of the US economy, which will require substantially low-cost platform solutions to operate their businesses. As a one-stop provider, THRY is able to enable SMBs to customise their marketing strategies with its extensive tools from Yellow Pages to SEM and SEO services, and manage their businesses through its SaaS segment, comprising of Thryv®, Hub By Thryv, Thryv Leads®, and ThryvPay. This allows the company to not only utilise a multi-channel sales approach to target audiences across all age groups but also provides a cost-effective approach for SMBs to manage their overall day-to-day operations on its platform. As of the latest quarter, THRY has 38,000 SaaS monthly active users utilising its services to manage operations, which is a 27% year-on-year increase. Compared to some of its peers, it has a tremendous penetration into the SMBs industry, which would translate to a greater average revenue per user (ARPU) as these businesses start to scale up and THRY charges more per user.

Top CRM Software for SMBs (Respective Company’s Annual Report/Website)

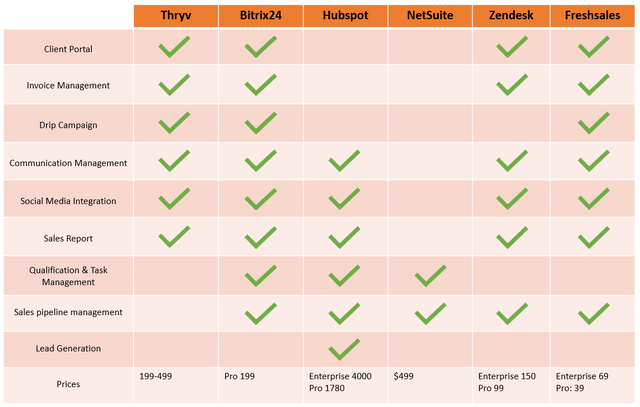

Unlike other CRM solutions that help businesses scale from small to large enterprises, THRY’s focus on the smaller players in the market could be seen as a strength in establishing market dominance without having to go head-on with the larger competitors. Not going to sugarcoat THRY’s SaaS business and go on to display how great its enterprise software is compared to its peers, but we think that THRY will get SMBs the most bang for their buck as compared to its peers. Although the prices for different packages are not publicly available, we think that the packages ranging from $199 to $499 for 2 to 10 users are pretty worth it for anyone looking to start a business and slowly scale it up, averaging about $116 per user for a small business with unlimited document storage. Compared to Bitrix24 and Freshsales, both charge $199 for 1024GB worth of storage in total and $69 for 100GB per user.

Comparison of Features Among Peers (Capterra, ITClick)

Functionality-wise, THRY accomplishes the basic capabilities that other CRMs are able to provide business owners: monitoring their reputation online by getting customers’ feedback, detailed insights into the performance of their marketing campaigns, and scheduling personalised announcements and campaigns. Overall, it is a water-tight CRM tool for serious business owners as it does not provide any free versions of packages. This means that its sales and customers can be organically reported and forecasted, without the interference of free accounts with little to no recurring revenue that could skew projection figures.

Valuation

Before we begin, we would like to put a disclaimer that our projections are based on a bear-case scenario. This means that the numbers are more conservative than what the management could have guided, or discounting any huge growth potential 5 years from now.

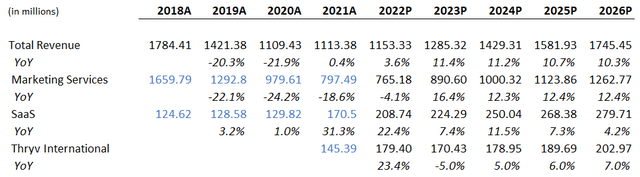

Revenue Drivers (Author’s Spreadsheet)

THRY’s 5-year target for the SaaS business segment is quite lofty, considering they are targeting 150,000 subscribers as compared to its current 46 clients. We assume that 2022’s revenue for this segment will remain strong for our projections as it is the company’s value proposition to its clients. However, we estimate that its marketing services in the US and Thryv International in the same year will slide between 10-15% year-on-year, considering a broad slowdown in ad spending in the industry. As such, our revenue projections are slightly lesser than the range of total revenues from SaaS and marketing services provided by the company’s management as guidance. We think that there is room for further revision of the band for the company’s guidance for the remaining two quarters, given the current macroeconomic situation in the markets.

Subsequently, we think that THRY’s strategy to sell to higher-spending clients would enable the company to retain a solid foundation of clients during this volatile period, and remain positioned to increase revenue through its clients’ increasing utilisation of add-on features on the Thryv platform after this period. Thus, we projected subsequent SaaS revenues by forecasting a single-digit percentage increase in monthly ARPU and a slight increase in no of clients from 2023-2026.

For marketing revenue, we factored in what the management mentioned in their Q2 earnings call that THRY’s strategy of rolling out its Marketing Center to the wholesales organisation could see fruitions next year, and projected a slight addition of clients from there on. We would be conservative about how many clients THRY would be able to bring on as it has plans to roll out more of such centres, thus growing the figures at a single-digit percentage rate as well. We also believe that its monthly ARPU will continue its downward trend before reaching an inflection point in 2023 as it will take some time for the effects of the Marketing Centre being sold to the whole sales force to be priced in by the company. From there, we see a slight increment in its ARPU projections till 2026 as the company could tap on its Vivial acquisition done in end-2021 to drive ARPU expansion further.

For the Thryv International business segment, we think that revenues for H2 2022 could be affected by a greater decline in business sentiments outside of the US, thus scaling back our projections by double-digit figures for H2 2022. We project a single-digit growth from 2023 onwards in light of changing macroeconomic situations after the consistent rising of interest rates to curb inflation, which could see as a declining trend then.

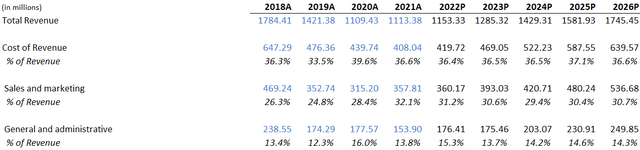

Cost Drivers (Author’s Spreadsheet)

For the cost drivers, we expect THRY’s cost of revenue to decrease marginally this year after taking H1 2022’s earnings into consideration. We think that the company is able to reduce much of its variable and fixed costs in a short period of time, continuing the trend in 2021. However, we anticipate a gradual hike in costs related to this segment as the rollout of the Marketing Centre and expansion of Thryv International would offset the decrease driven by strategic cost-saving initiatives.

For sales and marketing, we think that business sentiment in the advertising space remains gloomy, thus giving our projections a good margin of safety by pricing in the impact of the Marketing Centre gradually from 2023 onwards. We think that the management could remain prudent about promoting its platform before the launch of the Marketing Centre from 2023 onwards.

For general and administrative, we expect a steep increase in the next two fiscal years as part of the initiative to roll out the Marketing Centre, as well as taking into account the bearish market conditions to be conservative with our projections. We are only expecting an increase in cost for this segment in 2024 and beyond, as the company moves forward with the expansion of its Marketing Centre and Thryv International as a whole.

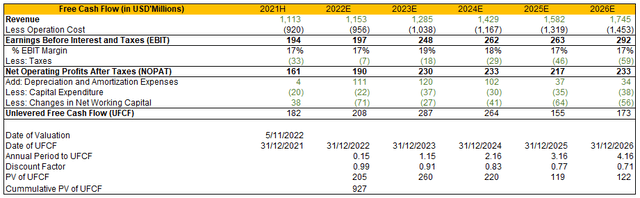

DCF Modelling (Author’s Spreadsheet)

From there, we conducted a DCF model, which accounted for aggressive capital expenditure in 2023 as a result of the roll-out of the Marketing Centre, and a bear case for changes in net working capital as a result of bearish market sentiment till 2023. Despite accounting for the worst-case scenario, THRY’s unlevered free cash flow continues to remain rather consistent in our projections.

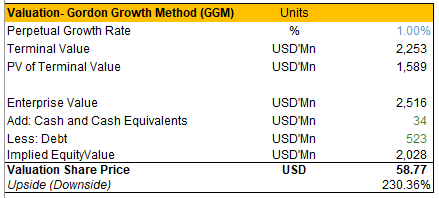

Discounted Cash Flow (GGM Method) (Author’s Spreadsheet)

Our first valuation method would be utilising the Gordon Growth Method to discount its future cash flows and obtain a current price target for THRY. We think that the company could grow at a meager 1% in perpetuity to account for the shift toward its SaaS business segment and focus more on providing value to its clients through SEM and SEO tools. We arrived at a whopping valuation that is more than thrice its current price as of writing this article.

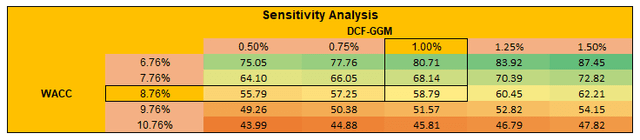

Sensitivity Analysis for GGM (Author’s Spreadsheet)

Even accounting for higher WACC and the lowest growth in perpetuity, THRY possesses great upsides.

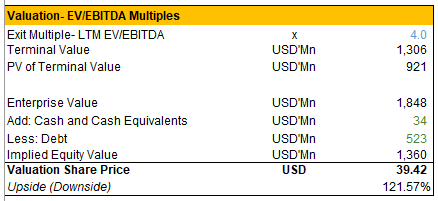

Discounted Cash Flow (Exit Multiple Method) (Author’s Spreadsheet)

To check if our numbers make sense, we conducted another DCF utilising the exit multiple method. We used the EV/EBITDA as an exit multiple for our valuation because it takes into account the company’s accelerated depreciation and amortisation, and benchmarked it to a mere 4.0x. This is taking into account the average of its yearly and quarterly ranges from historical data, which is a conservative and realistic estimate despite it being backward-looking. We arrived at a price target of over 2x its current price per share as of writing this article.

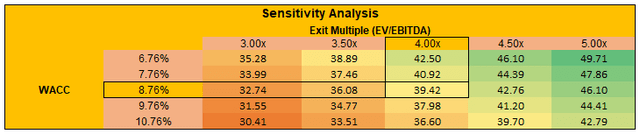

Sensitivity Analysis for Exit Multiple (Author’s Spreadsheet)

Once again, accounting for higher WACC and the lowest exit multiples for THRY since its IPO, THRY is still able to get a good return on investment for its investors in the time to come.

Conclusion

In all, THRY is a relatively obscure stock with an unloved business model, despite everyone almost having come into contact with a Yellow Pages book in the past. Currently, the headwinds facing the SaaS sector and general sentiment towards investing right now may be unfavourable for some, even foolish for others to be putting their money into anything but holding cash right now. However, investors with the appetite to stomach such volatile market conditions could be looking at tremendous upsides in THRY as it continues to provide value to a growing market of entrepreneurs with its own selling points.

Be the first to comment