Eric Francis

“I’d rather be vaguely right than precisely wrong” – Warren Buffett

Written by Sam Kovacs

Introduction

Many equity investors dreams got crushed when headline inflation figures came in higher than expected. It wasn’t so much the 8.3% vs 8.1% that stung, but the fact that core inflation was up from 6.1% to 6.3%.

It has now become evident that wages are driving inflation, a phenomenon which Robert & I warned of while everyone was busy buying a new flat screen TV with the government’s money shower.

At the time we were discredited because of our “limited understanding of economics” and ‘simplistic” market views.

When it comes to most things in life though, having a simple framework which mostly works beats having complex frameworks which are ineffective, to paraphrase the Buffett quote which opened this article.

Our framework was simple. We broke down modern monetary theory to its basics, then looked at where it would meet real world conflict, and asked: then what?

In the game of chess, opening theory is referred to as “book moves”. At the elite level, most of what happens from moves 1 through 10-15 are book moves. The second a move diverges from accepted opening moves, it is considered going “off book”.

When analyzing MMT we asked, when would the government go off book?

To make it short, in MMT, governments chose to print money to support the economy when it is operating below its potential. As the economy gets back to its potential, because of the increase in cash supply, prices start going up.

MMT says governments should directly take cash out of the economy to solve inflation, through higher taxation or lower government spending. This we identified as the real world conflict.

Neither of those measures have been taken mind you, as one side of American voters would be strictly opposed to higher taxation, and the other strictly opposed to decreased government spending.

So inflation kept going. The chosen method to fight it has been to raise rates, which is a monetary response to a fiscal stimulus. That is not a book move, and its efficacy is yet to be seen on taming inflation.

Feedback loops have been reinforced, whereby energy costs increasing led to increased food and shelter costs, which forced workers to ask for higher salaries.

Given that employment is tight, employers agreed and continue to agree to higher wages. This increases costs to run business, which is eventually passed on to consumers as higher prices. Higher prices mean more inflation.

The choice of a monetary response is questionable.

When inflation is 8%, having fed rates at 2.5% means running a negative 5.5% real rate.

Like I’ve said time and time again, negative real rates are stimulatory, not restrictive.

Unsurprisingly, consumer credit (excluding mortgages) increased 8.5% year over year past month, the highest rate since 2001.

At the same time, checkable household deposits have reached an all-time record of $4.9tn, which is a sizeable cushion which should see the American middle class through higher inflation.

There is so much confusing data that it seems impossible to position oneself as a bear or a bull on this market.

That being said here is what I do expect: increased market volatility, as investors all over get jittery with an ever increasing amount of “surprising” and contradicting data.

When thinking of the market over the next 6 months to one year, I can see the S&P 500 being 3,200 as likely as it being 4,500.

The real question is whether it needs to correct to 3,200 or lower before resuming the bull market.

The answer is that I do not know. And that is fine, because we invest in a way which means that knowing is nice but ultimately not important.

How so?

As dividend investors we focus on stocks which provide a combination of dividend yield and dividend growth potential which is sufficient to meet our income needs when we retire.

This means we’re buying when stocks offer attractive prices, and getting paid to wait.

When the tide ultimately turns, (as it always does) and the stocks become overvalued, we sell them at a profit, and buy another undervalued dividend company.

Buy low, get paid to wait, sell high.

That way we stay net buyers through all markets, making the most of the fact that there is always something out of favor.

As long as you buy high quality stocks, with large moats and lasting power, you can ride the up and down wave quite nicely.

Below are two stocks to buy if you think markets are going to crash, that will continue paying you sufficient dividends throughout the market trough and the next peak.

Buy Philipp Morris

Before dividends, Philip Morris (PM) has beaten the S&P 500 (SPY) by 17% year to date.

PM vs SPY YTD% (Dividend Freedom Tribe)

Of course, this has been mostly due to the S&P 500 tanking, while PM has maintained its value.

This makes a lot of sense when you think about the environment.

PM sells prices with very low price elasticity, which is the economic way of saying that smokers have a hard time saying “no”, regardless of the price.

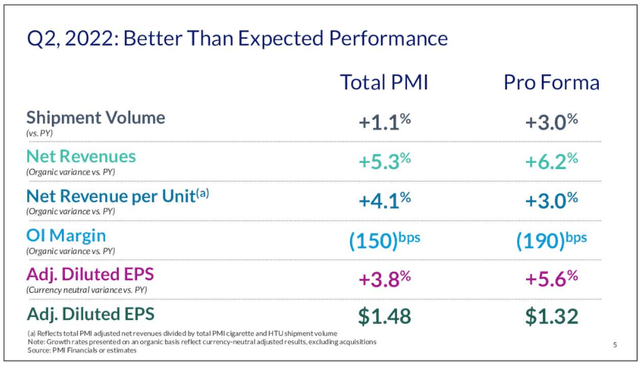

This translated into better than expected revenue and earnings growth in the first half for PM.

Tobacco companies have an edge in inflationary environments because the vast majority of the price of their sales is tax.

In the UK, as is the case in many developed countries which PM serves, the price of a cigarette pack is 80% tax. This means that a 10% increase in raw materials, if totally passed on to consumers, will only result in a 2% increase in price, which consumers will happily pay for.

Valuations of cigarette companies have remained depressed as people have asked whether tobacco companies will still exist in the 2030s, with cigarette sales on the decline.

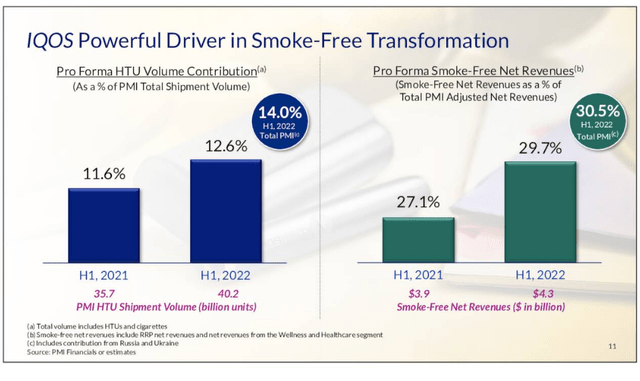

As we’ve been saying for a while now, PM has been asked this question before and the investment community found its answer. Smokeless devices, powered by IQOS, have been the linchpin of the company’s transition away from cigarettes.

PM Earnings Presentation (Seeking Alpha)

The drawback for IQOS, despite the fact that the sticks are sold at a 15% discount, is that you have to buy a device. The IQOS 3 costs about $80 in France, and $40 in Indonesia, to give a rough range based on the places I’ve been in recently.

This isn’t a huge barrier to entry, but it is one, especially in lower income countries. This barrier is going to get lower very soon, if we listen to what CFO Emanuel Babeau had to say at the Barclays Consumer Staples Conference:

So I’m going to keep you on the surprise and the secret for the time being, but it’s a new technology. And clearly, the objective is to come with something that would be targeting the emerging country with a lower purchasing power.

So it will be simpler design to cost, but still providing a great experience and we believe that it’s going to be in ’23 and beyond a very nice further boost and further acceleration to our growth for IQOS.

This will continue to fuel PM’s transition towards smokeless, with the goal of a majority of revenues coming from non-combustible sources by 2025, and combustibles potentially being phased out entirely next decade.

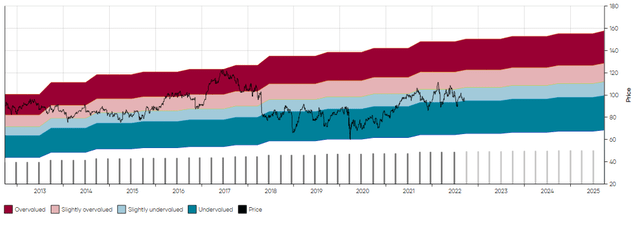

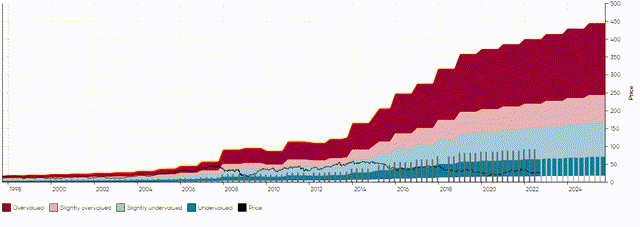

From a valuation standpoint, PM is still undervalued relative to its dividend.

Since initiating a dividend 14 years ago, the median dividend yield has been 4.76%, which would imply a price 13% higher than the stock currently trades.

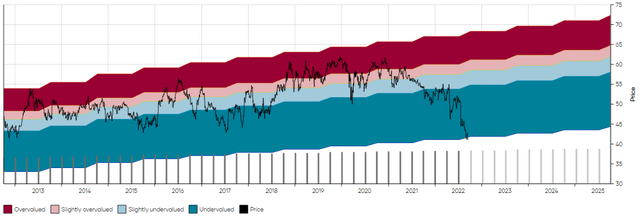

To learn more about the MAD Chart you see below, click here.

PM MAD Chart (Dividend Freedom Tribe)

At the current yield, our model suggests that PM would provide great income, as long as it continues token increases.

I personally believe that PM has the potential to increase the dividend at 3-5% per annum in upcoming years, but that it chose to only increase by 1.6% this year because of the environment. When stocks are beaten down and the market won’t react to any dividend increase, a token increase to maintain the streak will do.

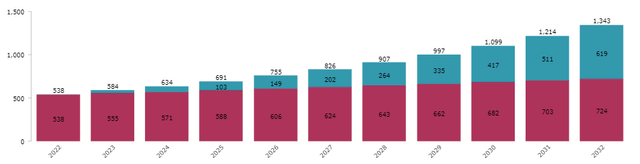

If you invest $10,000 today in PM, and reinvest dividends, while the dividend grows at 3%, then you could expect $1,349 in annual dividends in year 10.

PM Income Projection (Dividend Freedom Tribe)

This is equivalent to a 13.5% on your original investment which is a very attractive amount.

All the way up to $105, PM is an attractive buy. Because of its defensive model, it is likely going to continue suffering less than the market if the market struggles in upcoming months

Buy Verizon

Verizon’s (VZ) stock price looks like it has been going down one of those giant water slides in those water parks.

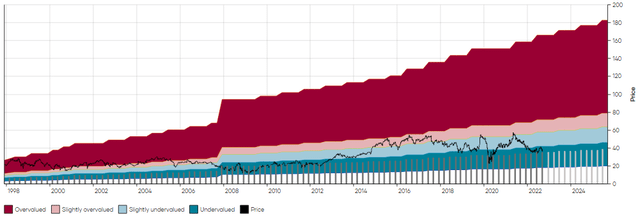

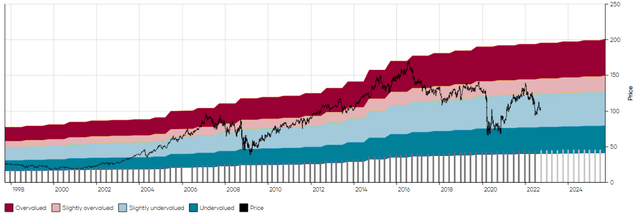

The yield is now the highest it has been in the past decade, at 6.35%.

VZ MAD Chart (Dividend Freedom Tribe)

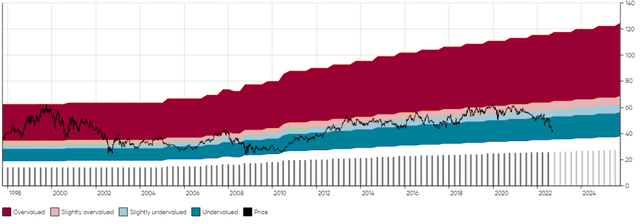

Does this mean that VZ has bottomed? If we take a longer term view, say going back 25 years, then not necessarily.

VZ 25 year MAD Chart (Dividend Freedom Tribe)

The “fair” range of yields for VZ has been between 4% and 5% over the past 25 years. That shows as when the price is in the pink or light blue bands on the chart above.

During the GFC, the price slid all the way down to $26, which was a 7.3% yield.

So the bad news, is that VZ could keep going down, but we have something of a hard floor at $35, which would match the yield the stock displayed at its darkest hour in 2010.

That caps downside at 15%. If you believe that the market is going to crater, this is quite comforting for long term investors.

Let’s just compare this to other high yielding options.

If W. P. Carey (WPC) were to return to its 25 year maximum yield, the stock price would drop by 55%.

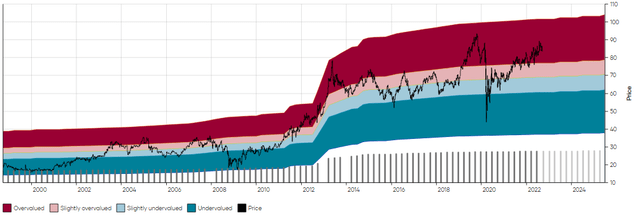

WPC 24 Year MAD Chart (Dividend Freedom Tribe)

If Leggett & Platt (LEG) were to return to its maximum 25 year yield, then the stock would drop by 49%.

LEG 25 Year MAD Chart (Dividend Freedom Tribe)

If Franklin Resources (BEN) were to return to its maximum 25 year dividend yield, the stock price would drop by 31%.

BEN 25 Year MAD Chart (Dividend Freedom Tribe)

Finally, if Federal Realty Trust (FRT) were to return to its maximum 25 year dividend yield, then the stock would drop by 60%.

FRT 25 Year MAD Chart (Dividend Freedom Tribe)

When taking a historical view of the situation, it becomes quite obvious that VZ has a lot of its downside priced in.

One might ask, why?

Well despite still being the premium brand in phone plans in the US, Verizon has been losing customers as pricing actions have clashed with AT&T’s (T) promotions.

An earnings miss, slashed guidance, and VZ’s price just kept going lower.

Management seems convinced that this is just a temporary blip due to timing of different offers and pricing actions. In a recent Goldman Sachs Telecom Conference, management said:

On the consumer side, we’re still going have a negative net ads on phones in the third quarter, but clearly we will have an improvement. And then the churn, of course. In the fourth quarter will come back to business as usual as we say.

Let’s give them the benefit of the doubt. The 5G roll out nation wide is still undergoing and keeps the growth story intact for VZ.

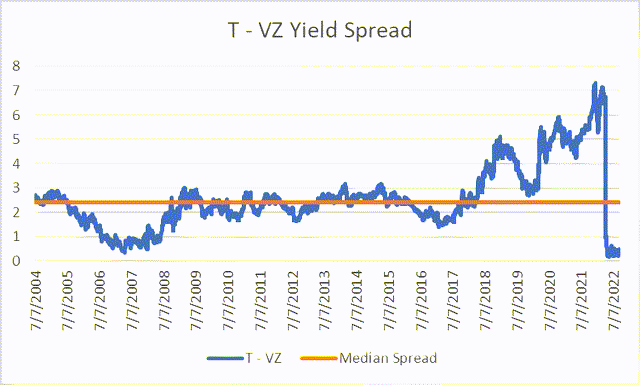

As we mentioned T, let’s look at an interesting spread between VZ and T, using data over the past 18 years.

What we’ll compare, is the difference in yield between T and VZ.

The median difference between both stocks is 2.42%, meaning that when T yielded 6.42% VZ yielded 4%.

As you can see the spread got bigger as T’s yield increased prior to the dividend cut, but using a median yield somewhat corrects for that.

T – VZ yield spread (Dividend Freedom Tribe Data)

The spread is currently 0.42%, meaning that we’ve got a two point divergence.

Currently VZ’s yield is 2% above its 10 year median yield, while T is 1% above its median yield.

So a convergence of both stocks over a 1-3 year periods make sense, whereby T’s yield increases by 0.5% to 1%, and VZ’s decreases by 1% to 1.5%.

If you want to ‘buy low’, it is a good idea to buy VZ right now, as it is already in the gutter, and a broad market sell off would push it down significantly less than the rest of stocks.

Sell Innovative Industrial Properties

Innovative Industrial Properties (IIPR) is in a bit of a tough spot.

The specialty real estate company, which purchases industrial properties which it transforms into licensed weed farms, then leases to pot producers, faces a number of hurdles in upcoming months.

- Marijuana companies remain unprofitable, mainly because of the federal illegality of weed. Furthermore, the market for raising equity or debt has tanked by 60% this year in the industry. This significantly weakens the profile of IIPR’s clients.

- The fundamentals keep deteriorating for the nascent weed industry: oversupply, high taxes, higher interest rates, and less access to capital.

- One of IIPR’s clients, Kings Garden, has stopped paying rent, cutting out 8% of IIPR’s revenue.

- While weed will likely remain illegal at the federal level, marijuana companies will likely be allowed to source other financing options once the SAFE banking act passes, which will likely put a lot of pressure on IIPR’s cap rates.

All of these elements create the perfect storm for IIPR.

Marijuana growers are viewed as a risky investment. In the event of a market crash, the demand for weed equity and debt will all but dry up. The oversupply of weed in many regional markets in the US means that certain firms MUST go belly up, in our opinion.

While IIPR just raised its dividend, it is doing so while hoping for the best.

Maybe SAFE gets delayed. Maybe no other clients stop paying rent. Maybe it replaces the Kings Garden rapidly.

Those are many uncertainties at the micro level, which get piled on with uncertainties at the macro level.

The 7% yield looks appealing at first, but you need to ask, does getting an 0.8% premium on VZ sufficiently compensate you for all those risks?

Now don’t get me wrong, good luck and favorable market conditions could spare IIPR of all its woes, but if you’re worried about markets right now, this is not a punt you should be willing to take.

Conclusions

When asked if the market is going up or down, I want to answer:

The market will go up and down, but not necessarily in that order.

I’m not too concerned about market direction. I do know that if the market tanks, some of my positions, especially those which are more exposed to the consumer will get hit hard.

Including staples and telecoms into your portfolio, and maybe upping their positions while they are good value, while saying goodbye to speculative positions might be a good idea.

Be the first to comment