scigelova/iStock via Getty Images

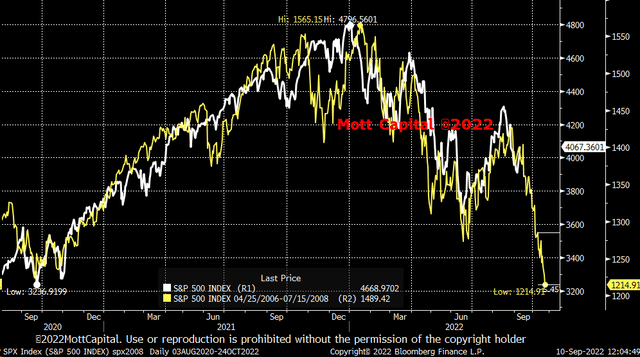

If history has any say, this week may be one of the most pivotal weeks in this 2022 bear market cycle. The S&P 500 of today continues to play very close to the 1937, 2000, and 2008 bear market cycles. All of those previous cycles called almost perfectly the June low and mid-August high, and now it tells us that this week will determine whether this bear market continues or morphs into something else.

Of course, this week is the all-important CPI report, and while it is not likely to change the Fed’s rate hike decision for September, it could be very influential in how the Fed views monetary policy. Based on analyst consensus estimates, the consumer price index is forecast to fall by 0.1% m/m and rise by 8% y/y. The core component of CPI is forecast to rise by 0.3% m/m and increase by 6.1% y/y.

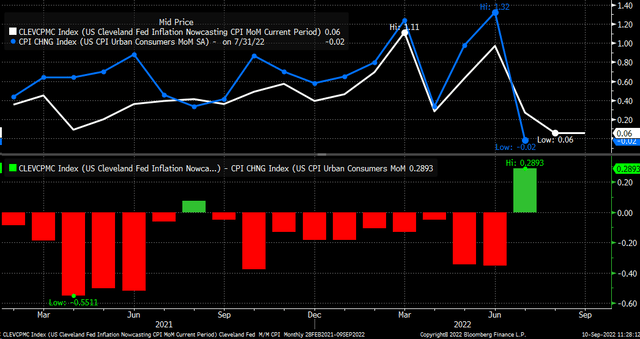

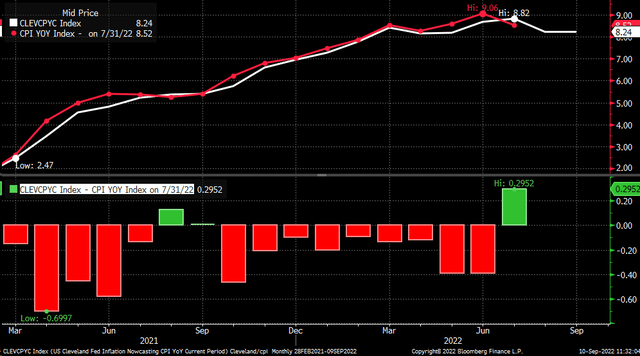

The Cleveland Fed

There is a chance that CPI comes in higher than expected on those month-over-month and year-over-year estimates. Since February 2021, the Cleveland Fed’s estimates for CPI have been a good predictor of the official CPI report. In fact, over that time, the Cleveland Fed’s estimates have been lower than the actual m/m every time but twice. The only time the Cleveland Fed estimates were higher than the CPI report were in August 2021, and the second was July 2022. The Cleveland Fed estimates that CPI rose by around 0.06% in August, which would be almost two-tenths higher than consensus estimates.

Additionally, the Cleveland Fed estimates an increase of 8.2% for August when measuring on a year-over-year basis. Also, since February 2021, the Cleveland Fed estimates have come below consensus estimates three times in August, September 2021, and July 2022. The miss in September 2021 was by a marginal amount of less than 0.01%.

Based on those Cleveland Fed estimates, the CPI inflation rate may come hotter than the consensus estimates.

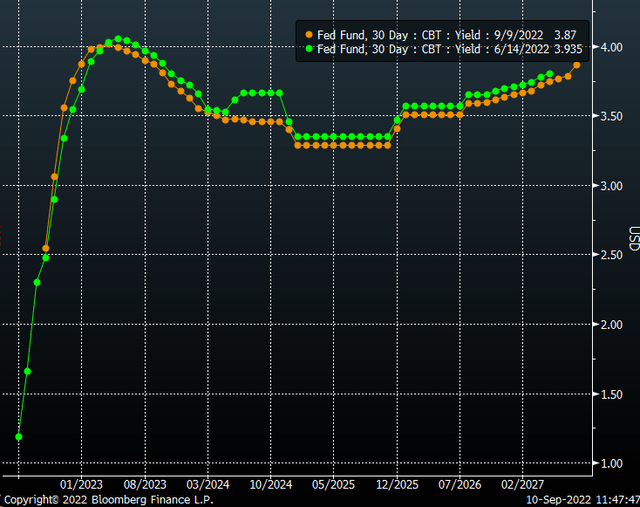

Higher Terminal Rates

Many Fed governors are already talking about a terminal Fed Funds rate of 4% or higher, following the better-than-expected job report. A CPI report that comes ahead of expectations is likely to push those interest rate estimates higher and is likely to be reflected in the Fed dot plot projections at the September FOMC meeting. The Fed Funds futures are taking the potential for a 4% Fed Funds rate seriously and reflect a peak rate of 4.01% by April 2023. That has the Fed fund futures back to nearly the exact positioning heading into that June FOMC meeting and peak hawkishness.

2008

It will make this week the most pivotal week of the year and will likely set the path of monetary policy for the next three months. The cycle of 2022 appears to track that of 2008 the most closely to this point, and that comparison also has this week as the pivotal week.

The comparison shows the S&P 500 turning sharply lower at some point this week. While many would say that we are not on the verge of a financial crisis today, and we are not, one must remember at this point in 2008, we were not on the cusp of a financial crisis either. The 2008 comparison corresponds with June 2008, which was pre-Lehman. The meltdown in June 2008 was just after a critical Fed minutes release showed the Fed downgraded its economic growth projections and raised its inflation projections. In those minutes, the market saw a recession on the horizon and a Fed that was not likely to cut rates further due to the high inflation rates.

In this case, a hotter-than-expected CPI could be what ends up being one of the most pivotal points in this whole saga that has played out over the last several months of 2022. In contrast, a weaker-than-expected CPI print could very well prove to be just as effective in setting the course of the market for the year’s balance.

A pivotal week this will be.

Be the first to comment