vernonwiley/E+ via Getty Images

A long climb down the mountain

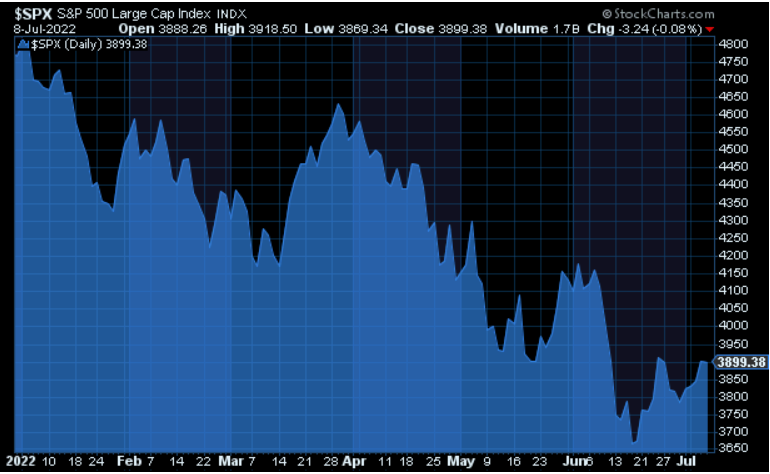

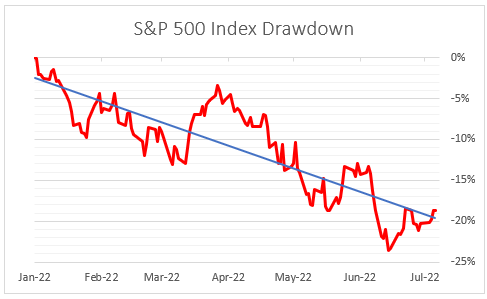

Here is a year-to-date chart of the S&P 500 index. Was the June 16th low of 3666 the bottom, or will this just turn out to be another failed rally? My answer is… who cares? It really doesn’t matter that much whether the bottom is in. If it is, great. Knock yourself out picking up high-quality merchandise at fire sale prices.

Solid and growing businesses are selling for discounts of 50%, 60%, 70%, or more. If you’re waiting for “The” market bottom before you start buying again, you may end up squandering an excellent opportunity. And, if this isn’t the bottom, I don’t think it’s far away.

StockCharts

High quality at fire sale prices

PayPal (PYPL) is on sale for 76% off. Its earnings are growing at 14% per year. It has a margin of safety of 25%. A consensus price target that’s 89% above current prices. And PayPal isn’t going away anytime soon.

RH (RH) is on sale for 65% off. It has a 9% margin of safety, a price target up 38% from here, and a 5-year earnings growth estimate of 27%. This is another solid business that is in the wrong industry at the wrong time. The home furnishing business is the 3rd worst performer out of 60 industries tracked by Zacks. Only apparel and semiconductors are doing worse.

Generac (GNRC) is on sale for 56% off. It has a 14% margin of safety, a price target up 70% from here, and a 5-year earnings growth estimate of 14%. If you think that generator sales will be in a prolonged slump, you probably haven’t been paying enough attention to the increasing frequency of power-killing storms we are living with today.

[Note: all of the estimates in this article are from StockRover.]

Other notable discounts

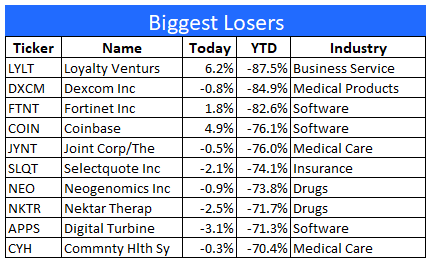

Here is a list of the ten worst-performing stocks on a YTD basis. Some of them I wouldn’t go near, but I do like healthcare, so the three names on the list bear further investigation.

I also like drugs, another beaten-down industry. Do you think we are likely to take fewer drugs in the future? If not, why not do some bargain hunting?

MRK (not on this list) looks especially attractive to me right now. It has a 17% margin of safety, earnings growing at a 12% clip over the next 5 years, but here’s the catch. The stock is near fair value, which means there is not much upside near term.

Microsoft 365; Author

CYH looks intriguing to me. It has an 89% margin of safety, an upside consensus target of 173%, and earnings are expected to grow by 70% per year over the next 5 years.

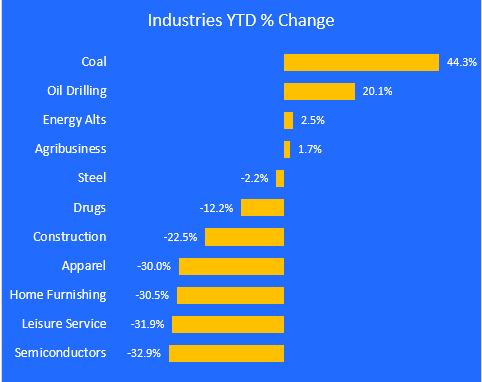

Industry YTD price changes

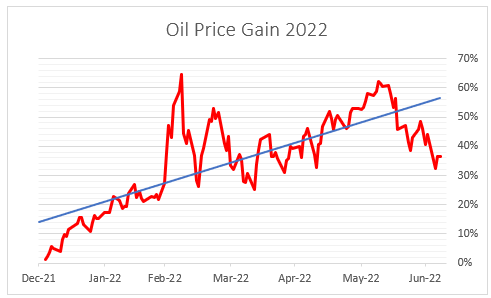

Coal, oil, steel, and other commodities-linked industries have been the top performers this year, although they have recently given back much of the gains from earlier in the year.

Technology-linked industries like semiconductors, software, and IT services have been leading the market lower all year. Barron’s has a positive write-up of the energy space this week, with OXY selected for special praise.

Microsoft 365; Author

For the 2nd half of this year, I still like energy – oil and alts like solar are particularly appealing. I’m not as bullish about coal, however. I still think it will continue to outperform the non-energy industries, but I don’t think it will be able to keep up the wide lead it has over oil drilling, for example.

Other industries I like are defense contractors like LMT, GD, and LHX. As long as the war in Ukraine drags on, these companies should have strong demand for munitions, missiles, rockets, and guidance systems. Putin himself recently said that, and I’m paraphrasing, “I’m just getting started in Ukraine.”

Green shoots?

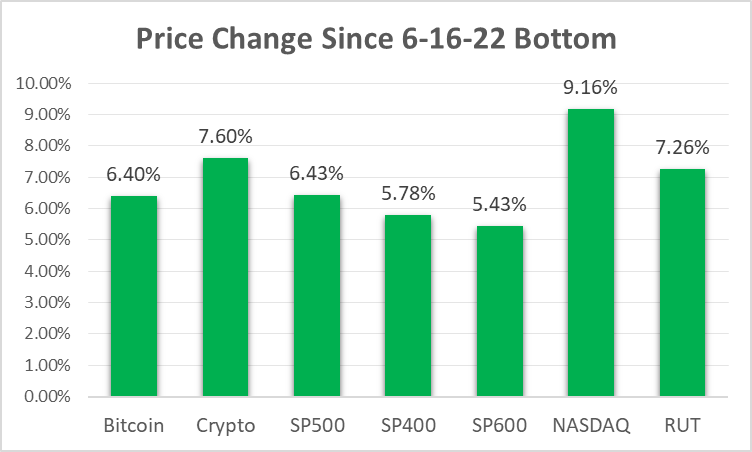

Using the S&P 500 as a surrogate, the stock market is off the floor by 6.4% in the past 15 days. That may not be something to write home about, but it’s better than what we have been doing, which is making a series of lower lows that just doesn’t want to end.

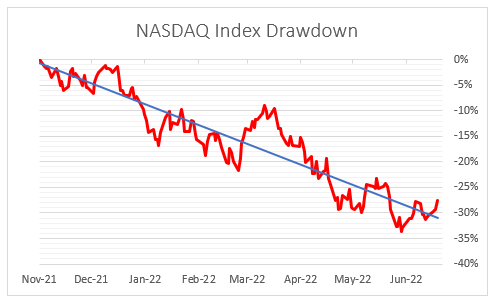

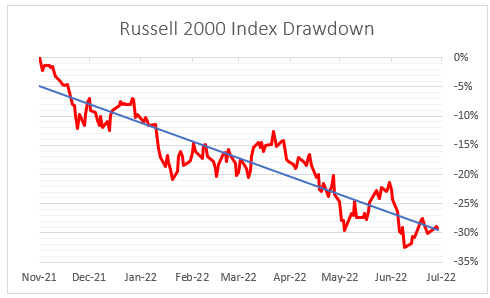

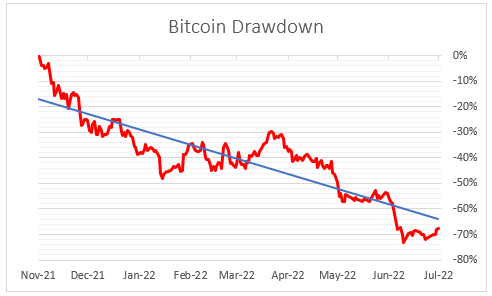

Even the long-suffering Bitcoin has managed to rally 7.6%. But the clear winner in the “bounce from the low” sweepstakes is the beaten-down NASDAQ. The small-cap Russell 2000 has done well too.

Yahoo Finance; Author

Recall that we had an even stronger rally back in March when the market got as far as 11% above the bottom before it crapped out. (That bottom is now higher than where we are now.)

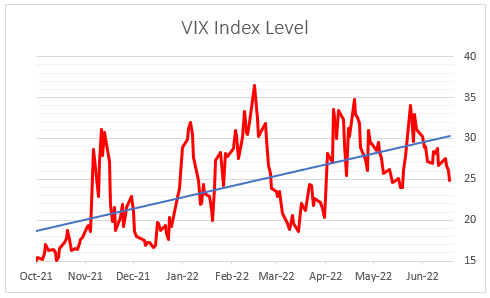

Another positive sign is the fact that the major asset classes are starting to break above their downward-sloping trajectories. A quick look at the below charts shows this clearly. The exception is Bitcoin, which still has some ground to make up first.

S&P 500 (Large caps)

Yahoo Finance; Author

NASDAQ Composite

Yahoo Finance; Author

Russell 2000 (Small Caps)

Yahoo Finance; Author

Bitcoin

Yahoo Finance; Author

Oil

Yahoo Finance; Author

VIX Index (volatility)

Yahoo Finance; Author

Final Thoughts

Whether we have seen the cycle low is debatable, but one thing is clear. The market is trying to tell us something. A 6% rally in the face of rampant fear of an upcoming recession tells me that at least some investors believe that a) we will have a soft landing, or b) if we do get a recession in a few months, it will be brief, shallow, or both.

As long as inflation remains public enemy #1, the Fed will keep raising rates until they see a series of lower prints for the CPI and PCE. With tightening monetary policy in place, the risks to any rallies will be heightened. If the Fed goes too far, or if earnings estimates come down sharply, the market could make a lower low, possibly in a big way.

For now, the dip-buyers are ascendent. It’s their rally, and as long as pullbacks are shallow, this rally could have legs. Investors seem to be discounting the bad news and focusing instead on the good, like Friday’s robust jobs report. When the CPI for June comes out this week, we could get a surprise to the downside. If not, we’ll probably get one next month. I think inflation has reached a peak and will start to come down as the rest of the year unfolds.

Be the first to comment