Baramee Temboonkiat

The cannabis industry operates in a highly regulated environment within a fragmented state-by-state structure in the US. Despite being a multi-billion-dollar business, the product has faced general macro pressures that include conflicting federal and state laws. Cannabis multi-state companies such as Cresco Labs (OTCQX:CRLBF), Columbia Care (OTCQX:CCHWF), Trulieve Cannabis (OTCQX:TCNNF), Green Thumb Industries (OTCQX:GTBIF), and Curaleaf Holdings (OTCPK:CURLF) among others have faced various bottlenecks such as being disallowed to do business with US financial institutions. Additionally, small businesses in the US with direct or indirect involvement with Cannabis are forbidden from accessing loans and other entrepreneurial development programs, especially in states that are yet to legalize the drug. However, 2022 is proving to be a very busy year for marijuana law.

Thesis

Cresco Labs is developing its strategic market footprint by driving organic growth and accretive mergers and acquisitions (M&A) to provide shareholder value. The company believes that its acquisition of Columbia Care will help it attain a material position by adding new markets to the company such as the lucrative states of New Jersey and Virginia. The company is also optimistic about launching new cannabis brands later in the year with additional store openings to boost strategic retail. However, the political terrain is still unresponsive as the US is yet to pass key legislation under the Biden Administration that will smoothen the Cannabis business and make this stock worthwhile in the long run.

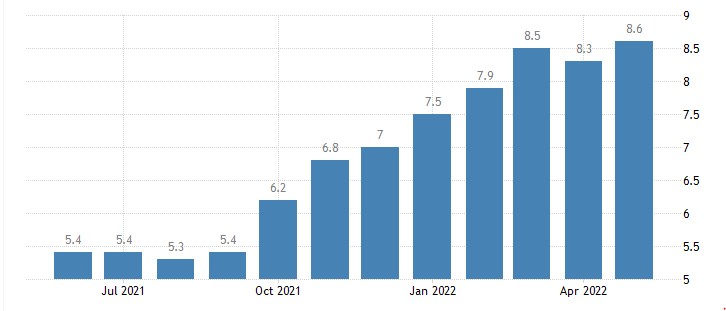

The share price of Cresco Labs is trending 72.54% lower in the one-year analysis translating to almost 300% below the 52-week high. At the outset, the stock is yet to reach its dominant levels primarily due to the challenging consumer environment marked by shrinking wallets. The annual inflation rate in the US jumped to 8.6% in May 2022, the highest in 40 years.

Trading Economics

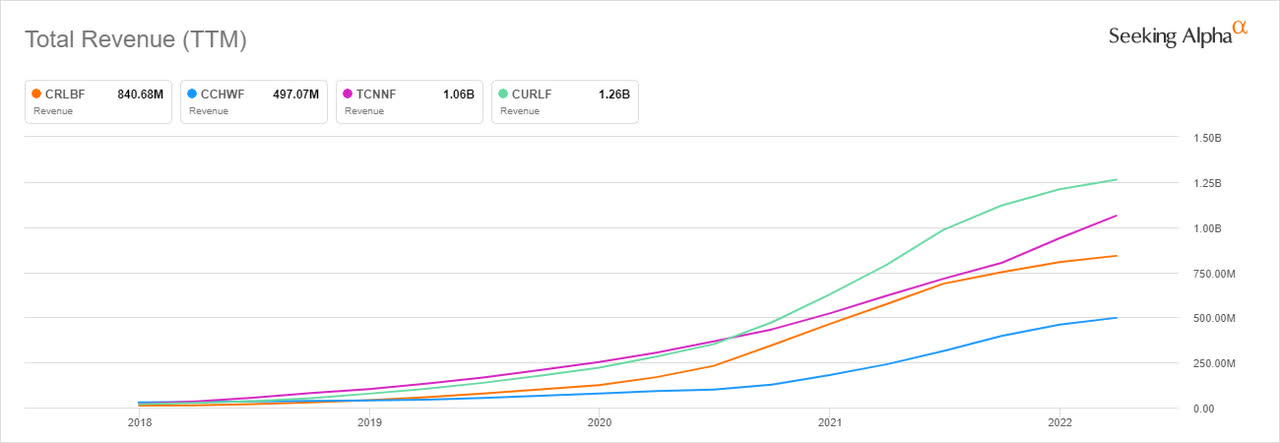

However, inflation may not be the direct reason for the decline in cannabis stock prices, seeing that companies such as Cresco Labs are hitting record revenues. It may come as a shock to investors that CRLBF still trades at $3.06 despite clocking revenues above $840 million in the quarter ending March 2022 and a market cap of $1.22 billion. The same growth was replicated across other cannabis players.

Seeking Alpha

We can rightly deduce that the cannabis sector appears to be somewhat immune to the impact of inflation (on the surface) seeing the direct relationship between inflation and revenues. Marijuana prices have been on a downward trajectory meaning that many factors come into play before dissecting the low marijuana prices adopted by the market.

Rightly put, the price of cannabis is majorly influenced by the maturity of a state’s cannabis legislation. In states such as Massachusetts, which are still in the early stages of cannabis legalization, wholesale marijuana prices can go as high as $3,000 per pound. In contrast, states that have legalized cannabis for a while such as Colorado will have lower-priced marijuana at $1,000 per pound.

Before we consider the legal processes in line that may have some implications on the cannabis business, we will first recapitulate Cresco’s financial performance for Q1 2022.

Financial Results

Cresco’s quarterly revenue declined 1.6% as of March 31, 2022 (to $209.5 million) translating to a 20.9% decrease in the gross profit to $102.5 million in the quarter. Further, the company’s operating income was also reduced by 43.17% to $20.8 million. This decline solidified Cresco’s negative income status by 86.4%. Cash and short-term investments also fell 19.78% to $179.3 million from $223.5 million realized in the quarter ending on December 31, 2021.

By calculation, it is seen that Cresco’s cash balance can only support the company for the remaining 12 months and will need to raise new money by March 2023. The company used up $1.9 million in operations and an additional $171.4 million as CapEx (TTM) in the lead-up to March 31, 2022. With the cash at hand at $179.3 million, it means Cresco will need to increase its stock dilution or increase its debt balance which currently stands at $640.5 million.

Cresco Labs’ total retail footprint now stands at 50 after it added 3 new stores in Florida and an additional one in Pennsylvania in the quarter. It seems that these new stores took up a large number of capital expenditures. The adjusted EBITDA stood at $51 million representing 24% of the quarterly revenue and a 45% increase from the previous year. Collectively, Cresco operates in 10 states across the US, with 21 production facilities, 51 retail licenses, and 50 owned dispensaries.

On the main front, wholesale revenue hit an upside of $95 million with Cresco’s flower, concentrates, and vape categories taking the number 1 spot in branded cannabis products. Additionally, retail revenue also surged 44% (YoY) to $119 million with up to $2.5 million recorded per average store open within the quarter. Same-store sales also surged 9% (YoY) indicative of strength and resilience despite a slow start to the year with reduced gross profit and lower net income.

Columbia Care Acquisition

Investors are ecstatic after Cresco received overwhelming approval for its acquisition of Columbia Care in an all-stock transaction. In a shareholders’ meeting conducted on July 8, 2022; Columbia Care stockholders approved the business combination between Cresco and the company bringing on board experienced cultivators, manufacturers, and providers of quality cannabis brands in the US.

Columbia Care’s quarterly revenues were almost half the amount attained by Cresco at $123.1 million while gross profit jumped 105.1% to $56.6 million. Still, CCHWF needed this transaction to handle its dwindling finances since it had $574.1 million in debt against a cash balance of $176.2 million. However, in terms of asset cover, it is vital to note that Cresco is getting more in return. Up for grabs are 19 licenses in 18 U.S jurisdictions and the EU. Further, CCHWF operates 131 facilities including 99 dispensaries and 32 cultivation and manufacturing facilities as well as those under development.

Still, Columbia Care’s cash flow was already in the red zone. Both operations and CapEx used up $235.7 million against a cash balance of $176.2 million. The company had until October 2022 to deplete its cash balance. Further, it had already issued 399.5 million in outstanding shares meaning further dilution in search of more capital would have plunged the share price under $0.50 as it still currently trading under $1.60.

Legislations in the Pipeline

Investors are upbeat that the passage of the SAFE plus Banking Act would allow cannabis businesses to access the US banking system before the close of 2022. But the reality on the ground is that the US Senate as it stands does not have enough votes to pass a sweeping marijuana decriminalization bill. There appears to be a disconnection between the House of Representatives and the US Senate over the passage of this Act.

In a letter by Senator Jacky Rosen, the Senate Appropriations Committee was asked to allow cannabis businesses to access business loans through acceptance by the U.S Small Business Administration (SBA) in the fiscal year 2023. As it stands, the SBA forbids all small businesses with direct or indirect involvement with cannabis from taking advantage of loans and entrepreneurial development programs. The Senator’s letter is in itself a channel to ensure the federal government gets to partially agree to guarantee a loan to budding businesses that are currently categorized as illegal entities based on their products. The end game is to get investors and politicians into the cannabis business discussion as a social-equity entity. It will lead to a change in federal law and thus help to provide SBA loans to cannabis businesses in the long run.

Takeaway

Approval of cannabis businesses in the US is still a long way off despite various states having legalized the drug for both recreational and medicinal uses. Investors are hopeful that cannabis will be decriminalized so that they can begin using the US banking system. However, as it stands, the SAFE Banking Act appears to be the best bet for investors even if cannabis does not undergo full legalization. For Cresco Labs, its merger with Columbia Care is seen to be of greater help to the latter in this transaction. Still, there are many add-ons such as new markets for the company which are considered timely in revenue growth. Still, the company needs to modify the pricing strategy to ensure it not only grows its revenue but also maximizes its profit margins. For these reasons, we propose a hold rating for the stock.

Be the first to comment