stockcam/iStock Unreleased via Getty Images

We have been following Duolingo (NASDAQ:DUOL) as a company ever since its IPO roadshow, and have been using the app for even longer. We are very impressed with the quality of the app, and how fun it can make learning a new language which is normally quite difficult for most people. In fact, with a 4.5 star rating in the Google Play Store and 4.6 stars in the Apple app store, we would argue that the company has a achieved a very strong product-market fit. In fact it is one of the few apps that has more than a 100 million installations.

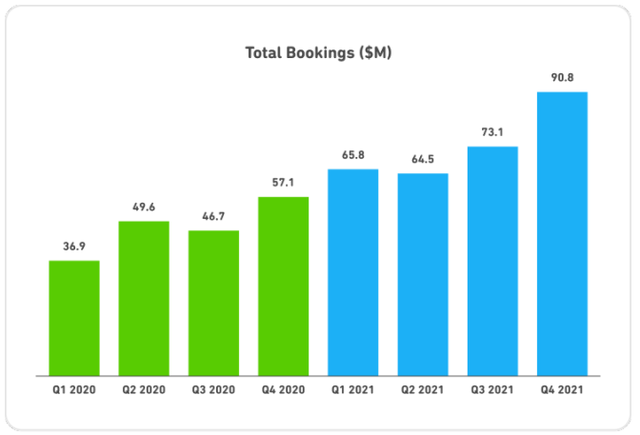

That said we are interested to see if the company makes a good investment right now, and for that we are going to have to analyze its growth and financials. First let’s look at bookings, and how they have increased exponentially, going from $36.9 million in Q1 2020, to $90.8 in Q4 2021. That is almost a tripling in only two years!

Duolingo Q421 Shareholder’s Letter

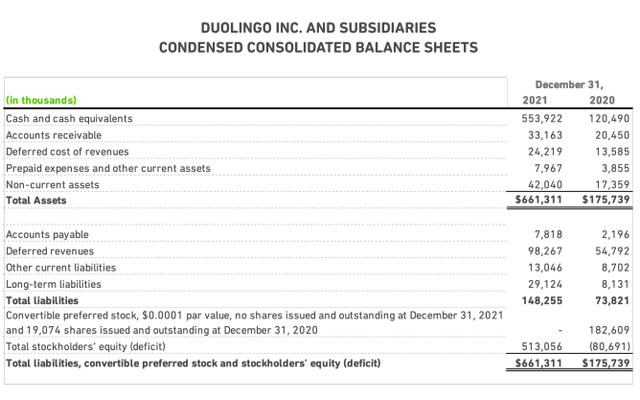

Financials

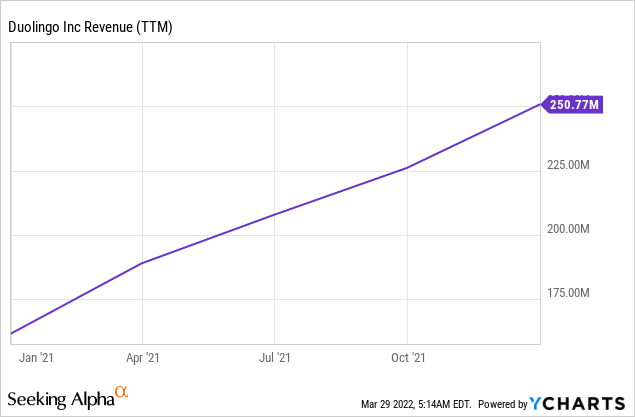

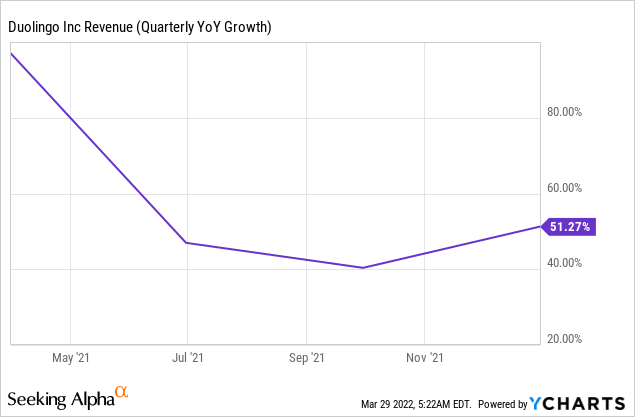

Increased bookings have resulted in growing revenues as we can see in the graph below. While growing quickly we have to point out that revenues are still relatively small compared to the market cap of the company.

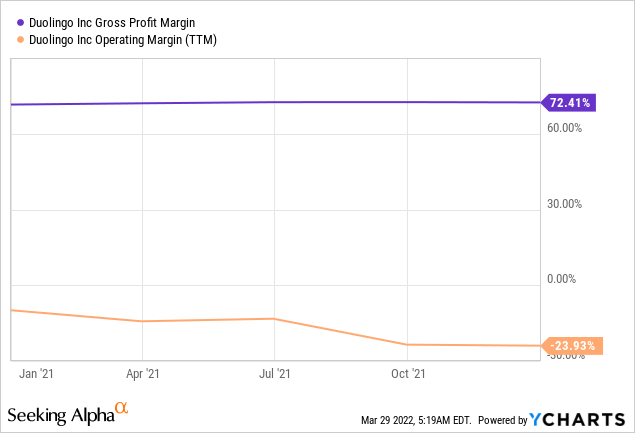

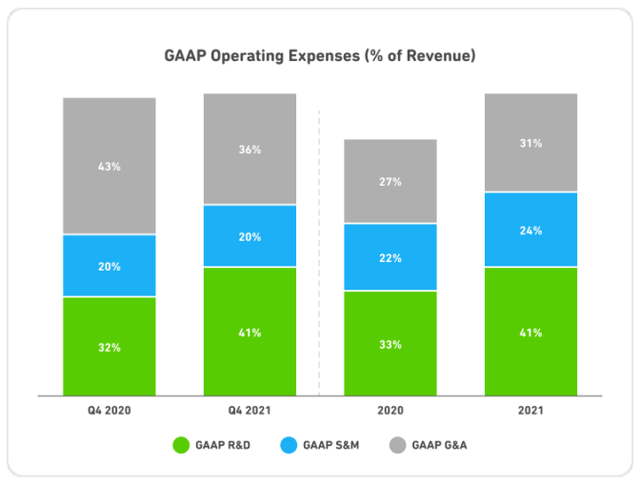

One key question with this type of expensive, rapidly growing company is whether it is displaying operating leverage. We see that Duolingo has attractive gross profit margins of ~72%; however, we are discouraged by the decreasing operating margin. This is something we will have to explore in more detail to understand why the company is not displaying operating leverage, and operating margins are actually decreasing too.

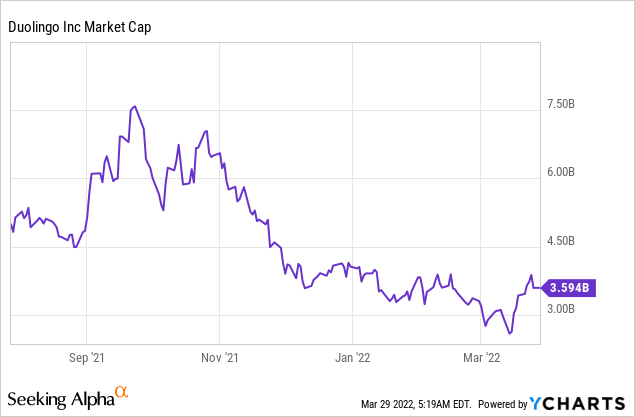

This is no small issue given how much investors are being asked to pay for the company. As can be seen below, the market cap is above $3 billion. For this to work out well for investors it will be indispensable that at some point the company figures out how to improve operating margins, otherwise growth alone will not result in attractive economics.

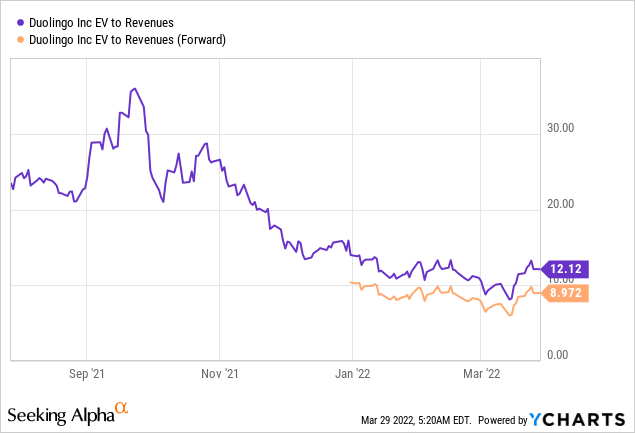

Valuation

Now the key question is, at what price would we be willing to buy Duolingo shares? If the company was profitable, or at least on a clear path to profitability, we would be willing to pay a higher multiple of sales. As things stand we see the company as more speculative until it proves that it can be solidly profitable. Right now shares are trading at a trailing twelve months EV/Revenues multiple of ~12x, and a forward EV/Revenues multiple of ~9x. This does not appear overly expensive for a fast growing young software business, however we would require a bigger discount given the declining operating margin. We would be interested in buying a small speculative position at an EV/Revenues multiple of ~6x, so about half the price where shares currently trade.

At least we can point to a positive, in that revenue growth is re-accelerating again. After falling from more than 80% to ~40%, it is now again above 50%.

Operating Leverage

Exploring the mystery of lack of operating leverage displayed by the company we find that one of the main reasons is the company has been increasing the percentage of revenue reinvested in R&D. This is a good justification for the lack of operating leverage, since it means the company is heavily reinvesting in its future. One example we could find is a planned math app that appears to be currently in development. We would be significantly more concerned should the operating expenses increase be mainly in general and administrative (G&A). Still, we remain a little concerned since the percentage going to G&A also increased from 2020 to 2021, even if it went down from Q4 2020 to Q4 2021. This is something that investors will want to monitor closely to make sure the company is not over-staffing and that it is being cautious in the way it grows.

Duolingo Q421 Shareholder’s Letter

App popularity

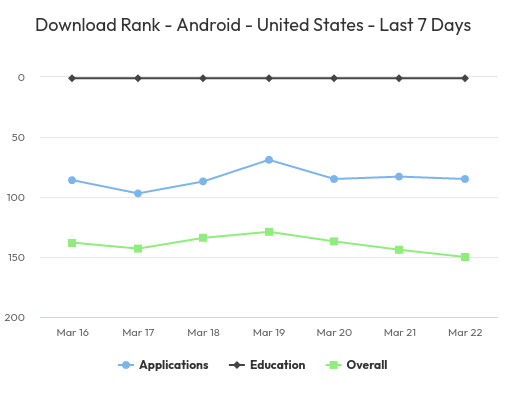

Unfortunately we do not have access to the app download statistics, but according to App Annie, Duolingo is currently the #1 app downloaded in the United States in the Education category.

App Annie

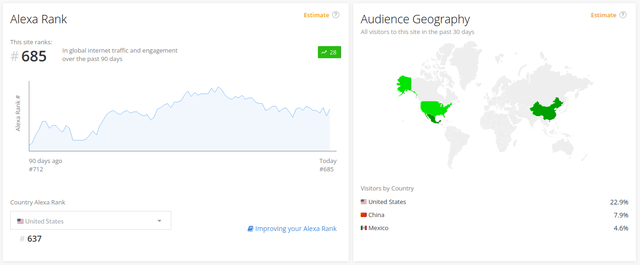

Looking at the statistics for the Duolingo website we see that its global ranking has gone up in the last 90 days, and that most visitors come from the US, Mexico, and India.

Balance Sheet

Despite profitability being nowhere in sight, at least the company has a long runway to experiment and grow revenues. At the end of 2021 it has $553 million in cash and cash equivalents which should be enough to keep the company going for a while as it works on increasing revenues and figuring out how to improve profit margins. We do believe that at some point the company is going to have to take a hard look at its cost structure and implement cost saving initiatives if it is to attain solid profitability. Otherwise it will have to figure out how to improve app monetization. Currently only around ~6% of users are paying users, maybe the company will figure out how to significantly increase this number.

Duolingo Q421 Shareholder’s Letter

Conclusion

We like Duolingo, both the app and the company, as well as its mission to help provide affordable education to the world. Its revenue growth has been impressive, but we remain concerned about the lack of operating leverage. Part of it as we saw was due to an increase in R&D investments to create new products, but the company does not appear too disciplined in the G&A segment either. We would still consider a small speculative investment position at around half current prices, but who knows if shares will go down that much. In any case, we’ll continue using the app and monitoring the company.

Be the first to comment