JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

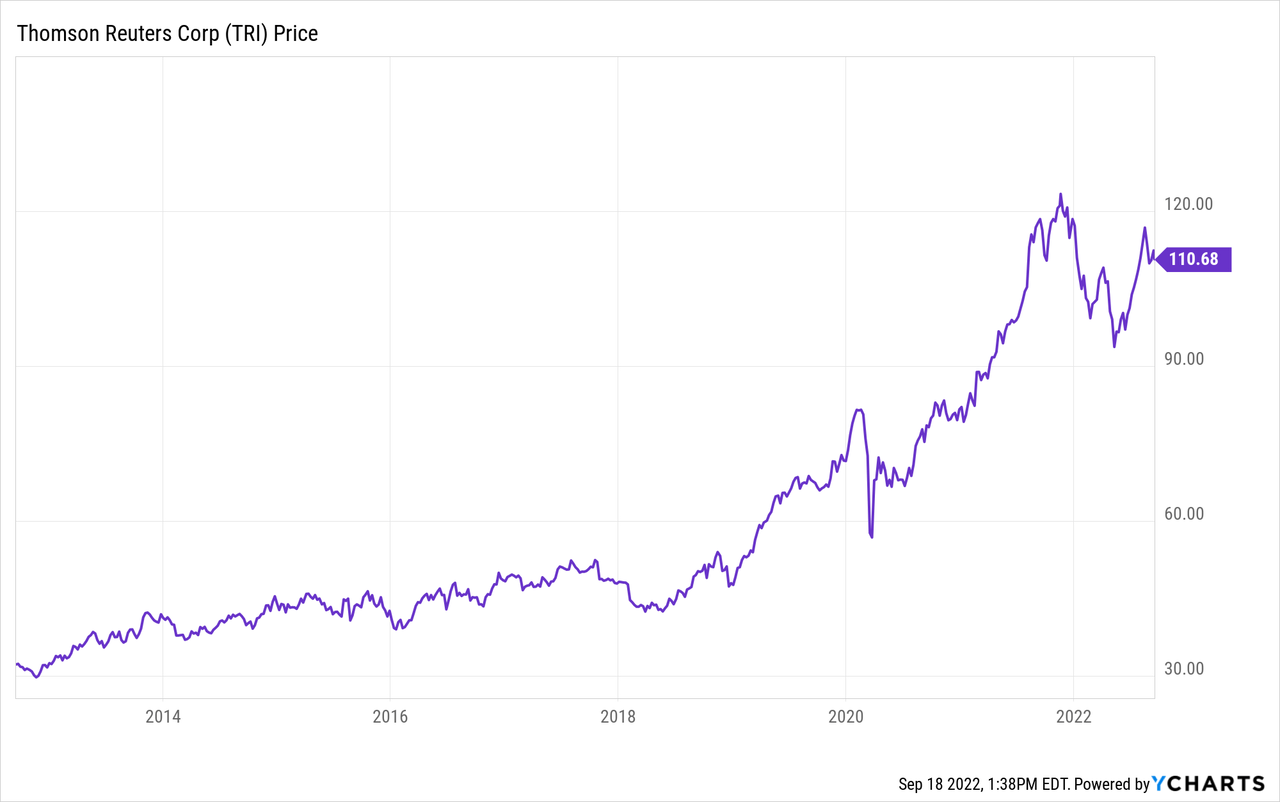

Thomson Reuters (NYSE:TRI) is one of the world’s largest business info service providers. It specializes in legal, tax, and compliance software and services, alongside the global renowned news outlet. The company has been a steady compounder, up over 250% in the past decade, easily outpacing the S&P index’s 165%. The company is currently operating in a large and growing TAM. It has a leading market position with a robust recurring revenue stream. It is also seeing tailwinds from cloud transition, increasing legal & tax complexity, and higher info & tech spend. While I do like the company’s prospects, the current valuation appears to be expensive when compared to other peers, which limits the potential upside. Therefore I rate the company as a hold and will wait for a better entry point.

Why Thomson Reuters?

Thomson Reuters is a global conglomerate with a strong presence in the legal, tax & accounting, news & media, and corporate space. It sells electronic content and services such as software, research, and workflow tools to professionals, firms, and corporations. The company currently has approximately 500,000 customers across the globe.

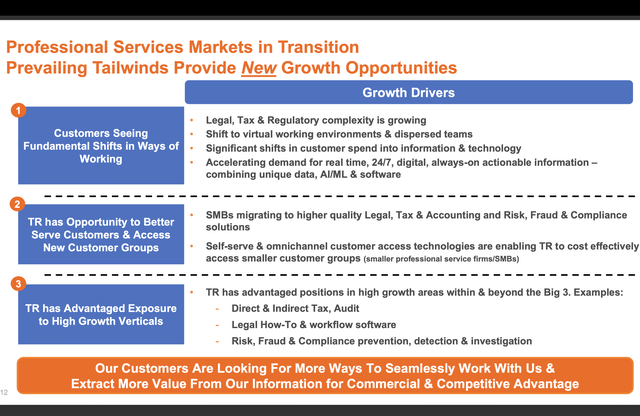

Legal is the company’s main segment, accounting for around 43% of total revenue. It provides solutions and software for legal research, data, marketing, resources, and management. Thomson Reuters is currently ranked number one in the global legal market, with all of the Global 100 companies being its customers. Tax and accounting is another segment the company focuses on, offering solutions such as accounting and auditing software, accounting firm management software, and tax technologies to firms worldwide. According to the company, the current TAM (total addressable market) combined for all segments is estimated to be around $29 billion and is growing at a 5-year CAGR of 6%-9%.

As legal & tax complexity continues to grow, professionals and firms now require better software and tools to handle the workload. Existing customers are also seeing better efficiency and higher ROI (return on investments) from these solutions and continue to increase their spending. This as a result is boosting the demand for Thomson Reuters’ industry-leading products.

Steve Hasker, CEO, on market tailwinds

we’re starting to benefit from meaningful tailwinds driven by a step change in complexity of regulation and compliance in our Legal, Tax and risk-related markets. We believe these tailwinds are in the early innings and position us well to continue our recent momentum over the next few years.

Thomas Reuters is also benefiting from the digital transformation in the legal, tax, and accounting industries. More and more firms are now adopting the change and moving their workloads onto the cloud. In 2021, only 37% of Thomson Reuters’ revenue comes from the cloud. The number has increased significantly to 60% this year and is forecasted to hit 90% next year. The ongoing shift will continue to generate substantial tailwinds for the company.

Financials

Thomson Reuters reported its second-quarter earnings last month and the results are mixed. Top-line growth was underwhelming but the bottom line was very impressive.

Steve Hasker, CEO, on second-quarter earnings

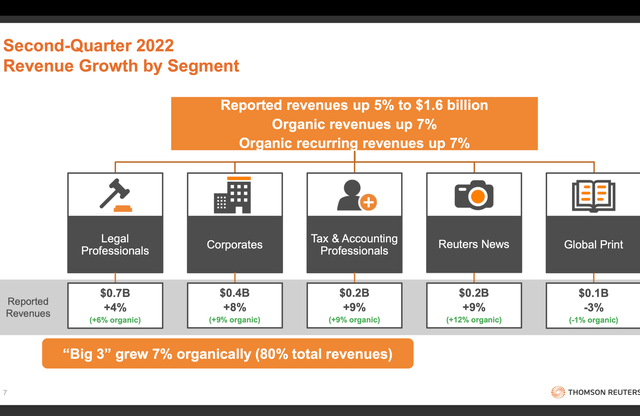

I’m pleased to report the momentum that has been building in our businesses continued in the second quarter with healthy sales and revenue ahead of our expectations. 4 of our 5 business segments again recorded organic revenue growth of 6% or greater and total company organic revenues rose 7%. Our Big 3 business segments also grew 7% organically.

The company reported revenue of $1.61 billion, up 5% YoY (year over year) from $1.53 billion, or 7% on a constant currency basis. The growth was largely driven by the increase in the tax & accounting and news segments, which were both up 9% to $217 million and $188 million respectively. Revenue from the legal segment was $700 million, up 4% YoY, while revenue from the corporate segment was $373 million, up 8% YoY. The print segment was the only segment that posted negative growth, down 3% YoY to $142 million.

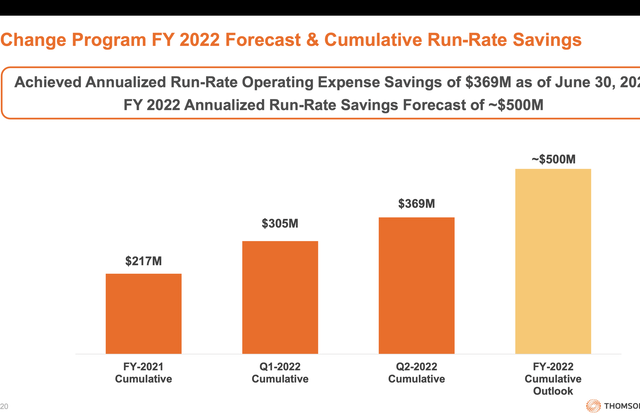

The bottom line was very strong. Despite facing inflationary pressure, operating profit grew 24% YoY from $316 million to $391 million. Adjusted EBITDA was $561 million compared to $502 million, up 12% YoY. Adjusted EBITDA margin improved 200 basis points from 32.7% to 34.7%. Adjusted EPS for the quarter was $0.60, up 25% from $0.48. The overall increase in the bottom line is attributed to better cost and expense control. Annualized run-rate operating expense savings amounted to $369 million during the quarter, and management expects the figure to hit $500 million for FY22.

The company continues to return cash back to investors through buybacks. A new $2 billion share repurchase program was announced in June and $394 million was spent during the quarter. The reduced share count will also help boost the EPS figure moving forward.

Valuation

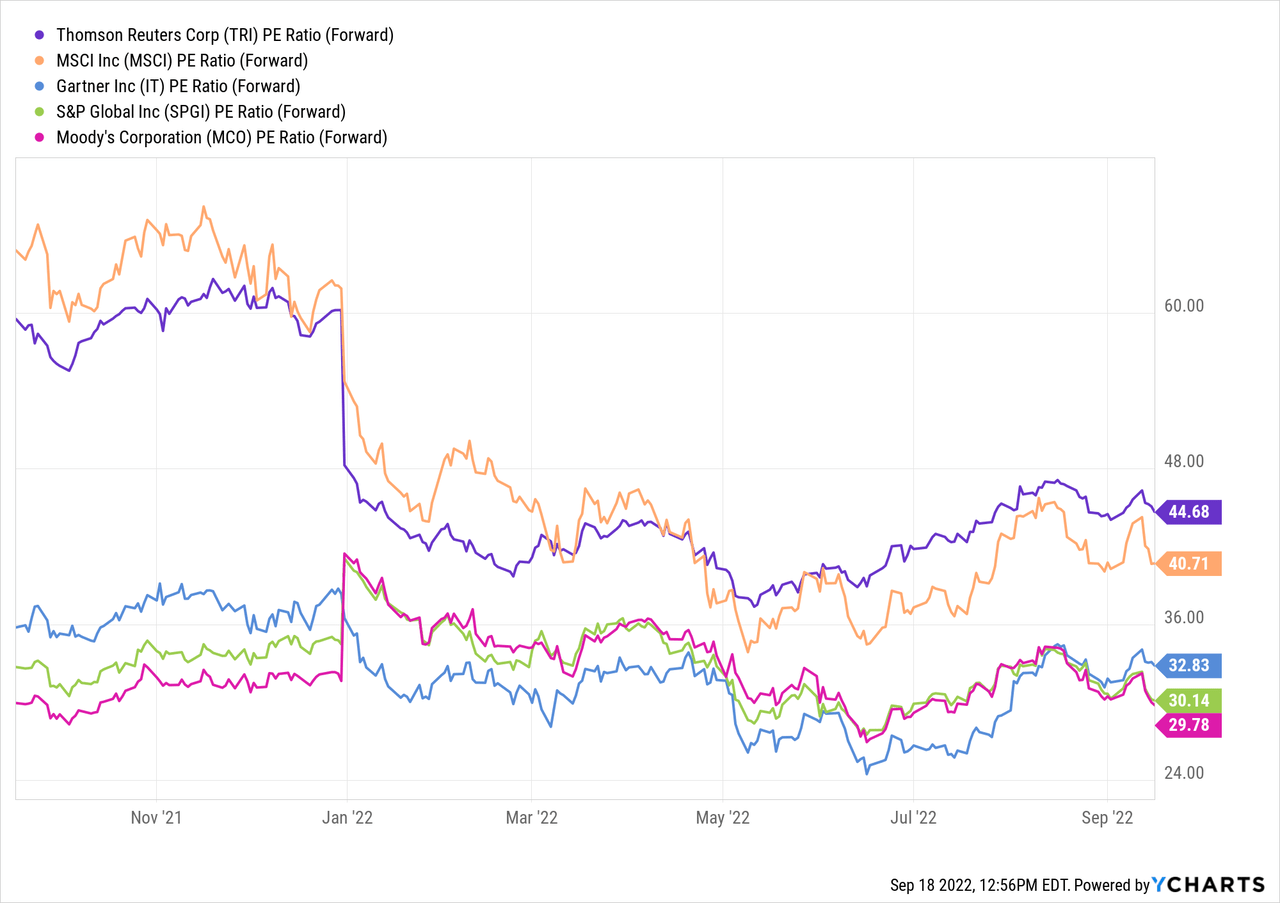

My main issue in regard to Thomson Reuters is its valuation. First, it is worth noting that the research and insight sector generally has a much higher multiple than other sectors. This is due to the SaaS (subscription as a service) nature of these businesses which generate consistent recurring revenue with exceptional margins. The sector is also much less cyclical than others and can often be classified as non-discretionary spending, as researches and insights are essential to all businesses. Therefore I am only comparing Thomson Reuters to peers within the sectors, as multiples will always look elevated compared to companies in other sectors.

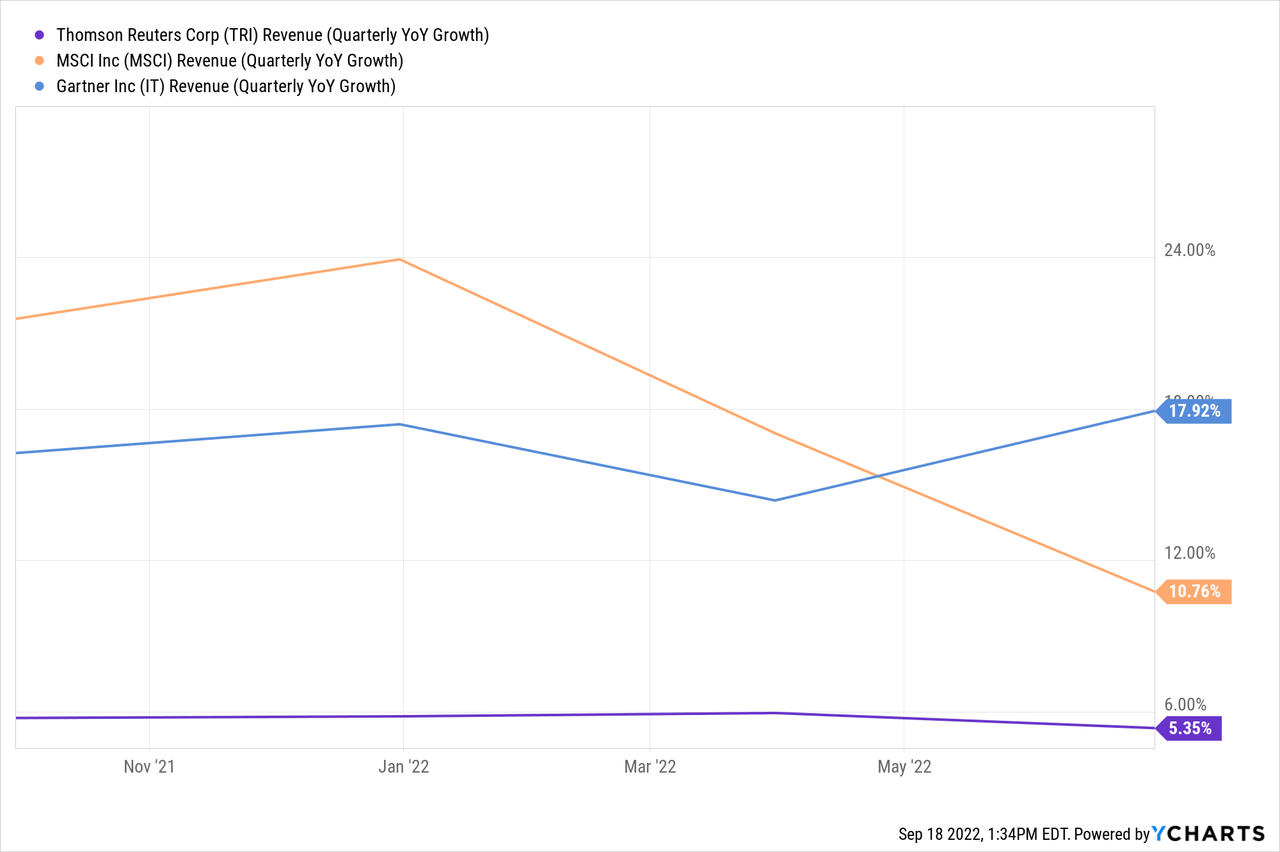

Thomson Reuters is currently trading at a forward P/E ratio of 44.7. This is a significant premium even when compared to other research and insight companies such as MSCI (MSCI), S&P Global (SPGI), Gartner (IT), and Moody’s (MCO), as shown in the first chart below. The company’s current multiple is 20.4% above the sector’s forward P/E ratio of 35.6. MSCI and Gartner have also been posting higher growth rates of 10.8% and 17.9% respectively compared to Thomson Reuter’s 5.4%, as shown in the second chart below. While I like Thomson Reuters’ prospects, the current valuation appears to be very stretched, which limits its upside moving forward.

Currency Headwinds

Before I get to my conclusion, I think FX’s impact is something investors should keep an eye on moving forward. Due to its global presence (currently, around 30% of total revenue is generated outside of the US), Thomson Reuters is currently facing currency headwinds as the dollar continues to spike. The company already took a 2% hit on revenue due to unfavorable FX in the recent quarter. If the dollar persists at high levels, the company may see a further impact on its financials. I don’t see this as a huge risk for the company but it is definitely something worth noting.

Conclusion

In conclusion, I think investors should be patient and wait for a better price point before entering. Thomson Reuters is a great business with a large addressable market. The company is also benefiting from strong tailwinds such as migration to the cloud and increasing legal & tax complexity. Earnings in the recent quarter were also pretty solid, with the bottom line being the highlight of the report. However, valuation continues to be the hurdle here. The current multiple is very elevated compared to peers yet revenue growth appears to be slower. I believe the current valuation offers limited potential upside therefore I rate the company as a hold.

Be the first to comment