alfexe

The Lion Electric Company (NYSE:LEV)(TSX:LEV:CA) announced two new facilities, and management is signing new agreements with governments. In my view and that of other investment analysts, the company will most likely experience significant revenue growth and positive free cash flow from 2024. There are obviously risks, and LEV is not for every investor. However, under normal conditions of manufacturing and EV production, my discounted cash flow model resulted in fair value that exceeds the current market price.

The Lion Electric Company: New Manufacturing Facilities Will Likely Enhance Production And Stock Valuation

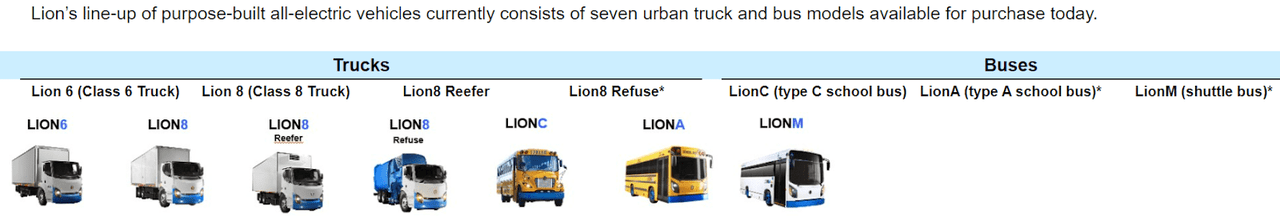

The Lion Electric Company designs, develops, manufactures, and distributes all-electric medium- and heavy-duty urban vehicles. The Lion Electric is a revenue generating company currently offering seven urban trucks and bus models.

Company Report Q2 2022

There are two main catalysts for the company’s growth that I think will make a difference. First, The Lion Electric expects to build a new 900,000 sq.ft. manufacturing facility in Joliet, Illinois. In my opinion, analysts will do good by following the company’s announcements very carefully. Keep in mind that production in this facility is expected by the end of 2022. Let’s remind readers that more production facilities will likely mean more revenue growth and more stock valuation:

The Company now has taken possession of the Joliet Facility, and commercial production of school buses is expected to begin towards the end of 2022. Source: Company Report Q2 2022

Besides, the company is expected to build a new battery manufacturing plant and an innovation center located in Quebec. With production expected towards the end of 2022, new capacity would mean 5 gigawatt hours more to electrify trucks and buses:

The battery manufacturing plant will be highly automated and is expected to begin production of battery packs and modules made from Lithium-ion cells towards the end of 2022, with a planned annual production capacity at full scale of 5 gigawatt hours Source: Company Report Q2 2022

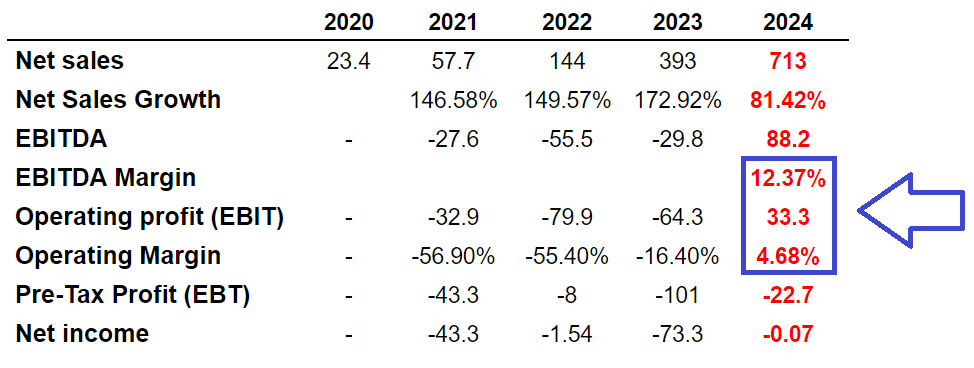

Expectations From Analysts Include Double Digit EBITDA Margin From 2024

I decided to review the company’s financials after I had a look at the expectations of other analysts. In two years, most investors are expecting not only double digit sales growth, but also an EBITDA margin close to 12% and operating margin around 4%.

marketscreener.com

In my view, as soon as more investment analysts review the expectations of the market, the demand for the stock will increase, and the stock price may follow. Considering this opinion, I decided to run my own financial models.

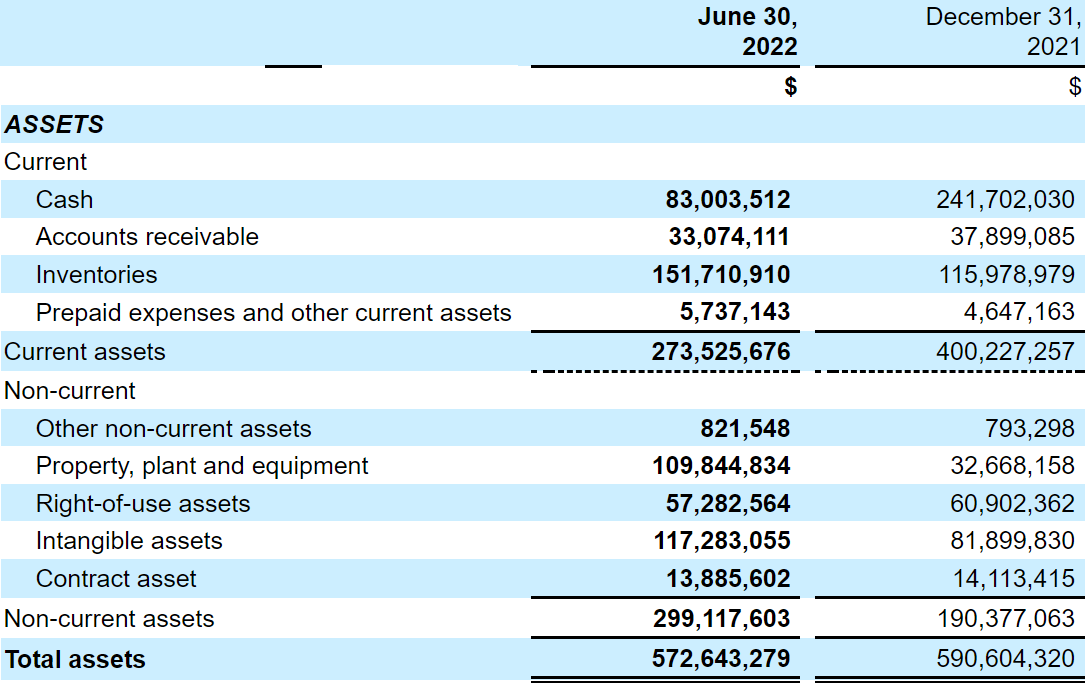

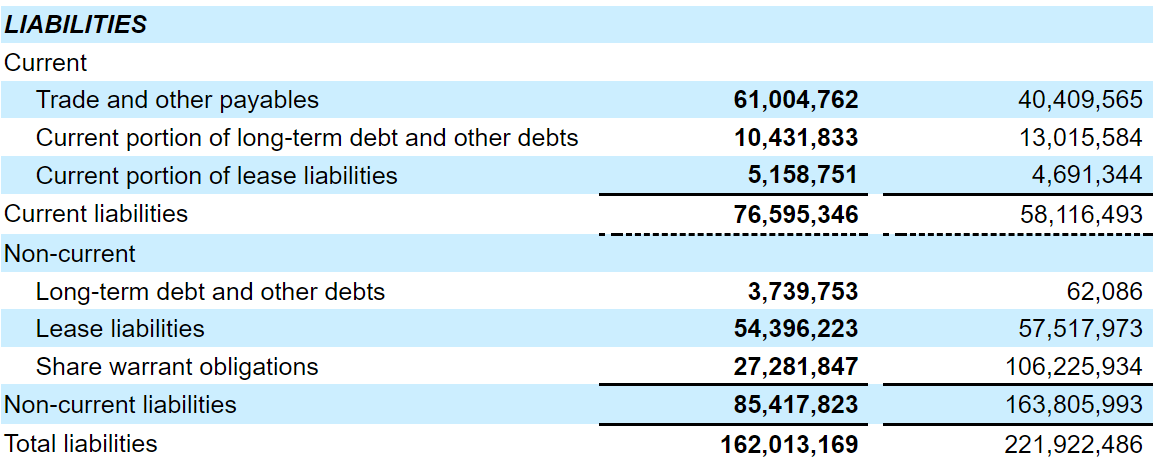

Balance Sheet

As of June 30, 2022, The Lion Electric Company reported cash worth $83 million and an asset/liability ratio worth 3-4x. I believe that the company’s financial situation will allow The Lion Electric to design and develop new models.

Company Report Q2 2022

The long-term debt is equal to $3 million, but the company also reports share warrant obligations worth $27 million. Short term debt stands at $10 million. Considering my EBITDA expectations for the years 2027 and 2032, I believe that The Lion Electric could use even more debt if necessary.

Company Report Q2 2022

Financing from Governments, Incentives, And Order Book Growth Would Imply A Valuation Of $9.9 Per Share

Under normal circumstances, I would expect new agreements with governments in the United States, Canada, and perhaps Europe. Considering the increase in public expenditure announced by many governments, I believe that The Lion Electric will likely find many opportunities for receiving public money. The most recent agreement with the U.S. Department of Energy is a very good example of what I am expecting:

On April 15, 2022, Lion signed a Memorandum of Understanding with the U.S. Department of Energy, aimed at accelerating the development and deployment of vehicle-to-everything technologies. Lion was the only school bus manufacturer selected by the DOE to sign onto the agreement. Under the MOU, Lion will collaborate with over a dozen industry leaders including utilities, OEMs, government agencies, industry labor organizations and the DOE to collaboratively explore the development and integration of bidirectional electric vehicle charging infrastructure into the nation’s energy grid. Source: Company Report Q2 2022

Besides, I also expect that incentives in Canada and the United States to acquire electric vehicles will likely have an impact on the company’s revenue growth. In this regard, let’s mention the financing to be received by customers that opt to buy EVs under the Canadian Incentives for Medium and Heavy-duty Zero-Emission Vehicles Program.

On July 19, 2022, Lion announced that its customers in Canada can now receive up to $150,000 in funding under Transport Canada’s newly launched Incentives for Medium and Heavy-duty Zero-Emission Vehicles Program. Source: Company Report Q2 2022

Finally, under this case scenario, I assumed that The Lion Electric would continue to receive orders in advance. The fact that the company’s order book continues to grow is quite beneficial. It means that equity financing may be easier because we know that management will receive cash for future production. If the company receives some cash in advance, it would also be easier for management to finance its operations. If The Lion Electric does not require debt financing, management will not need to pay financing costs, which is always beneficial for the free cash flow.

As of August 4, 2022, Lion’s vehicle order book stood at 2,357 all-electric medium- and heavy-duty vehicles, consisting of 286 trucks and 2,071 buses, representing a combined total order value of approximately $575 million as calculated per management’s methodology further described below. Source: Company Report Q2 2022

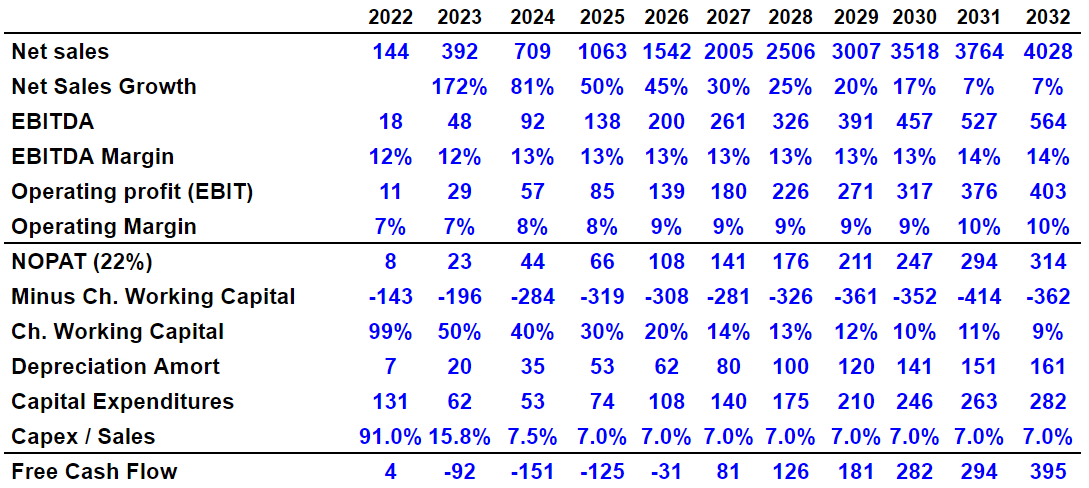

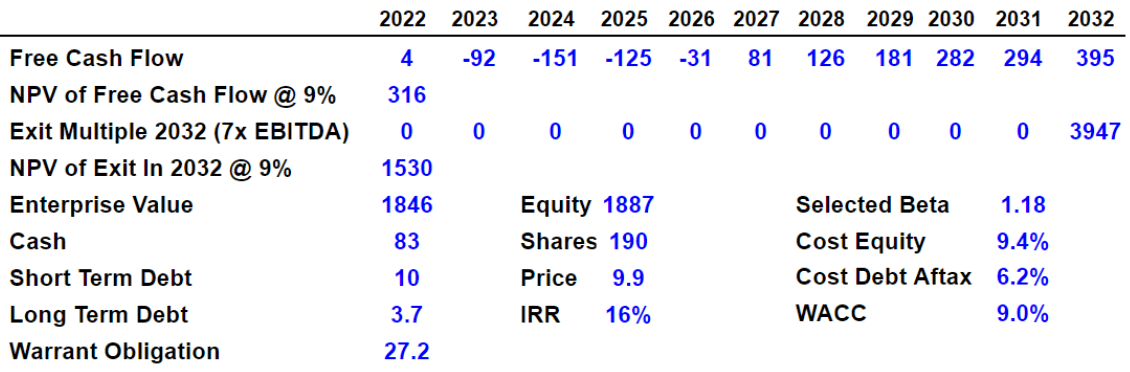

I think that sales growth will likely decline as more employees are hired, and the company becomes a larger organization. Hence, I assumed that sales growth will likely decline from around 49% in 2025 to 7% in 2032. Both EBITDA margin and the operating margin will likely increase over time. I believe that long-term EBITDA margin of 13% and operating margin of 9%-10% appear reasonable.

Next, I also included changes in 2032 working capital/sales close to 9%, growing D&A, and capex/sales of 7%. My results would include 2032 free cash flow of $395 million and positive FCF from 2027. In my view, my financial figures turn out to be more conservative than that offered by other investment analysts.

Arie’s DCF Model

If we assume a beta of 1.18, cost of equity close to 9.4%, and cost of debt around 6.2%, the weighted average cost of capital would stand at 9%. Discounting future free cash flow at 9% and summing the results turn out to be $316 million. I also included an exit multiple of 7x, which appears lower than the median EV/EBITDA in the industry. The resulting enterprise value would stand at $1.8 billion. Now, if we subtract the debt obligation and warrant obligations, and add cash in hand, the implied price would be $9.9 per share, and IRR would stand at 16%.

Arie’s DCF Model

Main Risks Would Include A Deterioration Of The Order Book And Supply Chain Disruptions That Would Lead To A Valuation Of $1.32 Per Share

In my view, the most worrying risk for The Lion Electric would be that its order book is not realized. Customers may decide not to pay in advance or not pay at all, which would have a detrimental impact on the free cash flow expectations. In the worst case scenario, management may also suffer reputational damage, which may lead to an increase in the cost of capital.

The Company cannot guarantee that its order book will be realized in full, in a timely manner, or at all, or that, even if realized, revenues generated will result in profits or cash generation as expected, and any shortfall may be significant. Source: Company Report Q2 2022

If The Lion Electric does not build enough facilities, it may not be able to fulfill its orders. The market may also lower its revenue expectations as expected production would be lower. In this case, perhaps certain investors would sell their shares to buy other EV manufacturers, which may increase the company’s cost of equity. The company discussed these risks in some of its corporate documents:

Any failure by the Company to successfully develop and scale its manufacturing processes within projected costs and timelines could have a material adverse effect on its business, results of operations or financial condition. As a result, the Company’s realization of its order book could be affected by variables beyond its control and may not be entirely realized. Source: Company Report Q2 2022

Considering the invasion of Ukraine, I am not naïve with respect to potential shortage of supplies. The Lion Electric will likely suffer from shortages of raw materials, equipment, or even labor for many other reasons. If shortages lead to a decrease in production, management may not reach the expectations of the market. Revenue growth may be lower than expected, and the free cash flow would be definitely lower:

Such disruptions including port congestion, rail and weather disruptions, trucker shortages, and intermittent supplier shutdowns and delays, have resulted in component shortages, extended lead times for delivery of parts and raw materials, as well as, in certain cases, additional costs and production slowdowns for manufacturers. Source: Company Report Q2 2022

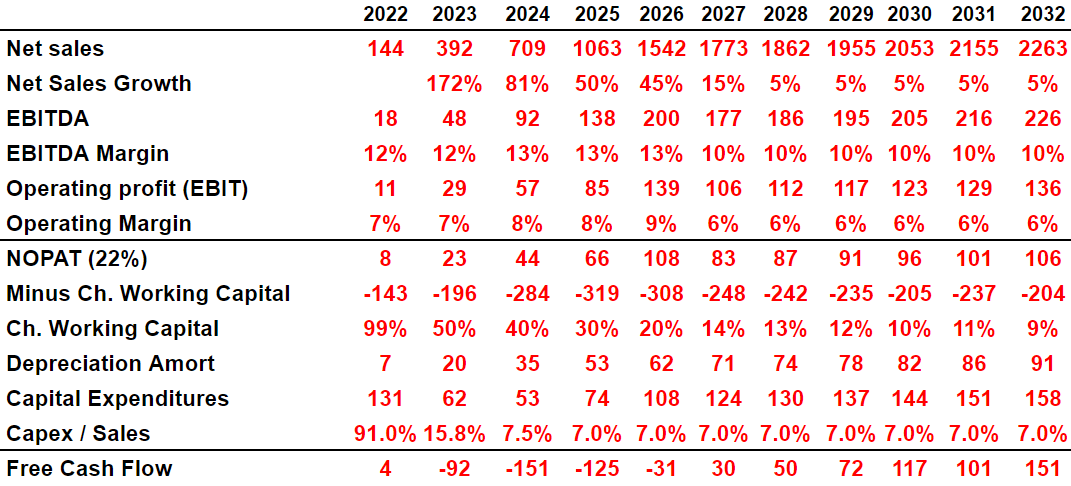

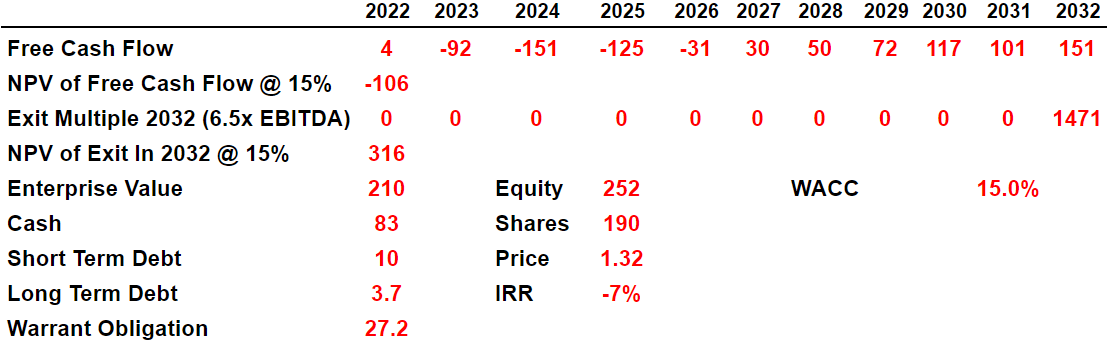

Under my worst case scenario, I assumed that sales growth would decline significantly from 2026 to 2032. I assumed long-term growth of 5% from 2028 to 2032. I also assumed that the EBITDA margin would stand at close to 10% from 2027 to 2032, along with a 2032 operating margin of 6%. Under these conditions, the free cash flow would increase from $30 million in 2027 to around $150 million in 2032.

Arie’s DCF Model

In my view, if investors lower their expectations, The Lion Electric Company may pay more for borrowed money. The cost of equity would also increase. If we assume a discount of 15% and an exit multiple of 6.5x EBITDA, the resulting enterprise value would be $210 million. The equity value would stand at $252 million, and the equity per share would be $1.32 per share.

Arie’s DCF Model

Conclusion

The Lion Electric Company announced two new facilities in Canada and the United States. Management also signed agreements with governments to finance the sale and development of new electric vehicles. In my view, more agreements with governments and successful production from new facilities will push the free cash flow numbers up. Even considering obvious risks from raw materials shortages or lower production than expected, The Lion Electric’s stock price appears too low.

Be the first to comment