hamzaturkkol/iStock via Getty Images

The Federal Reserve spent a lot of time last year trying to convince investors that it was going to tighten up on monetary policy in order to fight the growing threat of inflation.

But, as the Fed continued to purchase $120.0 billion in securities every month throughout the year, investors found it hard to believe that the Fed was really going to do what it said it was going to do.

Then, in October, the Federal Reserve started to reduce the amount of “excess reserves” that were in the banking system through the use of reverse repurchase agreements and the investment community began to pay attention.

And, some markets began to peak as the Fed continued to act and short-term interest rates tended to react to the Federal Reserve’s efforts.

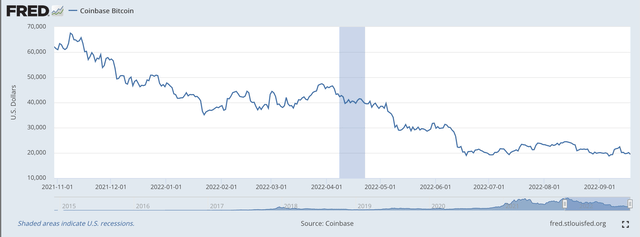

For example, the price of Bitcoin (BTC-USD) peaked on November 8, 2021. For that day, the crypto-currency topped out at $67,510.

Bitcoin (Federal Reserve)

Bitcoin, because of its risky nature, was one of the first assets to experience a falling price due to the changes taking place in the financial system.

As just an example, the S&P 500 Stock Index also peaked due to the efforts of the Federal Reserve.

However, the peak for this index came on January 3, 2022, just about two months following the peak reached by Bitcoin.

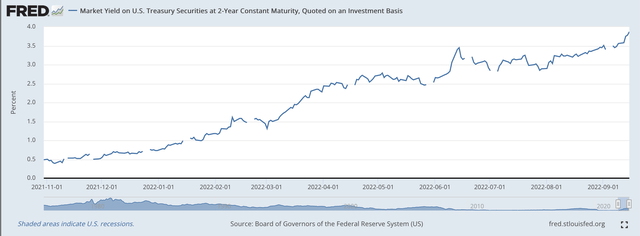

Evidence that the Federal Reserve’s efforts were having an effect on the financial markets, we see that the yield on the 2-year U.S. Treasury note began to creep up in November and December 2021.

One can see from the following chart, however, that the yield on the 2-year security really didn’t begin to move up faster until early February and then things started to pick up even further.

U.S. Treasury Yield–2-year (Federal Reserve)

It was in the middle of March that the Federal Reserve started to raise its own policy rate of interest. (I will discuss this a little more later on.)

But, now investors were seeing how the Fed’s actions were impacting riskier assets.

One can see from the above chart that the decline in the price of Bitcoin began to accelerate in April, May, and June as the markets moved to move even further from riskier assets to safer assets.

In fact, there was a movement of international funds into “safe assets” as risk-averse investors took money out of riskier global investments and channeled them into the safe haven of the United States.

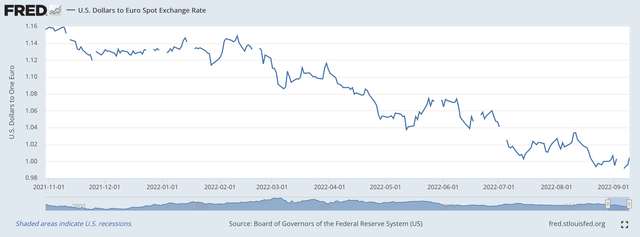

Here we see the movement into the U.S. dollar as the dollar appreciated in value against the Euro, the British Pound, and other currencies falling behind the Federal Reserve in the effort to fight inflation.

Check this chart out.

In November 2021, just when the price of Bitcoin was peaking out, it cost more than $1.1600 to purchase one Euro.

In July 2022, the U.S. dollar/Euro exchange range began to hang around parity… one dollar for one Euro.

U.S. Dollar/Euro Exchange Rate (Federal Reserve)

So, what do we have here?

The Federal Reserve moves to tighten up on monetary policy.

Market rates of interest rise.

The value of the U.S. dollar becomes stronger.

And, the price of risky assets fall as investors move money from riskier assets into safer places to put their money.

Everything seems to fit.

Fed Meeting This Week

And, the Federal Reserve is having a meeting of the Federal Open Market Committee this Tuesday and Wednesday, September 20 and 21.

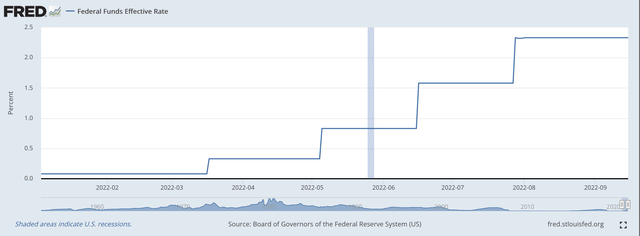

So far this year, the Fed has moved the range for its policy rate of interest four times.

This week the expectation is that the Fed will raise the range by at least another 75 basis points to go on top of what it has already done.

Effective Federal Funds Rate (Federal Reserve )

Further increases are expected this year.

In fact, many surveys have shown that analysts expect the range for the fund’s rate will move well up into the 4s this next year.

The yield on the two-year Treasury note, now just below 4.00 percent, will also rise well into the 4s.

And, if this happens, the value of the U.S. dollar can be expected to stay strong against the British Pound and the Euro.

More Fed moves will be followed quickly by the Bank of England and the European Central Bank as they work to keep the Fed’s policy rate from getting too far ahead of movements in their policy rates.

But, the value of the U.S. dollar should continue to rise, even if a little more slowly.

Given the results from the last twelve months, these moves should not be too good for the value of Bitcoin.

Again, the market movement will be from riskier assets to less-risky assets as investors become more cautious during this period of monetary tightening.

Right now, the investment in cryptocurrencies is considered to be quite risky, especially as many analysts believe that the Federal Reserve will follow up on its promise to do what is necessary to get the inflation rate back down to the Fed’s target of 2.00 percent.

One additional comment: investors are much more sensitive to these relationships now than they were in November 2021.

Consequently, I believe the market will be much more volatile than it has been over the past two years.

Be the first to comment