cagkansayin

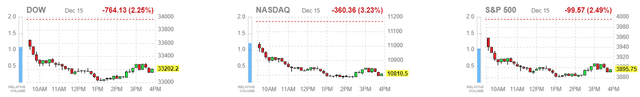

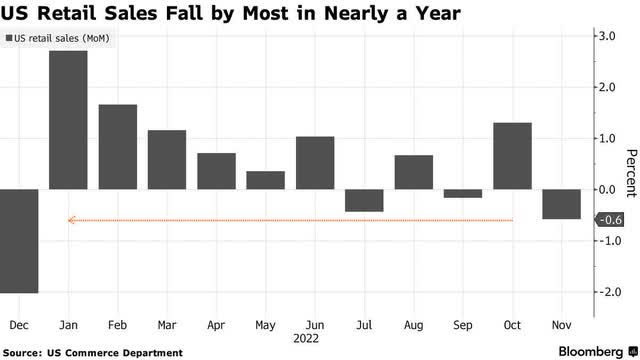

A weakening rate of economic growth is unavoidable in the process of taming inflation. Therefore, it should come as no surprise that retail sales declined in the month of November, especially following the outsized gains we saw in October. In fact, this should be welcome news for investors, because it shows that demand is finally starting to ease, which is what the Fed wants to see to rein in inflation. The problem now is that investors have been bombarded with recession forecasts to such an extent that they are hypersensitive to any high-frequency economic data that falls short of estimates. At the same time, a drop in weekly unemployment claims, which should have helped assuage those fears, aggravated concerns about higher short-term interest rates from the Fed. All news was bad news yesterday.

The retail sales number was not a reason for concern. Consumers continue to shift spending from goods to services, and the retail sales report is primarily focused on goods categories. The evidence of this was the 0.9% increase in spending last month at restaurants and bars, which was the fourth consecutive monthly increase for this service category. We need to see the much broader personal spending report for November to better judge the health of overall consumer spending.

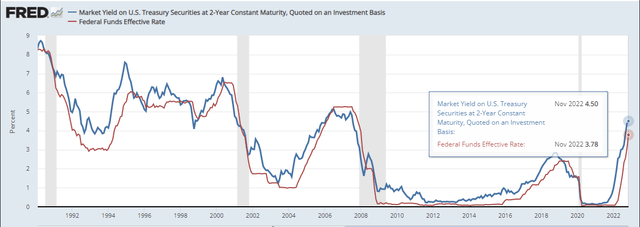

Stocks sold off sharply on yesterday’s news, but the bond market seems far less concerned. In fact, the 2-year Treasury yield has barely budged since Chairman Powell’s hawkish outlook for monetary policy on Wednesday, refusing to reflect what the Fed asserts will be a much higher terminal rate for Fed funds next year. As seen below, the 2-year yield consistently LEADS the Fund funds rate, and it has fallen from a peak of 4.5% in November to its what is 4.25% today. Unless the 2-year yield starts to rise meaningfully, it is telling me that Fed funds will never reach 5%.

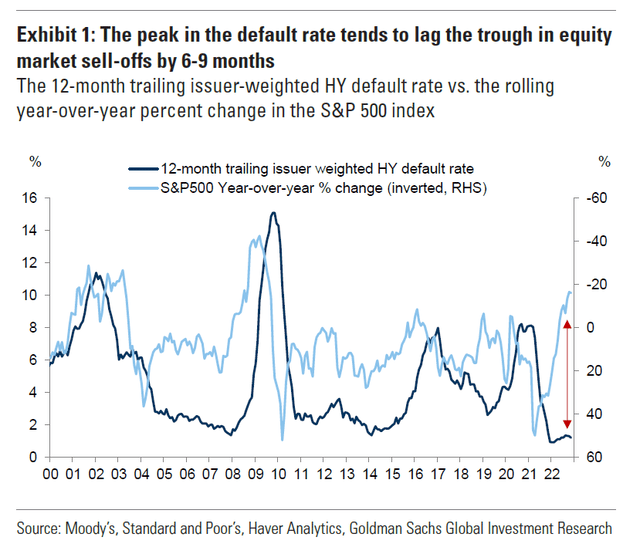

Additionally, if we are on the cusp of an economic contraction, it is not being reflected in the highest-risk segment of the bond market. High-yield bonds, otherwise known as junk, look to be completely unphased with a default rate of just 1.2% over the past 12 months. That is extraordinarily low compared to the 4.5% long-run average, which includes expansionary periods. Granted, defaults tend to lag moves in the stock market, but the S&P 500 has been declining for most of 2022, yet default rates remain near multi-decade lows.

The bond market has a tendency of being far more perceptive than the stock market when it comes to the reality on the ground. It is currently defying the Fed’s outlook for a far more restrictive monetary policy, as well as Wall Street’s forecast for a recession in 2023.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment